Technical Overview – Nifty 50

Presently the Indian Markets are in a phase of super volatility where prices are swinging both ways and always keep traders on their toes. Wild swings on the intraday charts have been witnessed in the past few sessions and taking a positional bet is highly difficult.

The Nifty on 20th March witnessed a marginal gap up opening but couldn’t hold on to its gains and drift near 21,700 levels. Post-recording a day’s low prices witnessed a V-shape reversal and recorded a day high at 21,930 levels and finally ended near its previous day close and formed a long-legged Doji candle stick pattern.

The Nifty has given a bearish dead cross where 9 EMA has crossed below 21 EMA suggesting a bearish crossover. The momentum oscillator RSI (14) witnessed a breakdown below 50 levels and continued to drift lower with sharp bearish momentum. The trend remains on the bearish side and immediate support is placed on a 21,600 level and resistance is placed at 22,100 levels.

Technical Overview – Bank Nifty

Bank Nifty Records 8th Consecutive Daily Fall. The Bank Nifty fell for the 8th consecutive day on 19th March 2024Since 2005, there have been only 2 instances when the Bank Nifty has fallen for 8 consecutive days with yesterday being the 3rd time. The Bank Nifty has broken its record and closed in red for a consecutive 9th day and it’s a new record for the banking Index.

Presently the Indian Markets are in a phase of super volatility where prices are swinging both ways and always keep traders on their toes. Wild swings on the intraday charts have been witnessed in the past few sessions and taking a positional bet is highly difficult.

The Bank Nifty on 20th March witnessed a marginal gap up opening but couldn’t hold on to its gains and drift near 45,800 levels. Post-recording a day’s low prices witnessed a V-shape reversal and recorded a day high at 46,655 levels and finally ended with a marginal loss and formed a long-legged Doji candle stick pattern.

The market context has changed for now as sellers use every smaller rally as a selling opportunity. The immediate support for the Bank Nifty is placed at 46,000 levels and 47,000 will act as an immediate resistance for the Banking index.

Indian markets:

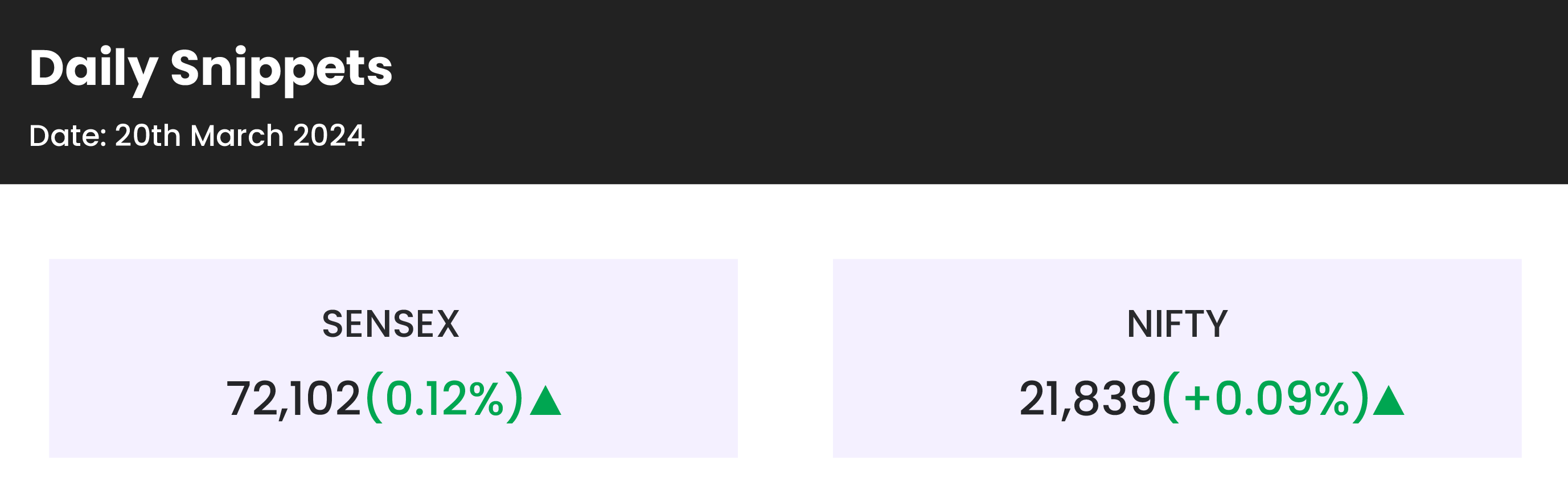

- Domestic market benchmarks the Sensex and the Nifty 50 managed to end with mild gains on Wednesday, March 20, despite facing volatility ahead of the US FOMC’s interest rate decision.

- The US Federal Reserve is anticipated to maintain steady rates, with investors and analysts closely watching Fed Chair Jerome Powell’s post-decision press conference for insights into the central bank’s stance on inflation and future interest rate trends.

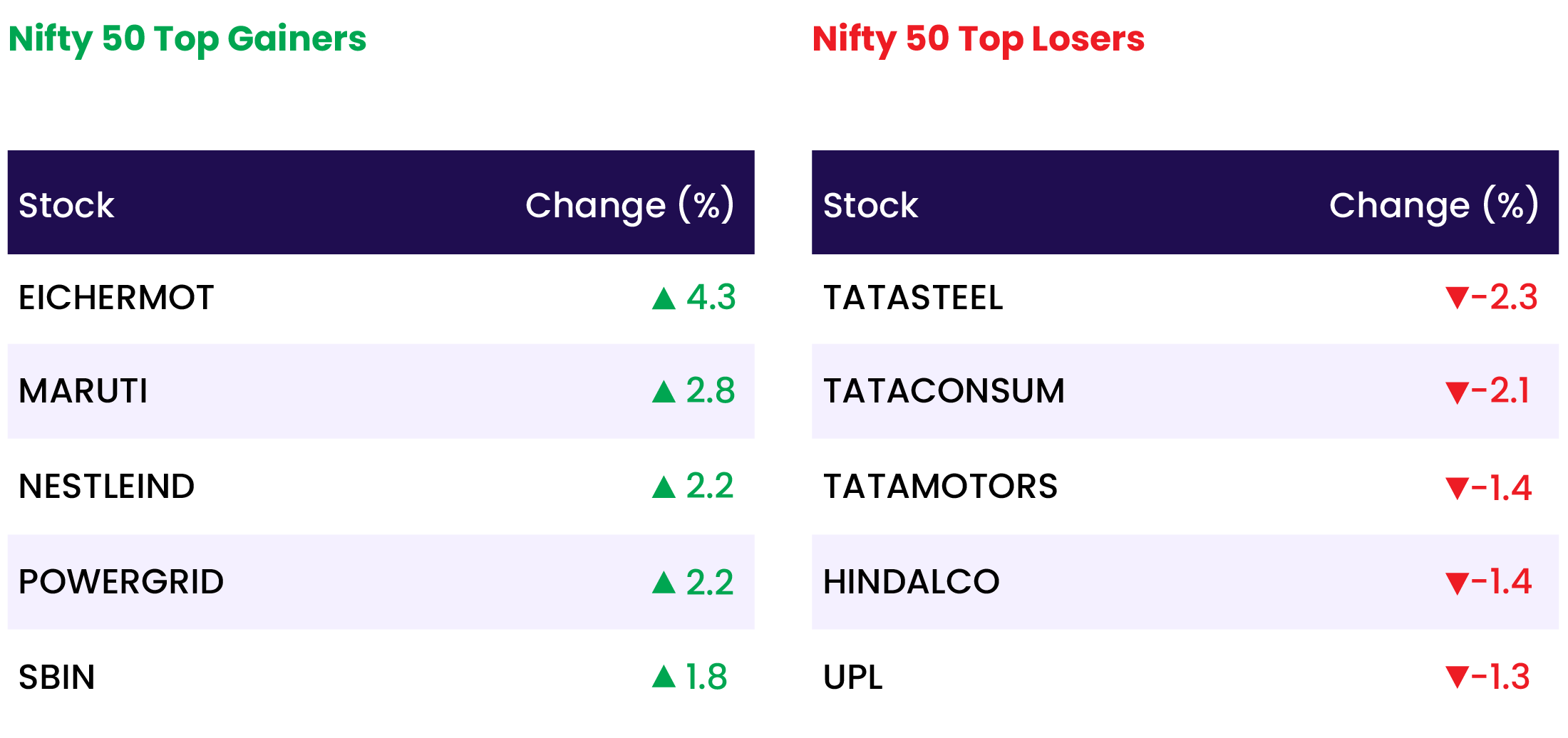

- Although the market initially showed gains at the opening, it fluctuated between gains and losses throughout the day. However, increased buying activity in auto and energy sectors supported the benchmark indices to end on a positive note.

- Among sectors, auto, FMCG, realty, oil & gas, power were up 0.5-1 percent each, while the metal index was down nearly a percent.

Global Markets:

- Asia-Pacific markets witnessed an uptick as investors processed the Bank of Japan’s significant shift in monetary policy while anticipating the U.S. Federal Reserve’s interest rate decision.

- The BOJ’s decision to raise interest rates for the first time in 17 years and abandon its yield curve control policy propelled the Nikkei beyond the 40,000 mark for the first time in nearly two weeks.

- Hong Kong’s Hang Seng index saw a 0.3% increase in the final hour of trading, while mainland China’s CSI 300 edged up about 0.22% to close at 3,585.38.

- Meanwhile, Australia’s S&P/ASX 200 experienced a 0.1% decline, closing at 7,695.8, following the central bank’s decision to maintain rates at 4.35% for the third consecutive meeting.

- South Korea’s Kospi surged by 1.28% to reach 2,690.14, buoyed by a 5.63% rise in heavyweight Samsung Electronics, marking its best performance since September 1, 2023. Conversely, the small-cap Kosdaq edged 0.05% lower to 891.45.

- Japan’s Nikkei 225 remained closed for a public holiday.

- In the U.S., all three major indexes registered gains as the Federal Reserve commenced its two-day policy meeting.

Stocks in Spotlight

- Maruti Suzuki shares witnessed a notable surge of 2.83 percent, accompanied by robust trading volumes, as the stock surpassed the Rs 12,000 mark during the session. Trading activity saw eleven lakh shares exchanged hands, a significant increase from the monthly average of 5 lakh. CLSA recently affirmed that Maruti is poised to maintain its leading position in the CNG PV segment, commanding a 72 percent market share.

- Eicher Motors experienced a remarkable uptick of 4 percent in its share price following brokerage UBS’s upgrade of its rating to “buy,” projecting a 35 percent upside potential. This upgrade was attributed to the company’s new product launches and the underperformance of its industry peers.

- Tata Chemicals encountered a notable decline of 7.93 percent in its stock price, coupled with heightened trading volumes on March 20th. Approximately 93 lakh shares were traded, surpassing the monthly average of 57 lakh shares.

News from the IPO world🌐

- Airtel’s unit Bharti Hexacom gets Sebi nod to raise funds through an IPO

- Sebi proposes audiovisual details of IPO disclosures

- Transrail Lighting files IPO papers with Sebi; eyes Rs 450-cr via fresh issue

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY OIL & GAS | 1.3 |

| NIFTY REALTY | 0.6 |

| NIFTY FMCG | 0.5 |

| NIFTY AUTO | 0.3 |

| NIFTY HEALTHCARE INDEX | 0.2 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1609 |

| Decline | 2180 |

| Unchanged | 114 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,111 | 0.8 % | 3.7 % |

| 10 Year Gsec India | 7.1 | 0.0 % | (1.1) % |

| WTI Crude (USD/bbl) | 83 | 2.7 % | 18.6 % |

| Gold (INR/10g) | 65,431 | 0.0 % | 1.3 % |

| USD/INR | 82.91 | 0.0 % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer