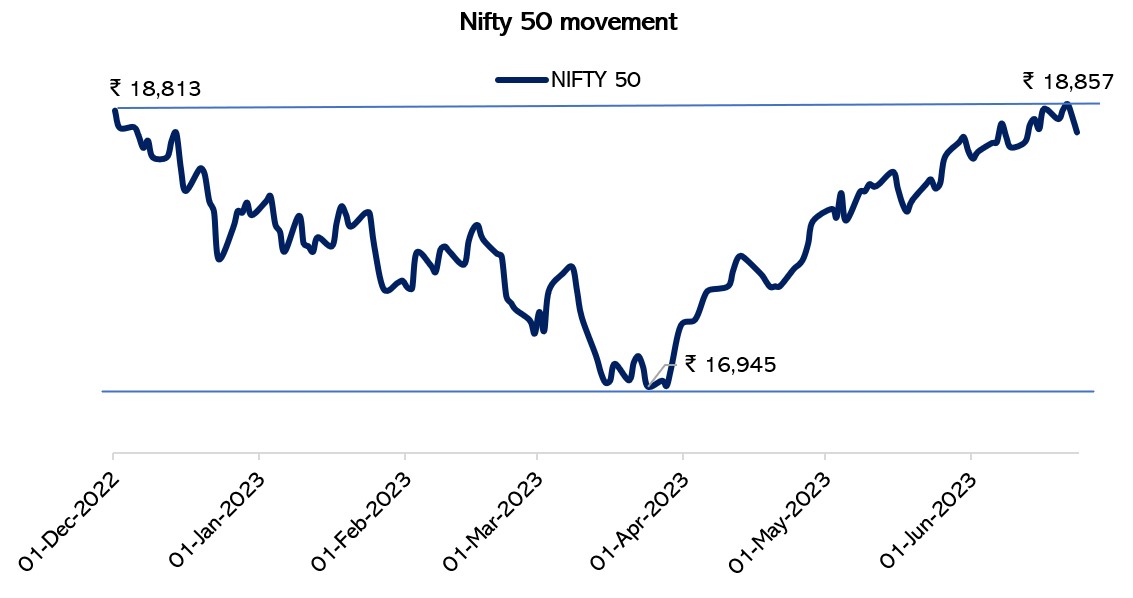

As we once again find ourselves in the midst of an exhilarating market rally, with indices touching all-time highs, it’s time to revisit the questions and concerns that such a scenario inevitably brings. Six months ago, we discussed the significance of these all-time highs, the implications for different types of investors, and the importance of time over timing in the market. Today, these insights remain as relevant as ever.

Read more: Decoding the NIFTY 50 all-time high for you

Source: NSE India. Data from December 2022.

But this time the story is even interesting. This time the overall market has reached an all-time high amid a mix of factors.

- Improved Corporate Balance Sheets: Despite rising interest rates, credit demand is increasing, and Indian corporations have healthier balance sheets than ever before.

- Value in Large-Cap Banking Stocks: Despite rich valuations, large-cap banking stocks present value, especially with sustained credit growth.

- Strong Performance of Mid and Small Caps: In India, mid and small-cap stocks have performed well and are expected to continue their strong performance.

- Healthy Macroeconomic Indicators: Despite global economic weaknesses, higher interest rates, and persistent inflation, the Sensex has shown resilience due to robust macroeconomic indicators and better-than-expected Q1 results.

- Increased Government Expenditure: The Government of India’s sustained capital expenditure, along with a rising manufacturing PMI, has boosted the benchmark indices. The Indian economy remains a beacon of stability in a volatile global economy, with increasing Capex enabling banks to improve credit growth. The long-term growth story of the Indian equity market remains promising.

- Global Rally: The market rally is not limited to India. Major markets worldwide, including the US, Euro Zone, Japan, South Korea, and Taiwan, are also near their 52-week highs.

- FII Flows Reversal: The Indian market rally has been bolstered by positive FII flows, robust economic growth compared to other emerging markets, a strong earnings outlook, robust demand across sectors, and expectations of a private capex cycle. Pertaining to foreign portfolio investors they have injected ₹47,602 crore into Indian equities this year, contributing to the market’s strength.

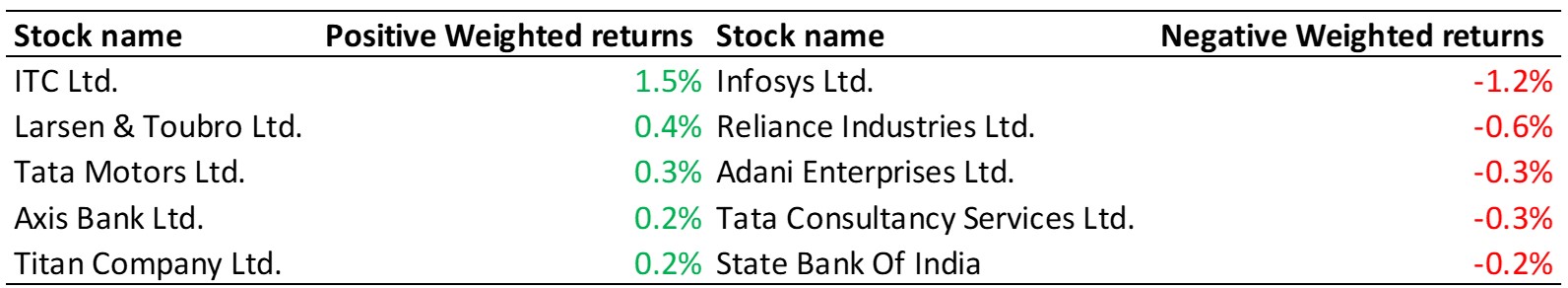

To understand the cause-and-effect relationship lets us dive deeper on which stocks and sectors have contributed positively or negatively to the overall market rally between the previous and current all-time high. While 33 out Nifty 50 stocks gained, a total of 17 stocks saw a decline in prices.

Stocks with positive and negative change in weights in the past 6 months:

Sector contributing positively and negatively to the Nifty 50:

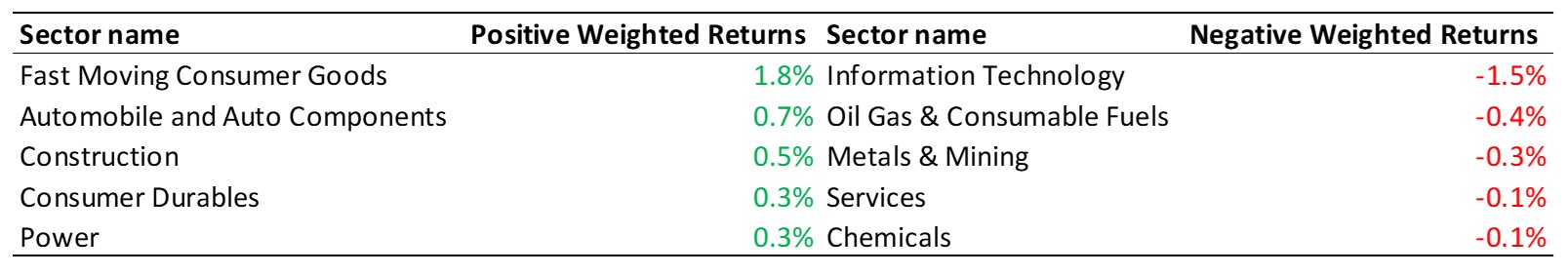

Here is how mutual funds have changed their stance on above stocks which have had a recent run-up:

Mutual funds have bought stocks that haven’t performed well over the past six months despite strong fundamentals. They have been slowly increasing allocation to IT amid a sharp decline. On the other hand, they’ve been selling shares in companies like ITC, L&T, and Axis Bank, which could be a sign they’re taking profits from these stocks. Despite significant increases in their stock prices, TATA Motors and TITAN continue to be popular choices for mutual funds, as they’ve been increasing their holdings in these companies.

So, all in all despite markets have reached at their all time high investors need not be worried since mutual fund managers are already adjusting their portfolios as per market dynamics.

When should investors be worried about all-time highs?

1. If the market rally is fueled by all stocks, resulting in an expensive valuation across the board.

Today: Despite the market appearing expensive, it is primarily driven by a select few stocks have been contributing to the overall rally.

2. If the economy is in the final stage of the economic cycle & earnings are at a peak.

Today: Corporate India finds itself at the early stages of both the economic and earning cycles, as we have just begun the process of economic recovery. This positions them favourably to capitalise on the solid growth in demand.

3. If an upsurge in initial public offerings (IPOs), a surge in borrowing to finance investments, a fresh trend that attracted significant capital, and various other factors that can contribute to market euphoria.

Today: The current market conditions do not reflect a significant increase in IPO activity or the influx of substantial funds into new investment themes. Additionally, there has been a noticeable decrease in leverage as companies have sought to reduce their debt burden and strengthen their balance sheets.

Conclusion:

The recent market rally and the all-time highs should not be a cause for alarm for investors. Instead, it should be seen as an opportunity to understand the dynamics of the market and make informed decisions. Mutual fund managers are actively adjusting their portfolios in response to market dynamics. They are identifying value in stocks that haven’t performed well and are taking profits from stocks that have seen significant increases.

The key is to stay invested and not make hasty decisions based on market highs. Remember, time in the market is more important than timing the market.

Read More – Bulls-eye On Mid and Small-caps

Markets this week

| 19th June 2023 (Open) | 23rd June 2023 (Close) | %Change | |

| Nifty 50 | ₹ 18,873 | ₹ 18,666 | -1.1% |

| Sensex | ₹ 63,474 | ₹ 62,979 | -0.8% |

Source: BSE & NSE

- The Indian market broke its four-week gaining streak in the volatile week ending June 23, influenced by global market volatility following hawkish comments from Federal Reserve Chairman Jerome Powell about future rate hikes.

- The surprise rate hike by the Bank of England and delayed monsoon in India also negatively impacted investor sentiment.

- All sectoral indices ended in the red. The Nifty Media index dropped by 3.6%, the Nifty Metal index fell by 3%, and the Oil & Gas, FMCG, and Realty indices each declined by 2%.

- Foreign institutional investors (FIIs) did not make any major contributions during the week.

- Domestic institutional investors (DIIs), on the other hand, purchased equities worth Rs 1,693.08 crore.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Tech Mahindra | ▲ +3.56% | Adani Enterprises | ▼ -11.00% |

| HDFC Life Insurance | ▲ +2.85% | BPCL | ▼ -4.56% |

| HDFC | ▲ +2.74% | Adani Ports & SEZ | ▼ -4.43% |

| HDFC Bank | ▲ +2.54% | Hindalco Ind. | ▼ -4.32% |

| Bharti Airtel | ▲ +2.03% | TATA Steel | ▼ -4.07% |

Source: NSE

Stocks that made the news this week:

BPCL dropped 4.5 percent during the week, ahead of a board meeting scheduled for June 28, 2023. The meeting is set to discuss various methods for capital infusion, including a potential rights issue. The aim of this fundraising plan is to achieve energy transition, net zero, and energy security objectives, subject to necessary approvals as required by law, as stated in the company’s release.

Adani Enterprises plummeted 11 percent in the week following reports that the ports-to-power conglomerate is under increased scrutiny by the US Attorney’s Office and the Securities and Exchange Commission. The regulatory authorities are investigating the representations Adani made to its American investors in response to a report by short-seller Hindenburg.

Larsen & Toubro (L&T), a leading engineering and construction company, announced a significant contract with the Defence Research and Development Organisation (DRDO). Under the contract, L&T will deliver two Air Independent Propulsion (AIP) System Modules for the Kalvari Class of Submarines serving the Indian Navy.

Glenmark Pharmaceuticals stock price declined as Monroe, North Carolina (USA) manufacturing facility received a warning letter from the U.S. Food and Drug Administration (USFDA). The warning came as a result of observations made during an FDA inspection conducted at the facility in April-May 2022, leading to heightened concerns about the company’s manufacturing practices.