Technical Overview – Nifty 50

Indian markets rose steadily throughout the day, closing above 27,200 and up 1.15 percent. For the majority of the day, the benchmark index held steady between 24,180 and 24,340. The index has created a DOJI candlestick on the daily chart. The index found support at 50 DEMA and has remained above it.

Momentum indicator RSI (14) found support at 40 and reversed from there. The benchmark index price has closed below the 10 and 20 DEMA, which may serve as resistance in the coming session.

The weekly chart shows the index trading above the main EMA, closing at the 10 EMA, and stabilizing between the 23,900 and 24,400 levels.

The short-term outlook is negative to sideways. Support levels for the upcoming sessions are 23,800 and 23,700, while resistance is at 24,400 and 24,500.

Technical Overview – Bank Nifty

The banking index rose steadily, closing above 50,000 and up 0.74 percent for the day. The index recovered from a fall and remained above the critical level for the day, building a pin bar structure on the daily chart. The index found support at the 100 DEMA level and held there.

On the weekly chart, the momentum indicator RSI (14) broke a rising trend line and fell below 55, indicating a loss of positive momentum. The banking index closed below the 10, 20, and 50 DEMA, which could act as resistance in the coming session.

MACD has fallen below the zero line, indicating lagging upside momentum on the daily chart and a negative crossover on the weekly chart.

The resistance and support levels for the upcoming sessions are 50,400, 50,700 for resistance, and 49,500, 49,000 for support.

Indian markets:

- In a much-needed respite, the benchmark indices ended the day on a strong note as positive global cues uplifted market sentiment.

- The Nifty and Sensex broke their three-day losing streak, buoyed by a positive trading day in Japanese and US markets following reassuring comments from Federal Reserve officials that alleviated US recession concerns.

- India VIX, the volatility index that measures market anxiety, eased nearly 14 percent to just above 16.

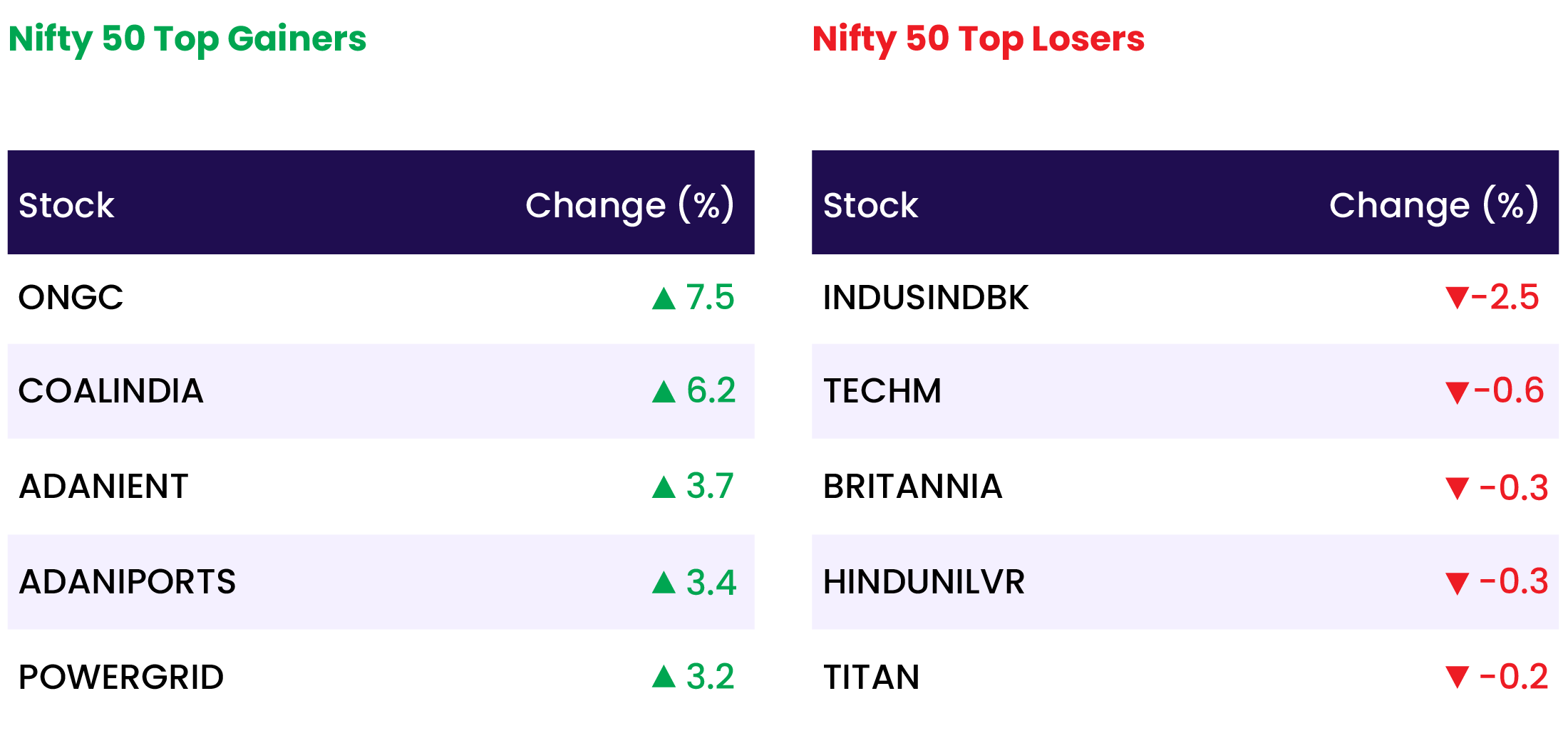

- All sectors closed in the green, with the Nifty Metal index leading the gains. Stocks like Vedanta, Tata Steel, Adani Enterprises, and Hindalco kept the sector vibrant. Nifty Energy also shone, driven by a rally in ONGC, Coal India, and Power Grid. Despite these gains, Nifty Bank was the least impressive performer, rising by less than a percent.

Global Markets:

- Asia-Pacific markets extended gains on Wednesday, following Wall Street benchmarks that broke a three-day losing streak overnight.

- Japan’s Nikkei 225 closed up 1.19% at 35,089.62, while the broader Topix index gained 2.26% to finish at 2,489.21, both continuing Tuesday’s rebound.

- Hong Kong’s Hang Seng index increased by 1.3% to 16,866.51 in its final hour of trading.

- South Korea’s Kospi surged 1.83% to close at 2,568.41, and the small-cap Kosdaq rose 2.14% to end at 748.54.

- Australia’s S&P/ASX 200 inched up 0.25% to 7,699.8.

Stocks in Spotlight

- Lupin Shares surged over 4 percent after the company reported strong all-around performance in the April-June quarter. The drugmaker posted a significant year-on-year spike of over 77 percent in its net profit, reaching Rs 801.3 crore for Q1 FY25. Revenue also grew over 16 percent year-on-year, rising to Rs 5,514.30 crore in Q1 FY25 from Rs 4,895.10 crore in the same period last year. This topline growth was driven by robust double-digit sales growth in both the India formulations and the US business.

- Oil and Natural Gas Corporation Shares surged over 7 percent after the company raised its production guidance for FY25. ONGC’s management projects a 12 percent increase in total crude oil production, reaching 23.1 million metric tonnes, and a 27 percent rise in gas production, reaching 25.9 million metric tonnes by FY27. This growth will be driven by the KG-98/2 and Daman upside development. The company announced it will begin gas production from the KG-98/2 asset in the fourth quarter of FY25.

- TVS Motors The stock hit an all-time high of Rs 2,620.2 on August 7 after the company reported a healthy performance for the June 2024 quarter (Q1 FY25). The company posted a 14.1 percent year-on-year growth in total sales volume, reaching 1.09 lakh crore units.

News from the IPO world🌐

- Ceigall India shares to debut tomorrow.

- Saraswati Saree’s Rs 160 crore IPO opens on August 12

- Unicommerce eSolutions IPO subscribed 5 times so far on Day 2

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY OIL & GAS | 3.1 |

| NIFTY METAL | 2.7 |

| NIFTY MEDIA | 2.6 |

| NIFTY PHARMA | 2.2 |

| NIFTY HEALTHCARE INDEX | 2.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2986 |

| Decline | 947 |

| Unchanged | 98 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,998 | 0.8 % | 3.4 % |

| 10 Year Gsec India | 7.0 | 1.6 % | 15.7 % |

| WTI Crude (USD/bbl) | 73 | 0.0 % | 3.6 % |

| Gold (INR/10g) | 68,865 | 0.2 % | 3.4 % |

| USD/INR | 83.94 | 0.2 % | 1.1 % |

Please visit www.fisdom.com for a standard disclaimer