Daily Snippets

Date: 27th June 2023 |

|

The Markets Today in a nutshell |

|

Technical Overview – Nifty 50 |

|

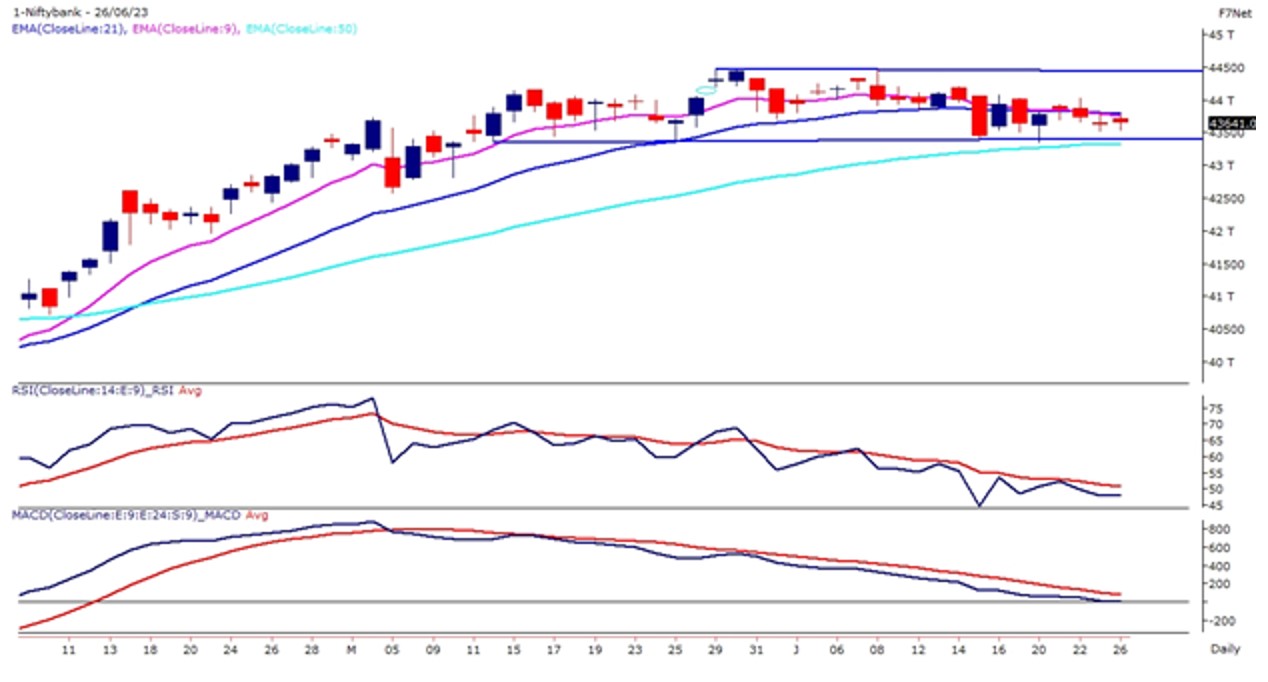

Nifty bounced back again from 21 EMA on the daily chart after 3 days of correction and closed near its day high at 18,817 levels. Nifty bulls were in total control despite the cautious mood in global stock markets.

As can be witnessed on the above Nifty daily chart prices are trading in a higher high higher bottom formation and presently sustained above their small and medium-term averages. In the lower panel, the momentum oscillator RSI (14) has again taken support near its horizontal trend line which is placed at 55 levels. Massive CALL unwinding indicating a short covering alongside the range breakout above 18760.

If today’s bullish action is any indication, then all eyes on will be at Nifty’s all-time high at the 18888 mark. Above the 18888 mark, Nifty Bulls will aim for the psychological 19000 mark. Immediate support is near 18500 which is an important level, a break below it would add a bearish signal.

|

Technical Overview – Bank Nifty |

|

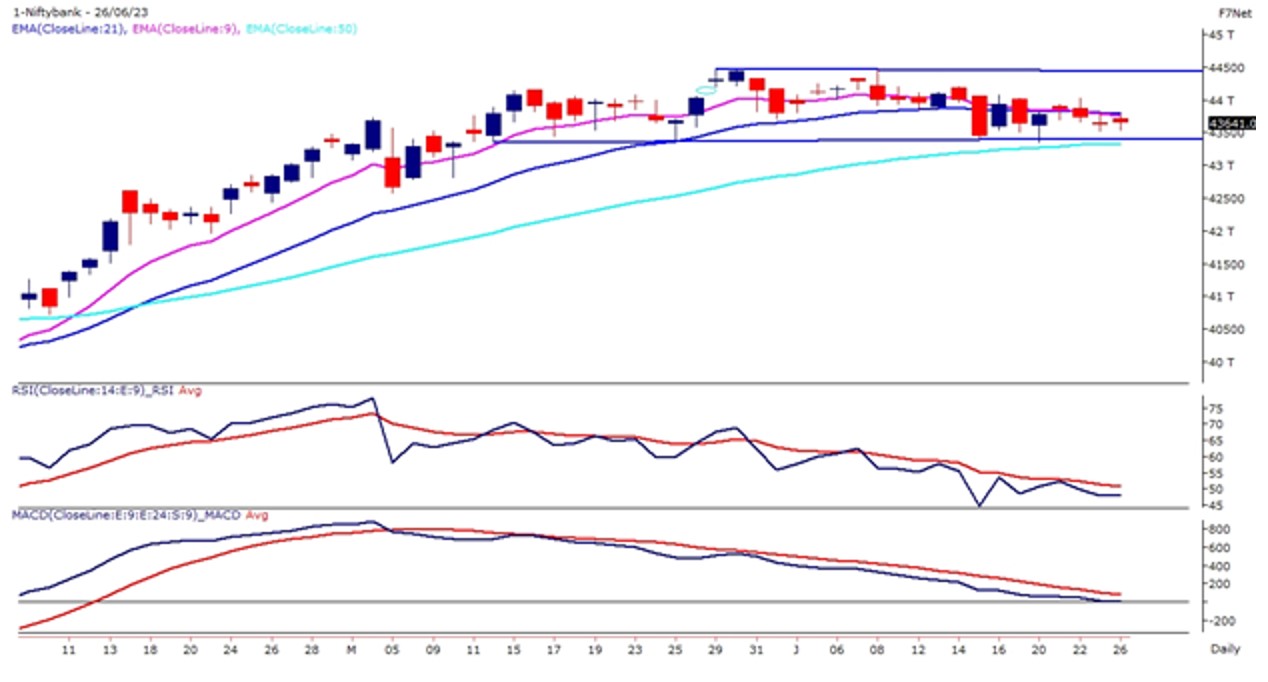

After a week of consolidation, Bank Nifty finally witnessed strength from the lower levels and has given a bullish rectangle pattern breakout on the lower time frame. The strong spurt in the prices helps the banking index to close above 9 & 21 – exponential moving average on the daily time frame.

In the longer picture Banking index is still trading within the rectangle pattern which can be seen in the above daily chart. In the lower panel, the momentum oscillator RSI (14) has taken support near 45 levels and has moved above 50 levels with a bullish crossover on the cards.

The immediate support for the Bank Nifty is placed at 43,600 and below that near 43,400 levels and similarly the upper band is capped below 44,400 levels. In case the Banking index breaks above the said levels then we may witness a bullish breakout in the prices.

|

Indian markets

- Equity indices rallied on Tuesday, with the Nifty settling above the 18,800 level, despite a lacklustre trend in Asian and European indices.

- Banks, financials, and realty shares were in high demand.

- The S&P BSE Sensex jumped 446.03 points or 0.71% to 63,416.03. The Nifty 50 index gained 126.20 points or 0.68% to 18,817.40.

- India’s current account deficit (CAD) fell to $1.3 billion in the January-March period, according to data released by the Reserve Bank of India (RBI) on June 27. The reduction in CAD was aided by cooling oil prices and a booming services sector.

- CAD narrowed to $1.3 billion or 0.2% in the last quarter of FY23 from $16.8 billion or 2% of GDP in Q3 and $13.4 billion in Q4FY22.

|

Global Markets

- European shares declined while Asian stocks ended mixed on Tuesday as investors held tight ranges awaiting clues on the interest rate outlook and wary of risks about Chinas shaky economic recovery and developments in Russia after an aborted mutiny.

- S&P Global on Monday cut its forecast for Chinas economic growth to 5.2% in 2023, down from an earlier estimate of 5.5%, underscoring the uneven nature of the countrys recovery from the pandemic.

- US stocks slid on Monday amid concern that the Federal Reserve and its peers around the world will push economies into recession. The technology sector led the declines on Wall Street, as AI-favorite Nvidia Corp. and Facebook-parent company Meta Platforms Inc. dipped.

- Central banks must accept the uncomfortable truth that they may have to tolerate a longer period of inflation above their 2% target in order to avert a financial crisis, IMF deputy head Gita Gopinath has reportedly warned.

|

Stocks in Spotlight

- Bharti Airtel announced a reshuffling of its leadership team in Airtel Business, leading to a 1.37% rise in its shares. Ajay Chitkara, the current CEO of Airtel Business, has decided to leave the company, with his tenure extending until the third week of August 2023. Following his departure, Airtel Business will be divided into three business and channel segments. Vani Venkatesh will lead the Global business, Ganesh Lakshminarayanan will head the Domestic business, and Ashish Arora will take charge of Nxtra Data Centers.

- Bajaj Auto saw a rise on June 27, ahead of the global unveiling of the first motorcycles from the Bajaj-Triumph partnership. The stock was trading 1 percent higher at Rs 4,655 on the NSE at 12:30pm. Although specific details are yet to be revealed, it is speculated that the Scrambler and Roadster models will be showcased in London. These bikes, expected to feature a 300-400cc engine, are set to compete directly with Royal Enfield.

- Shree Cements‘ stock value dropped by 6% in response to allegations of tax evasion amounting to Rs 23,000 crore. According to a report by NDTV, these allegations surfaced during tax searches at Shree Cements’ offices in Beawar, Jaipur, Chittorgarh, and Ajmer in Rajasthan. The alleged tax evasion has significantly impacted the company’s market performance.

|

News from the IPO world🌐

- Ideaforge IPO fully subscribed on Day 1

- Mukka Proteins refiles DRHP with SEBI to launch IPO

- Afcons begins IPO talks with banks

|

Day Leader Board

Nifty50 Top Gainers

| Stock |

Change (%) |

| HDFCLIFE |

▲ 5.50% |

| APOLLOHOSP |

▲ 2.20% |

| SBIN |

▲ 1.80% |

| JSWSTEEL |

▲ 1.80% |

| SBILIFE |

▲ 1.70% |

|

Nifty50 Top Losers

| Stock |

Change (%) |

| CIPLA |

▼ -1.10% |

| BRITANNIA |

▼ -1.10% |

| TATACONSUM |

▼ -1.00% |

| ADANIPORTS |

▼ -0.80% |

| UPL |

▼ -0.70% |

|

|

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY FINANCIAL SERVICES | 1.37% | | NIFTY REALTY | 1.24% | | NIFTY PRIVATE BANK | 1.11% | | NIFTY BANK | 1.10% | | NIFTY PSU BANK | 1.02% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1970 | | Declines | 1530 | | Unchanged | 139 |

|

Numbers📈 that matter | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 33,715 | (0.0) % | 1.7 % | | 10 Year Gsec India | 7.1 | 0.00% | -3.40% | | WTI Crude (USD/bbl) | 69 | 0.3 % | (9.8) % | | Gold (INR/10g) | 58,256 | 0.10% | 7.00% | | USD/INR | 81.95 | 0.0 % | (0.9) % |

|