Daily Snippets

Date: 10th October 2023 |

|

|

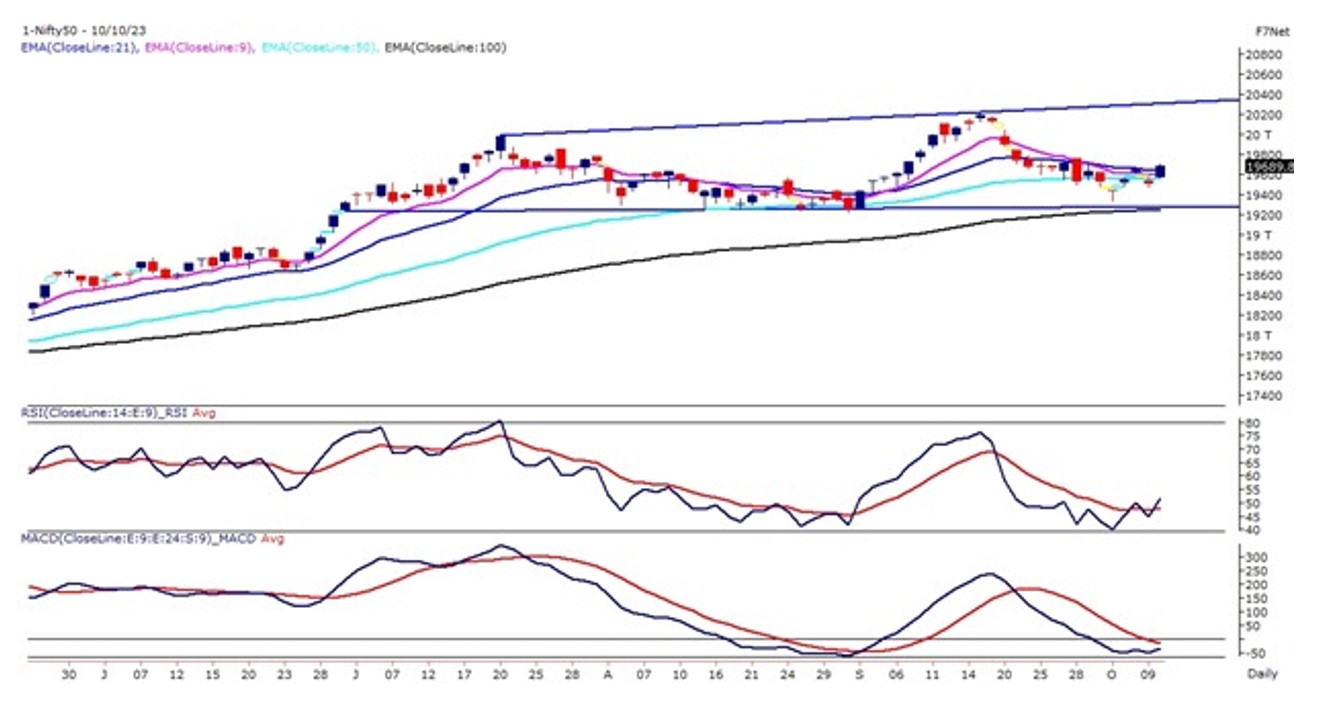

Technical Overview – Nifty 50 |

|

Indian markets opened higher, in line with mostly higher Asian markets and positive US markets on 10th October. The Nifty50 witnessed a gap up opening above 19,550 levels and sustained above the same in the initial trading hours and continued to trade higher throughout the day with higher high formation on the intraday chart.

The benchmark index on the daily chart has formed a tall bullish candle and has closed above its 9 & 50-day exponential moving average which is positive for the index. The momentum oscillator RSI (14) has formed an inverted head & shoulder pattern on the daily chart and the oscillator has just closed above the neckline of the pattern.

On the 30-minute chart index has witnessed an inverted head & shoulder pattern breakout at 19,640 levels and achieved its partial target near 19,700 levels. Buy-on dips will be the preferred strategy for the index with immediate support at 19,600 – 19,550 levels. A sustained move above 19,700 – 19750 levels will initiate a higher level of 19,900 levels.

|

Technical Overview – Bank Nifty |

|

The Banking index opened higher above 44,000 levels on 10th October and witnessed a sustained move with a higher high formation for the day. On the daily chart, the Index has formed a tall green candle near its trend line resistance and was unable to close above its short-term averages.

The momentum oscillator RSI (14) is hovering below 45 levels and the MACD indicator has drifted below its polarity line with a bearish crossover. There is a cluster of gap up and gap down on the daily chart which indicates a higher volatility factor at the present levels.

The index has completed its pullback near its trend line resistance which is placed near 44,400 levels. The immediate support for the index is placed at 43,800 and the upside is capped at 44,600 levels.

|

Indian markets:

- Indian benchmark indices rebounded, recovering losses from the previous session, closing nearly 1% higher on October 10.

- The market gains were attributed to positive global cues, particularly dovish comments from US Federal Reserve officials. This eased concerns about potential interest rate hikes.

- The US Dollar and US Treasury yields both decreased significantly, reinforcing dovish bets related to the Federal Reserve’s policies. Despite the positive momentum, concerns persisted due to the ongoing Israel-Hamas conflict, contributing to market uncertainty.

- Focus however stayed on geopolitics after Israel Defense Forces said that dozens of fighter jets attacked more than 200 targets in Gaza overnight.

|

Global Markets

- Gold prices continued to rise on Tuesday, a day after posting sharp gains on increased market uncertainty due to conflict in the Middle East, as dovish remarks from top U.S. Federal Reserve officials weighed on the dollar and bond yields.

- Benchmark 10-year Treasury yields retreated sharply from their 2007 highs and the dollar index eased as top Fed officials indicated on Monday that rising yields on long-term bonds could steer the Fed from further increases in its short-term policy rate.

- Markets now look forward to minutes of the U.S. central bank’s September meeting, due on Wednesday.

- European stock markets were higher Tuesday amid the geopolitical crisis and bloodshed in Israel and Gaza.

- The regional Stoxx 600 index was up 1.6% in early afternoon trade. Reversing the pattern seen on Monday, sectors were all sharply higher but lagged by oil and gas stocks, which were up 0.35% as crude prices retreated.

|

Stocks in Spotlight

- Coal India rose 5 percent as Nuvama increased the target price of the stock to Rs 389, saying it offered the triple benefits of volume growth, improved e-auction prices, and possible all-time high dividend in H2FY24. The stock also hit a 52-week high.

- JSW Steel shares traded 2 percent higher after the company reported a 13 percent year-on-year (YoY) growth in consolidated crude steel production at 6.41 million tonnes for the recently ended July-September quarter.

- One97 Communications Ltd, the Paytm parent, gained over 4 percent after brokerages Motilal Oswal Securities and Yes Securities raised the target price and Bernstein added the stock to its portfolio on expectations of strong September quarter earnings.

|

News from the IPO world🌐

- 28 IPOs worth Rs. 38,000 crore to hit the street in second half

- Mufti-owner Credo Brands Marketing gets SEBI nod to raise funds via IPO

- Prosus-owned PayU targets Feb for India IPO filing, hires bankers

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | COALINDIA | ▲ 5.1 | | ADANIPORTS | ▲ 3.5 | | BHARTIARTL | ▲ 2.5 | | KOTAKBANK | ▲ 2.4 | | HINDALCO | ▲ 2.4 |

| Nifty 50 Top Losers | Stock | Change (%) | | INDUSINDBK | ▼ -0.7 | | CIPLA | ▼ -0.5 | | TCS | ▼ -0.2 | | DRREDDY | ▼ -0.2 | | TITAN | ▼ -0.1 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY REALTY | 4.01 | | NIFTY PSU BANK | 2.08 | | NIFTY METAL | 2.05 | | NIFTY AUTO | 1.24 | | NIFTY FINANCIAL SERVICES | 1.23 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2503 | | Declines | 1160 | | Unchanged | 126 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 33,605 | 0.6 % | 1.4 % | | 10 Year Gsec India | 7.4 | -0.40% | 0.40% | | WTI Crude (USD/bbl) | 86 | 4.3 % | 12.3 % | | Gold (INR/10g) | 57,271 | 0.00% | 3.50% | | USD/INR | 83.1 | (0.2) % | 0.5 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|