Projected 2024 world GDP growth: 3.2%, US growth: 2.7%

The IMF has projected global GDP growth at 3.2% for the year, with a notable upward revision for the US to 2.7%.

| Projections | Difference from January 2024 WEO Update | |||||

| 2023 | 2024 | 2025 | 2024 | 2025 | ||

| A | World Output | 3.2 | 3.2 | 3.2 | 0.1 | 0.0 |

| Advance Economies | 1.6 | 1.7 | 1.8 | 0.2 | 0.0 | |

| 1 | United States | 2.5 | 2.7 | 1.9 | 0.6 | 0.2 |

| 2 | Euro Area | 0.4 | 0.8 | 1.5 | -0.1 | -0.2 |

| i | Germany | -0.3 | 0.2 | 1.3 | -0.3 | -0.3 |

| ii | France | 0.9 | 0.7 | 1.4 | -0.3 | -0.3 |

| iii | Italy | 0.9 | 0.7 | 0.7 | 0.0 | -0.4 |

| iv | Spain | 2.5 | 1.9 | 2.1 | 0.4 | 0.0 |

| 3 | Japan | 1.9 | 0.9 | 1.0 | 0.0 | 0.2 |

| 4 | UK | 0.1 | 0.5 | 1.5 | -0.1 | -0.1 |

| 5 | Canada | 1.1 | 1.2 | 2.3 | -0.2 | 0.0 |

| 6 | Other Advaned Economies | 1.8 | 2.0 | 2.4 | -0.1 | -0.1 |

| B | Emerging Market & Developed Economies | 4.3 | 4.2 | 4.2 | 0.1 | 0.0 |

| Emerging & Developing Asia | 5.6 | 5.2 | 4.9 | 0.0 | 0.1 | |

| 1 | China | 5.2 | 4.6 | 4.1 | 0.0 | 0.0 |

| 2 | India | 7.8 | 6.8 | 6.5 | 0.3 | 0.0 |

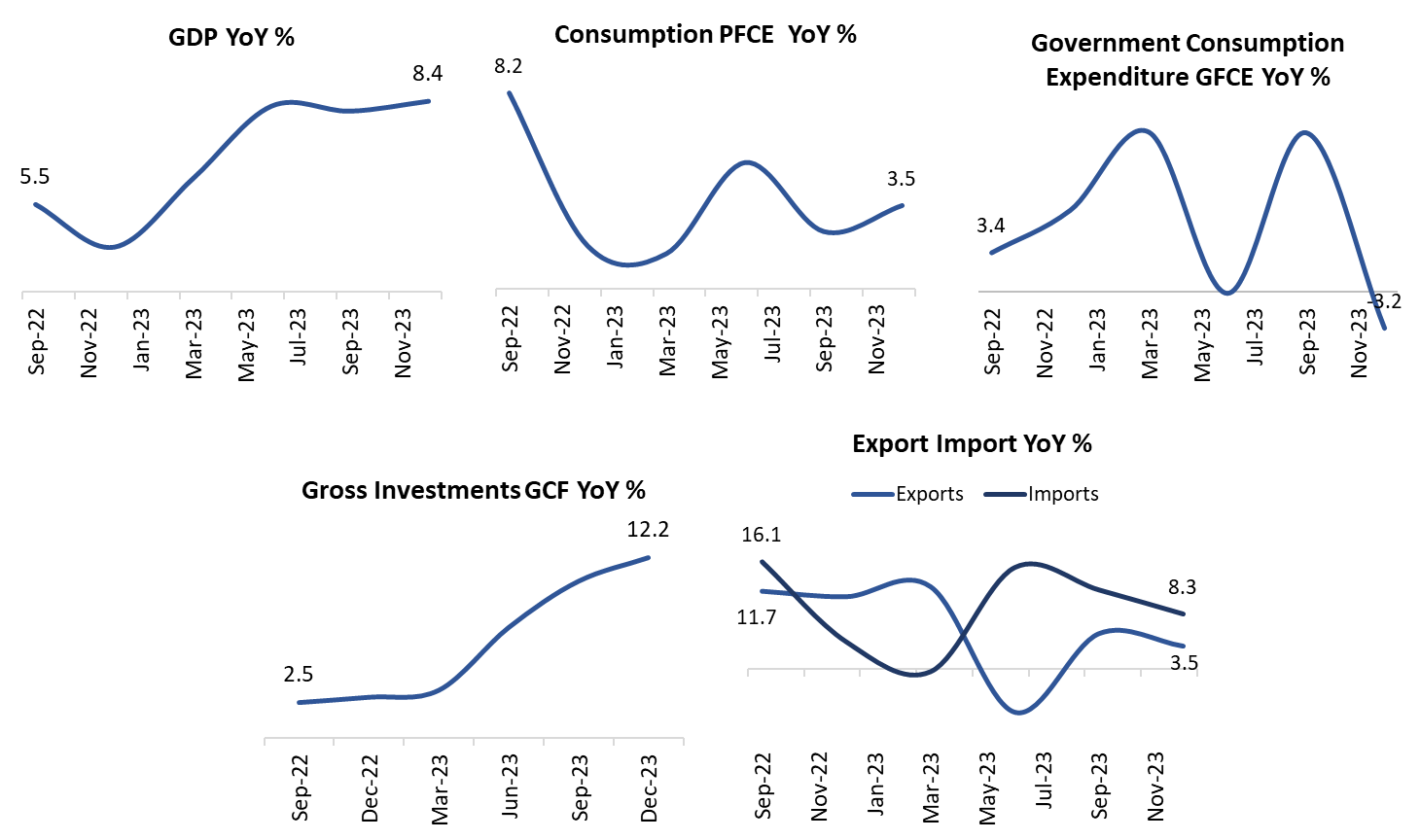

India’s Q3FY24 GDP numbers beat estimates

Strong GDP growth showcases India’s economic resilience and future optimism.

- India’s real GDP surged by a remarkable 8.4% year-on-year in the October-December 2023 quarter, exceeding expectations and marking the highest growth rate in six quarters. This growth was underpinned by robust investments, particularly driven by government capital expenditure, coupled with a substantial improvement in the trade deficit and a pickup in consumption demand. Despite sluggish private sector investments, the economy benefited from strong government spending and expanding exports.

- Looking ahead, sustaining this momentum will depend on continued government support, especially in the form of infrastructure spending and investment-friendly policies. Additionally, efforts to stimulate private sector investments and enhance consumption demand will be crucial for maintaining growth momentum.

- Overall, while challenges remain, the strong performance in the December 2023 quarter indicates resilience in the Indian economy, suggesting a cautiously optimistic outlook for the coming quarters.

FY25 GDP growth projections upwardly revised

Agencies now expect India to grow by seven percent or near-to-seven percent during the current year.

| Agency/ Institution | Month of Release | 2023-24 | 2024-25 |

| CMIE | Apr-24 | 7.8 | 6.4 |

| NSO, MOSPI | Feb-24 | 7.6 | — |

| RBI MPC | Apr-24 | — | 7.0 |

| RBI Forecasters Survey (Median) | Apr-24 | 7.6 | 6.7 |

| International Monetary Fund (IMF) | Apr-24 | 7.8 | 6.8 |

| World Bank | Apr-24 | 7.5 | 6.6 |

| Asia Development Bank (ADB) | Apr-24 | 7.6 | 7.0 |

| OECD | Apr-24 | 6.3 | 6.6 |

| UNCTAD (Calendar year) | Apr-24 | 6.7 | 6.5 |

| Fitch Ratings | Mar-24 | 7.8 | 7.0 |

| S& P Global Ratings | Mar-24 | 7.6 | 6.8 |

| Agency/ Institution | Month of Release | 2023-24 | 2024-25 |

| NCAER | Apr-24 | — | 7.0 |

| ICRA | Feb-24 | 6.6 | 6.2 |

| Crisil | Mar-24 | 7.6 | 6.8 |

| Ind-Ra | Apr-24 | — | 7.1 |

| Bank of Baroda | Mar-24 | — | 7.8 |

| CITI Bank | Mar-24 | — | 6.8 |

| Deloitte | Apr-24 | 7.6-7.8 | 6.6 |

| Nomura | Apr-24 | — | 7.0 |

| Morgan Stanley | Apr-24 | — | 6.8 |

| UBS India | Mar-24 | 7.6 | 7.0 |

Many of these expect a strong growth in private investments to drive overall expansion in the Indian economy. However, all forecasting agencies expect the Indian economy to slow during 2024-25 from the 7.6 percent growth estimated for last year.

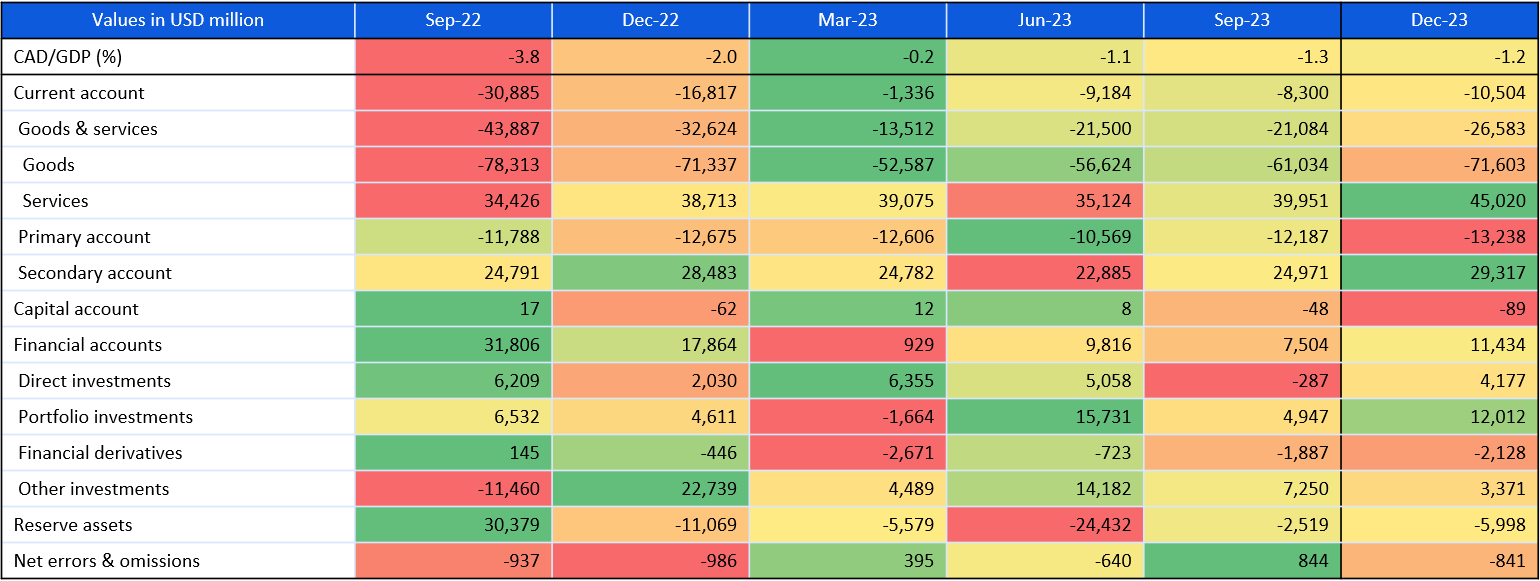

No major concerns on the balance of payment front

We can expect a slight deterioration in April

Source: CMIE, Fisdom Research

Despite a relatively comfortable Balance of Payments (BoP) situation in the March 2024 quarter, challenges remain. While the merchandise trade deficit is reduced and the services trade surplus stabilized, net foreign direct investment (FDI) flows are expected to remain stagnant. However, gross external commercial borrowings nearly doubled, and although foreign portfolio investment (FPI) inflows decreased slightly, forex reserves increased by USD 22.4 billion. These developments, along with a slight appreciation of the INR against the USD, indicate a positive trend for the BoP in the March 2024 quarter.