TL; DR

- The IT sector led the charts last week with all ten index stocks closing in green. However, don’t rush to invest, assuming it has bottomed out. The sector may still experience volatility in the near term due to prevailing global headwinds.

- Despite significant hiring and a slight uptick in utilization, the Q4FY24 earnings for the IT sector were subdued, impacting on the company margins. The disappointment in growth was mainly driven by a decline in revenue growth from leading IT companies like Infosys, Wipro, and Tech Mahindra. Additionally, INFY and HCL’s discouraging guidance indicates a softer FY25 for the sector overall.

- Considering the current global dynamics and demand environment, along with only mild clarity on policy and politics, we don’t anticipate a major revival in spending in CY24. Investors should consider cautiously investing in a staggered manner over the next few months. We expect the situation to improve in CY25 as clarity emerges on policy and politics, particularly with the US election. Even technical indicators show near-term bearishness for the sector. The NIFTY IT INDEX has broken down from its rising channel pattern on a weekly basis, causing it to trade below the lower band of the pattern. Since the breakdown, the index has been consolidating for the past six weeks, fluctuating between 32,600 and 34,300.

- Approach to follow: Buy on dip

The IT sector ended the week on a positive note, topping the charts with an 8.6% return. All 10 companies in the sector delivered positive results.

| Nifty IT Weekly Returns (%) | 8.6% |

| Stock Name | Weekly Returns |

| Persistent Systems Ltd. | 12.9% |

| Tech Mahindra Ltd. | 12.1% |

| Wipro Ltd. | 10.7% |

| Infosys Ltd. | 9.0% |

| HCL Technologies Ltd. | 8.2% |

After such a stellar performance, two questions may come to investors’ minds: why has IT seen a rally, and will it sustain?

Why has the IT sector seen a rally?

The key reason for the rally was not the improvement in the fundamentals of the sector but instead, the volatility surrounding the election, which benefited the sector. The election outcome didn’t align with expectations, leading investors to opt for sectors expected to be less impacted by any outcome. Among the stock, persistent systems, tech Mahindra & Wipro were the major contributors to the rally.

Having said that, not all stocks rally just because of the shift towards defensive but there are a few that are additionally getting an advantage due to their relatively better earning performance over others.

Case in point:

Persistent System:

- Despite challenging times, Persistent Systems continues to report strong growth, with increasing client engagement.

- In Q4FY24, Persistent Systems secured significant deals with a total contract value (TCV) of $447 million, indicating robust business momentum.

- The UK market shows higher cost optimization deals with faster decision-making.

- Encouraging quarter-on-quarter growth is seen across verticals like BFSI, Pharma, Tech, and Others. Strong growth trends are anticipated to continue, driven by a solid deal pipeline.

Infosys

- Infosys has exceeded profit estimates by a significant margin, showing a revenue surprise of 6.5% and a profit surprise of 30.3%. The company’s outperformance is attributed to higher-than-anticipated other income, including a tax refund of Rs 1,935 crore in the quarter, which contributed to surpassing Forecaster estimates.

Will it sustain?

While the IT sector saw gains last week and potential reasons were highlighted, it doesn’t address the fundamental issue of global client aversion to spending, impacting demand for companies.

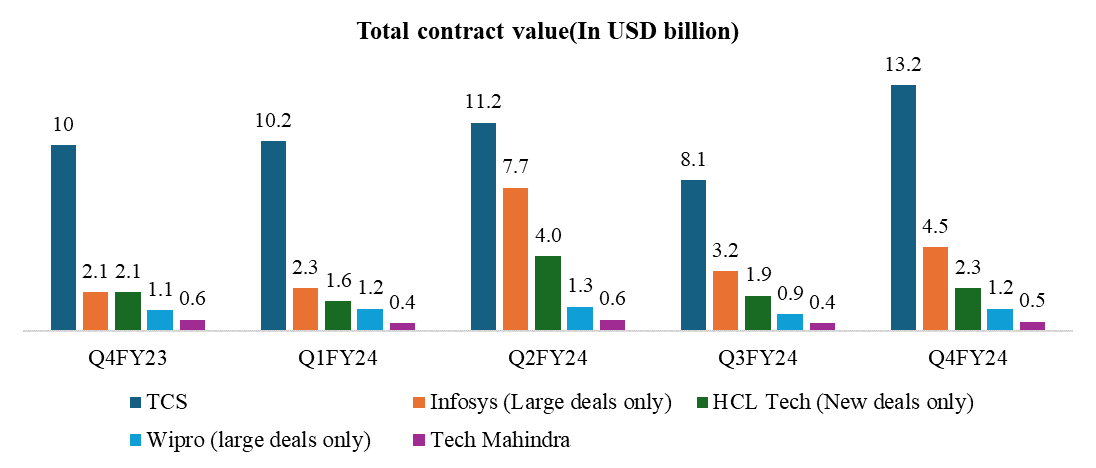

For instance, leading IT firms have witnessed no changes in their order books, which remain constant. The challenge lies in converting these order books into top-line revenue, which is currently not happening.

Source: Trendlyne, Fisdom Research

While spending is rising in sectors like banks, this hasn’t resulted in increased spending on IT services yet. Moreover, the lack of clarity in policy and politics further complicates the situation. Therefore, sustaining this momentum may be challenging in the near term. However, due to its defensive nature and relatively attractive valuations, the IT sector is expected to remain resilient.

Way Forward

We anticipate the current slowdown in the topline to persist into the first half of FY25 until the rate-cut cycle begins. Following rate cuts, momentum is expected to pick up in the BFSI segment. While venturing into new verticals may not yield immediate results, it could have a medium to long-term impact and improve operational margins for companies. We maintain the belief that most IT services companies will regain momentum in the next couple of quarters, driven by resilient deal wins and the easing of supply-side challenges.

Therefore, in the near term, we suggest investors adopt a “buy on dip” approach rather than being overly aggressive.

Key monitorable: Rate cuts in America & Easing banking crisis

Markets this week

| 3rd June 2024 | 7th June 2024 | Change % | |

| Nifty | 23,338 | 23,290 | -0.2% |

| Sensex | 76,583 | 76,693 | 0.1% |

- The Indian market wiped out the previous week’s losses and gained more than 3 percent amid extreme volatility, as the BJP-led NDA did not receive a clear mandate as expected in exit polls. However, the market rebounded strongly, reaching an all-time high after the RBI raised the growth forecast for FY25. Investor sentiment was also uplifted by the news that the BJP-led NDA will form a new government under Narendra Modi for the third consecutive term

- Among sectors, the Nifty Information Technology index rose 8.6 percent, the Nifty FMCG index rose 7 percent, the Nifty Auto index gained 6.8 percent, and the Nifty Media and Realty indices added 5 percent each. However, the Nifty PSU Bank index declined 1.4 percent.

- During the week, Foreign institutional investors (FIIs) sold equities worth of Rs 13,718.42 crore, while Domestic Institutional Investors (DII) bought equities worth Rs 5,578.71 crore.

Weekly newsletter

| Nifty 50 Top Gainers | Day Change % | Nifty50 Top Losers | Day Change% |

| Mahindra & Mahindra | 14.0% | Adani Enterprises | -5.6% |

| Tech Mahindra | 12.1% | Bharat Petroleum | -4.5% |

| Hindustan Unilever | 10.7% | Adani Ports & Special | -4.1% |

| Wipro | 10.6% | L&T | -3.7% |

| Hero MotoCorp | 9.0% | Coal India | -2.5% |

Stocks in Spotlight

- ITC: Shareholders of ITC have approved the demerger of the company’s hotel business, paving the way for the listing of ITC Hotels. This decision was made during a virtual meeting, with 99.6% of shareholders voting in favor. The new entity, ITC Hotels, will handle the hotel and hospitality business.

- IRB Infrastructure Developers: The company, along with its associate IRB Infrastructure Trust, reported a strong year-on-year toll revenue growth of 30% for May 2024. The combined toll collections for the month reached ₹536 crore, significantly higher than the ₹411 crore collected in May 2023.

- Bajaj Finance shares rose around 4 percent after the board approved the sale of Rs 3,000 crore worth of shares in the Bajaj Housing initial public offering (IPO). The Bajaj Housing Finance IPO aims to raise around Rs 4,000 crore through a fresh issue and an offer-for-sale component separately.