Technical Overview – Nifty 50

It was a good start to the week; the benchmark index increased by 0.5 percent during the day. Index reached a record-breaking 26,600. Bulls have largely controlled the market as the index held steady and ended close to its day high.

The momentum indicator, RSI (14) on a 125-minute timeframe, is encountering resistance at the falling trend line. The upward trend should continue as long as the daily MACD remains above its polarity and continues to rise. The index was supported by the 10-DEMA., also index is trading above the major DEMA, indicating an overall upward trend.

Based on benchmark index OI data, a base formation may take place at the 24,500 level, where put writing is almost 73 lakhs. At 24,700, call writing is almost close to 44 lakhs, which might act as a resistance. The PCR value of the benchmark index is 1.18.

The support and resistance levels for the next sessions are at 24,450 and 24,350 and 24,700 and 24,800, respectively.

Technical Overview – Bank Nifty

The banking index had a good start, rising by 0.5 percent and closing over the 52,500 mark. The index is in a consolidation zone. The benchmark index barrier is at 52,800.

The momentum indicator RSI (14) on a daily timescale shows a hidden positive divergence, suggesting that the rising momentum is likely to continue. During the previous session, the index found support at the 20-DEMA; nevertheless, the bulls’ interest in baking the index appeared to be waning. Over the daily chart, the MACD exhibits a negative crossover.

Based on benchmark index OI data, a base formation may take place at the 52,300 level, where put writing is close to 22 lakhs. At 52,600, call writing is almost close to 16 lakhs, which might act as a resistance. The PCR value of the benchmark index is 1.16.

In the event of a decline, the opinion is still to buy on dips and to pyramid over 52,800 levels. The resistance and support levels for the upcoming sessions are 52,650, 52,850 for resistance, and 52,000, 51,750 for support.

Indian markets:

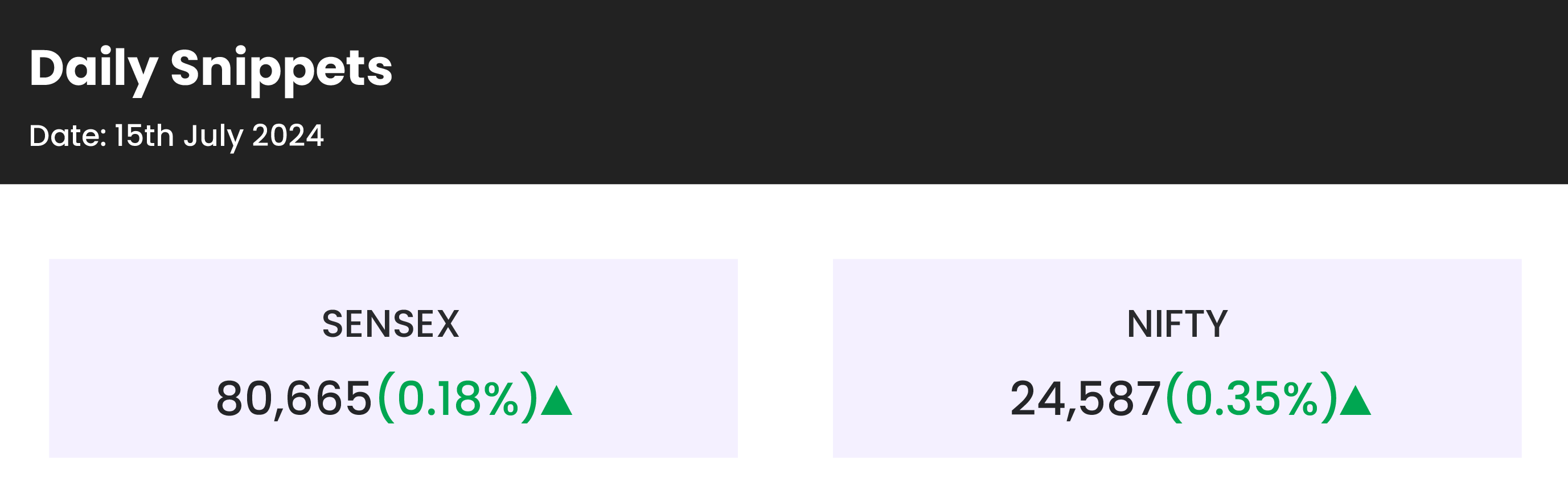

- The record run on Dalal Street continued for the second consecutive session on July 15, with Nifty climbing to a fresh all-time high amid buying across sectors, except Information Technology.

- Despite mixed global cues, the Indian equity indices opened higher and extended their gains throughout the day. Nifty surpassed 24,600 for the first time, reaching a new record high of 24,635.05, while the BSE Sensex approached its record high of 80,893.51.

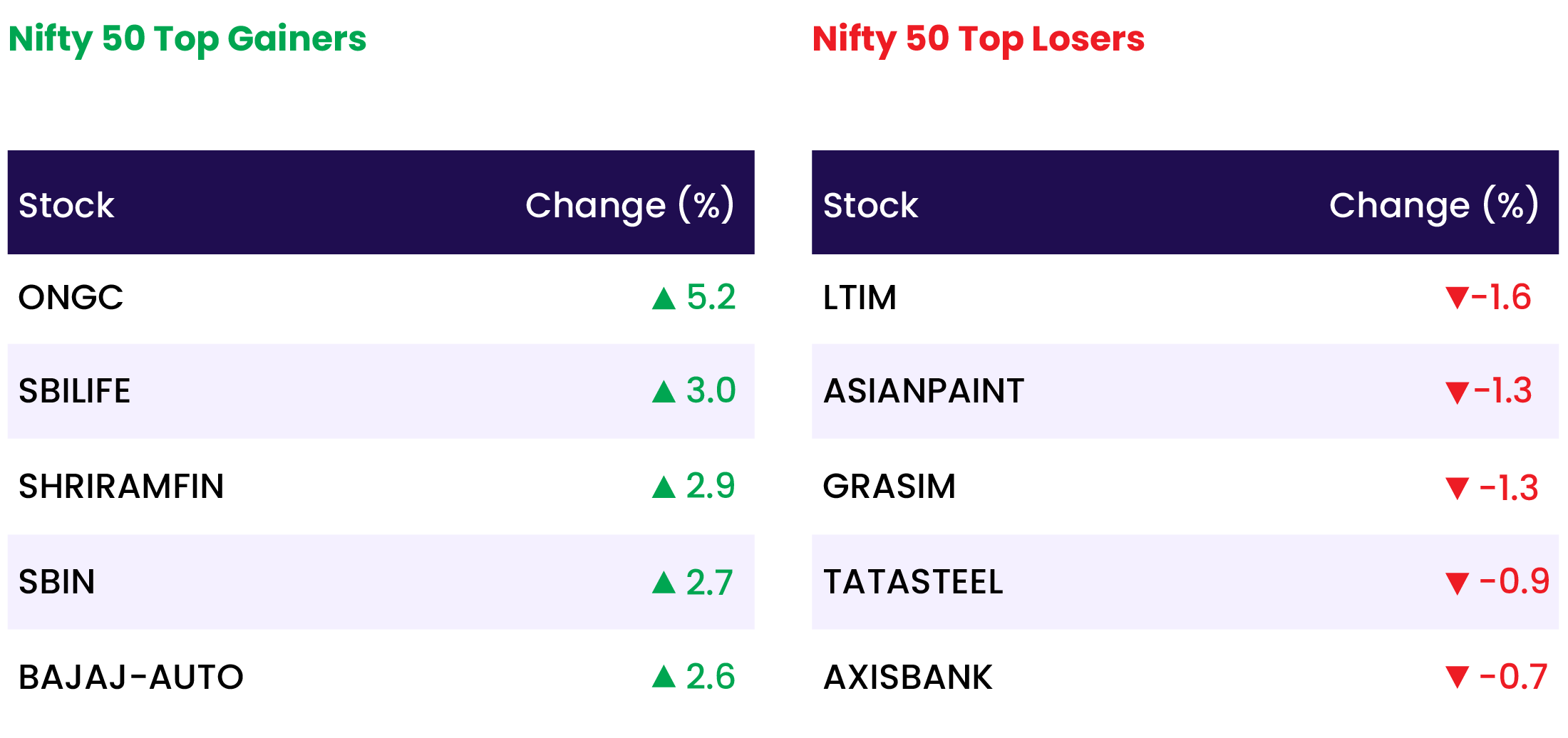

- All sectoral indices, except IT, ended in the green, with auto, pharma, PSU bank, realty, and oil & gas indices rising 1-3 percent.

- The BSE midcap index gained 1 percent, while the smallcap index increased by 0.2 percent.

Global Markets:

- Asia-Pacific markets mostly fell on Monday as China’s GDP data missed expectations, while investors also assessed the impact of an assassination attempt on former U.S. President Donald Trump at a rally over the weekend.

- Hong Kong’s Hang Seng index fell 1.73% in its final hour of trade, led by consumer stocks, while mainland China’s CSI 300 edged up 0.11% despite the disappointing economic data. Japan’s markets were closed for a public holiday.

- South Korea’s Kospi climbed 0.14%, while the small-cap Kosdaq gained 0.3%, snapping a three-day losing streak.

- Australia’s S&P/ASX 200 hit an all-time high, surpassing the 8,000 mark for the first time, and closed up 0.73%.

- It was the only major Asia-Pacific benchmark in positive territory.

- U.S. market futures rose on Monday morning, with futures tied to the Dow Jones Industrial Average higher by 0.24%, while the S&P 500 and Nasdaq saw gains of about 0.25% and 0.41%, respectively.

Stocks in Spotlight

- Shares of the Indian Renewable Energy Development Agency (IREDA) surged over 9 percent in morning trading, reaching a new record high of ₹310 on the National Stock Exchange (NSE).

- Jupiter Wagons Shares gained over 5 percent after the company announced it raised ₹800 crore through a qualified institutional placement (QIP). The floor price for the QIP was set at ₹689.47, and the company issued and allotted 12.2 million equity shares at a price of ₹655.5 per share.

- Zen Technologies | CMP: Rs 1,361 | Shares jumped 5 percent to Rs 1,361 to be locked in the upper circuit after the company said it introduced AI-powered robots and launched four defence products.

News from the IPO world🌐

- Sanstar’s Rs 510-cr IPO to open on July 19; sets price band at Rs 90-95 per share

- Swiggy announces $65 million ESOP programme for employees ahead of IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 3.1 |

| NIFTY OIL & GAS | 2.0 |

| NIFTY MEDIA | 1.5 |

| NIFTY MIDSMALL HEALTHCARE | 1.5 |

| NIFTY REALTY | 1.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2036 |

| Decline | 2004 |

| Unchanged | 128 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 40,001 | 0.6 % | 6.1 % |

| 10 Year Gsec India | 7.0 | (0.1) % | 1.2 % |

| WTI Crude (USD/bbl) | 82 | (0.5) % | 16.8 % |

| Gold (INR/10g) | 73,210 | 0.1 % | 8.1% |

| USD/INR | 83.52 | 0.0 % | 0.6 % |