Daily Snippets

Date: 21st December 2023 |

|

|

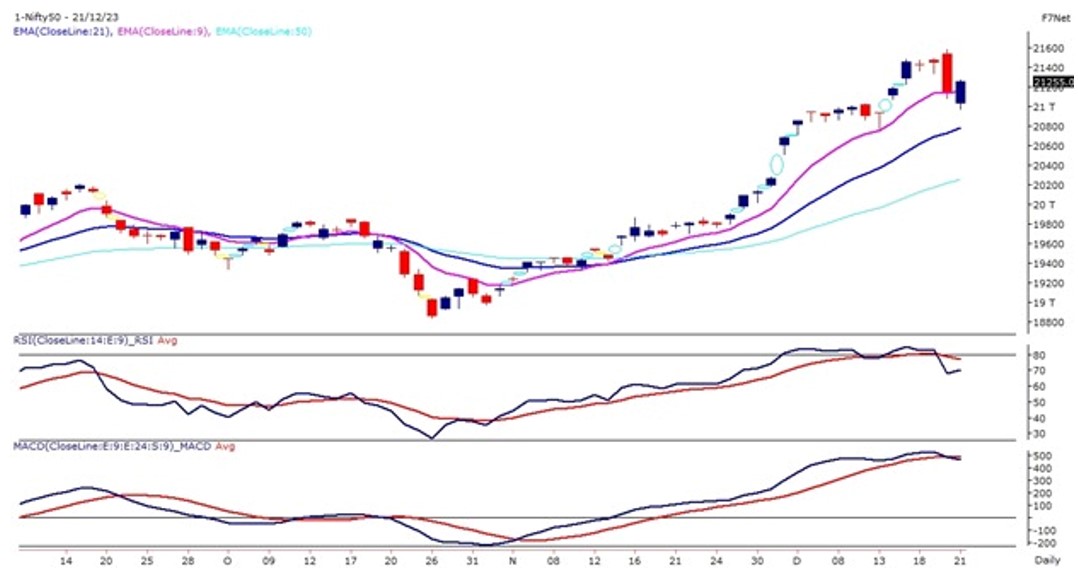

Technical Overview – Nifty 50 |

|

The Benchmark index witnessed a gap down opening on 21st December following its previous day’s sell of pattern. However, a strong turnaround was witnessed as the prices registered the intraday low within 15 minutes of the trade and formed a V-shaped reversal pattern on the intraday chart.

Nifty on the daily chart, has formed a green candle and prices have retraced almost 40% to its previous day’s loss. The Index has taken support near the 9 EMA which is placed at 21,160 levels and moved higher.

Technically two continuation gaps were left unfilled during the move and in the recent correction prices have filled the gaps and have closed the window on the daily time frame. The view remains to buy on dips for the index towards 21,100 – 21,000 levels and the upside can be extended to 21,600 levels.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty witnessed a gap down opening on 21st December following its previous day’s sell of pattern. However, a strong turnaround was witnessed as the prices registered the intraday low within 30 minutes of the trade, forming a V-shaped reversal pattern on the intraday chart.

The Banking Index on the daily chart has formed a green candle and prices have retraced almost 50% to their previous day’s loss and have formed a bullish piercing pattern The Index has taken support near the 9 EMA which is placed at 47,480 levels and moved higher.

Technically two continuation gaps were left unfilled during the move and in the recent correction prices have filled the gaps and have closed the window on the daily time frame. The view remains to buy on dips for the index towards 47,500 – 47,200 levels and the upside can be extended to 48,250 levels.

|

Indian markets:

- Benchmark indices opened lower but recovered gradually, closing with gains on December 21 despite mixed global cues.

- Broader market indices, which experienced significant selling in the prior session, gained attention on this day.

- However, the market trend remained subdued as Foreign Institutional Investors (FIIs) maintained a muted stance ahead of the festive break.

- Global markets traded negatively ahead of the announcement of US GDP data, contributing to the cautious sentiment.

|

Global Markets

- Most of the European stocks advanced. The UK Inflation fell sharply to 3.9% in November from 4.6% in October, lowest level in more than two years, the official data showed.

- Most Asian stocks ended higher on Wednesday, with Japan stocks extending gains to another session after the countrys central bank left its ultra-loose monetary policy unchanged at its final meeting this year.

- The People?s Bank of China held its one-year loan prime rate at 3.45%. The five-year benchmark loan rate was unchanged at 4.2%.

- US stocks ended higher on Tuesday as the Federal Reserve?s recent dovish shift on rates lifted stocks.

|

Stocks in Spotlight

- Delhivery experienced a surge of over 6 percent. This was a day after the company operationalised its largest gateway situated in Bhiwandi, Maharashtra. The Bhiwandi trucking terminal is one of the most extensive logistics facilities in India, built over 1,200,000 sqft of land. According to the company, the terminal has the capability to handle Delhivery’s parcel and part-truckload freight volume simultaneously. In addition, it combines automated hub, sortation, returns, and freight operations.

- AstraZeneca Pharma’s shares rose by 6% on December 21st as the company announced that it would launch Enhertu, a breast cancer drug, in India in January 2024. In May of this year, the company received import and market permission in Form CT-20 from the Drugs Controller General of India for Tanstuzumab Deruxtecan 100 mg/5 mL vial lyophilized powder for concentrate for solution for infusion (Enhertu).

- IRCTC’s share prices rose by about 8% on high trading volumes. Approximately two crore shares were traded on both the BSE and NSE, which is significantly higher than the average of 80 lakh shares traded in the past month. The stock has been performing well since the company announced its intentions to expand its non-railway catering business across the country last week.

|

News from the IPO world🌐

- Azad Engineering IPO Subscribed 11.09 Times On Day 2

- Emcure Pharma refiles IPO papers to SEBI trim issue price

- DOMS IPO lists at 77% premium over IPO price

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | POWERGRID | ▲ 2.3 | | BPCL | ▲ 2.2 | | BRITANNIA | ▲ 2.2 | | APOLLOHOSP | ▲ 1.9 | | HDFCBANK | ▲ 1.7 |

| Nifty 50 Top Losers | Stock | Change (%) | | BAJAJ-AUTO | ▼ -1.8 | | BAJFINANCE | ▼ -1.4 | | AXISBANK | ▼ -1.2 | | HCLTECH | ▼ -1.1 | | CIPLA | ▼ -0.6 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY MEDIA | 2.49 | | NIFTY OIL & GAS | 1.73 | | NIFTY PSU BANK | 1.64 | | NIFTY METAL | 1.38 | | NIFTY REALTY | 0.92 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2649 | | Declines | 1134 | | Unchanged | 113 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,082 | (1.3) % | 11.9 % | | 10 Year Gsec India | 7.2 | 0.20% | -0.40% | | WTI Crude (USD/bbl) | 74 | 2.0 % | (3.9) % | | Gold (INR/10g) | 62,120 | -0.20% | 12.50% | | USD/INR | 83.14 | 0.1 % | 0.6 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|