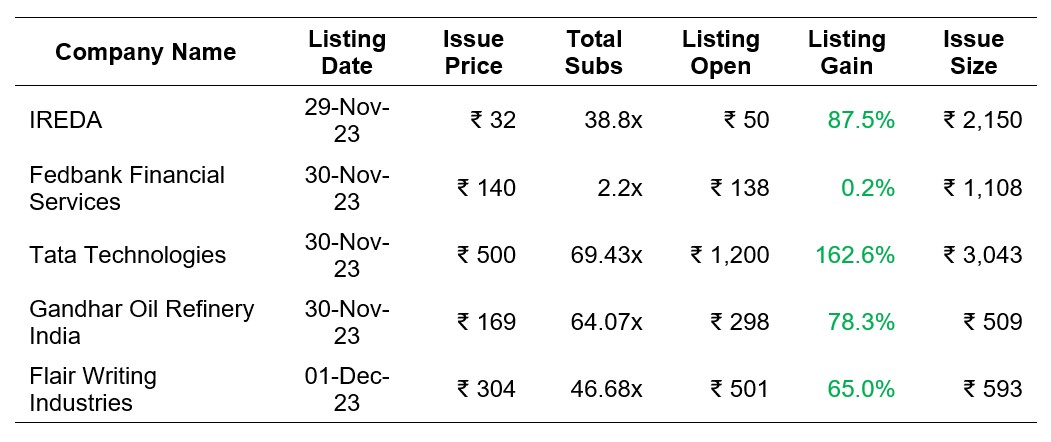

Investors have shown immense interest in the IPOs listed this week, making it a buzzing time for the market. The week saw the listing of 5 IPOs, including Tata Group’s Tata Technology, and the smooth listing of all the IPOs received applause from several industry majors. The investors on D-Street placed bids worth a total of ₹2.59 lakh crore in the five recently concluded mainboard initial public offerings (IPOs). The week-long bidding frenzy has gripped investors, and the five companies – Tata Technologies Ltd., Gandhar Oil Refineries Ltd., Fedbank Financial Services Ltd., Flair Writing Industries Ltd, and Indian Renewable Energy Development Agency (IREDA) Ltd – sustained the IPO pulse in India’s primary markets. |

||||||||||||||||||||

| ||||||||||||||||||||

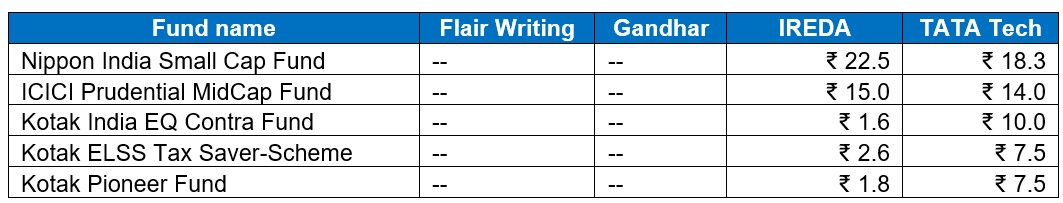

The IPO of Tata Technologies created quite a buzz in the market, with its price surging three-fold from the initial offering. For retail investors who missed out on the opportunity to subscribe, mutual funds provided a silver lining by taking advantage of this golden chance. Now, amid a buzz around these mainline IPOs, only a handful of investors who got the allotment could experience the listing gain. But wait, while the retail portion of these IPOs is oversubscribed multiple times, the institutional or big players have also participated in these IPOs with the same amount of exuberance. Even though you, as a retail investor, have not got any allotment to the mainline IPOs, your mutual funds have already subscribed to the best IPOs and captured the listing gains. |

||||||||||||||||||||

|

||||||||||||||||||||

|

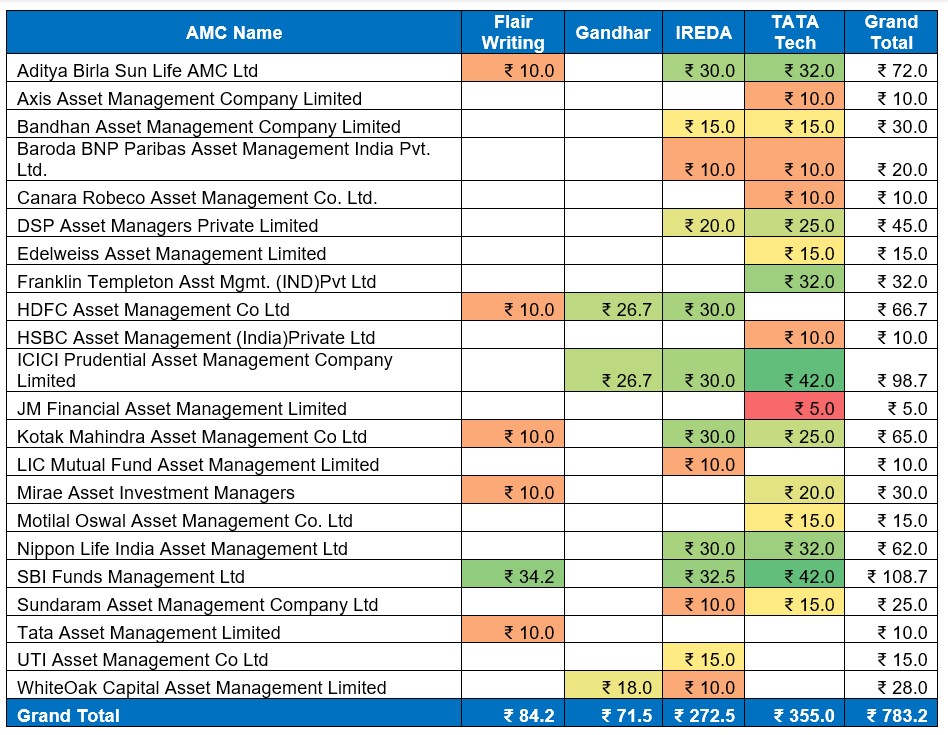

SBI mutual fund is leading the pack in IPO bidding, with a significant allocation towards Tata Technologies. The SBI Multi Asset Allocation Fund was utilized for this purpose, with a maximum allocation towards the company. It is to be noted that HDFC AMC, one of the largest AMCs in India, have stated clear off the TATA Technologies IPO and participated in other IPOs like Flair, Gandhar and IREDA. | ||||||||||||||||||||

Source: Fisdom Research. Amount in crores |

||||||||||||||||||||

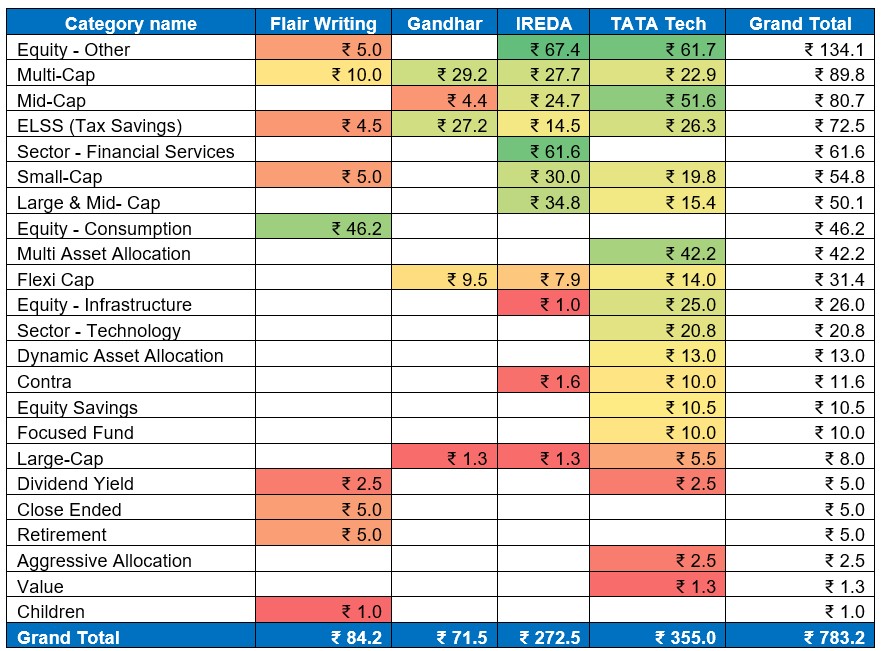

Many mutual funds have shown a preference for the Equity-Other or Thematic/Sectoral categories when it comes to allocating maximum funds towards recent IPOs. The Multicap category has also gained maximum interest for the addition of new companies to the portfolio. | ||||||||||||||||||||

Source: Fisdom Research. Amount in crores |

||||||||||||||||||||

Conclusion: The recent IPO rush has been a highly energetic and dynamic phase for the market, with significant participation from both retail and institutional investors. The success of these offerings, especially for Tata Technologies and other prominent companies, highlights the immense interest and robust bidding in the market. Mutual funds played a crucial role in securing the listing gains for their investors, with a trend towards thematic/sectoral allocations showcasing a strategic approach towards portfolio diversification. With several prominent funds participating in multiple IPOs, investors who lost out on listing gains can still gain benefit out of the funds that they invested in. | ||||||||||||||||||||

Markets this week

Source: BSE and NSE | ||||||||||||||||||||

| ||||||||||||||||||||

|

Weekly Leader Board

Source: BSE | ||||||||||||||||||||

Stocks that made the news this week:

| ||||||||||||||||||||

|

Please visit www.fisdom.com for a standard disclaimer. |