Election have finally begun in India. This initial phase, the largest of the seven phases, will see 102 out of 543 seats contested, signaling the start of the most anticipated and tracked event for the stock markets.

History suggests that election season can indeed influence market sentiment in the short term. However, once the election dust settles, the stock market tends to return to its usual course of upward trajectory, undeterred by the electoral outcome as the time passes.

As the nation awaits the outcome of the 2024 elections, with expectations of a return to power for the incumbent party. While any deviation from these expectations could trigger short-term market jitters, historical trends suggest that such fluctuations are often transient.

While major political parties have published their manifestos for the 2024 elections, the likelihood of the incumbent government’s return is highly probable when examining polling data from various sources.

| NDA | I.N.D.I.A. | Others | Total | |

| Times Now | 384 | 118 | 41 | 543 |

| Indi TV | 399 | 113 | 31 | 543 |

| News 18 | 411 | 105 | 27 | 543 |

| ABP News | 366 | 156 | 21 | 543 |

| India TV | 378 | 98 | 67 | 543 |

Let’s delve into the incumbent government’s manifesto and understand the key takeaways for investors from it.

Some of the key manifesto highlights are:

- Establish a fund to control vegetable and pulse prices, aiming to reduce food inflation and potentially restart rate cuts from August.

- Expand the PM Awas Yojna to ensure all impoverished households are covered and to support affordable housing for the middle class.

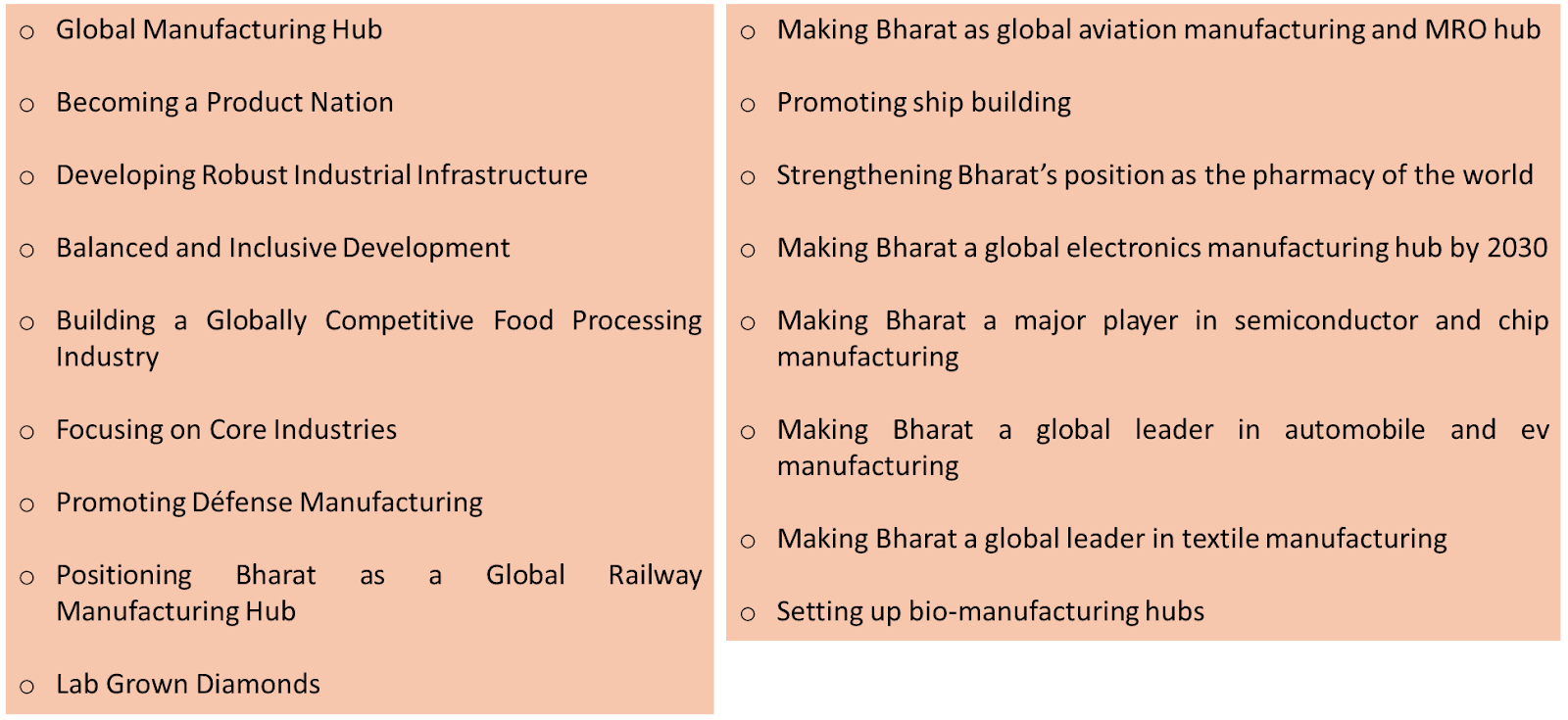

- Generate job opportunities by positioning India as a global manufacturing center, focusing on industries such as defense, aircraft, shipbuilding, pharmaceuticals, electronics, textiles, lab-grown diamonds, and biomanufacturing.

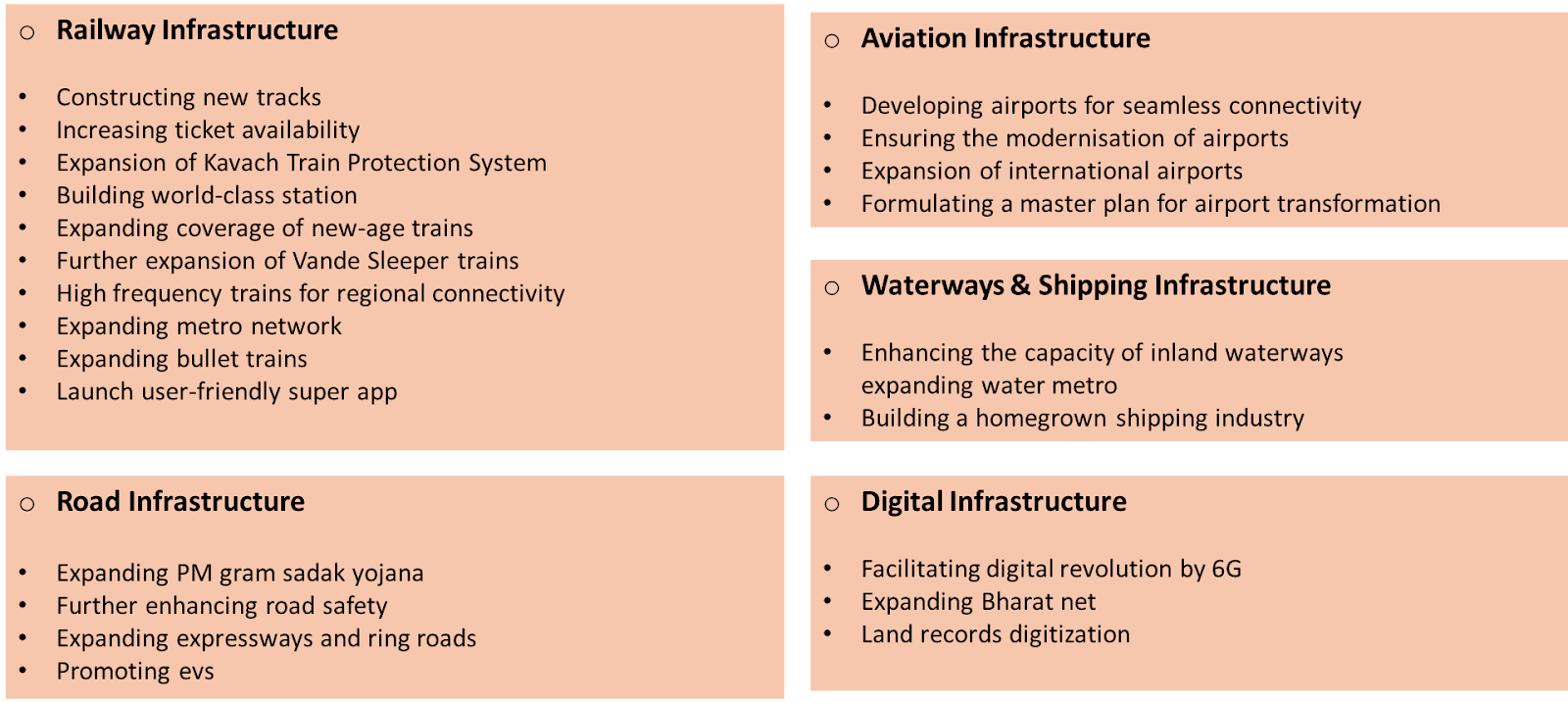

- Develop top-tier infrastructure, including railway tracks, stations, metros, airports, highways, inland water transport systems, electric vehicle charging stations, and expanding the 5G telecom network.

Below is a brief summary of Sector specific promises the incumbent government wants to focus on:

- The government plans to focus on the following initiatives to drive growth in infrastructure

- The government plans to focus on the following initiatives to drive growth in manufacturing

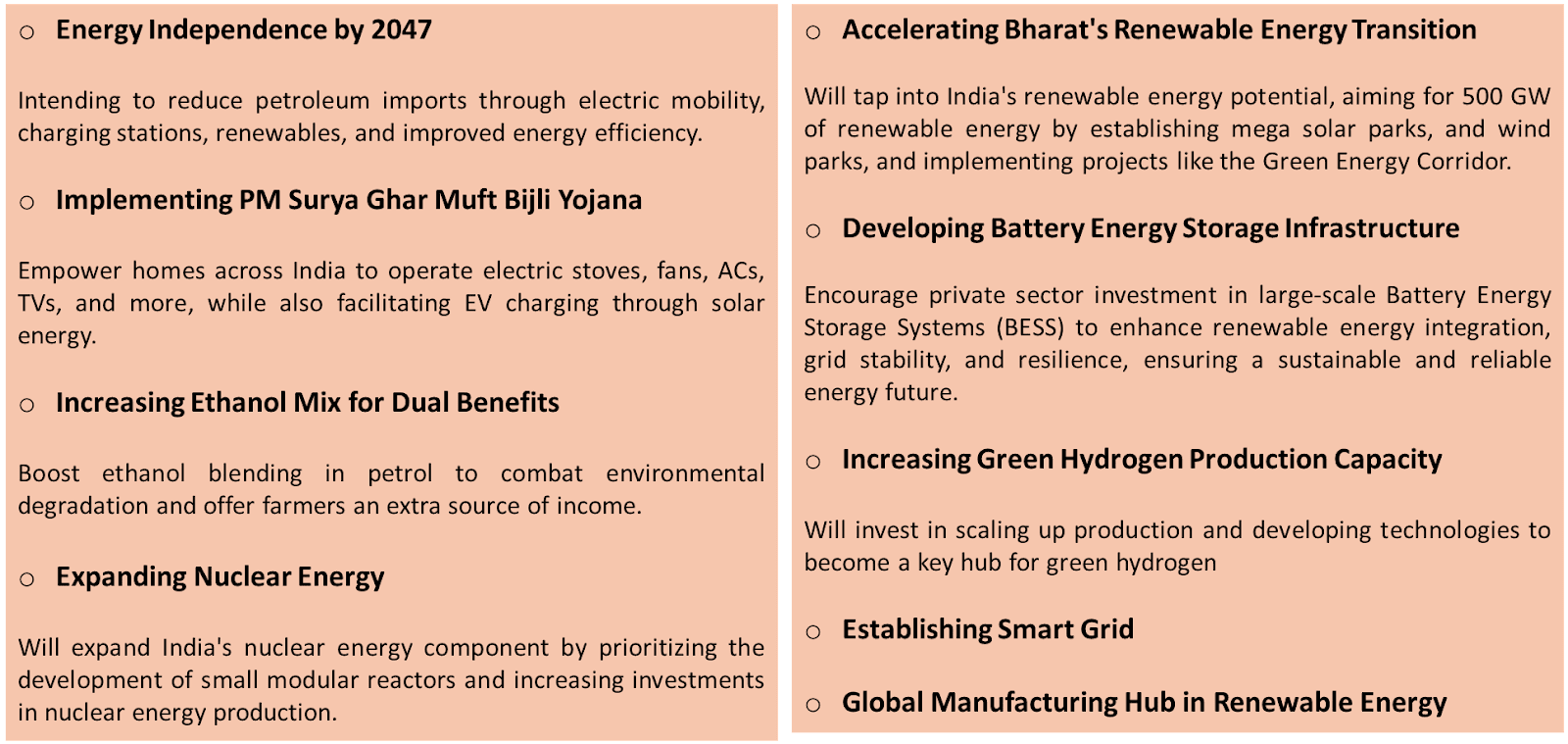

- The government plans to focus on the following initiatives to drive growth in renewables

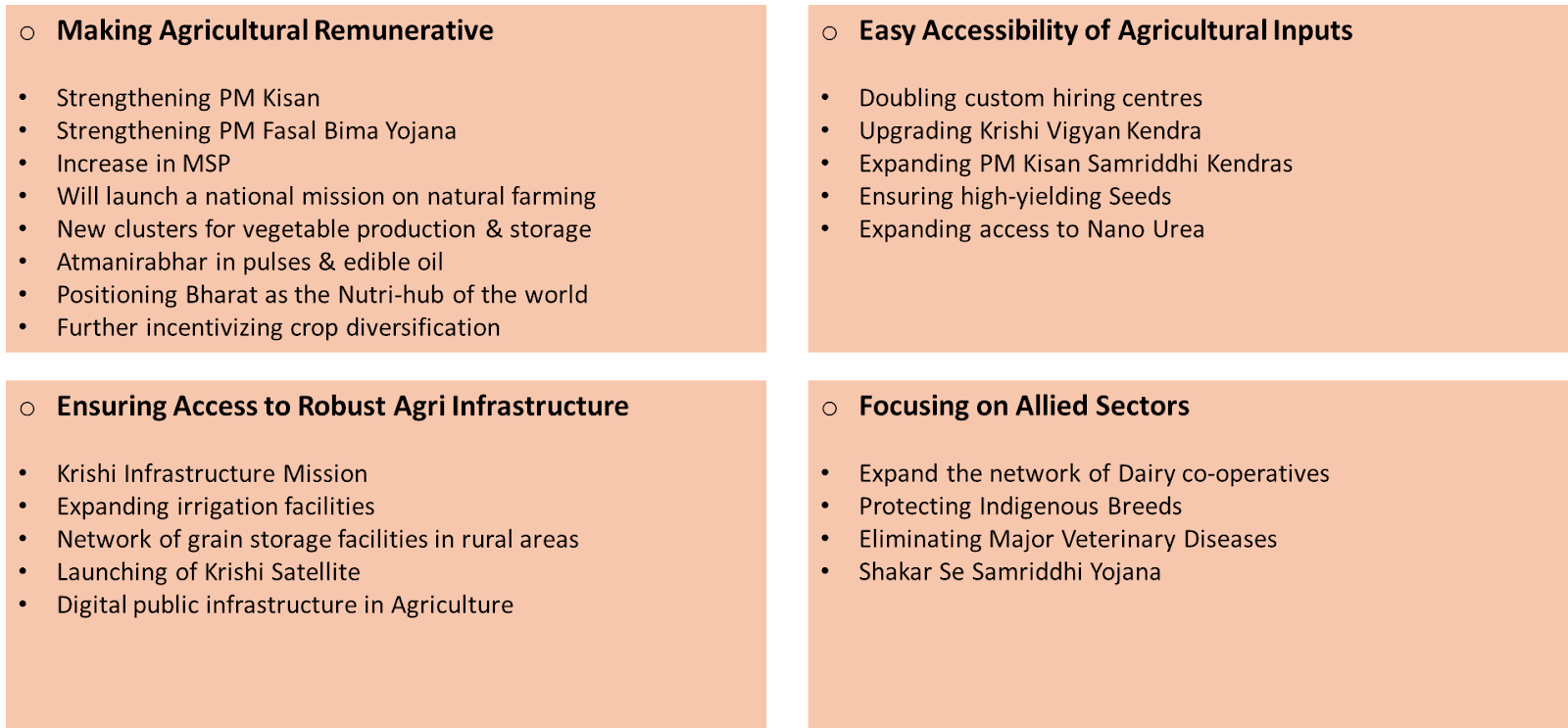

- The current administration has prioritized the dignity and empowerment of farmers above all else.

Source: BJP Manifesto, Capview – Monthly Outlook, Fisdom Research

Major beneficiary companies of the manifesto promises:

| Theme | Positive for | Company Names |

| Affordable Housing (AH) | Banks, Metals, NBFCs, Cement | HUDCO, UltraTech Cement, Ambuja Cement |

| Tourism | Hotels, Aviation, NBFCs | Indian Hotels, Shriram Transport Finance, Sundaram Finance, Chola Finance |

| Railway Infrastructure | Major Steel Players, APL Apollo, JTL, Surya, Hi-Tech | APL Apollo Tubes, Jindal Steel & Power, Tata Steel |

| Electric Vehicles (EVs) | Auto Manufacturers, NBFCs | Tata Motors, TVS Motor, Shriram Transport Finance, Sundaram Finance, Chola Finance |

| Auto Parts Suppliers | Motherson, Sona BLW | Motherson Sumi Systems, Sona BLW Precision Forgings |

| Mudra Loan Limit Expansion | PSBs, SFBs, MFIs | State Bank of India, Bandhan Bank, Ujjivan Small Finance Bank, Bajaj Finserv |

| Working Capital to MSMEs | Shriram Finance, MAS Financial (NR), Bajaj Finance | Shriram Transport Finance, Bajaj Finance |

| Natural Gas | Gas Companies, Pipe Manufacturers | GAIL (India), Petronet LNG, Indraprastha Gas, Welspun Corp, Maharashtra Seamless, Ratnamani Metals |

| Increase Crop MSP | Tractor Manufacturers, NBFCs | Escorts, Mahindra & Mahindra, Mahindra Finance, Chola Finance, Shriram Transport Finance |

| Har Ghar Jal Scheme | Pipe Manufacturers | Jindal Saw, Welspun Corp, Electrosteel Castings, Hi-Tech, JTL, Surya, APL Apollo Tubes |

| Pharma | Manufacturing and Research Companies | Divis Laboratories, Syngene International, Suven Life Sciences, Ami Organics |

| FMCG (Rural Recovery) | FMCG Companies | Dabur India, Emami, Bajaj Consumer, Hindustan Unilever, Colgate-Palmolive, Britannia Industries |

| PM-eBus | Automobile Manufacturers | Ashok Leyland, Tata Motors, JBM Auto, Olectra Greentech |

Market this week

| 15th Apr 2024 (Open) | 19th Apr 2024 (Close) | %Change | |

| Nifty 50 | ₹ 22,339 | ₹ 22,147 | -0.9% |

| Sensex | ₹ 73,315 | ₹ 73,088 | -0.3% |

- The market ended the week with a break in its four-week winning streak, influenced by geopolitical tensions that drove crude oil prices above USD 90.

- Despite the overall pressure, a strong recovery on the final day helped the Nifty index close above 22,100.

- Sectoral indices witnessed a decline across the board, with the Nifty Information Technology index dropping by 4.7 percent, Nifty PSU Bank falling by 3.7 percent, Nifty Realty Index shedding 2.7 percent, and Nifty Pharma index declining by 2 percent.

- Foreign institutional investors (FIIs) were net sellers, offloading equities worth Rs 11,867.03 crore, while Domestic Institutional Investors (DIIs) bought equities worth Rs 9036.33 crore.

- In the current month, FIIs have sold equities worth Rs 22,229.49 crore, while DIIs have counterbalanced by purchasing equities worth Rs 21,268.96 crore.

Weekly Leaderboard

| NSE Top Gainers | NSE Top Losers | ||||

| Stock | Change (%) | Stock | Change (%) | ||

| Bharti Airtel | ▲ | 5.18 % | Adani Enterprises | ▼ | (5.70) % |

| Maruti Suzuki | ▲ | 3.62 % | TATA Motors | ▼ | (5.43) % |

| ONGC | ▲ | 3.59 % | Hero MotoCorp | ▼ | (5.11) % |

| Hindalco Inds. | ▲ | 2.69 % | Infosys | ▼ | (4.95) % |

| Power Grid corporation | ▲ | 2.33 % | HCL Technologies | ▼ | (4.86) % |

Stocks that made the news this week:

- Despite delivering a strong financial performance in the fourth quarter, surpassing expectations, Bajaj Auto witnessed a decline in its share price by as much as 3.56 percent to Rs 8,700.05 on April 19. Investors expressed concerns that the stock price had already exceeded brokerage target prices and that valuations were becoming expensive. Although brokerages praised the company’s January-March earnings report, many maintained a ‘sell’ rating on the stock, with target prices well below the current level. They remained cautious about Bajaj Auto’s export business and anticipated the stock rally to lose momentum as most positive factors were already factored into the price.

- Man Industries (India) saw a 3 percent surge in early trading on April 19 following approval from Shell Global for the external, internal, and concrete coating of steel pipelines at Anjar, Gujarat. The company announced that its coating mill in Anjar underwent rigorous technical assessment, which included testing the performance of three different types of coatings. Shell Global Solutions International BV approved the results, signaling a positive development for the firm.

- Infosys reported a 30% year-on-year increase in net profit to Rs 7,969 crore, surpassing estimates, while revenue from operations grew by 1.3% to Rs 37,923 crore, slightly missing estimates. The company slashed its revenue guidance for fiscal 2025 to 1-3% from the previous 4-7%, citing uncertain demand conditions. Infosys declared a final dividend of Rs 20 per equity share and a one-time dividend of Rs 8 per share. However, Infosys ADR fell by 7% pre-market following the Q4 results. The CFO mentioned that hiring models have changed significantly, contributing to the revenue miss.