As India gears up to commemorate its 77th Independence Day on August 15, 2023, it’s a moment of reflection on the nation’s liberation from two centuries of British colonial rule. Looking beyond the celebrations an important narrative as a capital market participant or any other individual who wants to start investing or who has begun his/her journey towards building themselves wealth to become financially free needs to look at how on a broader level India as a country is becoming financially independent.

First let’s start with households.

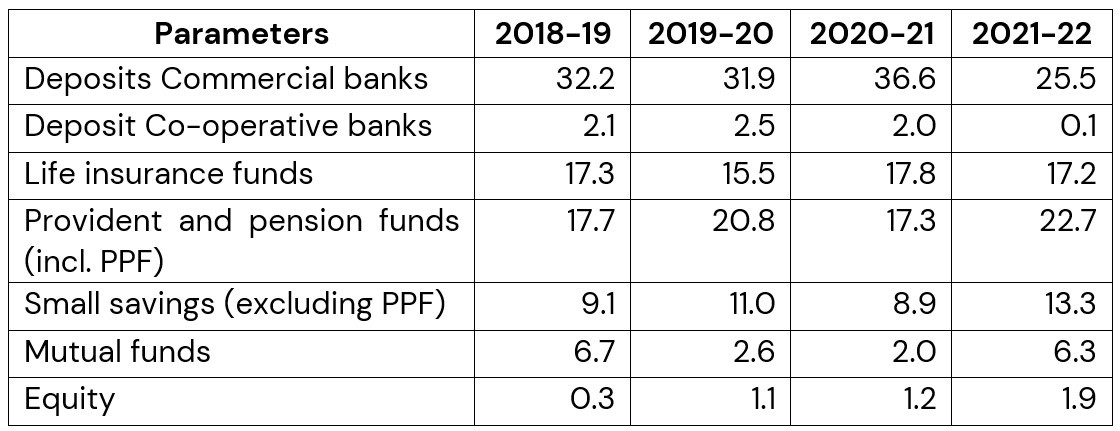

Breakup of Financial Assets of Households % share:

|

|

Source: SMIE, Fisdom Research.

Key Takeways:

- Shift Towards Higher-Yield Investments: Household investment preferences are shifting towards higher-yield options, evident through reduced bank deposits and increased interest in provident funds, mutual funds, and equity.

- Emphasis on Long-Term Planning: Rising investments in provident funds highlight households’ focus on long-term financial security. Indicating a rising awareness of retirement planning and the need for sustained financial stability.

- Diversification and Risk Management: Growing mutual fund and equity investments show willingness to diversify portfolios for balanced risk and returns.

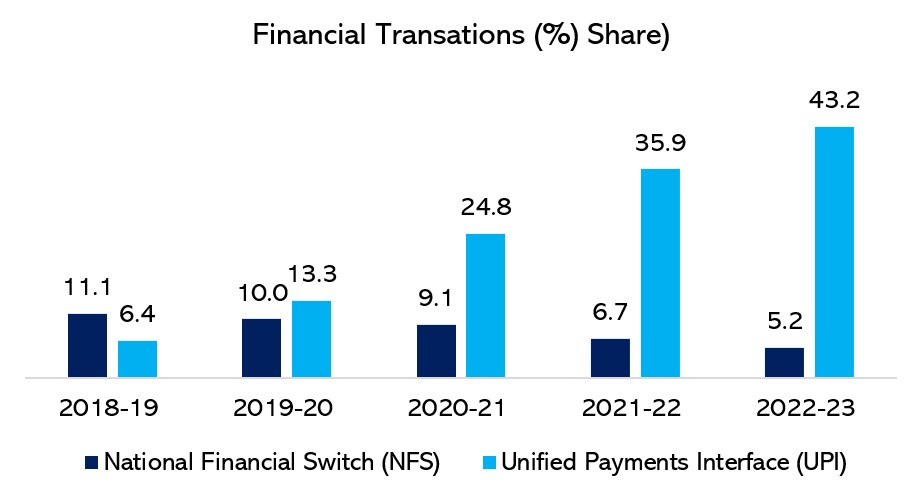

How are digital payments systems redefining financial independence?

|

|

Source: CMIE, Fisdom Research

Key Takeways:

- UPI’s rapid growth, surpassing NFS transactions by a significant margin, signifies a fundamental change in the way people carry out transactions, favoring the convenience and efficiency offered by digital platforms.

- Things have become more accessible since the onset of cashless revolution and UPI has been a key pillar to penetrate India’s huge chunk of financial savings and redirect them towards various avenues of investments and expenditure. New industries have developed among the digital payments players to further develop the reach of financial services and facilities which were never accessible before.

What are Micro and Macro factors leading India towards its financial independence?

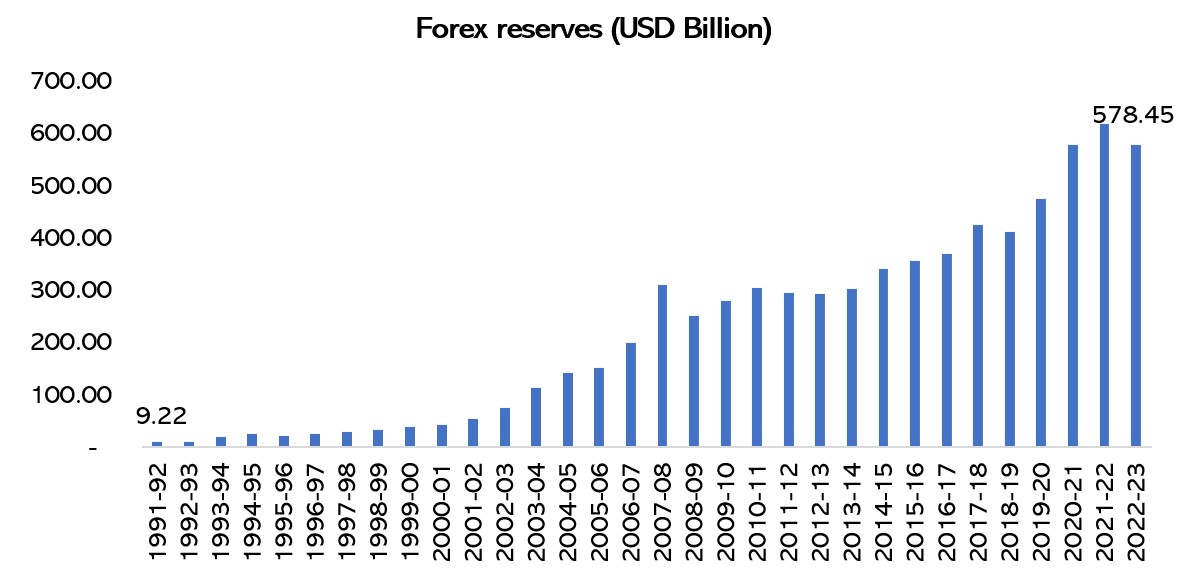

Forex Reserves are on the rise:

|

|

- India’s foreign exchange reserves experienced a substantial surge when compared to their levels during the early years post-independence. These reserves serve as a vital buffer against unforeseen external shocks, providing a safeguard for the country’s financial stability.

- Back in 1951-52, foreign exchange reserves were meager at just $1.82 billion, remaining below this threshold for the following two decades. There was a lack of significant growth due to the economic challenges faced during the initial stages of independence. Trade limitations resulted in India depleting more reserves than accumulating.

- However, the graph above reflects the transformation arrived with the economic policy reform of 1991. This shift saw a marked change in the trajectory of India’s foreign exchange reserves. The pace of accumulation accelerated significantly, showcasing a proactive approach to bolstering the country’s financial position.

- In essence, foreign exchange reserves play a pivotal role in a nation’s journey towards financial independence. These reserves act as a cushion, shielding the economy from unexpected external pressures. The historical contrast, with stagnant reserves during challenges and a dynamic surge post-reforms, underscores the significance of maintaining robust forex reserves to secure a nation’s economic sovereignty.

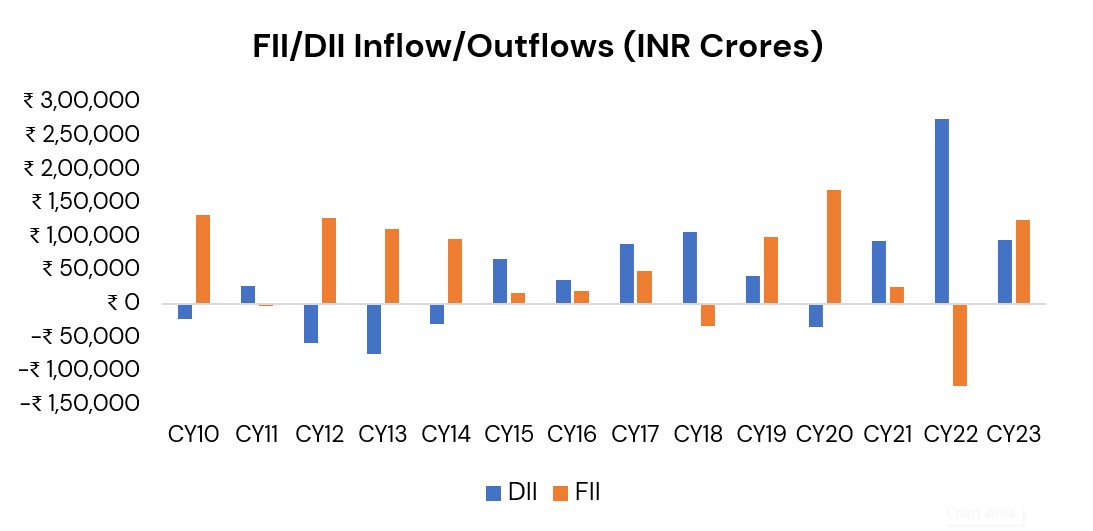

Why Indian equity markets are going to be a big part of this financial independence journey?

|

|

Source: ACEMF, Fisdom Research

Key Takeways:

- Taking example of CY22 we saw that despite facing the worst-ever sell-off from FIIs, the benchmark indices BSE Sensex and NSE Nifty 50 managed to finish over 3% higher. This positive outcome was largely due to the active participation of DIIs, whose net buying helped offset the negative impact of FII selling.

- Despite a significant sell-off by foreign institutional investors (FIIs) in the Indian equities market during 2022, the domestic institutional investors (DIIs) played a crucial role in maintaining market stability. Their strategic investments helped counterbalance the impact of FII volatility.

- The contrast between FII outflows and DII inflows underscores the stabilizing role that domestic institutional investors play in the Indian capital markets. Their consistent buying activity demonstrated confidence in the resilience of the Indian economy and its potential for long-term growth.

How investors can benefit from it?

As India approaches its 77th Independence Day, the nation’s strides towards financial independence come into focus. A shift towards higher-yield investments among households, the transformative impact of digital payment systems, the bolstering of forex reserves, and the resilience of equity markets collectively contribute to this journey. Investors stand to benefit from these trends, as opportunities for diversified investments grow, digital accessibility expands, and market stability is maintained. By aligning with these developments, individuals can not only enhance their financial portfolios but also become part of India’s evolving economic narrative.

|

Markets this week | | 07th Aug 2023 (Open) | 11th Aug 2023 (Close) | %Change | | Nifty 50 | ₹ 19,577 | ₹ 19,428 | -0.80% | | Sensex | ₹ 65,813 | ₹ 65,323 | -0.70% |

Source: BSE & NSE |

- Indian equity market marked its third consecutive week of decline, concluding on August 11, influenced by fluctuations driven by mixed data trends.

- On the domestic front, the week witnessed strong manufacturing activity, alongside a hawkish stance from the Reserve Bank of India (RBI), characterized by an elevated Consumer Price Index (CPI) projection. The imposition of Incremental Cash Reserve Ratio (ICRR) added to the factors impacting market sentiment.

- Internationally, weak economic indicators from China and a more favorable inflation report from the US contributed to the market’s cautious stance. The possibility of the US Federal Reserve concluding its rate hike cycle gained attention, shaping investor sentiments.

- The combination of robust domestic manufacturing, cautious RBI policy, global economic data, and US inflation trends collectively influenced the equity market’s volatility throughout the week.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | M&M | ▲ 5.58% | | Titan Company | ▲ 3.89 % | | Tech Mahindra | ▲ 3.85 % | | SBI Life Insurance | ▲ 3.44 % | | LTI Mindtree | ▲ 3.37 % |

| NSE Top Losers | Stock | Change % | | Britannia Ind | ▼ (6.01) % | | Asian Paints | ▼ (4.62) % | | Nestle India | ▼ (2.73) % | | Kotak Mahindra Bank | ▼ (2.56) % | | Bajaj Auto | ▼ (2.40) % |

|

Source: NSE |

Stocks that made the news this week:

👉Mazagon Dock Shipbuilders declined by 5% due to the company’s less favorable quarterly results. Despite a 40% increase in consolidated net profit at Rs 314.34 crore compared to the previous year, the company experienced a 3% drop in revenue to Rs 2,172.76 crore, and EBITDA decreased by 1% to Rs 171.69 crore. Although the operating margin remained stable at 7.9%, the revenue decline was primarily attributed to slower execution in key contracts, including P-75 submarines, P-15B destroyers, and P-17A frigates. The company’s order backlog is healthy at Rs 39,117 crore as of June 2023, five times FY23 revenues, with potential upcoming projects from the Indian Navy.

👉Paytm shares rose by 2.48% to Rs 858.6 as the Reserve Bank of India proposed raising the minimum limit for UPI Lite transactions. The central bank announced an increase in the UPI-Lite limit from Rs 200 to Rs 500 on August 10. UPI-Lite is designed for easier small transactions like paying for groceries, milk, and eggs. This feature helps UPI handle frequent transactions more smoothly.

👉Life Insurance Corporation of India (LIC) announced an impressive 1,299 percent increase in net profit, reaching Rs 9,543 crore for the quarter ending on June 30, 2023. This growth was attributed to higher income from investments, a significant jump from Rs 682 crore reported a year ago. Notably, the gross non-performing asset (GNPA) decreased from 5.84 percent to 2.48 percent compared to last year. LIC’s investment income rose to Rs 90,309 crores in the April-June FY24 quarter from Rs 69,570 crores last year.

|