Executive Summary

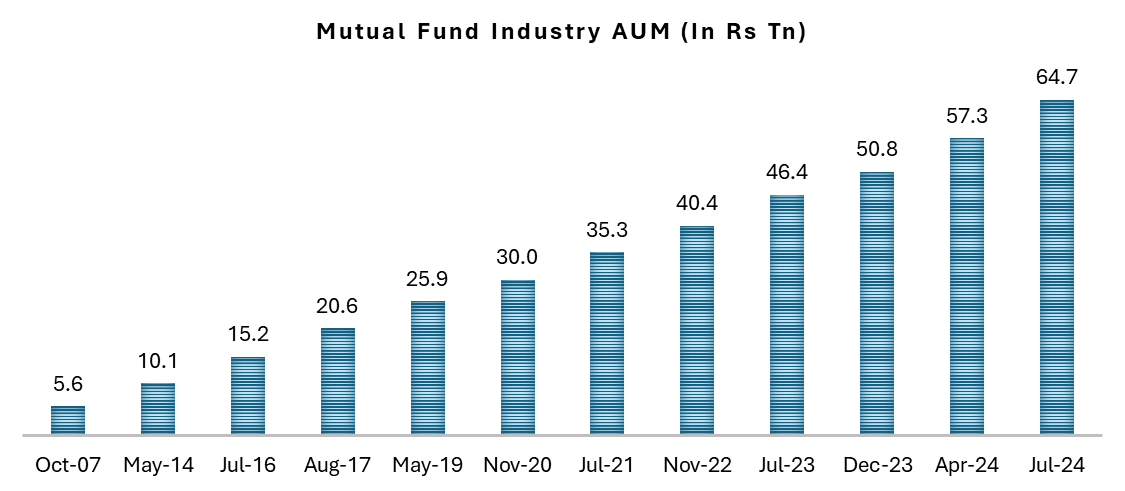

The Indian asset management industry has undergone remarkable growth, establishing itself as a critical component of the financial ecosystem. This growth is driven by multiple factors such as increasing investor awareness, rising financial literacy, and a growing preference for financial assets over physical ones. The mutual fund segment has seen an exponential rise in Assets Under Management (AUM), reaching INR 64.7 lakh crore, reflecting a robust CAGR of 21% over the last five years.

Key Trends Shaping the Industry

- Record SIP Flows: Systematic Investment Plans (SIPs) have surged to an all-time high of INR 23,332 crore in July 2024. The total number of SIP accounts reached 9.34 crore, with the highest monthly net addition of 35.29 lakh accounts.

- Rising Equity Share: Equity’s share in total AUM has reached a record high of Rs. 40 lakh crore, reflecting strong investor confidence in the equity market. As of July 2024, it now constitutes 62% of the industry’s AUM.

- Rapid Growth in Passive AUM: Passive AUM has grown by 33% year-over-year, highlighting a rising investor preference for cost-effective investment strategies. They have also reached a record high of Rs. 10.9 lakh crore, now representing 17% of the industry’s AUM.

- Broader Geographic Penetration: There is a noticeable increase in AUM contribution from B-15 cities, highlighting the success of financial inclusion efforts.

- Shift from Physical to Financial Assets: Investors are increasingly allocating funds to mutual funds and equities over traditional assets like gold and real estate.

Company Highlights

- HDFC Asset Management Ltd.

HDFC AMC has maintained a strong market position with a focus on equity-oriented funds and robust digital infrastructure. Its AUM grew to over INR 7 trillion.

Outlook: Despite strong fundamentals, the stock’s high valuation suggests limited short-term upside.

- Nippon India Asset Management Ltd.

NAM India has reported significant growth across various segments with a notable increase in QAAUM and PAT. It continues to expand its digital capabilities and product offerings.

Outlook: The company is attractively valued with substantial growth potential in the medium to long term.

- Aditya Birla Asset Management Ltd.

ABSL AMC has shown solid growth in AUM and SIP registrations. It is focusing on expanding its retail franchise and digital platforms.

Outlook: While the company has comfortable valuations, market share concerns persist.

- UTI Asset Management Ltd.

UTI AMC has reported strong financial performance with significant growth in equity and ETF segments. The company is expanding its footprint in tier-2 and tier-3 cities.

Outlook: The stock is relatively undervalued compared to its peers, with a focus on equity AUM growth and net inflows.

Our industry outlook remains positive, despite many stocks experiencing substantial gains over the past year. From a valuation and growth perspective, Nippon India AMC and UTI AMC are well-positioned with greater upside potential. Therefore, we recommend adding Nippon India AMC and UTI AMC at current levels. We continue to hold Aditya Birla Sun Life Asset Management, and for HDFC AMC, we suggest trimming exposure if overallocated due to valuation concerns; otherwise, maintain a hold for the long term.

| Stock Name | View | CMP | Target |

| Nippon India Asset Management Ltd. | Add | 707 | 870 |

| UTI Asset Management Ltd. | Add | 1,136 | 1,350 |

| HDFC Asset Management Ltd. | Hold | 4385 | 4,700 |

| Aditya Birla Sun Life Asset Management Ltd. | Hold | 743 | 800 |

Introduction to asset management industry

The asset management industry in India has grown significantly over the past few decades, establishing itself as a vital component of the country’s financial ecosystem. Asset management involves the professional management of various securities and assets to meet specific investment goals for investors. The industry serves a wide range of clients, from retail investors to high net-worth individuals (HNIs) and institutional investors.

Asset management companies (AMCs) in India primarily offer two types of services: mutual fund services and portfolio management services (PMS). Mutual fund services involve pooling money from multiple investors to invest in diversified portfolios managed by professional fund managers. This allows individual investors to access a wide range of securities and benefit from professional management. Portfolio management services (PMS), on the other hand, provide customized investment solutions tailored to the specific needs of HNIs and institutional clients, offering a personalized approach to managing a client’s portfolio. This report aims to provide an in-depth analysis of the current market structure, key players, regulatory environment, growth drivers, challenges, and outlook of the Indian asset management industry.

- Mutual Funds

The mutual fund industry has experienced remarkable growth, with assets Under Management (AUM) reaching an unprecedented high of INR 64.7 lakh crore. Over the past year alone, the industry has seen a substantial increase of INR 20 lakh crore in AUM, indicative of robust expansion and growing investor confidence. Since its inception in 2007, the industry’s journey to significant milestones has accelerated considerably. Initially, it took 79 months to add INR 5 lakh crore to the AUM.

However, recent trends show that it took only three-four months to achieve the same incremental growth, highlighting the rapid pace at which the industry is expanding. The industry’s AUM has grown at an impressive Compound Annual Growth Rate (CAGR) of 21% over the last five years and 19% over the past decade, up to July 2024. This sustained growth reflects a broadening investor base and the increasing penetration of mutual funds and other investment products across India.

Source: ACE MF, Fisdom Research

- Portfolio Management Services & AIFs

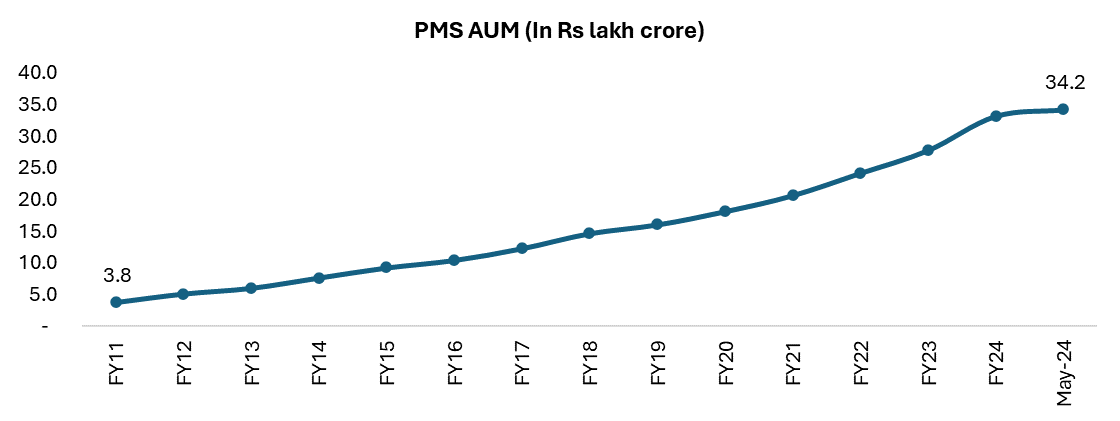

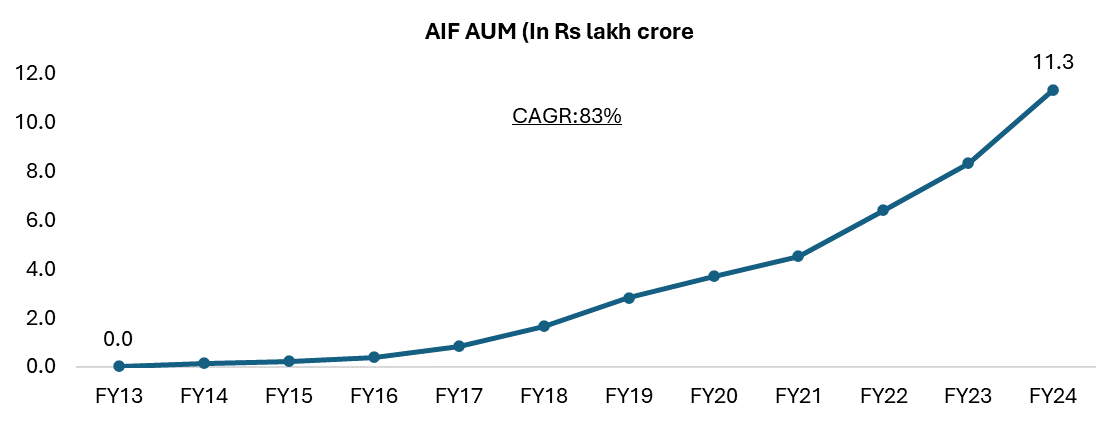

The Employee Provident Fund Organization (EPFO) contributes around 80%-85% of the assets under management (AUM) in Portfolio Management Services (PMS), while the Category II segment accounts for approximately 80%-85% of the overall AUM in Alternative Investment Funds (AIF). The PMS and AIF industries in India are experiencing significant growth.

As of May 2024, the total AUM for PMS (excluding EPFO) is approximately Rs. 9.5 lakh crore, whereas the AIF AUM has increased to Rs. 11.3 lakh crore in March 2024. Alternates industry has shown great resilience and robust growth, and it is expected to grow even faster soon.

Source: ACE MF, Fisdom Research

Listed Indian AMCs have a significant presence in the PMS and AIF sectors. They account for a substantial portion of the market, driven by the increasing preference for alternative investment products among high net-worth individuals (HNIs) and institutional investors.

Source: ACE MF, Fisdom Research

With the PMS and AIF industry expected to grow to Rs.43.64 lakh crore by 2028, the role of listed AMCs will likely become even more prominent.