India’s power sector is experiencing a period of rapid growth. The Indian economy has made a strong comeback from the recession of 2020 caused by COVID-19. Faster economic growth leads to a quicker increase in electricity consumption.

The CEA predicts that the nationwide peak power demand in FY 2024-25 will reach 256.63 GW, indicating a significant surge from the previous fiscal year, FY 2023-24. Power demand has shown consistent growth over recent years.

In fact, power demand rebounded so sharply that coal plants struggled to keep up, and the government had to intervene. Most power plants in India run close to total capacity, and fuel supply is a manageable challenge. Hence, growth is expected to follow with companies increasing their capacity. India’s most prominent power firms and suppliers have already begun meeting the growing demand. India’s electricity consumption is expected to grow by about 7%, so the sector is expected to grow at this pace. Capacity addition will likely grow faster, and some firms will grow faster than others.

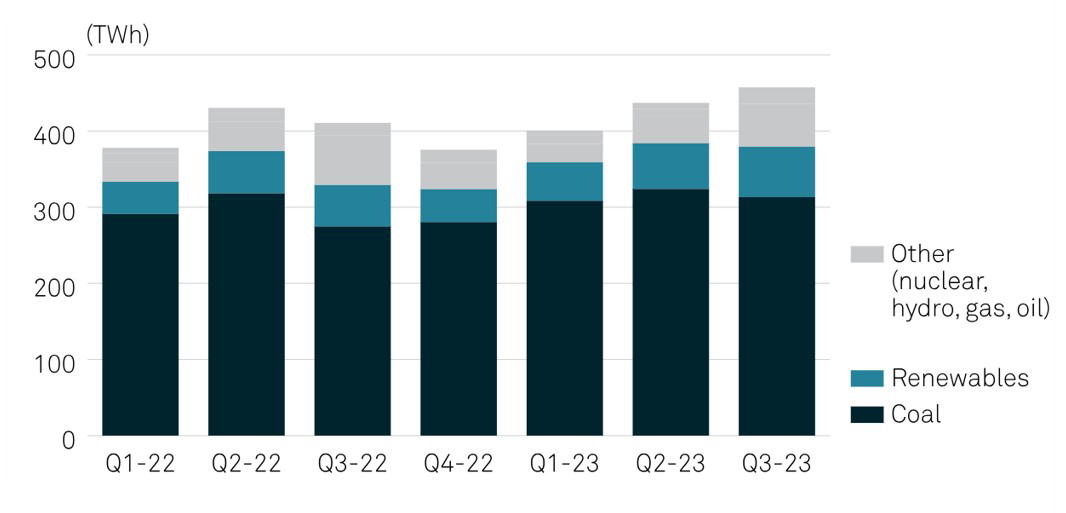

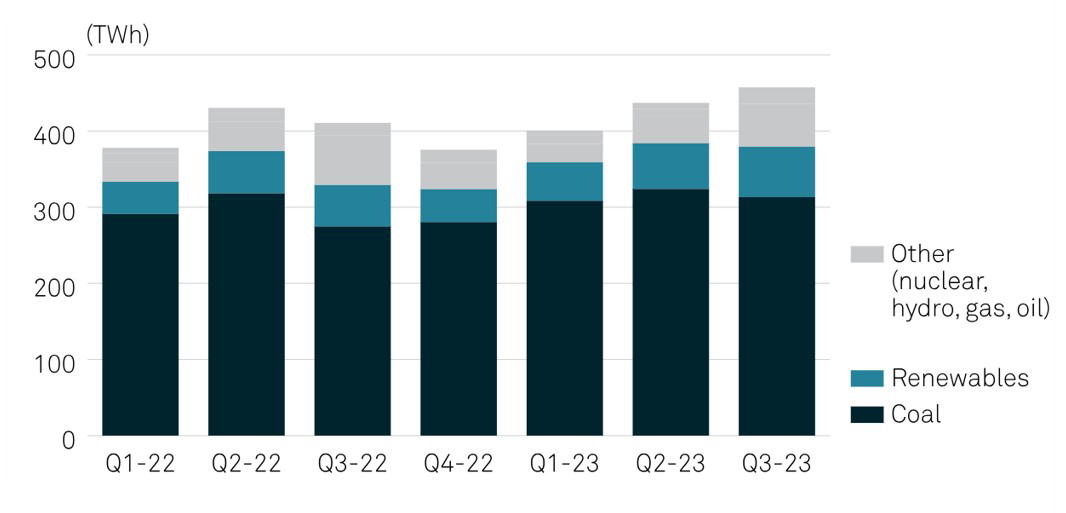

Most of India’s electricity is coal-based thermal power, and coal supply proved challenging during the reopening phase of the economy after the Covid-19 lockdowns. Electricity demand experienced a significant rebound, while coal power plants faced shortages in their coal reserve stocks. Some power firms had to import expensive coal from the global market, and the government had to intervene to ensure supplies from Coal India were delivered on time. Fortunately, the industry has overcome these troubles.

India: Coal firing at 68% of power output mix

|

Source: S&P Global Commodity Insights |

|

Coal India has taken steps to prevent a repeat of such a supply crunch, and global commodity prices have fallen, ensuring that input prices for India’s power plants, at least in the short term, won’t hurt margins.

India’s aim to achieve net carbon neutrality by 2070 implies a probable substantial allocation from the government to the power sector. The FY 2023-24 Union Budget allocated Rs 73.3 bn for solar energy, a jump of 48% from its revised estimates. This encompassed grid, off-grid, and the Pradhan Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyan (PM-KUSUM) initiatives. From the budget, Rs 49.7 bn is allocated for the interactive grid, Rs 20 bn for PM-KUSUM, and Rs 3.6 bn for off-grid solar energy projects. Wind energy projects bagged Rs 12.1 bn, and Rs 2.8 bn was allocated to the national green hydrogen mission.

The government projects that power demand in India will likely increase by about 1.6 times over the next 4 years. The installed capacity of India’s power sector stands at 426 gigawatts (GW) as of November 2023 and is anticipated to reach 692 gigawatts by 2028, reflecting a compounded annual growth rate (CAGR) of 12.9%. This is bullish for the sector, and the upcoming Union Budget could have more good news for power stocks.

While large-caps like NTPC were up 87% in 2023, investors shouldn’t confine their choices to the frontline stocks. An ideal investing strategy in power stocks should encompass the entire value chain, including engineering firms that are suppliers to power plants, companies playing a role in the transportation of coal, intermediaries involved in the actual supply of electricity to end consumers, and power trading firms.

Pay particular attention to renewable energy stocks, as this is a big focus area for the government and the private sector. Clean energy stocks are the biggest beneficiaries of India’s EV boom, making it a megatrend worth paying attention to. Also, the intelligent metering space is an exciting new megatrend that will change the sector forever.

Power stocks are a good choice for investors in 2024 and beyond, with the entire industry in a secular, long-term bull market due to India’s steadily rising power demand and the renewal of energy and EV megatrends. Urbanisation and increasing disposable incomes will only lead to higher demand for electricity, driven by a combination of factors.

|

Markets this week | | 01st Jan 2024 (Open) | 05th Jan 2024 (Close) | %Change | | Nifty 50 | ₹ 21,728 | ₹ 21,711 | -0.10% | | Sensex | ₹ 72,219 | ₹ 72,026 | -0.30% |

Source: BSE and NSE |

- Indian benchmark indices closed the initial week of the New Year with slight declines, marked by volatility, despite reaching new record highs during the first session of 2024.

- Foreign institutional investors (FIIs) continued as net buyers throughout the week, purchasing equities valued at Rs 3,290.23 crore. Conversely, Domestic institutional investors (DIIs) sold equities amounting to Rs 7,296.50 crore.

- The BSE Large-cap Index achieved a new record peak but concluded the week with no significant change.

- Notable gainers encompassed Adani Ports and Special Economic Zone, Indus Towers, Adani Energy Solutions, Adani Total Gas, Godrej Consumer Products, One 97 Communications (Paytm), and Zomato.

- Conversely, decliners included Eicher Motors, JSW Steel, Shree Cements, LTIMindtree, Avenue Supermarts, and Mahindra and Mahindra.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | Adani Ports & SEZ | ▲ 12.68% | | ONGC | ▲ 5.56 % | | Adani Enterprises | ▲ 5.53 % | | Bajaj Finance | ▲ 5.23% | | Tata Consumer | ▲ 3.33% |

| NSE Top Losers | Stock | Change % | | Eicher Motors | ▼ 6.43% | | JSW Steel | ▼ 5.78% | | LTIMindtree | ▼ 5.52% | | M&M | ▼ 5.05% | | Ultratech Cement | ▼ 4.64% |

|

Source: BSE |

Stocks that made the news this week:

- Suzlon Energy witnessed a rise of over 2 percent following an order acquisition. The company secured a contract for a 225-MW wind power project from Everrenew Energy Private Ltd. This project involves the installation of 75 wind turbine generators (WTGs) featuring Hybrid Lattice Tubular (HLT) towers, each boasting a rated capacity of 3 MW. Suzlon Energy specified that these turbines belong to their larger-rated 3 MW, S144-140m series. The installations are slated for sites in Vengaimandalam, Trichy district, and Ottapidaram, Tuticorin district, both located in Tamil Nadu, as detailed in the company’s filing.

- TCS and Infosys, among other major players, saw an uptick in their stocks, each gaining more than one percent. This surge occurred amidst prevailing optimism regarding the conclusion of the interest-rate hike cycle, despite short-term apprehensions regarding the December quarter results. The upward movement in these two stocks, along with LTIMindtree and HCL Technologies, contributed to driving the benchmark Nifty IT index up by one percent.

- KPI Green Energy Ltd observed a 1.7 percent increase following the announcement that its subsidiary, KPIG Energia Pvt Ltd, secured a solar power contract from Jayco Synthetics. The contract involves the execution of a 3-megawatt solar power project under the captive power producer segment, slated for completion in fiscal year 2025 across multiple phases as per the order’s terms. Previously, on January 3, the company disclosed to the exchanges that, in conjunction with KPIG Energia, it acquired contracts for executing 2.1 MW solar power projects under the captive power producer segment from Radhey Krishna Terene and Jay Metal Tech. This project is also scheduled for completion in FY25.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|