| As India’s economy continues to boom, the demand for premiumisation and luxury products is on the rise. According to Euromonitor International, the country’s luxury market is set to grow to an impressive Rs 82,186 crore by 2027, up from Rs 53,561 crore in 2022. With a projected 69% growth in the number of millionaires by 2027, compared to a 45% increase globally, India is fast becoming a new destination for luxury. From luxury cars and personal items like watches and jewellery, to experiential luxury, Indians are embracing the ‘have money, will splurge’ theme. Premiumisation has become a key trend that is happening across sectors, from cars, two-wheelers real estate properties to household goods. Despite the lower end of these product segments catching with tepid demand and an erosion of purchasing power amid elevated inflation woes, sales in the premium segment have picked up pace. For instance Nestle India Chairman and MD Suresh Narayanan recently highlighted that small-town India too is moving from single packs to multi-packs and from multi-packs to premium brands, indicating that the premiumisation brand journey has arrived in those towns. Consumers are now looking for better quality, better value, and better aspiration brands in their portfolio of consumption, making premiumisation a crucial element across sectors. |

||||||||||||||||||||||||||

| Where is this premiumisation getting reflected and how companies are benefitting out of it?

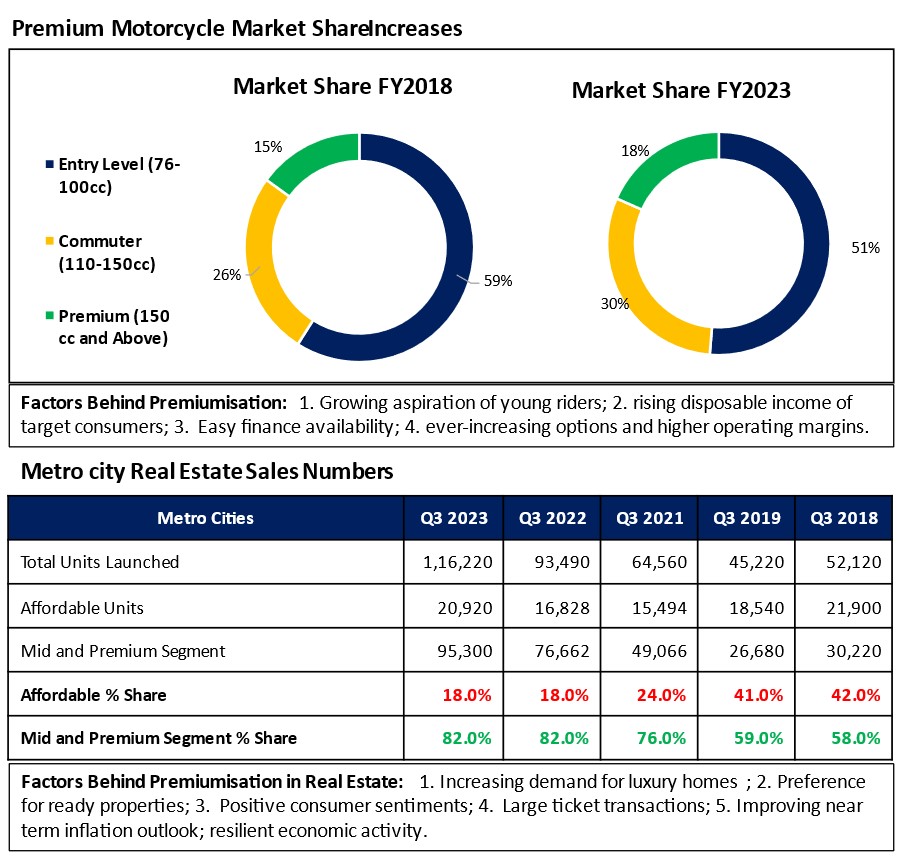

The entire auto industry which has shown resilient performance in the past few month are seeing this big shift of consumer towards their premium segments. Let’s take an example of what’s happening in the auto industry – While entry-level and commuter bikes have been the major contributors to the two-wheeler market in India, the premium segment of bikes above 150cc is gaining traction. Premium bikes now account for 18% of total bike sales in the country, compared to just 14% five years ago. The increasing demand for premium bikes has led to global motorcycle makers partnering with Indian companies to enter the fast-growing segment and challenge the dominance of Royal Enfield, which currently holds close to 40% of the market share in the premium bike segment. Hero MotoCorp, Bajaj, and TVS Motor Company are among the major players in the industry that are making significant investments to elevate their premium offerings and cater to the diverse desires of contemporary riders. TVS Motor Company for instance has doubled its premium motorcycle portfolio from 8% in FY14 to an impressive 16% in FY22. Meanwhile, Hero has recently launched the Harley-Davidson, and Bajaj unveiled the Speed 400 and Scrambler 400 X, developed in partnership with the UK-based Triumph Motorcycles. Partnerships between Hero-Harley Davidson, Bajaj-KTM, and TVS-BMW Motorrad are setting new standards in design and technology and rewriting the rules of the game. Royal Enfield has been successful in updating its portfolio with new launches at attractive price points and making lifestyle the USP of its bikes. This has worked for the company, making it the largest premium bike maker in the country. However, with the premiumisation trend gaining momentum, Indian mass-market two-wheeler makers are now shifting their focus towards the premium segment to tap into the high-margin product opportunities. Talking another big ticket sector which is real estate industry, is currently witnessing a remarkable transformation, with the luxury housing segment driving its growth. In the post-pandemic world, overall sales across the top seven big cities in the country have been rising steeply, and the premium housing category has been performing exceptionally well since 2021. The year 2022 has been a game-changer, with approximately 18% (approx. 65,680 units) of the total 3.65 lakh units sold across the top seven cities being in the premium housing category priced over INR 1.5 Cr. Compare this with the year 2019, where just 7% (approx. 17,740 units) of the total 2.61 lakh units sold were in the luxury category. Over the past five years, the share of luxury real estate has seen the largest increase. For instance, in July-September 2018, only 9% (4,590 homes) of the 52,120 units launched were in the luxury segment. All top property markets, except Chennai, witnessed an increase in the share of luxury housing launches between 2018 and this year. Chennai’s share of luxury inventory to hit the market in a quarter declined in July-September, with the city seeing only 460 luxury launches last quarter versus a significantly higher 580 luxury units launched in July-September 2018. The luxury property market in Hyderabad saw the largest supply of luxury homes among the top-performing property markets. The last quarter saw the city launch a whopping 14,340 luxury homes out of 31,180 luxury units — that’s 46% of the total luxury inventory — launched pan-India. The Mumbai Metropolitan Region (MMR) was a distant second at 7,830 luxury homes. The demand for luxury homes is propelling the growth of the real estate segment. The demand for luxury goods is on the rise in India, and local companies are taking notice. Titan Company Limited, a leading Indian jewellery retailer, is set to launch an exclusive invite-only retail store that will cater to luxury customers with a minimum ticket size of Rs 10 lakh. This move comes as other international brands like Swiss luxury chocolate maker Laderach and French luxury retailer Galeries Lafayette also enter the Indian market. Aditya Birla Fashion Retail (ABFRL) has partnered with Galeries Lafayette to sell over 200 luxury brands such as Armani, Christian Dior, and Prada, taking advantage of the rise in demand for high-end products. Meanwhile, Reliance Brands is rapidly expanding its existing partnerships with global brands like Valentino and Tiffany, with ambitious plans in the luxury segment, in preparation for the festive season. |

||||||||||||||||||||||||||

| Conclusion: Premiumisation is a growing trend in the Indian market, and companies across sectors are capitalizing on it. From the auto industry to real estate and luxury goods, businesses are investing in premium offerings to cater to the diverse desires of contemporary consumers. This trend is expected to continue as the country’s economy grows, and the number of millionaires increases. As a result, companies that focus on premiumisation are likely to see higher sales, profitability, and rising stock prices, making them attractive for investors looking to benefit from this trend. | ||||||||||||||||||||||||||

| Premiumisation to Drive Investor Wealth Premiumisation Drivers- Increase Wealth of Individuals | ||||||||||||||||||||||||||

Source: Anarock Reasearch, Knight Frank WealthReport 2023. ET, Fisdom Research |

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

Market this week

Source: BSE and NSE |

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

|

Weekly Leader Board

Source: BSE |

||||||||||||||||||||||||||

Stocks that made the news this week:

|

||||||||||||||||||||||||||

|

Please visit www.fisdom.com for a standard disclaimer. |