For over two decades, Indian investors relied on a clever trick to gauge market sentiment: looking at the Singapore stock exchange (SGX) Nifty futures contracts. However, this practice came to an end on July 3, 2023, as the National Stock Exchange (NSE) and SGX parted ways amidst differences. However, this breakup led to a groundbreaking development that could reshape India’s financial landscape—the birth of GIFT Nifty. This article explores how the NSE and India can benefit from GIFT Nifty and the potential implications it holds.

The Rise of GIFT City and IFSC Authority: Amidst the NSE-SGX dispute, India had been working on establishing a financial hub called the Gujarat International Finance Tec-City (GIFT City). This 900-acre campus between Gandhinagar and Ahmedabad aimed to create a free trade zone with a 10-year tax holiday to attract foreign businesses. To bolster GIFT City’s potential, the government established the International Financial Service Centre Authority (IFSC Authority) as a unified regulator, streamlining policies in GIFT City.

NSE’s Proposal and Collaboration with SGX: In a bid to bring trading back to India and leverage the potential of GIFT City, NSE proposed a collaboration with SGX. The idea was to set up a platform in GIFT City where foreign investors could trade the Nifty index in US dollars, eliminating the need for investors to rely on SGX. Recognizing the significance of the Indian market, SGX agreed to the proposal, despite the loss of the SGX Nifty, which accounted for a substantial portion of its offerings.

The Emergence of GIFT Nifty: On July 3, 2023, $7.5 billion worth of SGX Nifty contracts migrated to GIFT City, marking the birth of GIFT Nifty. NSE took charge of handling trades, while SGX ensured the verification and compliance aspects. GIFT Nifty retains the essence of its predecessor, offering foreign investors a platform to trade the Nifty index in dollars. This move has opened doors for increased participation in India’s equity market, attracting more global investors and capital to fuel growth.

Benefits for India:

One of the key benefits of GIFT Nifty and the NSE IFSC receipts is the broadening of liquidity. Fragmented liquidity will now converge into a single pool, creating a larger and more comprehensive market. To provide a sense of scale, the total open interest on Nifty in India is approximately $1.5-2 billion. In contrast, this new market boasts a much larger notional open interest of around $7 billion.

Strengthened Position as a Financial Hub: GIFT City and IFSC Authority gain prominence as a unified regulator, consolidating the roles of SEBI, RBI, IRDAI, and PFRDA. This integration promotes ease of doing business and attracts financial services companies, solidifying India’s position as a global financial hub.

Increased Foreign Investor Participation: GIFT Nifty offers foreign investors a convenient avenue to access India’s equity market in US dollars, streamlining transactions and reducing currency-related complexities. This accessibility can result in higher foreign capital inflows, driving economic growth.

India’s Growing Influence: GIFT Nifty reinforces India’s growing stature in the global investment landscape. By offering a dollar-denominated platform within GIFT City, India becomes an attractive destination for foreign investors seeking exposure to the Indian market, strengthening its economic and financial influence.

What does it mean for India’s leading stock exchange which may go for public offering in the upcoming months? And more importantly how does benefit foreign as well as Indian investors?

With GIFT Nifty operating within the regulatory framework of GIFT City, NSE is poised to witness increased trading activity. This shift can boost liquidity and depth in India’s futures market, attracting more domestic and international participants.

Primarily, the establishment of GIFT Nifty brings about a win-win arrangement for both Indian and foreign investors. This move aligns with the agenda of the International Financial Service Centre (IFSC), which aims to onshore offshore activities. By shifting the market into our own jurisdiction, NSE India regains control over pricing that was previously outside its purview. The IFSC Authority acts as the oversight regulator, ensuring supervision of this market.

From a FEMA (Foreign Exchange Management Act) perspective, all participants in this market are non-residents. However, Indian companies and broking firms have the opportunity to establish full-fledged subsidiaries and actively participate in this expanded market.

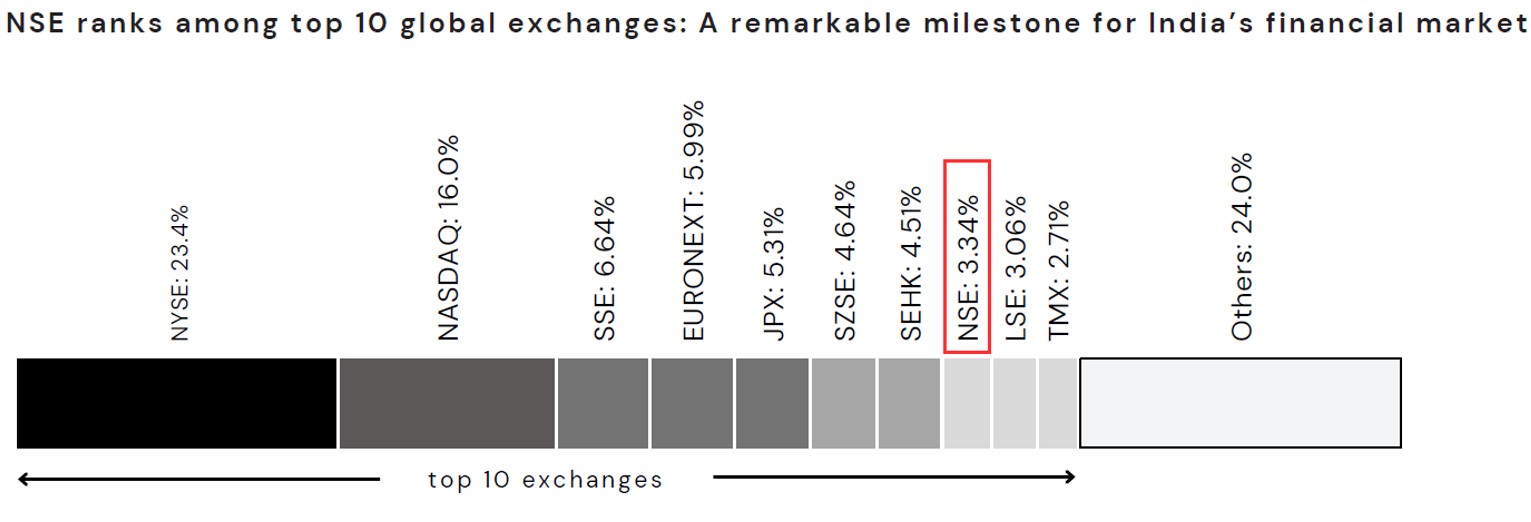

Source: World Federations of Exchanges, Fisdom Research

Moreover, the NSE International Exchange has a product of interest to Indian residents. Under the Liberalized Remittance Scheme (LRS) framework, every Indian is eligible to invest up to $250,000 per year in the international market. The NSE IFSC equity receipts now offer access to the top 50 stocks from the New York Stock Exchange and NASDAQ in the form of unsponsored Depositary Receipts (DRs). This allows Indian customers to avail themselves of this product and further diversify their investment options.

Few AMCs have already begun to penetrate into this market by launching products within this segment. One of the leading AMCs in the Alternate products space has already migrated their operations to GIFT City Gujarat. This particular move is estimated to make the existing fund’s structure more efficient from both operations and a cost perspectives.

With the morning bell now ringing at 6:30 am in Gujarat, investors no longer need to look to Singapore to gauge market sentiment; instead, they can turn their focus to the promising opportunities in GIFT Nifty. Overall, the introduction of GIFT Nifty brings numerous advantages to both Indian and foreign investors, including increased market control, broader liquidity, and expanded investment opportunities.

Markets this week

| 03rd July 2023 (Open) | 07th July 2023 (Close) | %Change | |

| Nifty 50 | ₹ 19,246 | ₹ 19,331 | 0.44% |

| Sensex | ₹ 64,836 | ₹ 65,280 | 0.69% |

Source: BSE & NSE

- The market continued its winning streak for the second consecutive week, reaching new record highs.

- The strong inflow of foreign institutional investors (FIIs) played a significant role in driving the market’s upward momentum.

- Positive pre-quarterly updates from companies contributed to the market’s positive sentiment. The healthy progress of the monsoon season added to the optimistic outlook.

- Market participants had high expectations for positive Q1FY24 results, further boosting market confidence. However, market sentiment was impacted by escalating tensions between the United States and China.

- Concerns over a potential interest rate hike by the US Federal Reserve in the upcoming policy also dampened market sentiment. The contrasting factors of positive domestic cues and external uncertainties created a mixed sentiment in the market.

- In this week, foreign institutional investors (FIIs) made net equity purchases of Rs 9,164.85 crore. On the other hand, domestic institutional investors (DIIs) sold equities worth Rs 6,878.21 crore.

Read More – HDFC Ltd-HDFC Bank Merger: Banking Behemoth Born

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Hero MotoCorp | ▲ +7.75% | Eicher Motors | ▼ -11.04% |

| M&M | ▲ +7.61% | UPL | ▼ -3.57% |

| BPCL | ▲ +7.39% | TATA Consumer | ▼ -3.21% |

| Bajaj Finance | ▲ +6.45% | Adani Ports & SEZ | ▼ -2.78% |

| Bajaj Finserv | ▲ +5.69% | HCL Tech | ▼ -2.55% |

Source: BSE

Stocks that made the news this week:

👉Tata Motors witnessed a significant surge in its share price as it extended its marginal gains, climbing over 3 percent during the week to reach a record high of Rs 621.50 at the close of the last trading session on Friday. The impressive performance came on the back of strong sales reported by its luxury arm, Jaguar-Land Rover, during the April-June quarter. Wholesale volumes for the quarter stood at 93,253 units, marking a 30 percent increase compared to the same period last year. Retail sales also saw a notable rise of 29 percent, totaling 101,994 units. Notably, overseas markets experienced the highest growth, with retail volumes rising by 83 percent, followed by North America (42 percent), China (40 percent), and the UK (6 percent). The European market, however, remained relatively stable.

👉The Bombay Stock Exchange (BSE) has received approval for a share buyback program worth Rs 374.80 crore. The buyback will be conducted at a price of Rs 816 per share through the tender route. This initiative aims to repurchase 45,93,137 equity shares, accounting for 3.39 percent of the total equity shares in the paid-up capital.

👉Olectra Greentech witnessed a significant surge of 18.02% after a consortium comprising the company and Evey Trans secured a Letter of Intent (LOI) from Maharashtra State Road Transport Corporation (MSRTC). The LOI entails the supply of 5,150 electric buses, with an approximate value of Rs 10,000 crore for Olectra Greentech. This development highlights the company’s commitment to the transition towards sustainable transportation solutions in India.