In the realm of corporate dynamics, conglomerates often house diverse businesses, each with its distinct value and prospects. A prime example is TATA Group, where the automobile and IT businesses operate in entirely different environments, warranting differential valuations. While it may seem intuitive to consider the parent company’s value as a sum of its parts, the reality is more complex. For larger companies with a diverse portfolio, investors often harbor apprehensions. Concerns arise over divided management focus, lack of transparency in business dealings, and the need to expose investments to various businesses. These uncertainties lead to the application of a discount on the total value, commonly referred to as the conglomerate discount. However, savvy companies have recognized an alternative route to unleash untapped potential and drive higher returns for their investors – demerging their businesses. By demerging or merging specific business segments, conglomerates can eliminate the conglomerate discount and propel the value of the core business forward. In this article, we will delve into the reasons why companies opt for demergers, how such moves contribute to their betterment, and the potential for substantial gains that await investors in blue-chip companies set to become ready for the next leg of growth amid the positive outlook on Indian economy and its future growth prospects. Investors in the Indian equity markets have been kept busy by announcements from big corporations in the last few weeks. It started with the merger of HDFC Limited and HDFC Bank, followed by the demerger of the financial services wing of the Reliance Group, and recently a demerger announcement of the hotels business of ITC Limited. These events have unlocked a lot of latent value in big corporations and also presented many lucrative arbitrage opportunities. | ||||||||||||||||||||||||||

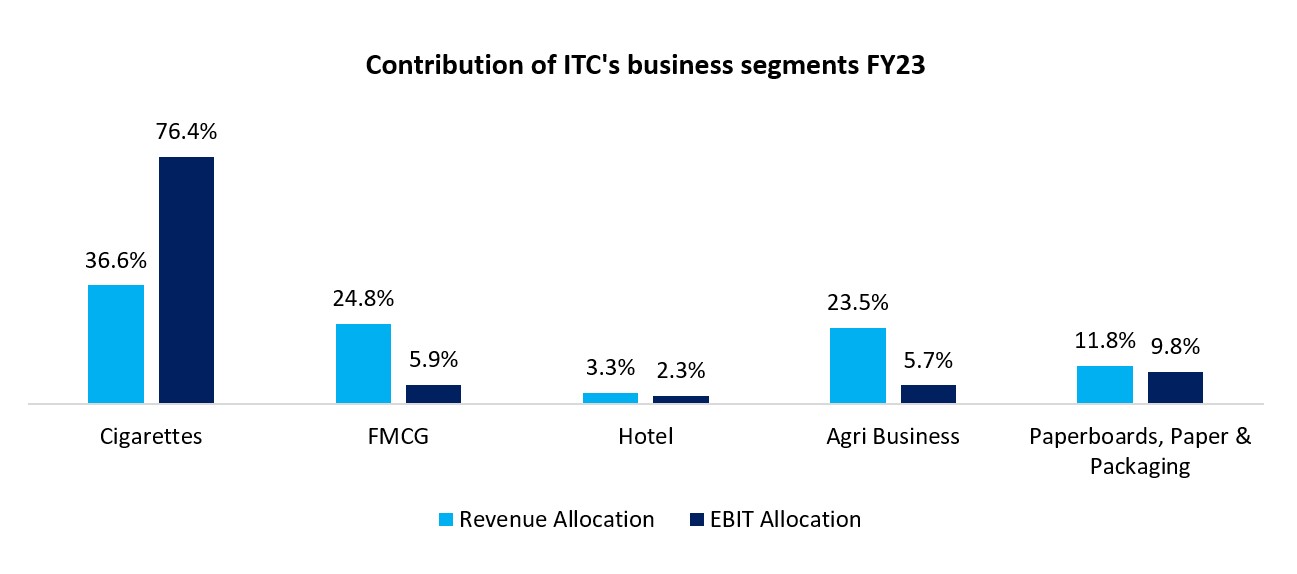

ITC Hotel Business Demerger: As part of its proposed restructuring, ITC is embarking on a strategic demerger, separating its hotel business into a standalone entity within the thriving hospitality industry. This move aims to allow the hotel business to focus on its growth trajectory with an optimized capital structure, operating as a separate entity independent of the FMCG giant. In the demerged setup, ITC will retain a 40 percent ownership stake, while the remaining 60 percent will be held by current ITC stockholders. The decision to demerge the hotel business stems from the unique challenges and capital-intensive nature of the hospitality industry. Establishing and maintaining hotels requires substantial investments, often spanning years and involving millions of dollars. The need to preserve the pristine condition of properties on a daily basis further adds to the complexities. Additionally, hotels face the inherent seasonality of the industry, experiencing periods of high occupancy and others marked by emptiness. These factors combine to create a demanding landscape for companies like ITC. Moreover, the hotel business’s contribution to ITC’s overall revenue and profits has been relatively modest. For FY23, the hotel segment’s revenues barely touched ₹2,585 crores, representing less than 3.5% of the total revenues. Even more concerning, the segment reported a profit of around ₹542 crores in FY23. It is one of the best-performing years, for its hotel business, making it a less lucrative venture for the conglomerate. The capital-intensive nature of the hotel business has been a persistent challenge for ITC. The company has had to allocate significant funds each year to keep the hotel business operational. However, the return on this capital investment has been relatively low, averaging around 2%. Comparatively, other investment avenues like fixed deposits could yield better returns on capital. Despite these challenges, the hotel segment is currently experiencing a promising phase. The post-pandemic resurgence in travel, often referred to as “revenge travel,” has led to soaring hotel occupancy rates. This upturn has caught the attention of investors, contributing to the anticipation and excitement surrounding ITC’s demerger of its hotel business. By demerging the hotel business, ITC seeks to unlock the potential for growth in both its core FMCG operations and the standalone hotel entity. This strategic move aims to streamline the businesses, allowing each to focus on its unique growth path, while offering investors the prospects of higher returns and capitalizing on the resurgence in the hospitality industry. | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

Source: Company Financials Reliance-Jio Financial Servies Demerger The recent demerger of Reliance Industries’ financial services business, resulting in the creation of a separate entity named Jio Financial Services (JFS), has signaled the ambitious intentions of Chairman Mukesh Ambani. With this strategic move, Ambani aims to make a significant impact on the financial services sector, particularly in the domain of retail lending. JFS plans to initially enter the B2B credit business, leveraging the vast wholesale business network of Reliance Industries. Subsequently, it intends to venture into consumer lending, capitalizing on Ambani’s strong financial standing and unwavering focus on consumer segments. Industry experts predict that JFS could potentially claim a substantial share of the retail lending market, thanks to its robust financial resources and innovative approach. This intent to become a financial services behemoth is evident from JFS’s recent partnership with BlackRock Inc., the world’s largest asset manager. Together, they are establishing a 50:50 joint venture called Jio BlackRock, aimed at creating a groundbreaking asset management business in India. BlackRock’s expertise in asset management technology, particularly its renowned Aladdin platform, aligns perfectly with Ambani’s strategy of leveraging data and technology to disrupt the Indian financial markets. The Aladdin platform offers sophisticated risk analytics and comprehensive portfolio management, trading, and operational tools on a unified platform. By combining Reliance’s deep pockets, market experience, and execution power with BlackRock’s expertise in investment and risk management and cutting-edge technology, JFS and Aladdin together aim to tap into India’s burgeoning mutual fund market. The Indian mutual fund industry has witnessed remarkable growth over the years, with Assets Under Management (AUM) expanding significantly. As of June 30, the AUM of the Indian mutual fund industry stood at Rs 44.39 lakh crore, compared to Rs 8.11 lakh crore in June 2013, representing a five-fold increase in a span of ten years. With Jio BlackRock’s innovative offerings and access to consumer data, the venture seeks to cater to millions of investors in India, providing them with tech-enabled, affordable, and innovative investment solutions. Through the demerger of Jio Financial Services and its subsequent collaboration with BlackRock, Mukesh Ambani has positioned his conglomerate for substantial growth in the financial services arena. This strategic move is poised to revolutionize the industry, harnessing the power of data, technology, and unparalleled expertise to unlock new avenues of success and deliver value to investors across the country. Another big corporate action that hit Indian markets was the HDFC Bank and HDFC Ltd merger. Here’s our detailed coverage on this merger – https://bit.ly/450vniO | ||||||||||||||||||||||||||

TATA Motor DVR Shares Converted to Ordinary Shares This week we saw another corporate action as Tata Motors, another Nifty 50 company, coming up with a big announcement of converting its DVR shares into ordinary shares post which prices of DVR shares hiked by 12% in a day, reaching a new high. When companies issue equity shares, their primary goal is to raise capital for various purposes, such as acquisitions, day-to-day activities, or loan repayments. However, the issuance of equity shares can lead to dilution of ownership for existing shareholders. Founders and promoters often prefer to retain control and avoid dilution, as new shareholders gain voting rights and can influence management decisions. To address this concern, Tata Motors introduced Differential Voting Rights shares (DVRs) in 2008. These special shares carried fewer voting rights but offered additional dividends and were issued at a discount to regular shares. While DVRs have been popular in the US, they didn’t gain much traction in India due to investor preference for shares with voting rights, resulting in a significant discount on Tata Motors’ DVRs. After 15 years of issuing DVRs, Tata Motors has decided to cancel all DVR shares and offer a 20% premium on the share price to holders. This move streamlines share management, improves liquidity, and enhances the company’s earnings per share (EPS) metric, potentially attracting more investors and boosting the stock price. The cancellation of DVRs eliminates the price differential between the two share classes and simplifies trading as investors will now focus on regular Tata Motors shares. By understanding the mechanics of DVRs, investors can gain insight into this unique financial instrument and its implications on ownership and corporate decision-making. Currently mutual fund holds Rs. 5,322 crore in TATA Motors DVR. Where as TATA Motors Ltd. holds Close to Rs. 19,000 crores worth of shares as of June 2023. | ||||||||||||||||||||||||||

Conclusion: In conclusion, the realm of corporate dynamics is witnessing significant transformations as conglomerates like TATA Group, Reliance Industries, and HDFC navigate strategic demergers to unlock hidden value and drive higher returns for their investors. The move to demerge businesses allows these companies to eliminate the conglomerate discount and focus on the growth trajectory of their core operations. For instance, ITC’s hotel business demerger enables it to concentrate on the thriving hospitality industry, while Reliance-Jio Financial Services seeks to disrupt the financial sector with the integration of data analytics and asset management technology. Moreover, Tata Motors’ decision to cancel DVR shares and offer a premium to shareholders marks a notable step to streamline share management and enhance EPS, attracting more investors to the company. As the Indian economy presents positive growth prospects, these strategic moves open up lucrative arbitrage opportunities and signal the readiness of blue-chip companies for the next phase of growth. | ||||||||||||||||||||||||||

Markets this week

Source: BSE & NSE | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

|

Weekly Leaderboard:

Source: NSE | ||||||||||||||||||||||||||

Stocks that made the news this week: 👉Larsen & Toubro (L&T), India’s largest engineering company, has announced a buyback plan to return extra funds to its shareholders. The proposal involves repurchasing up to Rs 10,000 crore worth of shares, which represents 2.4 percent of the total paid-up equity share capital. The tentative buyback price is set at Rs 3,000 per share, offering an over-17 percent premium to the July 25 closing price. Once shareholder approval is obtained, L&T will finalize the date and price for the buyback. Analysts believe this move will likely boost L&T’s Earnings er Share (EPS) and Return on Equity (RoE), with RoE potentially increasing by 40-60 basis points and EPS seeing a slight upward revision of around 4-5 percent. | ||||||||||||||||||||||||||

|

Please visit www.fisdom.com for a standard disclaimer. |