Daily Snippets

Date: 19th December 2023 |

|

|

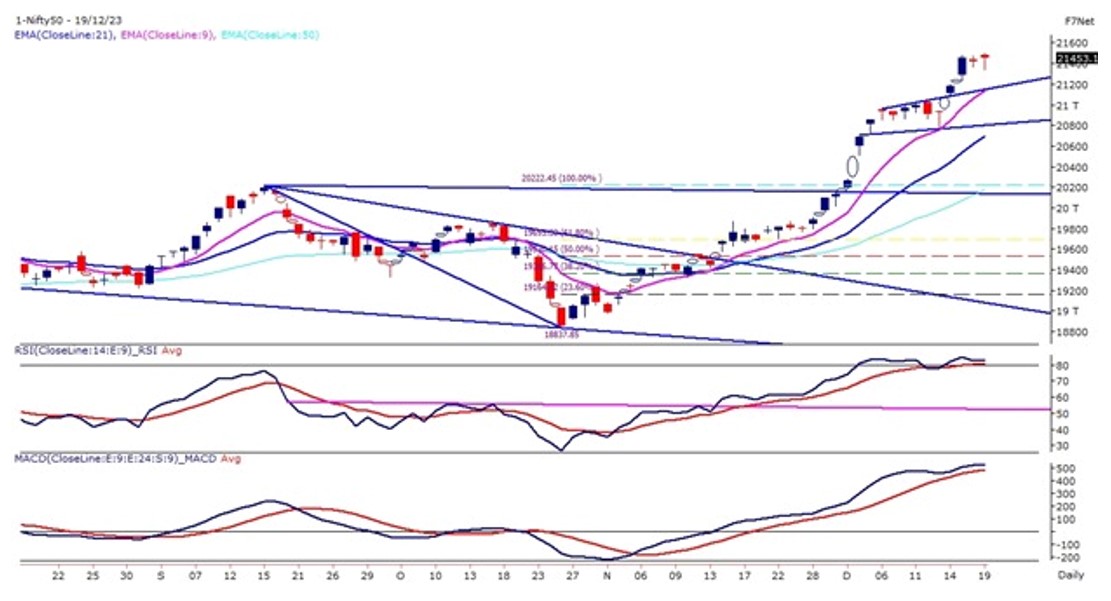

Technical Overview – Nifty 50 |

|

The Frontline index on 19th December witnessed a positive opening near 21,500 levels but couldn’t hold on to its opening gains and drifted lower within a few minutes of the trade. The index gave an upward rising trend line breakdown on the intraday chart and recorded a day slow at 21,337 levels and post that, the Index witnessed a smart V shape reversal formation and prices hit 21,500 levels for the first time.

However, the index being near its record high and maintaining its previous day’s closing low, it seems that the momentum still lies with the bulls. The Nifty recovered from the low and formed a Doji kind of candlestick pattern.

The Index VIX has given a breakout above 13 levels and has sustained above the same which calls for a rise in volatility. The index can more consolidation in the coming days before the market gets into a strong mood with the resistance at 21,650 and support at 21,300 levels.

|

Technical Overview – Bank Nifty |

|

It was a volatile day for the Banking Index where the index traded in a broad range of 350 – 400 points and swung both the day during the trade which kept traders guessing for the intraday trend. The banking index on the intraday chart witnessed a V-shaped reversal from the lower levels and formed a Doji candle stick pattern on the daily chart.

The Bank Nifty on the daily chart has witnessed a rectangle pattern breakout and the post that the index is trading in a higher high higher low formation indicates a strong bullish trend. The index is trading comfortably above its short and medium-term averages on the daily time frame, which is a positive sign for the index.

The volatility index ‘INDIAVIX’ is currently at elevated levels above 13 and it needs to cool off. The trend for Bank Nifty remains bullish with a buy-on-decline approach and the upside is open for 48,300 – 48,500 in the near term. The immediate support for the Banking index is placed near its continuation gap which is placed at 47,500 levels.

|

Indian markets:

- Domestic stock market displayed resilience, bouncing back from early losses to reach new highs, with Sensex peaking at 71,623 and Nifty at 21,505.

- Sectors like energy, FMCG, and utilities saw increased demand, while IT and auto shares experienced downward pressure.

- Foreign institutional investors are projected to decrease activity before the holiday season, with domestic institutional investors expected to steer market momentum.

- The upcoming new year and imminent interim Budget might introduce market volatility, potentially affecting stock movements.

|

Global Markets

- European and Asian shares saw an uptick in trading on Tuesday following evaluation of the Bank of Japan’s final rate decision for 2023.

- The BOJ maintained its negative interest rate policy, keeping the benchmark interest rate at -0.1%, alongside keeping its stance on the yield curve control policy unchanged.

- US stocks closed higher on Monday amid growing anticipation of Federal Reserve interest rate cuts in the upcoming year. The market also looked forward to a week featuring pivotal economic data.

- A moderate but widespread surge propelled the S&P 500 and Nasdaq to substantial gains, while the Dow concluded the day without much change.

|

Stocks in Spotlight

- IDFC First Bank’s shares rose 3% after RBI approved its merger with IDFC and IDFC Financial Holding Company. However, the stock closed up 0.56% indicating a more modest gain by the end of the trading day. according to the exchange filing, the RBI conveyed its ‘no objection’ to the composite scheme of amalgamation, subject to compliance with the terms and conditions specified therein.

- Oil India’s shares surged by 7% following the government’s windfall tax reduction, alongside a global rise in crude oil prices due to concerns about maritime trade disruption from Iran-backed Houthi attacks in the Red Sea. This led to four shipping giants suspending operations in the region. The government’s recent decision to reduce windfall profit tax on crude oil production and diesel exports further contributed to the positive market sentiment.

- Shares of Devyani International went up 5.33 percent after the KFC and Pizza Hut operator in India announced its entry into Thailand by signing a share purchase agreement to acquire controlling interest in Restaurants Development Co Ltd (RD) Thailand to enter the QSR/ limited-service restaurants (LSR) market in that country.

|

News from the IPO world🌐

- Happy Forgings IPO fully subscribed within hours of opening on strong NII, retail push

- RBZ Jewellers IPO: Issue fully subscribed on Day 1.

- Credo Brands IPO sails through on strong retail bidding.

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | COALINDIA | ▲ 6.1 | | NESTLEIND | ▲ 4.7 | | NTPC | ▲ 2.1 | | CIPLA | ▲ 1.9 | | TATACONSUM | ▲ 1.9 |

| Nifty 50 Top Losers | Stock | Change (%) | | ADANIPORTS | ▼ -1.8 | | WIPRO | ▼ -1.6 | | ADANIENT | ▼ -1.4 | | TCS | ▼ -1.3 | | UPL | ▼ -1.3 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY FMCG | 1.41 | | NIFTY CONSUMER DURABLES | 0.82 | | NIFTY OIL & GAS | 0.8 | | NIFTY PSU BANK | 0.79 | | NIFTY PHARMA | 0.36 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1828 | | Declines | 1940 | | Unchanged | 136 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,306 | 0.0 % | 12.6 % | | 10 Year Gsec India | 7.2 | 0.30% | -1.90% | | WTI Crude (USD/bbl) | 72 | 4.3 % | (5.8) % | | Gold (INR/10g) | 62,014 | -0.10% | 15.10% | | USD/INR | 83.03 | (0.3) % | 0.4 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|