Technical Overview – Nifty 50

Nifty’s rollover is marginally lower than the previous month, standing at 79.31%. The three-month average rollover for Nifty is 77.96%, and the current rollover for Nifty slightly surpasses this three-month average. Nifty is anticipated to exhibit a pattern similar to the last series.

Nifty has started the March series with an open interest of 1.40 crore shares compared to an OI of 1.28 crore shares at the beginning of the February series. Nifty saw a lower rollover with a higher cost of carry (+0.90%) and a rise in open interest, compared to its previous month, indicating high chances of profit booking in the upcoming series.

The Nifty50 witnessed a strong reversal at the start of March expiry and the index registered its new lifetime high which indicates a buy-on-dips market. On the weekly chart, the Index has given a bullish breakout of a consolidation pattern and rose more than half percent in the week.

It’s a buy-on-dips market presently and any dip towards 22,150 which be utilized as a fresh buying opportunity. The immediate resistance is likely to be capped near 22,500 levels.

Technical Overview – Bank Nifty

The Bank nifty’s rollover rate in the March series decreased compared to the previous series, registering at 74.24% in contrast to the 77.05% from the preceding month. This rollover falls below the average of the last three months. Analyzing the rollover data suggests sluggish movement in Bank nifty.

A strong turnaround was witnessed from the Banking index, especially from the private sector banks. The Bank Nifty moved strongly above 47,000 levels and has closed above its 21,50 and 100-day exponential moving average on the daily time frame.

On the weekly chart, the Banking Index has formed a bullish candle and has given an almost 1 percent return. The momentum oscillator RSI (14) on the daily chart has reversed from 45 levels and has reached nearly 60 levels with a bullish crossover.

It’s a buy-on-dips on Bank Nifty presently and any dip towards 46,500 which be utilized as a fresh buying opportunity. The immediate resistance is likely to be capped near 48,000 levels.

Indian markets:

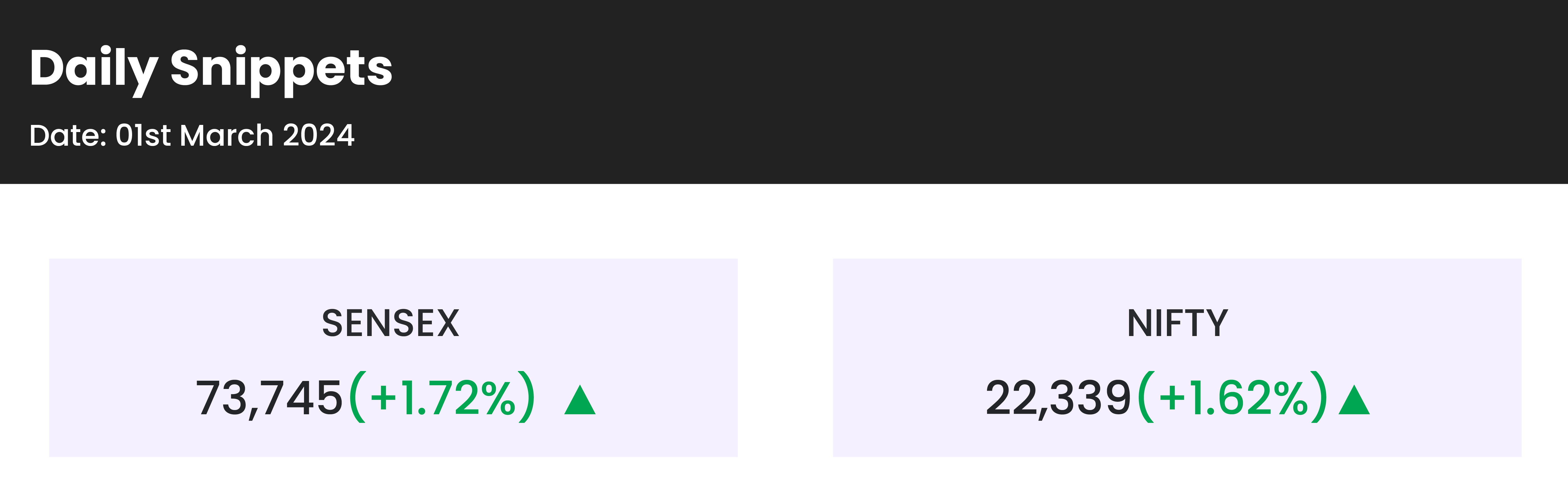

- Domestic equity benchmark indices, the Sensex and Nifty 50, closed the trading session on a positive note, propelled by favorable global signals, robust GDP figures, and a surge in banking, metals, and oil marketing companies (OMC) stocks.

- Notably, the Nifty 50 breached the 22,300 mark for the first time during intraday trading, while the Nifty Bank reached an intraday peak of 47,000.

- Additionally, the Sensex reached a historic high, surpassing the 73,700 milestone.

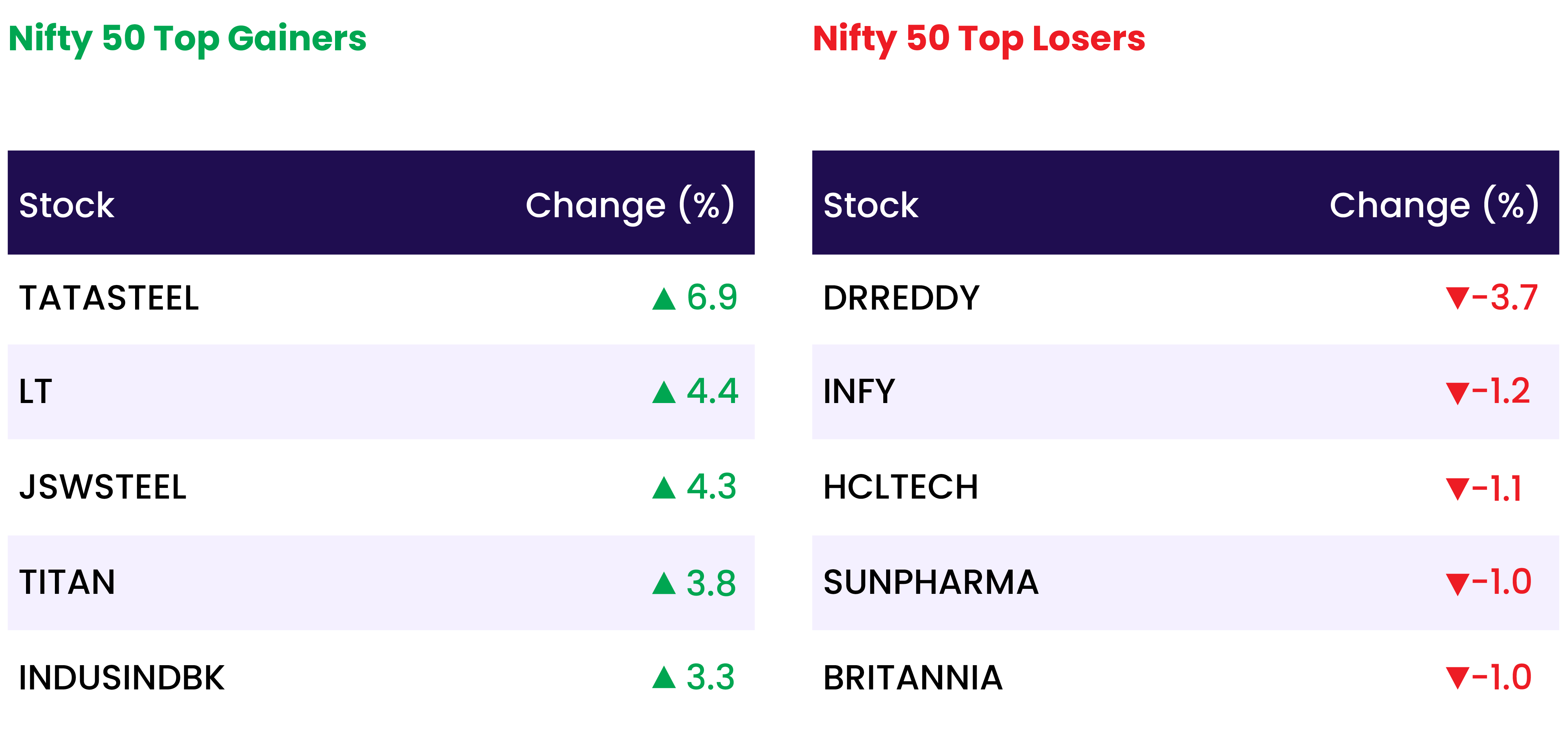

- Among sectors, the metal index was up 4 percent, while auto, bank, capital good and oil & gas were up 2 percent each. The healthcare index was down 1 percent and Information Technology index 0.5 percent.

Global Markets:

- In Asia-Pacific Japan’s Nikkei 225 concluded Friday’s trading session at a new all-time high, approaching the 40,000 level. Meanwhile, Chinese markets experienced gains fueled by recent manufacturing data from the mainland.

- European markets moved higher on Friday to start the new trading month after a winning February, as investors assessed fresh inflation data out of the euro zone.

- Futures for U.S. stocks showed a cautious uptrend after Wall Street completed its fourth consecutive month of gains. The tech-heavy Nasdaq Composite achieved its first closing record since November 2021.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- ICICI Bank stock surged 3.12 percent after the private lender increased its stake in ICICI Lombard General Insurance via an open market transaction, the second such purchase in a week. The transaction comes within days of the private sector lender purchasing a 1.6 percent stake in the insurer for Rs 1,356 crore.

- The Paytm stock saw a 5 percent increase and reached the upper circuit following the approval from the fintech’s board to terminate various inter-company agreements with its associate entity, Paytm Payments Bank Limited (PPBL).

- The Suven Pharma stock gained 12.49 percent a day after the firm announced a scheme of amalgamation for a merger with Cohance Lifesciences. The transaction is expected to conclude over next the 12-15 months, subject to shareholder and regulatory approvals, the company said in a release.

- Olectra Greentech experienced a 2.76 percent decline as investors took profits, following the stock’s previous session gains driven by securing a Rs 4,000 crore contract from Brihanmumbai Electricity Supply and Transport Undertaking (BEST) for the provision, operation, and maintenance of 2,400 electric buses.Top of Form

- Shares of Dr Reddy’s Labs fell 3.65 percent after the company was named a defendant in an antitrust motion in the US District Court for New Jersey.

News from the IPO world 🌐

- JG Chemicals’ Rs 251-crore IPO to open on March 5

- Gopal Snacks IPO price band fixed at Rs 381-401/share; issue to open on March 6

- Mukka Proteins IPO subscribed nearly 5 times so far on Day 2

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY METAL | 3.6 |

| NIFTY BANK | 2.5 |

| NIFTY PRIVATE BANK | 2.5 |

| NIFTY AUTO | 2.3 |

| NIFTY OIL & GAS | 2.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2386 |

| Decline | 1453 |

| Unchanged | 108 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,939 | (0.0) % | 3.2 % |

| 10 Year Gsec India | 7.1 | (0.2) % | (1.6) % |

| WTI Crude (USD/bbl) | 78 | (0.4) % | 11.2 % |

| Gold (INR/10g) | 62,309 | 0.0 % | (1.4) % |

| USD/INR | 82.91 | 0.0 % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer