Technical Overview – Nifty 50

The hallmark of the day was volatility. The benchmark index recovered about two percent from its day low after reversing from the 24,074 level for the day. At the 20-DEMA, the index developed a long-legged bullish pin bar candlestick. The FMCG, IT, and AUTO indexes led the rally after the index ended the day unchanged.

The benchmark index is forming a higher low. The positive momentum continuing is indicated by the momentum indicator, RSI (14) being above 55 levels. On both the weekly and daily charts, the index is trading above the major EMA, maintaining its bullish momentum.

Based on benchmark index OI data, a base formation may take place at the 24,400 level, where put writing is almost 40 lakhs. At 24,600, call writing is almost close to 55 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.70.

The view remains buy on dips. The support levels for the upcoming sessions are at 24,250 and 24,150 and resistance at 24,600 and 24,700, respectively.

Technical Overview – Bank Nifty

Extremely volatile banking index on the day of the event. The index moved to the downside of the consolidation zone, but it was unable to hold there and closed back inside. The index was able to hold above 51,150, which is currently serving as support following the polarity shift. On the 75-minute chart, the banking index is in a lower high – lower low configuration.

The RSI (14) momentum indicator has fallen below 55 on a daily basis, suggesting that the banking index is currently experiencing a lag in its upward momentum. The index ended below the 20-DEMA even though bulls’ desire to bake the index appeared to be waning. There appears to be a lag in the upward trend as the MACD displays a negative crossover over the daily chart.

Based on benchmark index OI data, a base formation may take place at the 51,500 level, where put writing is close to 14 lakhs. At 52,500, call writing is almost close to 22 lakhs, might act as a resistance. The PCR value of the benchmark index is 0.48.

In the event of a decline, the opinion is still to buy on dips and to pyramid over 52,800 levels. The resistance and support levels for the upcoming sessions are 52,250, 52,500 for resistance, and 51,350, 51,000 for support.

Indian markets:

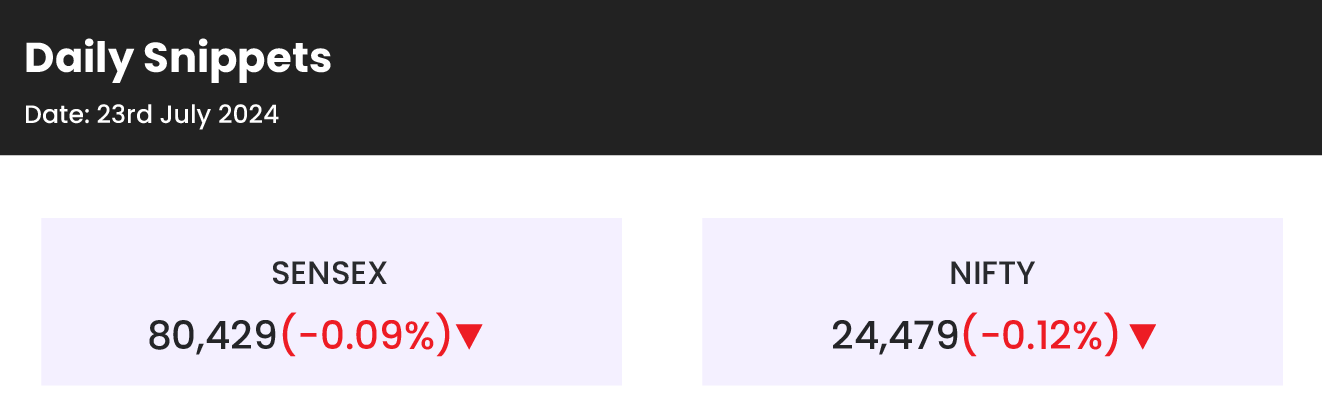

- Indian equity indices ended lower for the third consecutive session on July 23, influenced by a series of announcements from Finance Minister Nirmala Sitharaman during her Union Budget speech.

- Despite positive global cues leading to a strong start, Indian indices quickly erased gains and traded flat through the first half. In the second half, profit booking pushed the Nifty below 24,100 after the Finance Minister increased the long-term capital gains tax (LTCG) on all financial and non-financial assets to 12.5 percent from 10 percent in the Union Budget for 2024-25. However, last-hour buying helped it to close flat.

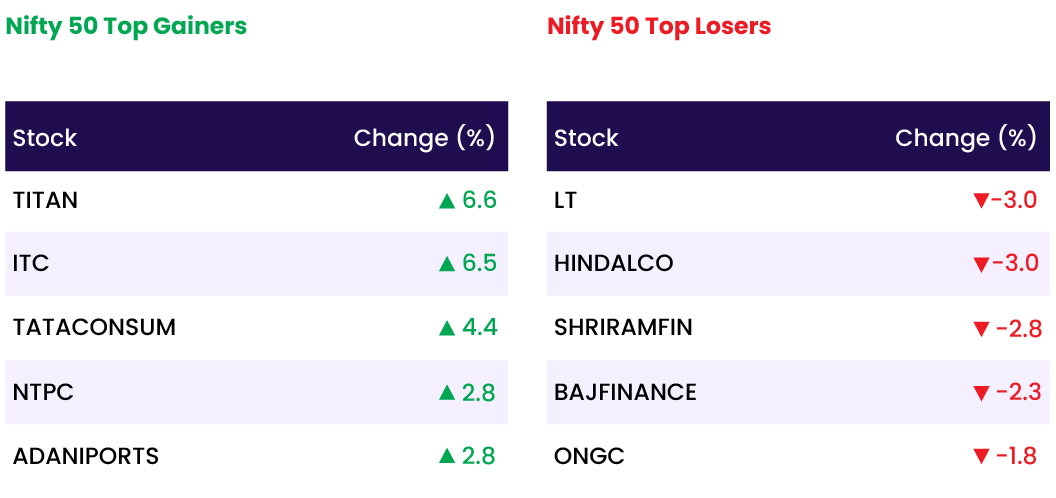

- Sector-wise, FMCG, healthcare, media, and IT indices rose by 0.5-2.5 percent, while banking, capital goods, metal, oil & gas, and realty indices declined by 1-2 percent.

- The BSE midcap index fell by 0.7 percent, while the smallcap index remained flat.

Global Markets:

- Asian markets showed mixed performance. Tokyo’s Nikkei 225 closed nearly unchanged, while Chinese markets faced significant losses.

- The Shanghai Composite dropped 1.7%, marking its biggest single-day loss in six months, and the Hang Seng in Hong Kong declined by 0.9%.

- Conversely, South Korea’s Kospi advanced by 0.4%, and Taiwan’s Taiex surged 2.8%, driven by gains in semiconductor stocks.

- Meanwhile, Australia’s S&P/ASX 200 rose 0.5%.

- European stocks rose on Tuesday, with the pan-European Stoxx 600 index climbing 0.61%. Investors are anticipating the latest earnings reports from regional companies, which could provide insights into the economic health and performance of various sectors in Europe.

Stocks in Spotlight

- Hindustan Unilever (HUL) reported its Q1 FY25 financial results on Tuesday, 23 July. The company posted a net profit of ₹2,538 crore, marking a 3% increase compared to ₹2,472 crore in Q1 FY24. This result slightly exceeded analysts’ expectations. Additionally, HUL’s total sales for the April-June quarter rose by 2% year-on-year, reaching ₹15,523 crore.

- Oil India: The stock of Oil India surged by 3% after the company announced a significant deal with Dolphin Drilling from Norway. The contract involves hiring the ‘Anchor Moored Semi-Submersible Drilling Unit Blackford Dolphin’ for exploration activities in the Andaman Offshore Blocks. This development led to a peak intraday high of Rs 571.10 per share.

- Jefferies India is optimistic about ITC Ltd’s prospects following the Union Budget announcement. The unchanged tobacco taxes likely provide stability for ITC’s revenue stream, and the slight increase in earnings per share suggests improved profitability expectations. The target price revision to Rs 585 per share reflects this positive outlook. If you’re considering investing or just keeping track of market movements, this upgrade could be a significant indicator.

News from the IPO world🌐

- Stallion India Fluorochemicals gets Sebi’s approval to float IPO

- Sanstar IPO gains momentum on Day 2

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY FMCG | 2.7 |

| NIFTY CONSUMER DURABLES | 2.1 |

| NIFTY MEDIA | 1.2 |

| NIFTY IT | 0.7 |

| NIFTY PHARMA | 0.6 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1743 |

| Decline | 2160 |

| Unchanged | 113 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 40,415 | 0.3 % | 7.2 % |

| 10 Year Gsec India | 7.0 | (0.0) % | 0.9 % |

| WTI Crude (USD/bbl) | 78 | (2.2) % | 11.4 % |

| Gold (INR/10g) | 69,124 | 4.8 % | 2.8 % |

| USD/INR | 83.72 | 0.1 % | 0.8 % |