Technical Overview – Nifty 50

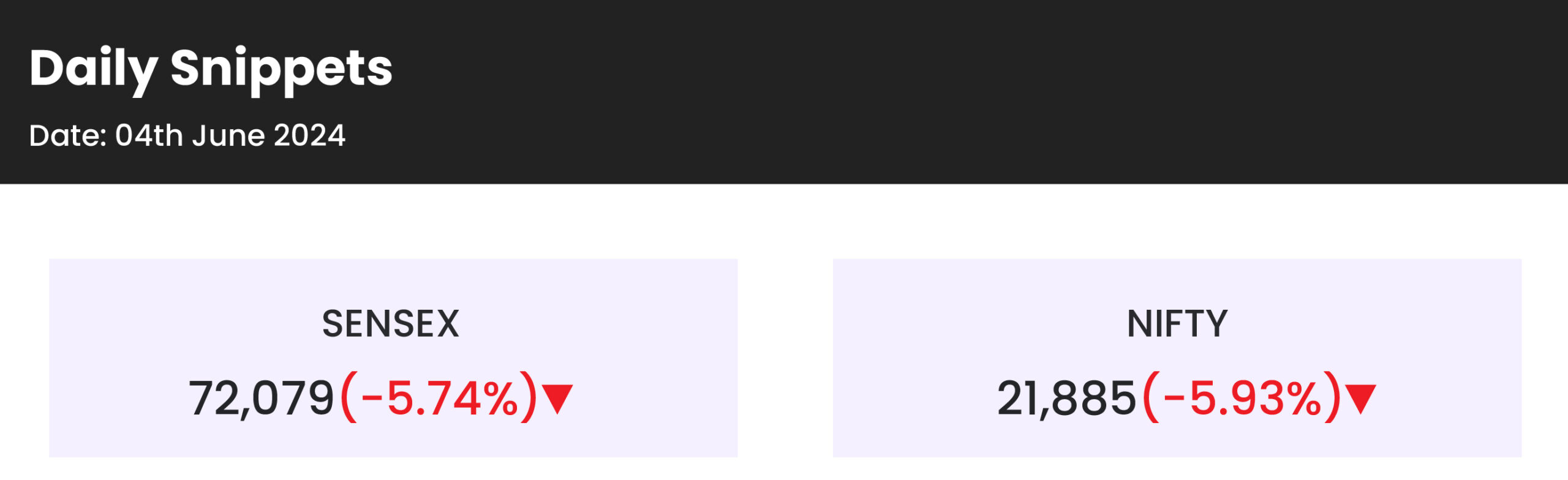

The benchmark NIFTY index closed at 22,885, down 1379 points, or -5.93 percent. Today was a blood bath for the benchmark index; the index fell by nearly 2000 points, or -8.50%. A major event turnaround resulted in a chaotic day with a large profit booking. We may continue to see strong volatility in future sessions.

The index has formed a BEARISH BELT-HOLD pattern on a daily basis. Following such a significant drop, the index found support at the 200 DEMA and reversed by over 700 points. The index now trades below the 10, 20, 50, and 100-day exponential moving average.

On a daily time period, the momentum indicator RSI (14) has fallen below 40, entering oversold territory. INDIA VIX has reached 31 levels since May 2022, suggesting a strong level of concern.

Though key swing low support levels were breached on a daily basis, the next crucial support levels are at 21,500, and 21,200, with resistance levels to watch for at 22,300, and 22,700.

Technical Overview – Bank Nifty

The BANK NIFTY index concluded at 46,929 points, down 4051 points, or -7.95% on the day. The banking index suffered its worst single-day drop since 2020, falling about 5000 points / -9.61% approaching the day’s trough. The index has closed below its rising trend line. The index has formed a BEARISH BELT-HOLD pattern on the daily timeframe.

The index found support at the 200-DEMA and closed above it. The index trades below the 10, 20, 50, and 100 DEMA, indicating that the short-term negative trend will continue.

On a daily basis, the momentum indicator RSI (14) has plummeted from 71 to 40 in a single session and is presently reaching its support zone of 42 – 43.50.

Though major swing low support levels were breached on a daily basis, the next critical support levels are at 46,350 and 45,850, with resistance levels to monitor at 48,200 and 48,500.

Indian markets:

- A massive across-the-board selloff engulfed the Indian stock market on Tuesday, June 4, after vote-counting trends revealed a significant divergence from exit poll predictions. When the Nifty 50 closed, trends showed the Bharatiya Janata Party (BJP) falling short of a clear majority, with the BJP-led National Democratic Alliance (NDA) expected to secure only a slim majority to form the government at the Centre.

- Investors’ wealth eroded by around Rs 30 lakh crore as the market capitalization of BSE-listed companies dropped to Rs 395.99 lakh crore from Rs 425.91 lakh crore in the previous session.

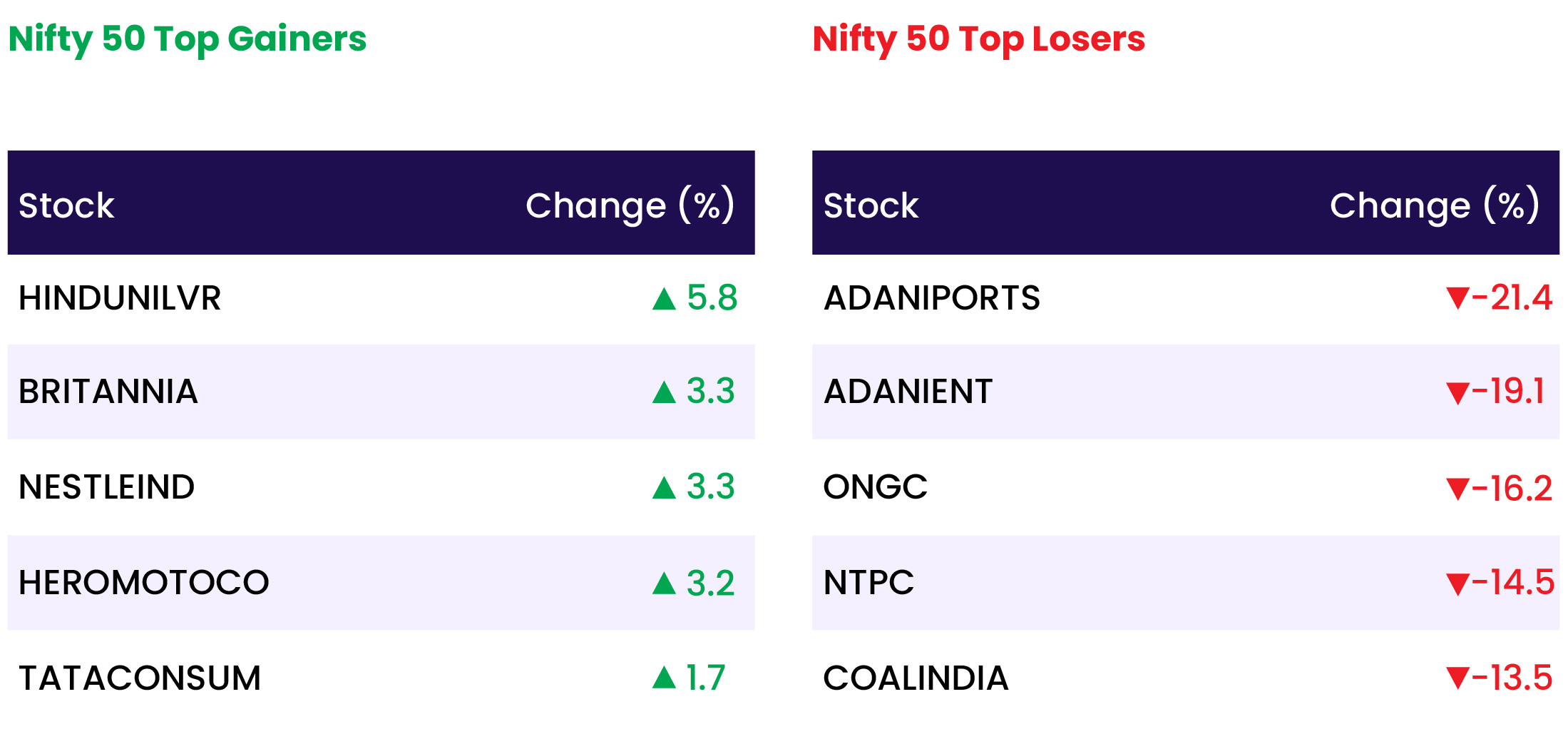

- Except for FMCG, all other sectoral indices ended in the red, with Realty, Telecom, Metal, Capital Goods, Oil & Gas, Power, and PSU Bank down more than 10 percent each. The BSE Midcap index shed 8 percent, and the Smallcap index fell nearly 7 percent.

Global Markets:

- India stocks tumbled on Tuesday in volatile trading, leading Asia markets lower as the country continued vote counting for its 2024 general election.

- Japan’s Nikkei 225 fell 0.22% to close at 38,837.46, while the broader Topix ended 0.38% lower at 2,787.48.

- South Korea’s Kospi shed 0.76% to finish at 2,662.10, while the smaller-cap Kosdaq closed 0.13% higher at 845.84.

- Hong Kong’s Hang Seng index rose 0.12%, and the CSI 300 index increased by 0.75% to close at 3,615.67.

- In Australia, the S&P/ASX 200 index was down 0.31%, closing at 7,737.10. Overnight, U.S. stock index futures were listless as Wall Street sought to find its footing after an uneven start to the month.

Stocks in Spotlight

- HUL shares surged six percent as trends indicated that the incumbent government might not perform as well as exit polls predicted. FMCG stocks are considered a defensive play and are likely to do well if the current government cannot enforce its growth-led policies.

- Stocks of listed group entities like Adani Ports, Adani Power, Adani Enterprises, and others nosedived up to 25 percent, suffering severe losses after substantial gains in the last few trading sessions. Of the Rs 30 lakh crore eroded from the market capitalization of all listed companies on the BSE, around Rs 3 lakh crore was wiped from Adani Group firms.

- Defence stocks: Shares of Hindustan Aeronautics, Bharat Dynamics, Bharat Electronics, and BEML plummeted as much as 20 percent as investors rushed to take home partial profits after the recent bull run in these counters.

- Railway stocks: Shares of railway companies such as RVNL, Ircon International, RITES, and IRCTC fell by up to 16 percent on the counting day, as investors rushed to book profits. This reaction followed early leads that painted a different picture from exit polls, which had suggested a landslide victory for the BJP.

News from the IPO world

- Hero FinCorp approves Rs 4,000 crore fundraise via IPO

- A dozen consumer companies line up IPOs amid a thriving stock market

- Canara Bank starts IPO process to take Canara HSBC Life public

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY FMCG | 1.0 |

| NIFTY IT | -0.6 |

| NIFTY HEALTHCARE INDEX | -0.9 |

| NIFTY PHARMA | -1.4 |

| NIFTY MIDSMALL HEALTHCARE | -2.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 488 |

| Decline | 3349 |

| Unchanged | 97 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,571 | (0.3) % | 2.3 % |

| 10 Year Gsec India | 7.0 | 1.3 % | (0.2) % |

| WTI Crude (USD/bbl) | 74 | (3.6) % | 5.5 % |

| Gold (INR/10g) | 71,700 | (0.2) % | 6.8 % |

| USD/INR | 83.43 | 0.1 % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer