Technical Overview – Nifty 50

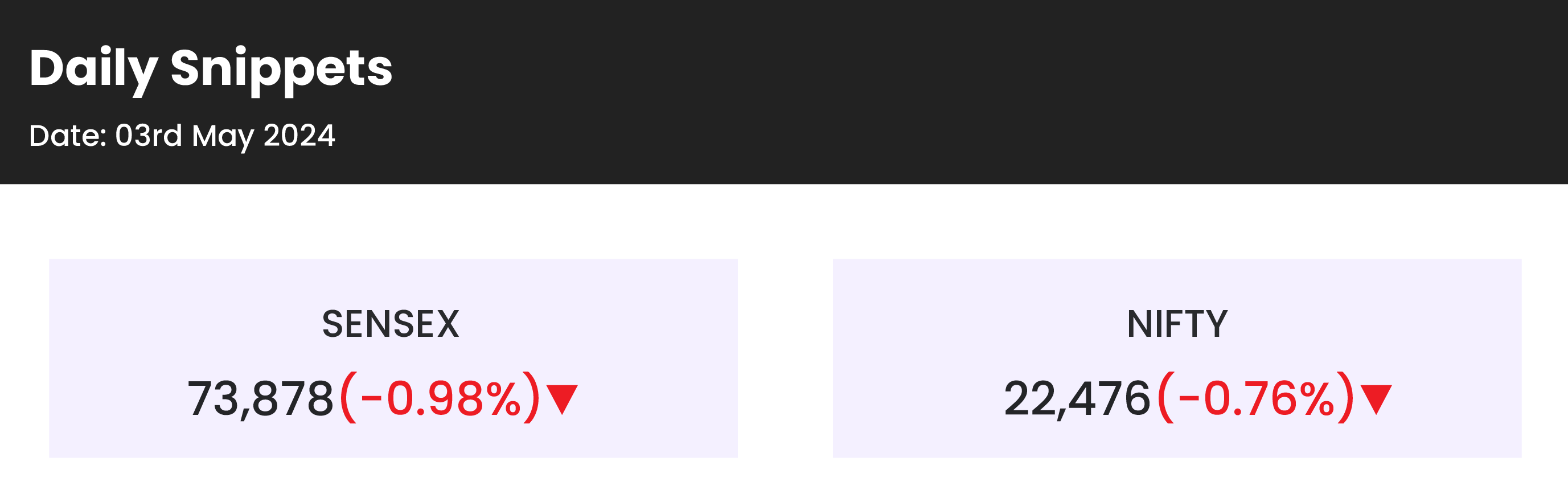

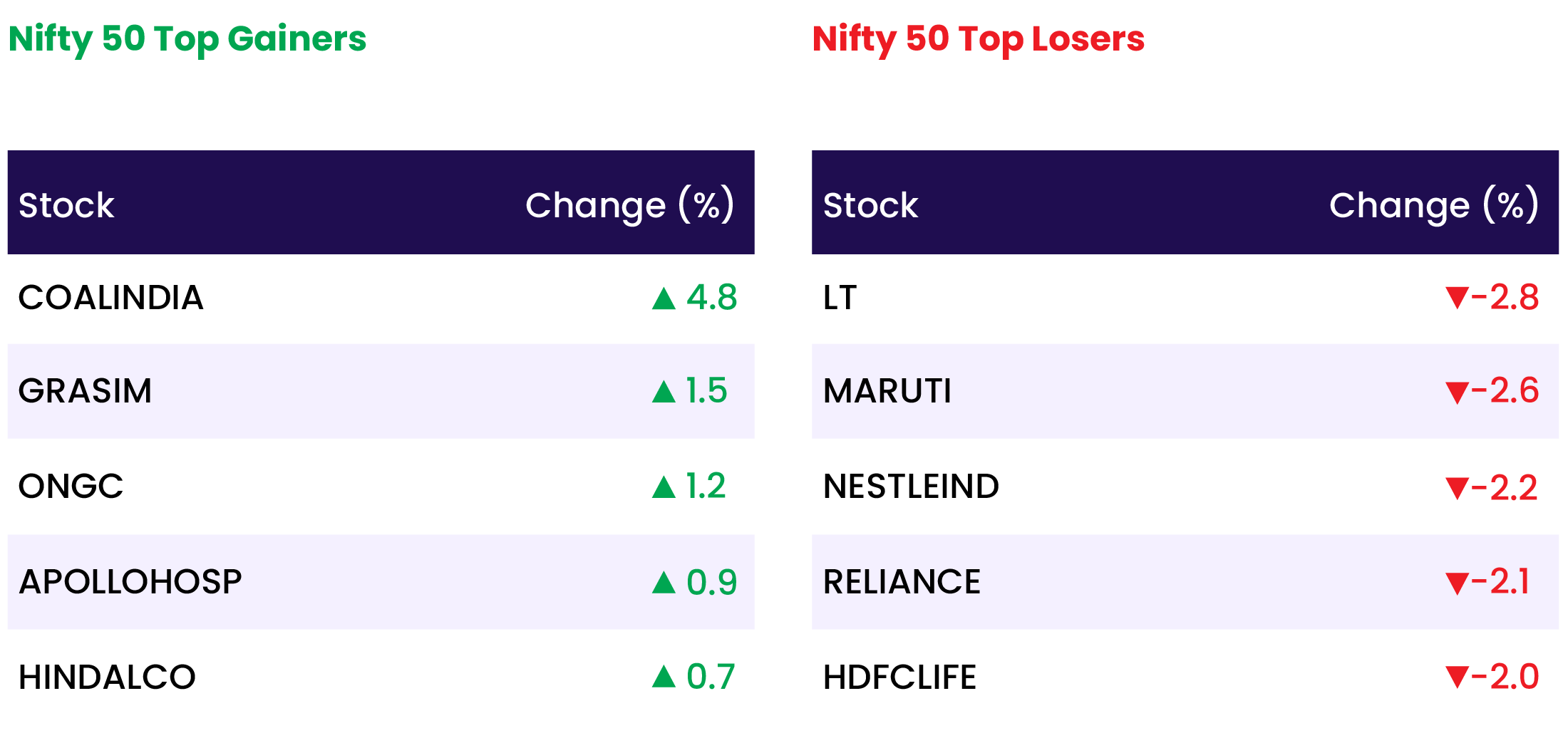

Benchmark index NIFTY closed at 22,475.85, down by 172.35 points/-0.76%. After opening higher and making a new all-time high, the benchmark index declined by 436 points on Friday. After opening it rose for an initial 15 minutes to 22,790, didn’t sustain, and cracked down to 22350 levels on Friday, but the index managed to cover 155 points in the last 90 minutes sustaining above 20-DEMA. India Vix was up by 10% and inched towards 15 level. Dragged down by Reliance, HDFC Bank, and LT while top gainers were Coal India, Grasim, and ONGC.

A Double Top structure is forming at an all-time high. A big bearish candle has formed on daily time-frame indicating huge selling pressure at all-time high. 7 days of gains have been wiped out in a single day. There is a huge negative divergence in the momentum oscillator 14 period RSI.

The index is facing resistance at the 22,780 level and needs to sustain above the same for further moves. Immediate next support levels are 22,300, 22,180. CNX INFRA, CNX OIL&GAS, and CNX IT were the major indices that dragged most on Friday.

Technical Overview – Bank Nifty

BANK NIFTY index closed at 48,923.55, down by 307.50 points/-0.62%. After opening higher and moving towards 49,600, the index didn’t sustain and cracked down to 48,660 levels. Index for the other half of trading session hovered around 48,800 level, but managed to cover 350 points in last 30 minutes. A major drag down was seen in Federal Bank, PNB, and Kotak bank.

Shooting Star candle formed on 30th April at an all-time high level, follow-up selling is seen in the index. Momentum oscillator 14-period RSI has a negative divergence. The index has reversed 200 points intraday from 10-DEMA.

Index resistance levels are 49,130, 49,600, and 49,950 for upcoming trading sessions. Immediate support levels for the index are 48,500 and 48,000.

Indian markets:

- In a session marked by volatility, the Indian markets relinquished their early gains and closed lower, with the Nifty dipping below 22,500 amidst selling pressure in heavyweight stocks and across various sectors, except for metal.

- Apart from the metal sector, all other sectoral indices ended in negative territory, with capital goods, realty, telecom, and PSU Bank sectors declining by one percent each, while oil & gas, auto, Information Technology, and Media sectors saw a 0.5 percent decrease each.

- Despite initially reaching fresh highs, the broader indices also faced downward pressure, with the BSE midcap index declining by 0.2 percent and the smallcap index by 0.5 percent.

Global Markets:

- Hong Kong led the gains in Asia on Friday, buoyed by a rise on Wall Street the previous day, with investors awaiting key U.S. employment data.

- South Korea’s Kospi slipped 0.26% to settle at 2,676.63, while the smaller-cap Kosdaq declined 0.22% to finish at 865.59.

- U.S. stocks closed higher on Thursday as investors focused on upcoming earnings reports and the release of the nonfarm payrolls report on Friday.

- The Taiwan Weighted Index climbed 0.53% to close at 20,330.32, while Hong Kong’s Hang Seng index surged by 1.34% in the final hour of trading.

- In Australia, the S&P/ASX 200 ended the day 0.55% higher, closing at 7,629.

Stocks in Spotlight

- Hindustan Zinc’s shares soared by 9 percent, extending its winning streak for seven consecutive days, as investors awaited an imminent dividend announcement from the company. Earlier, the company informed exchanges that dividends would be revealed on May 7, with a record date scheduled for May 15. In the fiscal year FY24 thus far, it has declared Rs 7 per share in July 2023 and Rs 6 per share in December 2023, totaling approximately Rs 5,493 crore.

- Ajanta Pharma witnessed a surge of over 6 percent in its shares following the company’s outstanding earnings performance in the March quarter and its announcement of buyback plans. The pharmaceutical company intends to repurchase up to 10.28 lakh equity shares, equivalent to 0.82 percent of its total outstanding shares. The buyback price is set at Rs 2,770, representing a premium of 24.5 percent over the stock’s previous close. Ajanta Pharma plans to allocate Rs 285 crore for the share repurchase.

- Coforge’s stock plummeted by 10 percent after brokerage firms downgraded it due to the company’s subdued performance in the quarter ended March 2024. The IT services company recorded a consolidated net profit of Rs 229.2 crore for the March FY24 quarter, marking a 5.6 percent decline compared to the previous quarter. Foreign research firm Jefferies downgraded the stock to ‘underperform’ and reduced the target price to Rs 4,290 per share, citing a Q4 performance that missed estimates due to lower-than-expected margins.

News from the IPO world🌐

- Swiggy secures shareholder nod for a potential $1.2 billion IPO

- Healthcare tech firm Indegene’s Rs. 1800 crore IPO to open on May 6th

- TBO Tek IPO to open for subscription on May 8

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MIDSMALL HEALTHCARE | 0.3 |

| NIFTY HEALTHCARE INDEX | 0.1 |

| NIFTY PHARMA | 0.1 |

| NIFTY METAL | 0.0 |

| NIFTY FINANCIAL SERVICES | -0.4 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1527 |

| Decline | 2306 |

| Unchanged | 125 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,226 | 0.9 % | 1.4 % |

| 10 Year Gsec India | 7.2 | (0.2) % | 0.4 % |

| WTI Crude (USD/bbl) | 79 | (4.5) % | 12.2 % |

| Gold (INR/10g) | 71,018 | (0.1) % | 5.9 % |

| USD/INR | 83.46 | 0.0 % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer