Technical Overview – Nifty 50

The benchmark index touched a fresh new all-time-high level of 23,880 on 26th June. The bullish momentum continues in the benchmark index, with follow-up buying seen in the index after the breakout of consolidation in the previous session. 3rd consecutive buying seen in the index from 10 DEMA support. Bulls seem to have dominated and there seems no momentum losing till the 24,000 mark

The RSI (14) momentum indicator rose and closed at levels of 67, given that the MACD is rising and above its polarity, the positive trend is anticipated to continue. The fact that the index is above each major DEMA adds extra support to the general bullishness.

For the upcoming sessions, the levels of support and resistance are 23,650 and 23,550, and 24,000 and 24,200, respectively.

Technical Overview – Bank Nifty

A quite volatile day for the banking index. The index increased, although it wasn’t a really significant shift. For most of the day, the index settled within a relatively narrow range between 52,800 and 53,000. The index saw follow-up purchasing following a little correction during the first hour of trading.

The daily time-frame trend line is being broken by the RSI (14) momentum indicator, which has also surpassed the 70 threshold. It is expected that the bullish trend will continue because the MACD is rising and above its polarity. The index’s position above each major DEMA lends more credence to the overall bullishness.

For the next sessions, the resistance and support levels are 53,000–54,000 for resistance and 51,950–51,250 for support.

Indian markets:

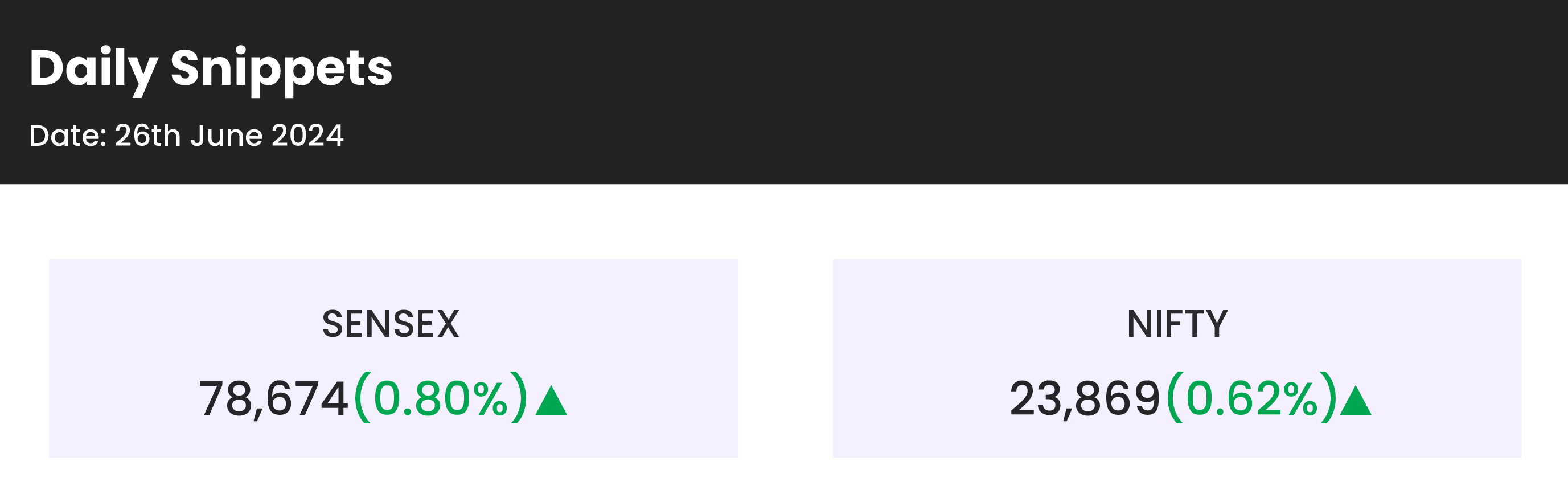

- Indian benchmark indices continued their record-breaking streak on June 26, with Nifty crossing 23,850 for the first time ever, led by banks and heavyweights.

- The Nifty Bank index also surged to a fresh record high near 53,000.

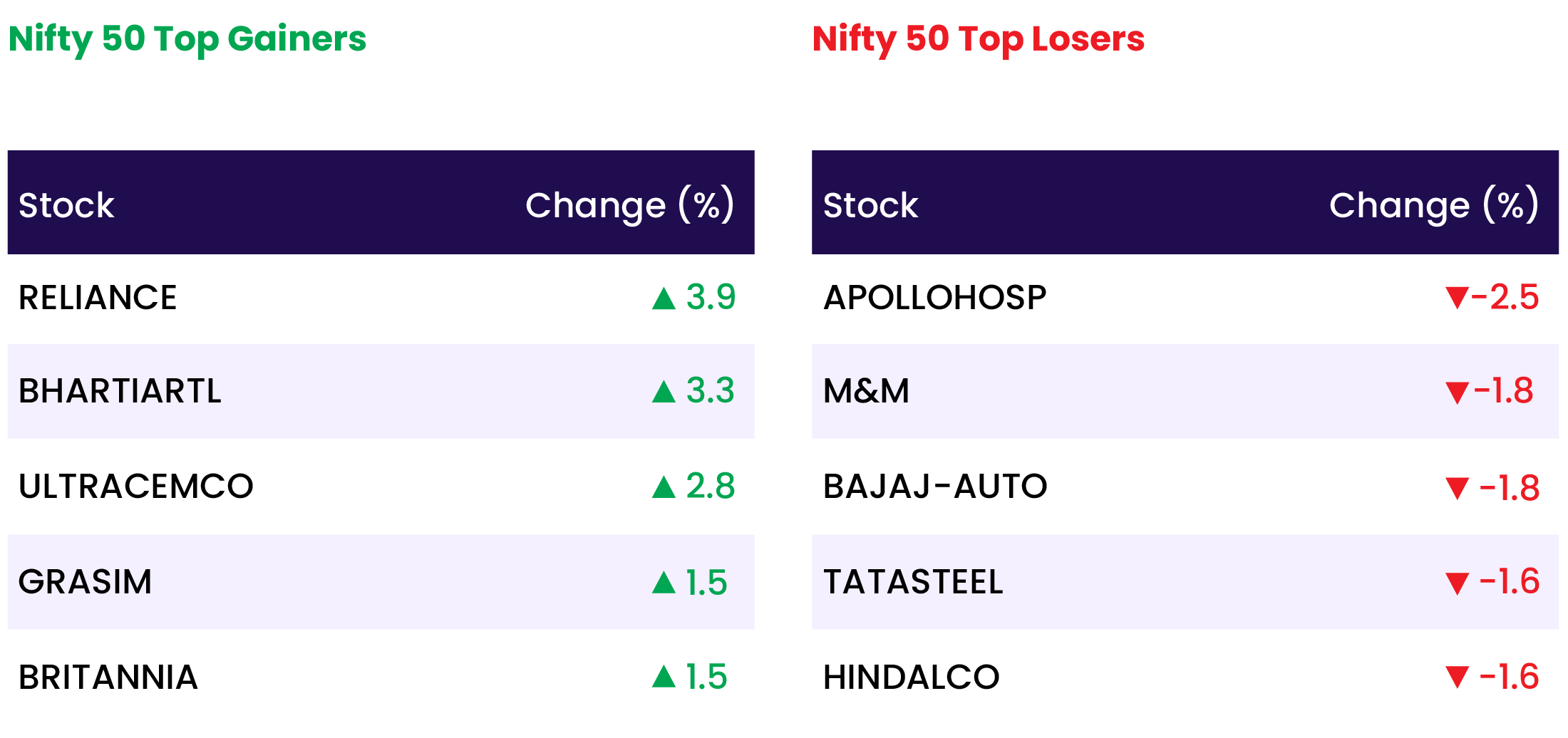

- Market started flat, gained momentum later with banking, oil & gas, and FMCG sectors driving gains of 0.3-2%. Auto, metal, and realty sectors saw declines of 0.7-1.5%.

- BSE midcap index fell 0.30%, while smallcap index ended flat.

Global Markets:

- Asia-Pacific markets mostly rose on Wednesday driven by semiconductor stocks rallying after Nvidia’s strong performance.

- However, Australia’s inflation rate, climbing for the third straight month, tempered market sentiment.

- Australia’s S&P/ASX 200 fell 0.71% due to declines in retail trade stocks.

- While Japan’s Nikkei 225 gained 1.26% to reach its highest level since April 9.

- South Korea’s Kospi rose 0.64%.

- Hong Kong’s Hang Seng Index saw marginal gains, and China’s CSI 300 closed 0.65% higher, rebounding from recent lows.

Stocks in Spotlight

- Hindustan Foods Shares zoomed 15 percent in trade following a block deal worth Rs 638.40 crore. Around 1.27 crore shares of Hindustan Foods changed hands on the exchanges at a floor price of Rs 502 per share.

- UltraTech Cement Shares gained nearly 4 percent in the morning trade after the Aditya Birla-led cement player to acquire a stake in UAE-based RAK Cement (RAKWCT).

- Mazagon Dock Shipbuilders Shares soared 7.5 percent in trade to hit a fresh record high of Rs 4,271.20 after the company became the latest to join the list of companies to be granted the ‘Navratna’ status by the Department of Public Enterprises.

News from the IPO world🌐

- Akme Fintrade shares list at 6% premium over issue price

- Vraj Iron and Steel IPO booked 3.5 times so far on Day 1

- Insurer Niva Bupa plans $360 million IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 1.6 |

| NIFTY OIL & GAS | 1.4 |

| NIFTY PRIVATE BANK | 0.6 |

| NIFTY BANK | 0.5 |

| NIFTY FMCG | 0.4 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1922 |

| Decline | 1960 |

| Unchanged | 126 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,112 | (0.8) % | 3.7 % |

| 10 Year Gsec India | 7.0 | 0.2 % | 0.9 % |

| WTI Crude (USD/bbl) | 81 | (1.0) % | 14.8 % |

| Gold (INR/10g) | 71,060 | (0.2) % | 6.1 % |

| USD/INR | 83.49 | (0.1) % | 0.5 % |