In a significant development in India’s banking sector, HDFC Bank, a leading private sector bank, and HDFC Ltd., the country’s premier housing finance company, announced the successful completion of their merger on June 30, 2023. The merger, which was first announced on April 4, 2022, has received all necessary shareholder and regulatory approvals and is set to be effective from July 1, 2023.

HDFC Ltd., currently the largest mortgage lender in the country, and HDFC Bank, the largest private bank and second largest bank in the country, only behind SBI, announced a merger in May 2022. As per the merger scheme, HDFC Ltd. would acquire a 41 per cent stake in HDFC Bank. This $40 billion merger will propel HDFC Bank’s balance sheet to around 17 lakh crore, making it the 10th largest bank in the world.

The merger decision was driven by a two-dimensional view: regulatory and profitability. Unlike commercial banks, NBFCs like HDFC Ltd. do not typically accept deposits from the common people. As a result, they were free from many restrictions, which translated into lower regulatory costs compared to commercial banks. However, with increased scrutiny of NBFCs in recent years, the regulatory cost arbitrage that the HDFC group enjoyed by keeping the bank and the NBFC separate was depleting. Additionally, decreasing costs of mergers made the decision easier for the two entities.

From a profitability perspective, HDFC Bank currently sells housing loans offered by HDFC Ltd. and earns a commission fee on it. This means that HDFC Ltd’s products get exposed to HDFC Bank’s customers but the same is not true for the opposite. The merger offers opportunities to the combined entity to “cross-sell products”. After the merger, HDFC Bank will be able to build its own mortgage lending portfolio and expand its customer base from HDFC Ltd. Additionally, the merger will expand HDFC Bank’s balance sheet allowing it to sanction higher ticket loans. The merger will also increase profitability since HDFC Bank’s low-cost funds from deposits can be channeled into financing the housing loans which were earlier out of bounds.

The merger also brings strategic cost savings. Banks can offer cheap home loans because they can mobilize funds through deposits. They pay very little interest on your savings account and they can use these funds to then create home loans at a higher interest rate. HDFC Ltd., even though it wasn’t a bank, could still access deposits. However, they couldn’t do it at the scale HDFC Bank was operating. The merger solves this problem, allowing the combined entity to access deposits at a significantly lower rate of interest.

Over the years, the distinction between NBFCs and banks had narrowed. In most cases, both these entities could accept deposits and dole out loans. But regulations favoured NBFCs. They didn’t have to deal with as many restrictions and red tape. They had more leeway and time when it came to classifying bad loans. This gave NBFCs an undue advantage over banks. However, when IL&FS blew up in 2018, everyone feared that the fallout would destroy the NBFC landscape. So the RBI decided to act. They tightened restrictions and put a new regulatory framework. Big NBFCs were now bound by similar regulations — the kind banks had always been dealing with. This might have influenced HDFC’s decision to merge, as there was no point running a bank and another almost bank-like institution in parallel.

Implications for individual investors.

The shares of HDFC Ltd. will be delisted with effect from 13th July. As per the merger scheme, shareholders will get 42 shares of HDFC Bank against 24 shares of HDFC Ltd. This has created an arbitrage opportunity wherein investors are buying shares of HDFC Ltd., eventually hoping to acquire shares of HDFC Bank at a discount. However, this spread is as thin as 1%. So unless the amount invested is huge, the profits are likely to be slim.

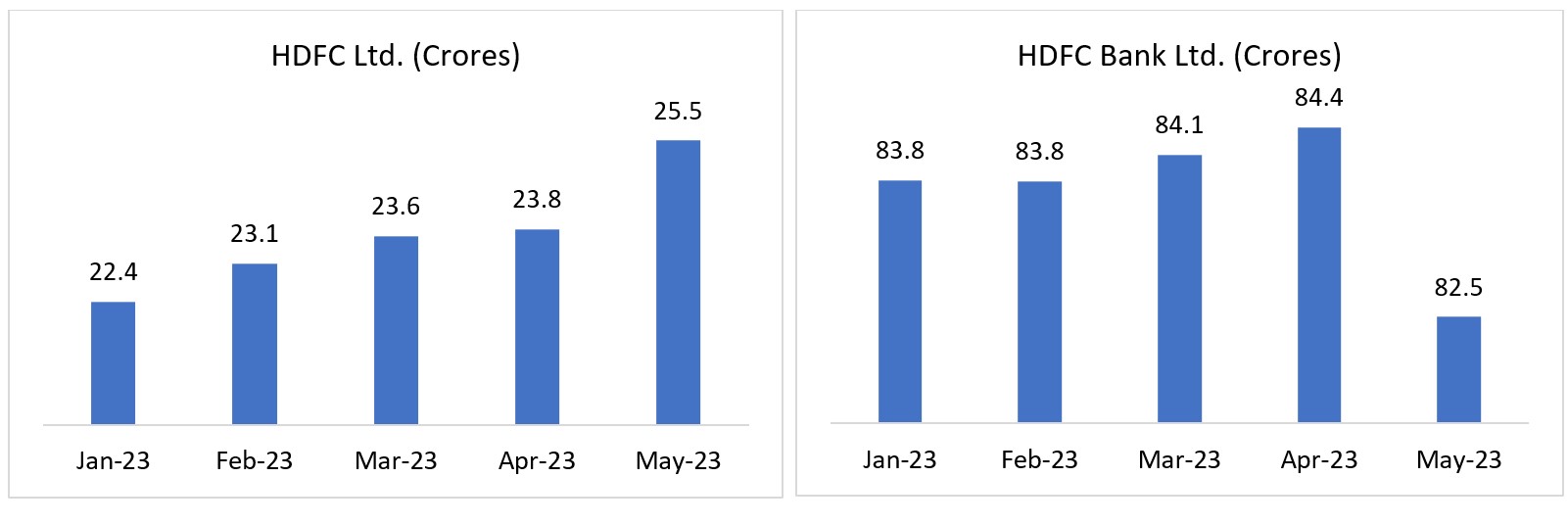

Mutual Fund Industry share holding in HDFC Bank and HDFC Ltd

Source: ACEMF, Fisdom Research & NSE

The impending merger of HDFC Ltd. and HDFC Bank, set to be effective from July 1, has created an arbitrage opportunity that domestic equity mutual fund managers have capitalized on. In May, they bought a net 1.7 crore shares of HDFC. Simultaneously, they sold HDFC Bank 1.8 crore shares.

This strategy is a type of “spread trade,” where funds have been purchasing shares in HDFC Ltd. as a means to reduce the cost of acquiring shares in HDFC Bank. The merger deal stipulates that HDFC shareholders will receive 42 shares of HDFC Bank for every 25 shares they hold in HDFC Ltd., based on the share-swap ratio announced in April last year. By capitalizing on this ratio, trader can effectively buy shares in the merged entity at a discount to HDFC Bank’s current price. This arbitrage opportunity is a strategic move to maximize potential gains from the merger of the two companies, which had a combined market value of about $173 billion as of Monday’s close.

There is another uncertainty that this merger has created. There is a ceiling of 10% for mutual funds to invest in shares of a single company. So, mutual funds, whose sum of investments in HDFC and HDFC Bank will exceed 10% post-merger, will be forced to disinvest thus leading to possible bulk selling.

Below are Top 5 actively managed excluding thematic category funds holding HDFC Bank Ltd as of May 2023.

| Fund name | Holding % | Category |

| Mirae Asset Large Cap Fund-Reg(G) | 10.5% | Large Cap Fund |

| Mirae Asset Focused Fund-Reg(G) | 10.4% | Focused Fund |

| Quant Large Cap Fund-Reg(G) | 9.7% | Large Cap Fund |

| Quant ESG Equity Fund-Reg(G) | 9.7% | Thematic Fund |

| Quant Value Fund-Reg(G) | 9.6% | Value Fund |

Source: ACEMF, Fisdom Research & NSE

Below are Top 5 actively managed excluding thematic category funds holding HDFC Ltd as of May 2023.

| Fund name | Holding % | Category |

| Invesco India Tax Plan(G) | 887.0% | Equity Linked Savings Scheme |

| Taurus Tax Shield Fund-Reg(G) | 842.3% | Equity Linked Savings Scheme |

| Aditya Birla SL Focused Equity Fund(G) | 836.1% | Focused Fund |

| Parag Parikh Tax Saver Fund-Reg(G) | 793.6% | Equity Linked Savings Scheme |

| Parag Parikh Flexi Cap Fund-Reg(G) | 789.4% | Flexi Cap Fund |

Source: ACEMF, Fisdom Research & NSE

Lastly, since HDFC Ltd. is part of all major Indian Indices, its delisting will lead to outflow of funds. There are investors and institutions who track the stocks in indices and invest in them passively. So delisting might encourage them to sell HDFC shares massively and look at alternatives. However, this delisting has pushed shares of LTIMindtree Ltd. in the past week due to its possible inclusion in the NIFTY index as a replacement for HDFC Ltd.

In conclusion, the merger of HDFC Bank and HDFC Ltd. is a significant event in the Indian banking sector. It brings together two major financial entities, creating a financial services conglomerate that offers a full suite of financial services. The merger is expected to create meaningful value for various stakeholders, including customers, employees, and shareholders, and has significant implications for individual investors. While the merger presents some uncertainties, it also offers opportunities for strategic cost savings, increased profitability, and economies of scale. Analyst community has become more bullish on the merger entity giving out significant upgrades in terms of stock rating amid the long term prospects of the stock.

Read more: Market’s Ascent from High to Higher

Markets this week

| 26th June 2023 (Open) | 30th June 2023 (Close) | %Change | |

| Nifty 50 | ₹ 18,682 | ₹ 19,189 | 2.7% |

| Sensex | ₹ 62,947 | ₹ 64,719 | 2.8% |

Source: BSE and NSE

- Positive global data and increased buying from foreign investors contributed to the upward trend in Indian indices for the week ending June 30.

- The strong progress of the monsoon and the positive impact of the HDFC merger further boosted the market.

- The market’s upward momentum was also supported by strong inflows from FIIs and a narrowing current account deficit.

- Globally, investor confidence was uplifted by favourable revisions in US Q1 GDP, a decline in jobless claims, and positive outcomes from the US bank stress test conducted by the Fed.

- IT, Pharma, and Auto sectors emerged as top performers throughout the week, significantly contributing to the overall market performance.

- Mid- and small-cap stocks recovered from their losses of the previous week, indicating a regained investor interest in these segments.

- All sectoral indices ended in the green, with Nifty Pharma index gaining 4.4 percent, Nifty auto index rising 4 percent, Nifty Information Technology index rising 3.5 percent, and Nifty PSU Bank index up nearly 3 percent.

Weekly Leaderboard

| NSE Top Gainers | |

| Stock | Change (%) |

| Adani Enterprises | ▲ +6.73% |

| TATA Motors | ▲ +6.48% |

| Sun Pharma | ▲ +6.00% |

| M&M | ▲ +5.87% |

| Infosys | ▲ +5.49% |

Source: BSE

Stocks that made the news this week

👉HDFC AMC stock surged amid Securities and Exchange Board of India’s (SEBI) decision to defer the rationalization of the total expense ratio (TER). The TER comprises the costs that mutual fund schemes can levy on their investors. The market regulator’s anticipated move to include additional charges within the TER limits had set alarm bells ringing among the Asset Management Companies (AMCs), fearing a dip in their profitability.

👉Mahindra and Mahindra Ltd (M&M) to a 52-week high during the week, after earning the distinction of being the first company to qualify under the government’s production-linked incentive (PLI) scheme for automobiles. This crucial milestone paves the way for M&M to avail of subsidies from a massive Rs 25,938-crore scheme aimed at turbocharging domestic production, job creation, and overall economic growth.

👉InterGlobe Aviation, the operator of IndiGo, experienced a commendable surge in the week, marking a milestone in India’s aviation sector by becoming the first company to cross a market capitalization of Rs 1 trillion. This extraordinary achievement came on the back of its shares hitting a record high, registering a robust gain of 29 percent this year alone. Further bolstering its global standing, IndiGo now proudly ranks 10th in terms of market value among the top ten listed aviation companies worldwide.