IMPACT ON MUTUAL FUND INVESTORS

Executive Summary

- Steep decline in HDFC Bank share prices in reaction to the recent quarterly results has dragged bellwether indices like the SENSEX, NIFTY50 and Bank Nifty. These declines rank among the steepest declines witnessed by the stock as well as indices.

- Actively managed mutual funds have diversified holdings while most have been consciously underweight on the bank since quite some time now.

- Considering actively managed equity funds,

- AMCs with zero exposure to HDFC Bank include Quant Mutual Fund that consciously trimmed positions post Aug’23, Samco MF that has not taken any exposure to the bank along with Trust MF and Zerodha MF not offering any actively managed equity funds in the first place.

- AMCs with the lowest exposure to HDFC Bank include Bajaj Finserv MF (1%), Motilal Oswal MF (1.3%), Navi MF (1.6%), Mahindra Manulife MF (1.8%)

- AMCs with the highest exposure to HDFC Bank include Helios MF (10%), Shriram MF (10%), PPFAS MF (9.3%), Quantum MF (8.9%), 360 One (8.5%)

- Total exposure of AMCs to the Bank is INR 1.3 Lakh Crore (4.2%)

Highlights:

- Quant Mutual Fund has proactively trimmed exposure to HDFC Bank after Aug’23 despite featuring meaningful allocation prior to the month. The AMC offers multiple funds and has garnered inflows at a relatively fast pace in recent quarters, yet does not hold the bank in any portfolio.

- Though limited in size and number of funds, Samco MF does not hold HDFC bank in either portfolio.

Quick Comments by AMCs with zero exposure to HDFC Bank within actively managed equity funds:

| “Since the beginning of CY23, we have highlighted how the year will be remembered as a year where all stocks and sectors will be divided as ones trading in the hated/neglected zones or trading in the admired zones. We have also highlighted how those in the admired category and featuring over-ownership will underperform during this year. This category includes several private sector banks, which are expected to underperform. Our other big macro call is that ‘leverage economy concept‘ will lose its relevance and the process aligning with this will gather momentum over the next 30 years. Accordingly, banking institutions, are expected to be impacted adversely. As a fund house, we are led by data analytics with roughly one-third of the methodology represented by valuation analytics and the remainder focused on risk and liquidity analytics. Currently, we have 4.5% weight to banking and virtually no exposure to Kotak Bank, Axis Bank, and HDFC Bank. As covered in last month’s factsheet we have a sizeable exposure to Jio Financial services and believe this would turn out to be among the best plays in BFSI for the decade.” – Sources from Quant Mutual Fund |

| “SAMCO’s HexaShield framework is a rigorous scientific and statistical process helps get an understanding of risks, reduces room for bias and beliefs, inculcates discipline and enhances the probability of success. Companies that pass the criteria often exhibit 2 characteristics – they survive as a going during economic distress and operate as true compounding machines in normal economic cycles. The 6 facets of testing that are followed in our HexaShield framework are Competitive Strength and Pricing Power, Balance Sheet and Insolvency, Re-investment and Growth, Corporate Governance and Leadership, Cash Flow and Regulatory. The HexaShield tested framework observes if companies pass the test on various fundamental factors and only the ones that cross the benchmark percentage hurdle in all 6 pillars will be eligible to be a part of the investment universe. HDFC Bank fails on the Regulatory test as the entire banking industry is overregulated in India, though it is good for the country, but from investing point of view, sometimes such excessive regulations hamper the profitable growth of the private organization. (note low score on regulatory test has nothing to do with regulatory compliance of the bank per se, it is out internal proprietary scoring mechanism)” – Nirali Bhansali (Fund Manager, Samco Mutual Fund) |

Free fall and dragging them all

HDFC Bank’s Q3FY24 results were a shocker that resulted in the second-steepest one-day decline in the stock’s share prices in its history since listing. The bank’s ADR replicated the nosedive and resulted in a sharp slide on the overseas index as well.

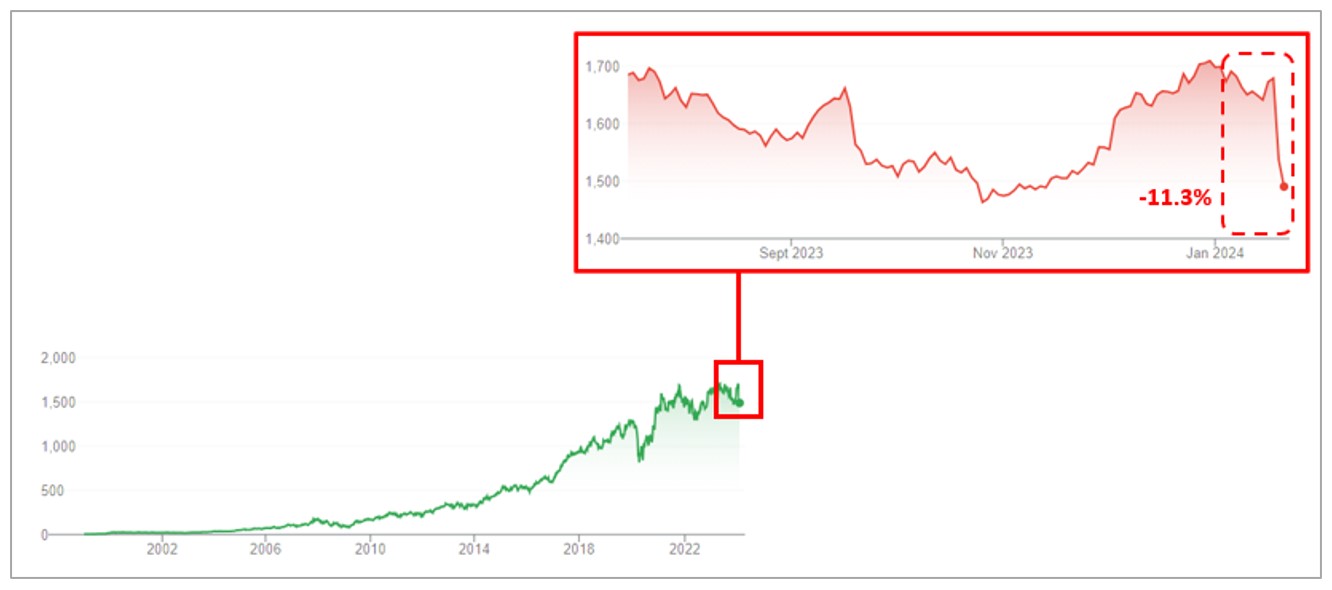

Illustration: HDFC Bank Share Price Slides post Q3FY24 Results

Source: Google Finance

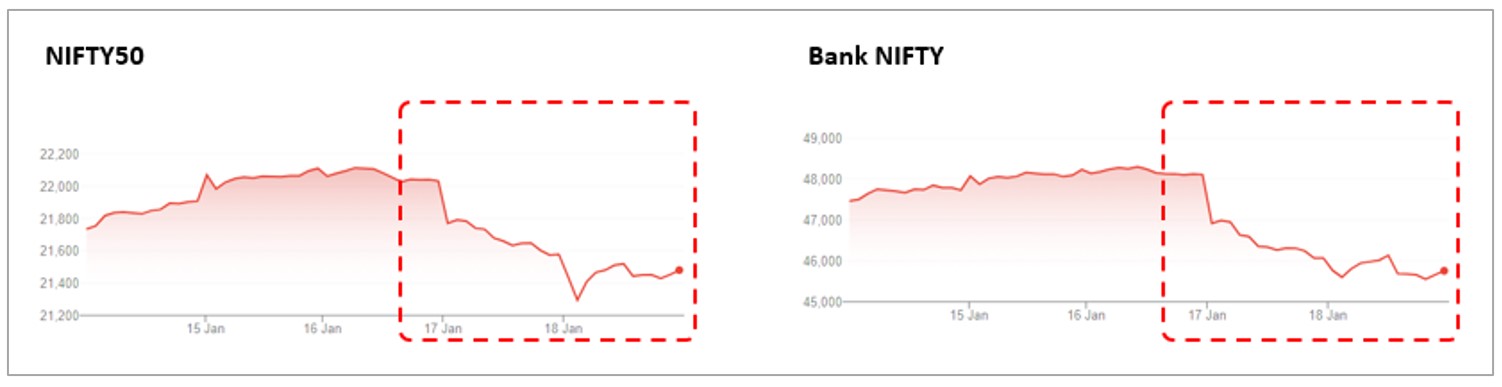

The rout triggered a ripple effect on India’s largest bellwether indices – the NIFTY50 and Bank Nifty. The bank represents the highest weight on both indices. HDFC Bank has a 13.52% weight on the NIFTY50 and 29.39% weight on the Bank NIFTY indices. The free -fall in the stock led to the indices replicating a slide in value which only gave way to a cascading effect wherein the sudden jolt resulted in follow-through selling in the banking sector as well as the NIFTY to a meaningful extent. The one-day decline in both indices has been the steepest since June-July 2022.

Illustration: HDFC Bank drags NIFTY50 and Bank NIFTY

Source: Google Finance

Disappointment on multiple fronts

The bank’s earnings report revealed a disappointing performance due to sluggish growth, shrinking margins, cautious margin guidance, and a feeble loan-to-deposit ratio. The post-merger Loan-to-Deposit Ratio (LDR) reached an alarming 110%, compared to the pre-merger range of 85% to 90%. This highlights a substantial outpacing of the loan book over deposit growth, surpassing similar private banks and significantly exceeding the typically healthy 75% LDR range. The prevailing expectation is that the bank will aggressively mobilize deposits to bring the LDR into more favorable territory. However, such a mobilization is likely to squeeze margins.

In an effort to restore balance, the management has outlined a three to four-year plan to align the loan and deposit books. To counter intense pricing competition, the bank intends to shift focus from competitive non-retail deposits to building a more diversified retail deposit base. Yet, the successful execution of these corrective measures remains an intention, necessitating close monitoring over time. Meanwhile, challenges such as a low credit deposit ratio, weak liquidity coverage, and a tepid deposit growth rate pose constraints on achieving meaningful expansion in net interest margins.