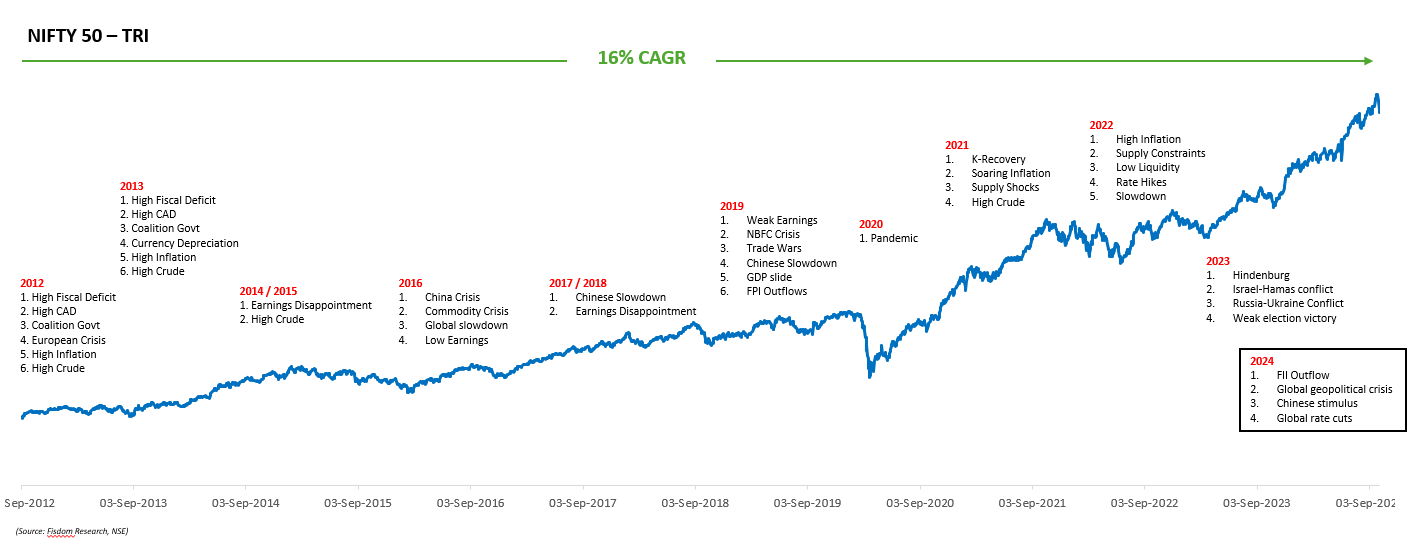

Indian equities have been witnessing a secular uptick even as it faces a series of global and domestic challenges

Indian equities have been growing with resilience across several cycles of crises and opportunities

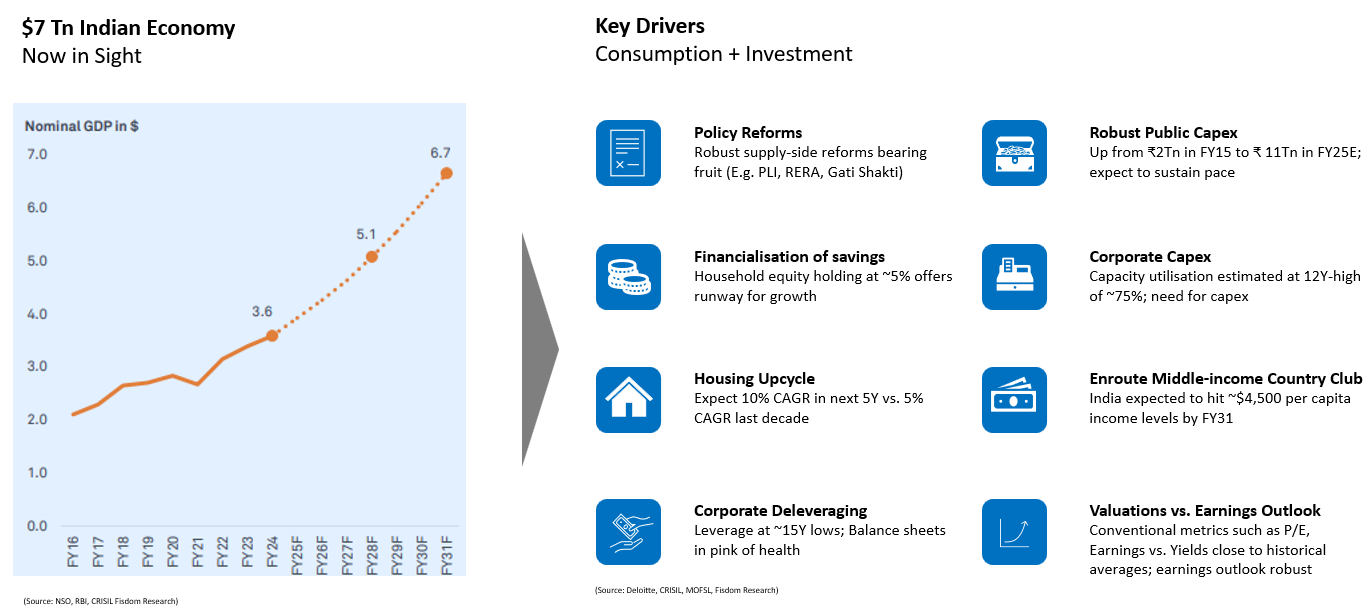

India is already the fastest growing economy; on track to feature among the global top three

Even global investors are betting big on India’s growth despite volatility

These are just a few examples – many more are betting on India’s bright future.

Navigating markets: tailored views on key asset classes

| Asset Class | Our View | |

| Equity | Cautious – Be Selective | Bottom-up opportunities still exist. Follow 60:20:20 when it comes to large, mid and smallcap allocation. It’s a buy-on-dip market. |

| Debt | Positive | Follow Barbell Strategy. Overweight on duration play. Reduced fiscal deficit projections, coupled with global bond inclusion and decreased gross borrowing, will likely have a positive impact on the bond market. |

| Gold | Positive | Suggested to buy on the dip. Maintain it as a strategic allocation. |

| Real Estate | Negative | Opting for investments through REITs and realty stocks might be the favorable choice. |

| International Equities | Neutral | Maintain it as a strategic allocation; avoid going overweight. |

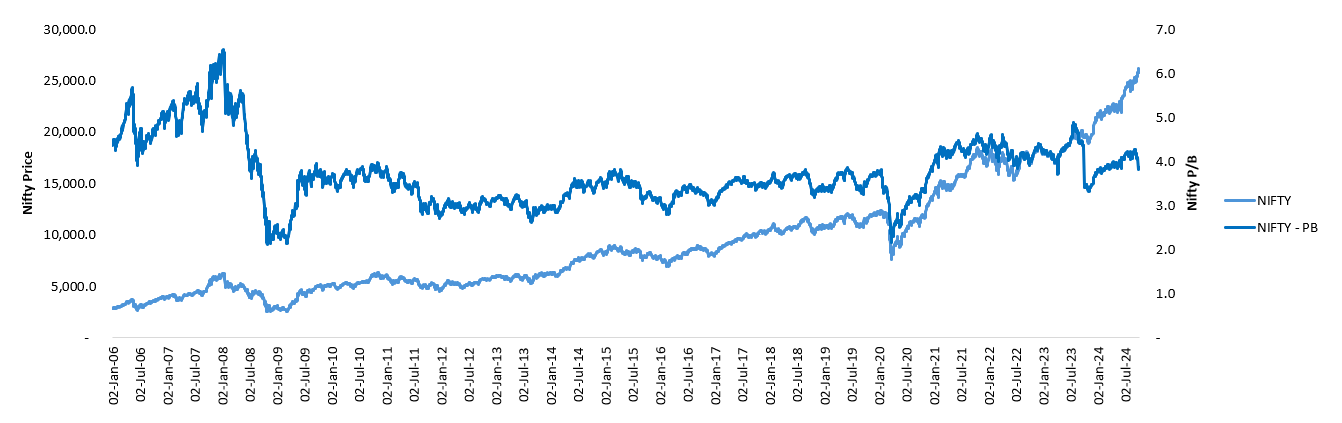

Valuations are rich, but India’s growth story justifies the premium

- Robust economic growth, outperforming most emerging markets.

- Political Stability

- Earning is expected to grow at 15% CAGR which justifies current valuation numbers.

- The Indian market’s forward P/E multiple has steadily increased over the last decade, reflecting robust corporate profit growth

- Favorable macroeconomic factors, including controlled inflation and stable interest rates.

- Long-term growth potential, driven by both domestic consumption and structural reforms, continues to attract global investors.

- Record-high FX reserves and strong remittances have strengthened India’s financial position, adding further support to market valuation.

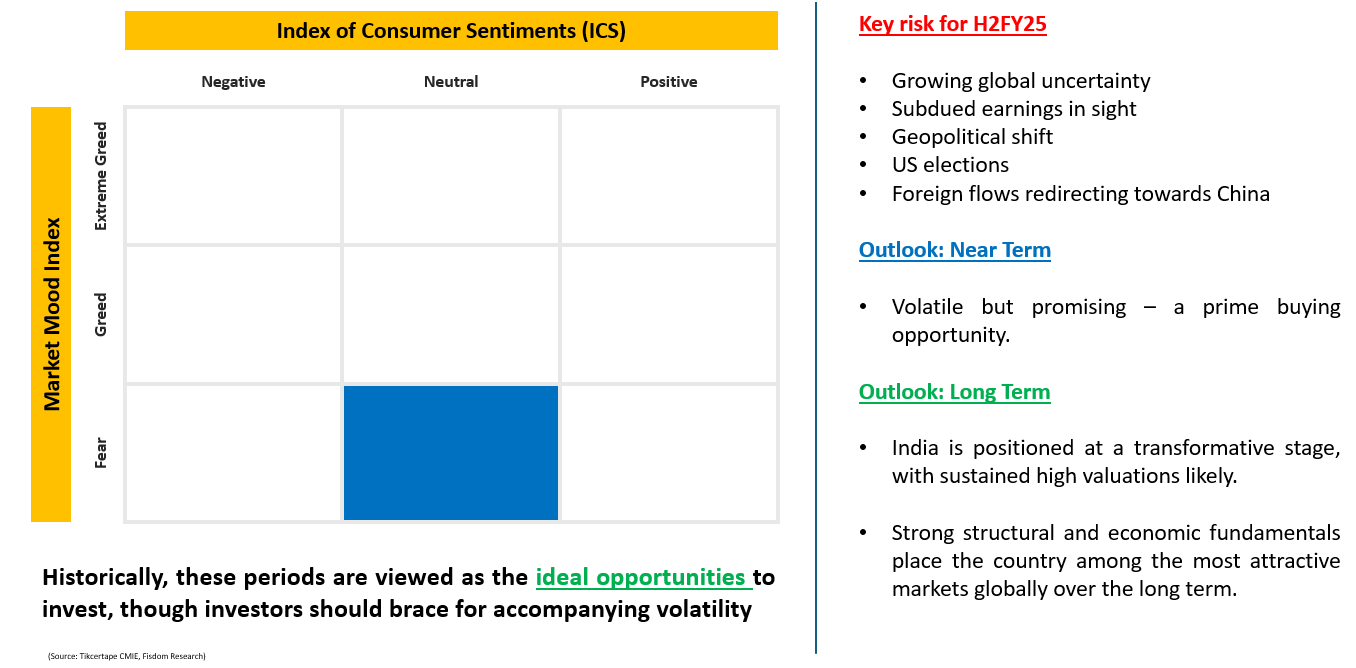

Market sentiments at crossroads: risks and rewards ahead