During the week, India’s benchmark indices declined by 2.5 percent, marking the longest six-day losing streak since February 2023 until Thursday. This downward trend was attributed to elevated US bond yields and ongoing concerns around the Israel-Hamas conflict, causing investors to retreat from risky assets.

Let us try and understand why US treasury yields are impacting the markets globally.

If a country like US wants to borrow money to meet its various needs, they issue bonds. Now the maturity of these bonds may depend on different cash flow requirements. It might be for short term or long term. But the important question here is that how do these countries decide interest rates on these bonds?

Well, a simple answer to that is, interest rates are close to inflation numbers within the country. The interest rate should be attractive enough for investors to purchase those bonds. And at the end everyone wants inflation beating returns.

So, for instance, the government could anticipate an inflation rate of around 6% over the next decade. To attract investors, they might issue a 10-year bond valued at ₹100, adding a slight premium to the yield. In this scenario, the yield or interest rate could be set at 6.50%.

Government bonds possess a distinctive and intriguing characteristic; they serve a important purpose by indicating inflationary expectations. If investors perceive inflation to be higher than predicted, they will seek higher returns from these bonds. Consequently, they might sell their existing bonds and explore alternative assets that promise better value. This surge in selling activity puts downward pressure on bond prices. And as we know bond prices and yield have an inverse relationship.

The US Federal reserve had printed and pumped a lot of money in the aftermath of Covid-19 pandemic to boost the economy by keeping interest lower so that companies and individuals can borrow money easily. This led to rise in inflation. As things started to normalise inflation was far away from normalising. Eventually, the US Federal reserve started to withdraw the excess money from the system and raise interest rates to control sticky inflation.

Due to this, the US 10-year Treasury yields have reached a 16-year high in anticipation of further rate hike. Federal Reserve Chairman Jerome Powell recently indicated that additional interest rate increases might be necessary to curb inflation and achieve the 2 percent target.

If the US Federal Reserve expresses concerns about elevated inflation, they may opt to maintain high-interest rates. This decision could lead to a scenario where individuals find it challenging to meet their current loan obligations. The implication might already be visible in the US economy.

|

|

Source: Federal Reserve Markets Insider, Fisdom Research

- The 30-year fixed mortgage rate has recently surged beyond 8%, marking the highest borrowing cost in 23 years for one of the United States’ most favored mortgage options, as per Mortgage News Daily’s estimation.

- As per Federal Reserve data, the 24-month personal loan rate at commercial banks has reached 12.17%. This marks the highest borrowing cost for personal loans since 2007.

- In August of this year, commercial bank interest rates on credit cards spiked to 21.19%, as indicated by Federal Reserve data. Additionally, an analysis by Bankrate revealed that the average retail card interest rate stood at approximately 28.93%, marking the highest rate ever recorded.

- Consumers facing escalating interest expenses on their debts are experiencing a surge in late payments. Credit card delinquencies in the second quarter reached their highest level since 2012, while consumer loan delinquencies rose to their peak since the onset of the pandemic.

|

How will this impact India?

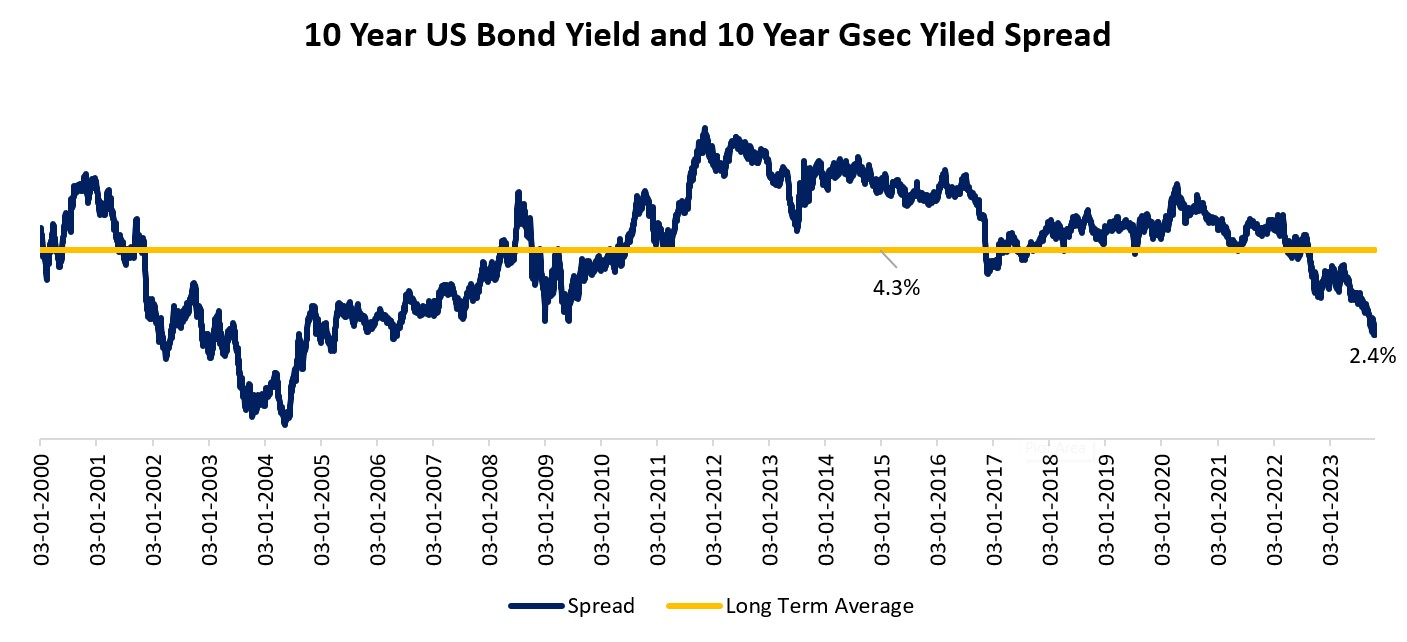

- FII Selling: The higher interest rates in US have incentivised foreign institutional investors to move money to the US. In September and October so far foreign investors have remained net sellers as the spreads between US 10 year bond yield and 10 year Gsec have dropped below long term average.

|

|

Source: Fisdom Research

- This situation also indicates a slowdown in the American economy. Notably, a few weeks ago, Infosys made a surprising announcement stating their probable decision not to recruit from colleges this year. This revelation is significant considering that IT companies like Infosys are usually consistent participants in campus placements. Such a statement could serve as a substantial indicator of broader economic trends.

- Nifty 50 surged to an all-time high of 20,222 on September 15. However, Dalal Street has faced challenges in maintaining this peak.

|

What should investor do amid all the euphoria around markets?

Amid all the fuss around FII selling, it is crucial to recognize India’s unique position in the global landscape. Despite trading at a premium compared to its emerging market counterparts, India’s valuations must be interpreted through the lens of its robust growth potential.

As the fastest growing large economy, India stands tall with the support of a stable political scenario, a vast domestic market, favorable demographic factors, and its emergence as a viable alternative to China as a manufacturing powerhouse.

Interestingly, Domestic Institutional Investors (DIIs) took advantage of the situation. Despite the challenges posed by FII selling, Domestic investor have remained resilient and invested heavily as markets cooled off.

In October so far, the Nifty Midcap index saw a 4.1 percent decline, while the Nifty Smallcap index fell by 1.7 percent, compared to the benchmark Nifty’s 3.0 percent drop. For long-term investors, the best strategy is to remain steady and focus on quality investments. Adding to holdings during market dips could be beneficial. While predicting short-term market fluctuations is challenging, the market might appear reasonably valued if it corrects further and geopolitical risks stabilize.

|

Markets this week | | 23rd Oct 2023 (Open) | 27th Oct 2023 (Close) | %Change | | Nifty 50 | ₹ 19,522 | ₹ 19,047 | -2.40% | | Sensex | ₹ 65,422 | ₹ 63,783 | -2.50% |

Source: BSE and NSE |

- Indian indices experienced a second consecutive weekly decline ending on October 27, reflecting investor apprehension due to escalating geopolitical tensions, higher interest rates, and global market weaknesses.

- Across sectors, all indices closed in negative territory:

- Nifty Media index declined by 5.3%.

- Nifty Metal index saw a nearly 4% drop.

- Nifty Information Technology, Nifty Oil & Gas, and Nifty Realty indices all decreased by nearly 3% each.

- During the week, foreign institutional investors (FIIs) accelerated their selling activities, disposing of equities worth Rs 13,187.01 crore. In contrast, domestic institutional investors (DIIs) stepped in by purchasing equities valued at Rs 11,553.34 crore, mitigating some of the selling pressure.

- FIIs offloaded equities totalling Rs 26,598.73 crore.

- DIIs, however, made substantial purchases, acquiring equities worth Rs 23,437.14 crore

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | Axis Bank | ▲ 2.28% | | HCL Technologies |

▲ 0.80% | | Coal India |

▲ 0.50% |

| NSE Top Losers | Stock | Change % | | UPL | ▼ 7.42 % | | Adani enterprises | ▼ 5.52% | | HDFC Life | ▼ 4.89% | | JSW Steel | ▼ 4.86% | | Asian Paints | ▼ 4.85% |

|

Source: BSE |

Stocks that made the news this week:

- Canara Bank witnessed a remarkable 6 percent surge in its stock value following the announcement of a substantial 42.8 percent increase in its net profit, which amounted to Rs 3,606 crore during the second quarter of FY24. Additionally, the bank’s net interest income demonstrated strong growth, surging by almost 20 percent to reach Rs 8,903 crore in the same quarter.

- Ipca Laboratories witnessed a significant surge of approximately 6 percent following the favorable Voluntary Action Indicated (VAI) classification by the US Food and Drug Administration for its Ratlam unit, surprising the market positively. This development propelled the stock to reach its 52-week high on the stock exchanges, reflecting the strong investor confidence in the company’s prospects. The news of the VAI classification served as a catalyst, driving the stock’s impressive performance in the market.

- Adani Group shares faced downward pressure after reports emerged that one of its auditors, SR Batliboi, affiliated with EY, was under scrutiny by India’s accounting regulator, the National Financial Reporting Authority (NFRA). The NFRA had requested files and communications from SR Batliboi, which audits five prominent Adani Group companies, including Adani Power, Adani Green Energy, Adani Wilmar, as well as cement giants Ambuja Cements and ACC. This development led to market concerns, causing a decline in Adani Group shares.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|