News: Adani enterprises file for an Rs.20,000 crore follow-on public offer (FPO)

Executive Summary:

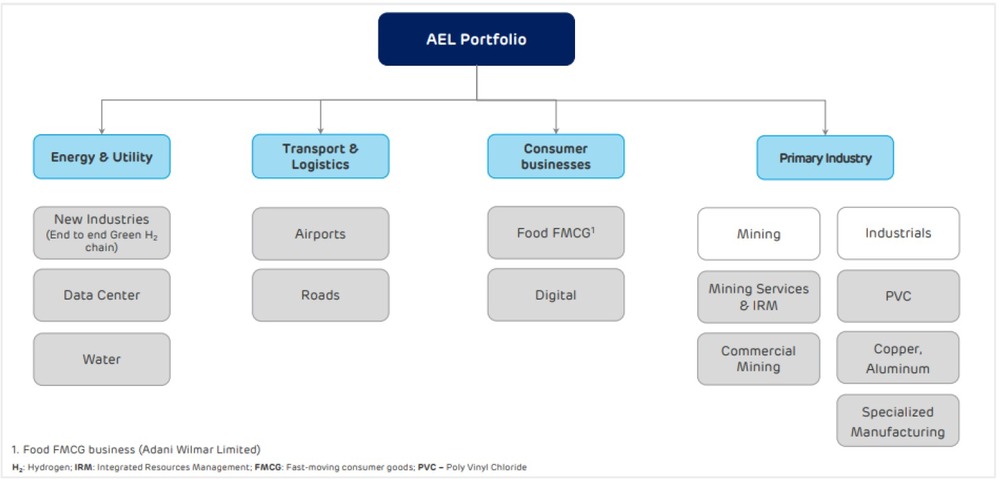

- It is one of India’s largest listed business incubators of market capitalization. It is driven by the philosophy of incubating businesses in four core industry sectors – energy and utility, transportation and logistics, consumer, and primary industry.

- It has, over the years, seeded new business interests for the Adani group, developed them into sizeable and self-sustaining business verticals, and demerged them into independently listed and scalable platforms.

- Their current business portfolio includes a green hydrogen ecosystem, data centres, developing airports, roads, food FMCG, digital, mining, defence and industrial manufacturing, among others.

- Raising fresh money by issuing fresh equity would reduce the company’s high leverage and increase public shareholding.

Except for the current valuation, the current state of business, growth prospects, and financial strength seems close to reasonable. High-risk investors with a long-term horizon seeking a play into infrastructure, industrials & utilities can utilise the FPO as an opportunity to invest in AEL.

| Snapshot of The Issue | |

| Type: | Fresh Issue |

| Offer size: | ₹ 20,000 Cr |

| Face value: | ₹ 1/- |

| Employee reservation: | ₹ 50Cr |

| Price band: | ₹ 3112 – 3276 |

| Bid Lot: | 4 shares and in multiple thereof. |

| Discount for retail investors: | 64 per equity share |

| Offer Period: | January 27, 2023 – January 31, 2023 |

| BRLMs: | ICICI Securities, Jefferies India private limited, SBI capital markets limited, Axis capital limited, BOB capital markets Limited, IDBI capital markets & securities limited, JM financials limited, IIFL securities limited, Monarch net worth capital limited, Elara Capital (India) private limited |

| Registrar: | Link Intime India Private Limited |

| Indicative Timetable | |

| Activity | |

| Anchor Investor Issue Opens | 25-01-2023 |

| Issue Opens | 27-01-2023 |

| Finalization of Basis of Allotment | 03-02-2023 |

| Refunds/ Unblocking ASBA Fund | 06-02-2023 |

| Credit of equity shares to DP A/c | 07-02-2023 |

| Listing | 08-02-2023 |

| Listing: BSE & NSE | |

| Issue Break Up | ||

| Retail | QIB | NII |

| 35% | 50% | 15% |

Overview

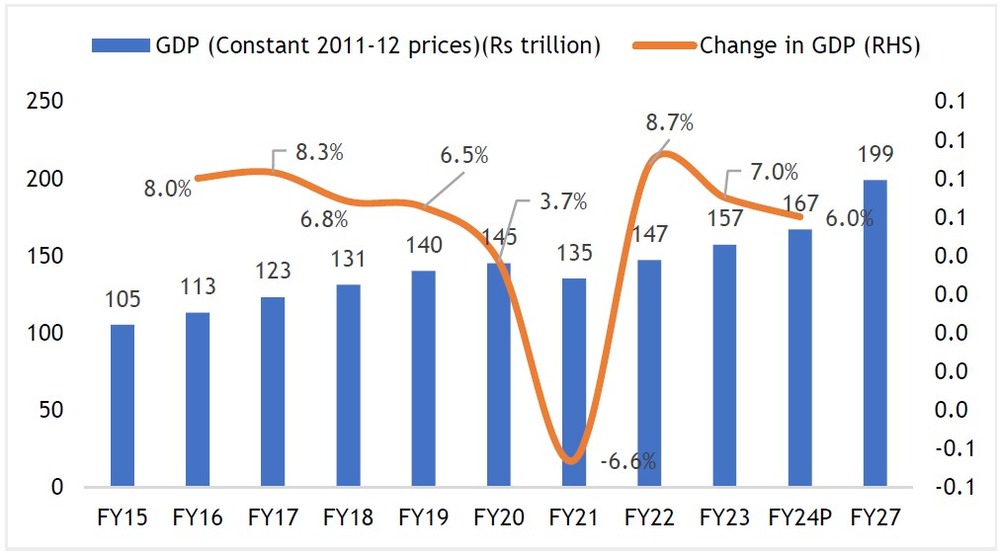

India drives in the fast lane to economic growth. Despite being significantly sensitive to the pandemic and still reeling under the pressure of adverse fallouts, the domestic economic growth story remains resilient.

Exhibit 1.1: Movement in GDP across years

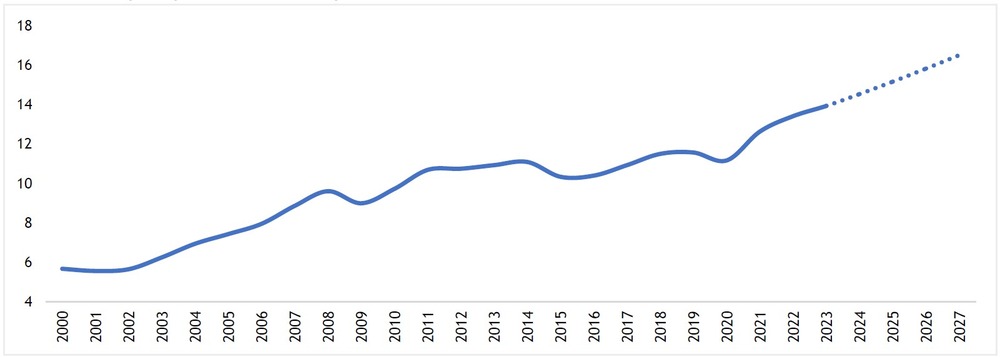

Even the global per capita income rebounded after a decline during the pandemic induced the calendar year 2020.

Exhibit 1.2: GDP per capita in US$ at current prices

Source: IMF, Fisdom Research

For example, the 2020 per-capita declined due to the COVID-19 impact but has recovered and is estimated to grow in 2023 and 2024, implying growth in the standard of living.

Government’s key initiative

During the 26th united nations climate change conference of parties summit, the GOI presented the following five nectar elements of India’s climate action: ‘Panchamrit.

- Reach 500GW non-fossil energy capacity by 2030

- 50% of its energy requirements from renewable energy by 2030

- The total projected carbon emissions will be reduced by one billion tonnes from now to 2030.

- Reduction of the economy’s carbon intensity by 45% by 2030, over 2005 levels.

- Achieving the target of net zero emissions by 2070

The objective of this initiative was mainly to cut the dependency on conventional sources alone, decrease the import bill & also to reduce the higher emissions. While India does have the prospect in various industries for carbon capture but has a significant competitive edge in green hydrogen due to the giant strides it has made in renewable energy over the past few years. It, combined with capital land resources extensive grid system, makes it an ideal candidate to transition to green hydrogen quickly.

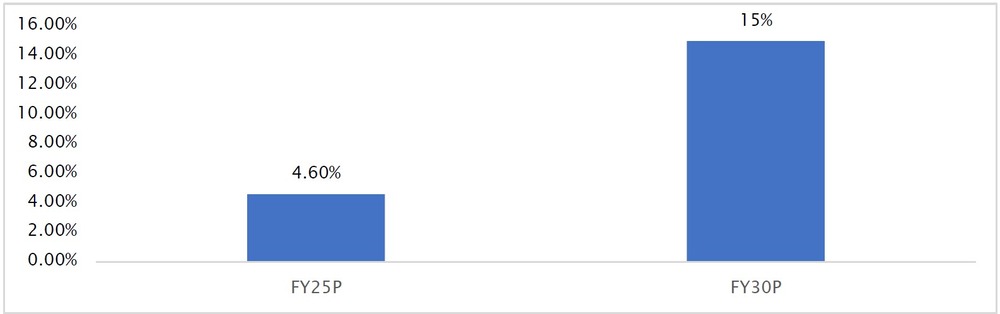

Exhibit 1.3: Expected share of green hydrogen

Source: Crisil MI&A Research, Fisdom Research

Background & Operations

Incorporated on March 2, 1993, Adani Enterprises Limited (AEL) is the flagship company of the Adani Group, one of India’s most prominent business organisations. Over the years, Adani Enterprises has focused on building stellar infrastructural assets that contribute to nation-building.

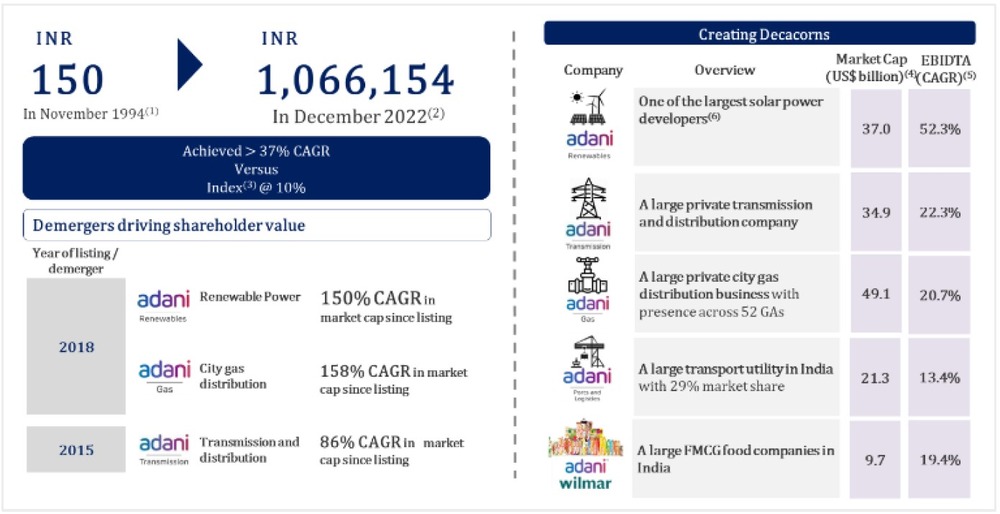

Having successfully built unicorns like Adani Transmission, Adani Power, Adani Ports & SEZ, Adani Green Energy and Adani Total Gas, the company has contributed significantly to making the country self-reliant.

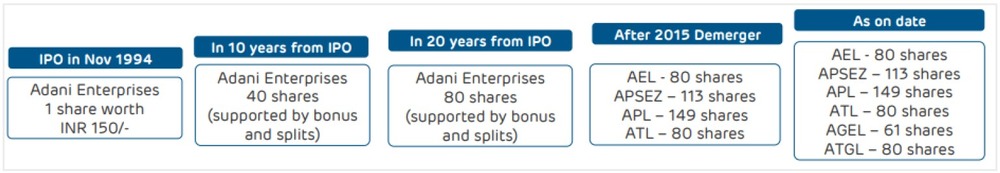

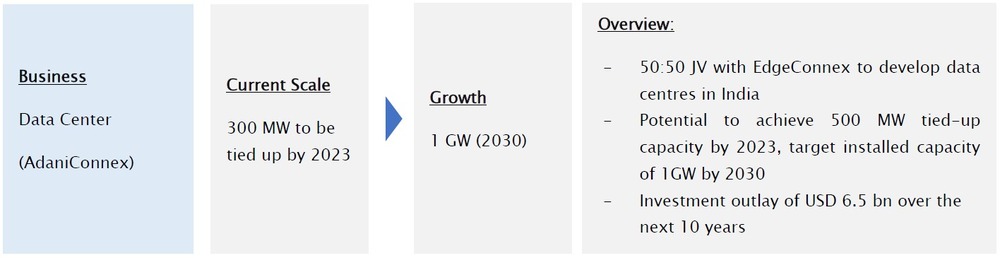

The next generation of its strategic business investments is centred on airport management, roads, data centre and water infrastructure. Following these principles has led to very strong returns for our shareholders. A one-rupee investment in Adani Enterprises, the group’s first IPO in 1994, has returned over 800x.

AEL has a demonstrated track record of creating high-quality sustainable infrastructure businesses since 1994

Source: AEL Business Presentation for Nov’22

Business Verticals

Source: AEL Business Presentation for Nov’22

- Energy & Utility

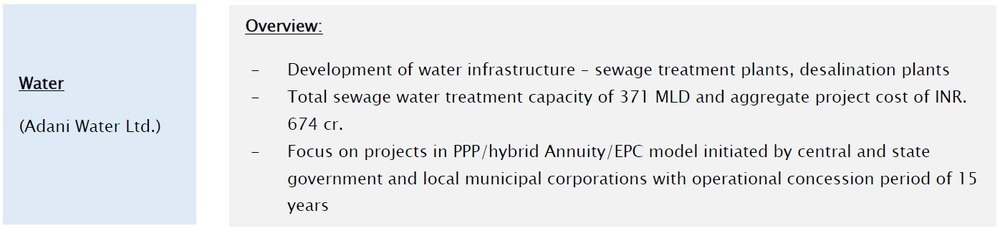

The company is setting up a green hydrogen ecosystem to incubate, build and develop an end-to-end integrated ecosystem to manufacture green hydrogen. They develop data centres to maintain and drive India’s internet-derived data in India & also develop infrastructure projects that improve water treatment and use efficiency. - Transport & Logistics

They manage significant airports in India as part of their airport business. We currently develop, operate and manage seven operational airports across the cities of Mumbai, Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati, Thiruvananthapuram, and one greenfield airport in Navi Mumbai. - Consumer Business

They manufacture, market, and brand food FMCG products. Additionally, they are developing a super-app, “AdaniOne”, as part of their digital business to complement Adani group’s consumer-serving businesses. - Primary Industry

They offer mining services involving contract mining, development, production-related services, and other related services to customers, primarily in the coal and iron ore industries. To cater to the high demand for coal in India, the company offers integrated resource management services for coal which involves access to coal from diverse global pockets and provides just-in-time delivery to Indian customers.

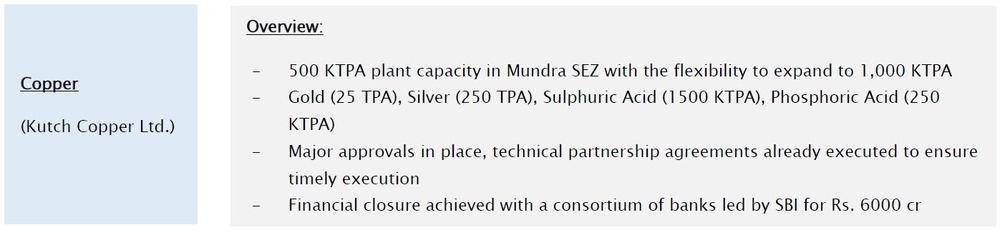

They have also recently acquired commercial mines to conduct commercial mining activities. Under industrials, they intend to manufacture petrochemicals, copper and similar metals and manufacture strategic

military and defence products that enhance India’s self-reliance.

Why is AEL raising the money?

| Particulars |

Amount |

Proposed Deployment of the net proceeds |

Funding capital expenditure requirements of some of their subsidiaries in relation to:

|

10,869 |

Rs.3,335 crores in fiscal 2023 Rs.7,535crores in fiscal 2024 & 2025 |

| Repayment, in whole or part, of certain borrowings of the Company and three of their Subsidiaries, namely, Adani Airport Holding Limited, Adani Road Transport Limited, and Mundra Solar Limited | 4,165 | Rs. 4165 crores in fiscal 2023 |

| General Corporate Purpose | – | – |

| Total | 20,000 | – |

Competitive Strengths

1. Business incubator with a demonstrated track record of incubating sustainable infrastructure businesses in India with a focus on enhancing stakeholder value

It is one of India’s largest listed business incubators in terms of market capitalisation. It represents a good complement of established and developing businesses that address India’s needs.

Since they started the operation, they have smartly expanded their portfolio to cover diversified businesses across multiple industries.

They continue to add new companies to their portfolio to address India’s growing needs, which also have strategic importance and possess a complement of scale, sustainable processes and technological sophistication.

The image below provides an overview of our successful incubations that are now listed on the Indian stock exchanges:

2. Demonstrated track record and expertise in project execution and management

The company has incubated several companies across many verticals in the infrastructure sector and has built a distinctive specialization in project execution, and has successfully executed all projects that they have undertaken since its inception to date. They develop and operate businesses with an aim for these businesses to lead in their respective sectors, offer customers a superior price-value proposition, widen markets, and contribute to the nation’s sustainable development. As a result, their businesses serve existing markets and are built and operated to enlarge markets, enhance lifestyles, further sustainability and foster prosperity.

- Case in point:

- Tapped on the Government of India’s initiative to enter into public-private partnerships (“PPP”) to develop, modernize and operate airports in India, they bid for and acquired rights to build and operate seven airports in India, including one greenfield airport.

- Recognizes the potential of water infrastructure in India early & they bid for and won the mandate to develop the wastewater treatment project at Prayagraj in Uttar Pradesh and Bhagalpur in Bihar under the “Namami Gange, One City OneOperator” framework.

- Tapping the growing potential for green hydrogen in India, they are setting up a fully integrated green hydrogen ecosystem in India.

To supplement their project execution capabilities, they have invested in sustainable technology standards, thereby giving them a sustainable competitive advantage, respect, talent traction and profitability.

Depending on the industry and sector, they form strategic alliances to support the growth of their businesses.

- Case in point:

- Over a two-decade-long joint venture with Wilmar International to form Adani Wilmar Limited, a leading FMCG company.

- Partnered with Total Energies through their subsidiary, Adani New Industries Limited (“ANIL”), for their green hydrogen ecosystem.

- Partnered with EdgeConneX to build a reliable network of data centres in India through their joint venture AdaniConneX Private Limited.

3. Tapping on the growing green hydrogen potential in India to build a fully-integrated green hydrogen ecosystem in India

Tapping on to the potential and further companies and India’s sustainable growth, they are setting up a fully-integrated green hydrogen ecosystem in India under their subsidiary ANIL to incubate, build and develop an end-to-end integrated ecosystem for the manufacture of green hydrogen.

- Their green hydrogen ecosystem covers:

- The manufacture of equipment required for the manufacture of renewable power and green hydrogen,

- The manufacture of green hydrogen and the renewable power required for it.

- The manufacture of downstream products

To further bolster their green hydrogen ecosystem, in 2022, they partnered with TotalEnergies, where they agreed to acquire a 25% minority interest in ANIL.

They also have a solar and wind equipment manufacturing facility at Mundra SEZ. They commissioned India’s largest vertically integrated solar Photovoltaic (“PV”) facility as of September 30, 2022, with the largest market share of 28% in installed capacity for PV cell manufacturing.

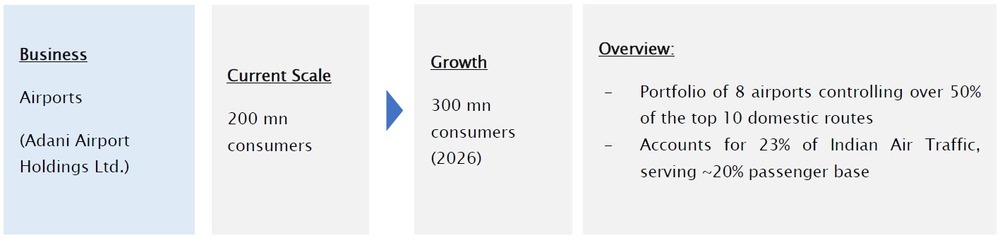

4. Airport assets of national importance are strategically located and are supported by a stable regulatory framework concession term

As of December 31, 2022, companies portfolio comprises seven operational airports and one greenfield airport & has emerged as the largest private operator of airports based on a number of airports.

A stable regulatory framework in India supports their operations. They are subject to price regulation by Airport Economic Regulatory Authority (“AERA”). It involves setting caps every five years on the amount their airports can charge from the airlines using their facilities.

In addition to this favourable regulatory environment, the long-term tenor of our contracts of 50 or more years provides them with an operational advantage and allows them to implement various long-term plans. It also allows lenders to determine financing terms, such as substitution rights, termination payments, and trust and retention accounts.

5. Robust environmental, social, and governance (“ESG”) focus on enhancing value in a responsible way

Companies’ journey of value-creation for all our businesses rests on an integrated approach of considering ESG principles.

- Environmental: The Adani group’s portfolio companies have been set up to build sustainable businesses in line with India’s decarbonisation agenda and have set up a green infrastructure with integrated ports, renewable power generation and sustainable power and gas transmission infrastructure.

- Social: The company has formulated a robust corporate social responsibility (“CSR”) Policy which encompasses its philosophy and guides its sustained efforts for undertaking and supporting socially beneficial programmes for society’s welfare and sustainable development. In Fiscal 2022, we spent ₹15.60 crores on CSR initiatives that span education, community health, sustainable livelihood development and community infrastructure.

- Governance: The company has initiated various corporate governance policies and committees, including its Corporate Responsibility Committee (“CRC”), consisting solely of independent directors tasked with keeping the Board of Directors informed about the ESG performance of businesses.

6. One of the leading global players in integrated resource management

Integrated resource management is one of the core current business activities of the company. They are one of India’s leading imported coal suppliers, with 64.4 MMT of coal volumes sold during Fiscal 2022.

It has a diversified trading portfolio, storage facilities at outbound and inbound ports, and the requisite infrastructure to manage sea-borne and inland multi-modal logistics movement efficiently.

Their competitive advantage is derived from the synergies between Adani group’s various business verticals, including the port terminals on India’s east and west coasts, which provide a robust infrastructure for efficient logistics management.

Its integrated resource management business is not capital intensive, thereby focusing on enhancing the mined throughput for the mine owner. Accordingly, their asset-light operating approach has enhanced our profitability and lowered our risk.

7. Experienced promoters and strong leadership

The company is led by Promoters, Mr Gautam S. Adani and Mr Rajesh S. Adani, supported by able and experienced senior management.

It has an experienced management team with experience across sectors such as mining services, manufacturing, green hydrogen, water management, airports and roads, FMCG and digital offerings, among others.

Their board of directors have a collective experience of over many decades.

Key Opportunities & growth drivers

1. Green Hydrogen

While India does have the opportunity in various industries for carbon capture but has a significant competitive edge in green hydrogen due to the tremendous strides it has made in renewable energy over the past few years. It, combined with capital, land resources, extensive grid system, makes it an ideal candidate to make a quick transition to green hydrogen.

Over the past two years, India has witnessed a slew of announcements by PSUs and private companies in the hydrogen space. The project pipeline calls for 5.5GW of electrolyser capacity installations, with an investment of more than ₹5 trillion crores over the next decade. However, this is significantly lower than the NITI Aayog’s demand estimation of 20GW of electrolysers by 2030. Thus, we expect more announcements in the hydrogen ecosystem in the coming days.

Adani and TotalEnergies have jointly entered a new partnership to create the world’s largest green hydrogen ecosystem. In this strategic alliance, TotalEnergies will acquire a 25% minority interest in ANIL.

2. Airports

India was the fifth largest aviation market based on airline passengers as of 2019. The country is poised to emerge as the third largest by 2025. It is already the third-largest domestic passenger market and is expected to be among the fastest-growing domestic air passenger markets over the next decade (source: IATA). The factors that boost the domestic aviation sector are:

- The country’s population is the second largest and increasing per capita income

- Low air trips per capita than other developing nations

- Improving the aviation ecosystem

- A land mass that is the world’s seventh largest

- The country’s ideal geographical location is between the western and the eastern hemisphere.

- Domestic freight traffic has outgrown international freight traffic between Fiscals 2016 and 2020 with domestic traffic recording a CAGR of 6% and international traffic a modest 5%

- Passenger traffic is expected to rise 70-80% on-year to 320-340 million in Fiscal 2023

3. Data centres

India hosts approximately 164 data centres spread across nine cities. Total installed capacity as of Fiscal 2022 was 550–580 MW and 320-370 MW in Fiscal 2020. With the pandemic-induced challenges, digital transformation became necessary, and the demand for hybrid cloud and colocation models surged. Data usage also increased, creating more need for data storage and transforming the data centre industry to a large and strategically important segment.

India’s data centre industry is expected to add 320-340 MW capacity in the current fiscal. This capacity addition will be due to the growing internet penetration, increase in data consumption, and rising adoption of cloud and big data analytics.

Government initiatives like Digital India and emphasis on data protection and localisation will also play a significant role in the capacity addition. India holds high potential to become the data centre hub in the Asia-Pacific region because of the low power tariff, presence of undersea cable landing stations, and high bandwidth speed.

4. Roads

India has the second largest road network in the world, aggregating 6.4 million km. Roads are the most common mode of transportation and account for about 87% of passenger traffic and close to 63% of freight traffic.

- Industrial and economic development in areas surrounding the national highways and the corresponding increase in economic activity are significant drivers for traffic growth.

- Improved quality of roads would reduce the risk of accidents and enable vehicles to move faster. It would make highways a preferable mode of transport and act as a tailwind for traffic on national highways.

- Four- and six-laning national highways would increase the capacity of Indian roads and reduce congestion, enabling a more significant number of vehicles to use the streets without delay in travelling time.

- Higher surveillance and security on national highways would increase safety and reduce the occurrence of theft. It would improve the acceptability of highways as a mode of transport and encourage more drivers to use the national highways.

- A pick-up in tourism activities in areas in and around the national highways would lead to an increase in the recreational/passenger traffic on national highways

5. Water

In India, water use is broadly used for domestic (household purposes) and industrial usage. The water treatment industry comprises fresh and clean water and managing wastewater for commercial/residential customers and industries.

About 0.13 million MLD of wastewater will be generated in India in the Fiscal 2025. Wastewater can be classified into that generated from sewage and industrial segments. Wastewater treatment includes sewage treatment and effluent treatment.

6. Copper

Domestic copper demand logged a 1.9% CAGR between Fiscals 2017 and 2022. The share of secondary copper has been rising gradually since 2017 owing to better scrap availability and increasing primary copper prices.

Renewable energy as a sub-segment in the overall power segment will significantly determine copper demand over the medium term. Copper is used to making solar modules and electric motors for wind and hydropower generation.

Electric vehicles (“EV”) as a sub-segment of the transport segment will significantly influence copper demand growth over the medium term. Copper usage in EVs increases especially compared with conventional vehicles, as copper is used for batteries, electric motors, inverters and charging infrastructure.

Along with renewable & EV, which are still in the very early stages but other industries such as power, capital goods, consumer durables, building construction etc, also contributed to the overall copper demand, and it is expected to rise in the near future.

Financials

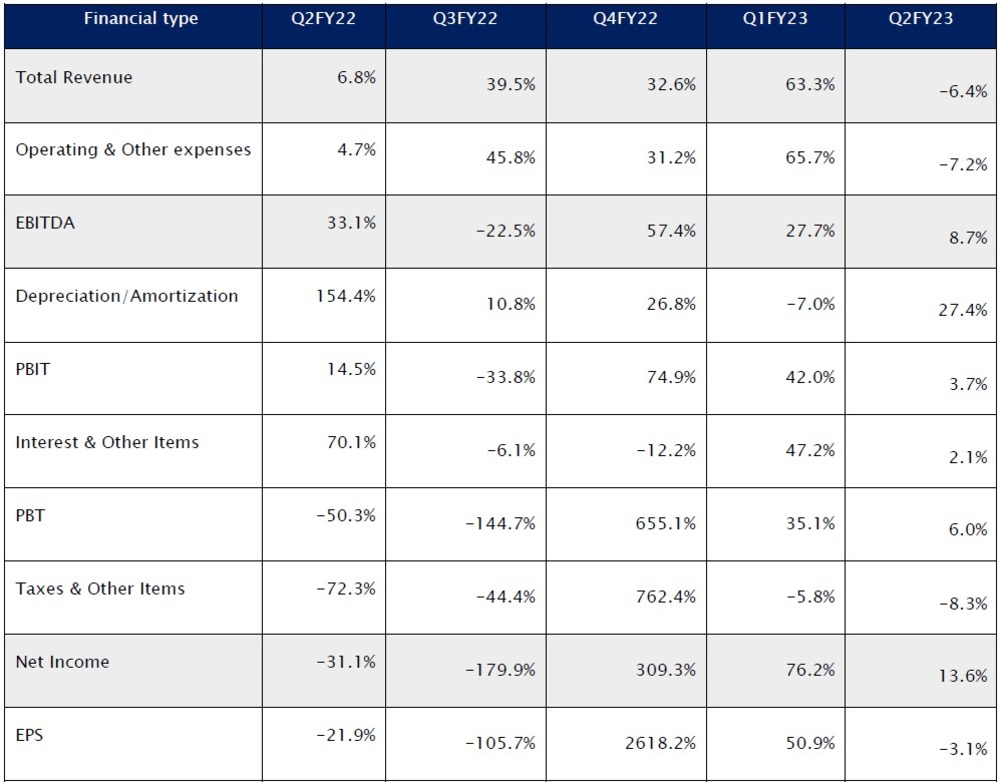

1. Consolidated Income Statement

% Numbers represent a change from last quarter. Source: Company Financials, Fisdom research

- Increasing total revenue: Total revenue for Q2FY23 increased by 182.7% YoY

- Increasing EBITDA: EBITDA for Q2FY23 increased by 69.2% YoY

- Increasing net profit: Net profit for this quarter went up by 234.8% YoY

2. Consolidated balance sheet

% Numbers represent a change from last FY. Source: Company Financials, Fisdom research

Analyst Inferences

Key Strengths

- Business incubator with a demonstrated track record of incubating sustainable infrastructure businesses in India with a focus on enhancing stakeholder value

- Demonstrated track record and expertise in project execution and management

- Tapping on the growing green hydrogen potential in India to build a fully-integrated green hydrogen ecosystem in India

- Diversified business streams

- Robust ESG framework

- Experienced promoters and strong leadership

Key Risks

- High Valuations

- Substantial indebtedness

- Exposed to unsecured loans that the lender may recall at any time

- Limited operating history of the few AEL businesses

- Reliance on concessions and other contracts where the counterparties are central and state government companies.

- Ability to raise foreign capital may be constrained by Indian law

Raising fresh money by issuing fresh equity would reduce the company’s high leverage and increase public shareholding.

Except for the current valuation, the current state of business, growth prospects, and financial strength seems close to reasonable. High-risk investors with a long-term horizon seeking a play into infrastructure, industrials & utilities can use the FPO to invest in AEL.