Crude Prices Continue To Skyrocket; Asset Classes Bear The Brunt

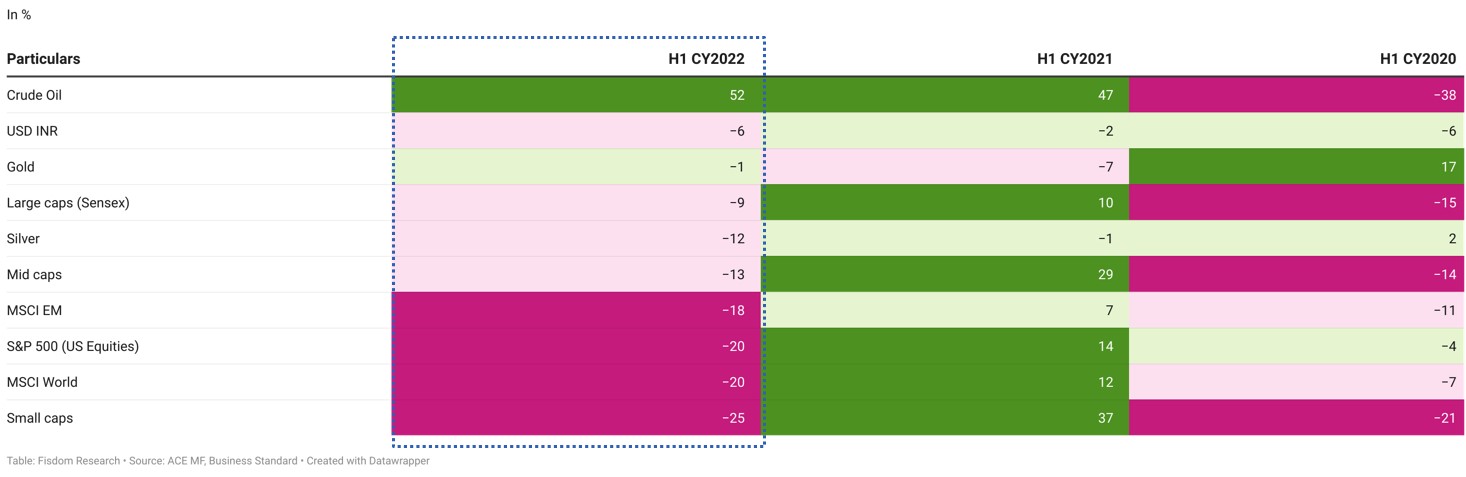

Asset Class Performance: Half Yearly Overview

Key reasons for market downfall:

?Geopolitical Risk

?High Commodity Prices & Inflation

?Widening trade deficit

?FPI Outflows

?Hawkish stance by central banks

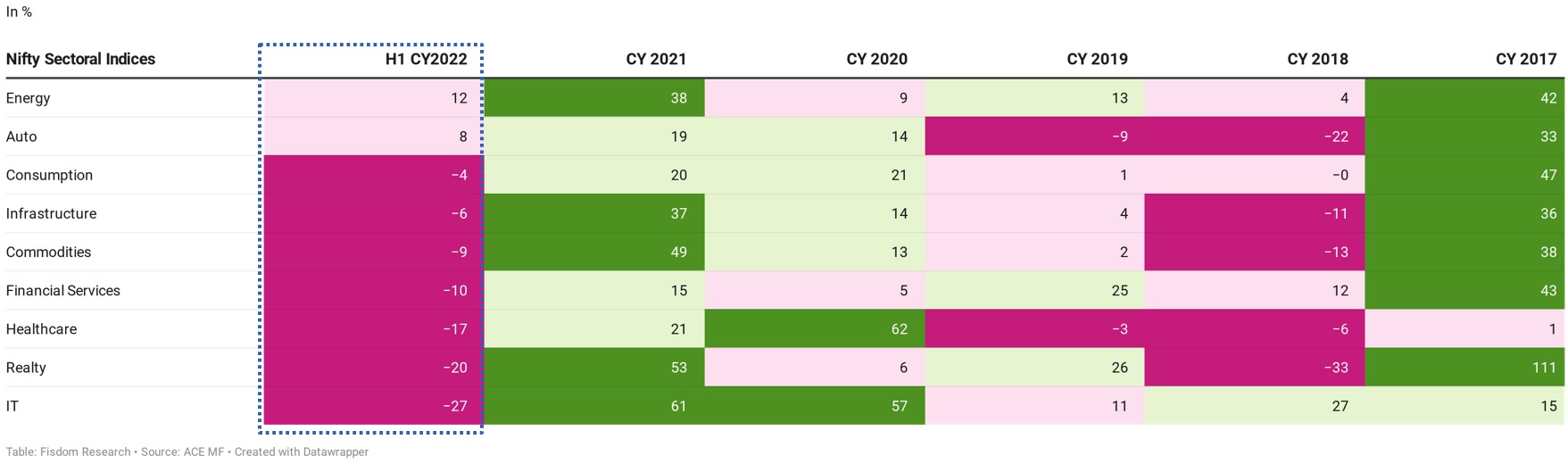

Energy And Auto Scrips Recover As Others Continue To Bear The Brunt Of A Broader Selloff

Sector Performance Details

- As commodity prices rise and aggregate demand resurrects, we are observing margin expansion across energy counters. The same may be underway or potentially depending on the positioning in the energy value chain. Progress on the renewable energy agenda continues to be a large opportunity being factored into the prices of heavyweight energy constituents. Newly announced windfall taxation on refineries and heightened probability of an economic slowdown are key risks to the segment.

- Most other sectors have erased gains earned over the exuberant past year as global macroeconomic challenges bear heavy on investor sentiment and have created a global ‘risk-off’ leading to broad selling across risk assets.

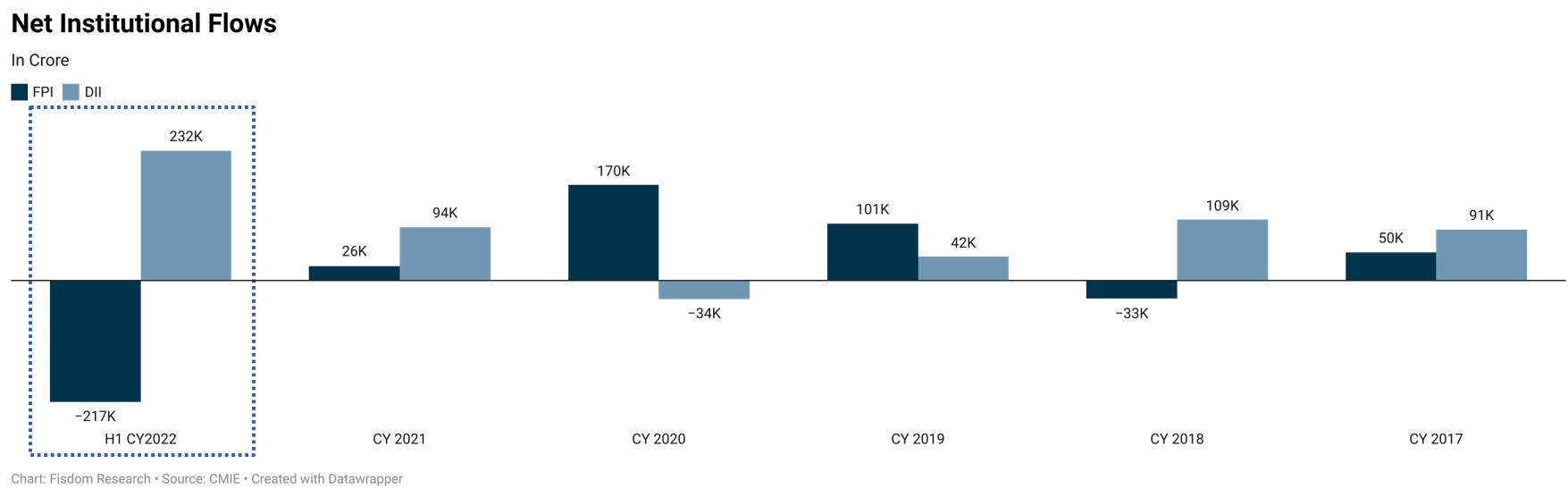

Domestic Investors Capture Every Opportunity Foregone By Foreign Investors Amid Risk-off

- FPI net sales of INR 2.1 Tn have been met with domestic investors’ solid net buying of INR 2.3 Tn.

- FPI outflow has more to do with rebalancing global portfolios, global risk-off environment, and international funds’ re-alignment with mandates. The net outflow of FPIs is barely indicative of any deviation in the Indian economy’s growth narrative.

- The rising flow of DII is a counterbalancing force against Sharpe FPI outflows. Even valuations have rationalized significantly from Oct’21 levels, and the fear of a structural increase in inflation is reducing as global commodity prices decline over the recent past, which should build the confidence of slowing down FPI outflows incrementally.

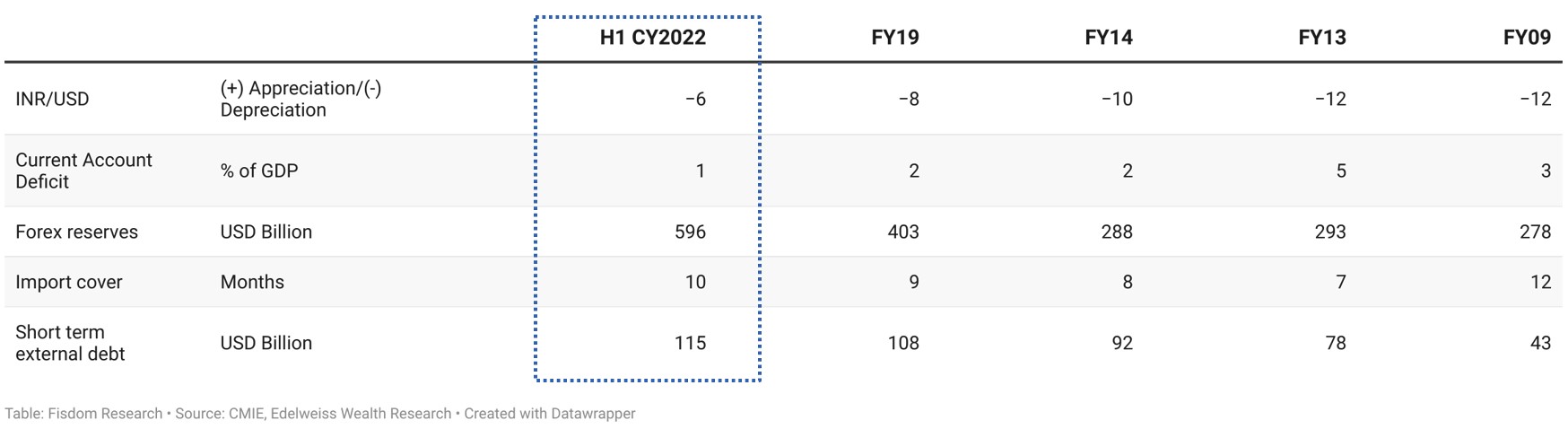

Key Macroeconomic Metrics Support The Indian Economy’s Long-term Growth Narrative

- The current slide in INR’s value seems steep; however, it continues to be relatively resilient versus previous crisis periods. Also, most depreciation in the currency value, while lower than developed economic counterparts, can be attributed to the strengthening of the greenback because of its prominence in capital allocation and global trade during a global risk-off and geopolitical crisis-stricken world economy.

- In line with India’s spectacular run in the past couple of years, attracting foreign capital investments into the primary, secondary and private equity markets, the current forex reserves remain relatively healthy. However, the pace of decline in an attempt to insulate the economy against global macroeconomic headwinds warrants discomfort.

- At 19% of forex reserves, short-term debt obligations are relatively comfortable, especially considering the same in light of economic challenges.