A Closer Look at Valuation Concern

Here’s the rationale behind justifying the current market valuations

Factors driving the market’s premium valuation relative to other nations:

- Robust economic growth compared to other countries. India has the highest real GDP growth at 7.6% among emerging markets.

- A promising outlook for strong corporate earnings.

- Witnessing robust demand across various sectors

- The banking sector exhibits improved stability and resilience.

- Anticipating positive trends in private capital expenditure cycles

- The ruling party’s favourable performance in state elections contributes to market sentiment.

- Strengthening market confidence for political stability, anticipating continuity of macro policies in the 2024 general election.

Investor Actionable

Rather than avoiding the markets, concentrate on active participation through intelligent portfolio strategies.

| Asset Class Views | ||

| Equity | Neutral – Bias Positive | Bottom-up opportunities still exist. Follow 60:20:20 when it comes to large, mid and smallcap allocation. It’s a buy-on-dip market. |

| Debt | Overweight | Follow Barbell Strategy. Overweight on duration play. Reduced fiscal deficit projections, coupled with global bond inclusion and decreased gross borrowing, will likely have a positive impact on the bond market. |

| Gold | Neutral: Bias Positive | Suggested to buy on the dip. Maintain it as a strategic allocation. |

| Real Estate | Negative | Opting for investments through REITs and realty stocks might be the favorable choice. |

| International Equities | Netural | Maintain it as a strategic allocation; avoid going overweight. |

Don’t Avoid Midcap & Smallcaps

While midcaps and smallcaps may be trading at premium valuations compared to large caps, certain focused sectors and stocks within those sectors are exclusively available in the midcap and smallcap segments.

| Industry | Largecap | Midcap | Smallcap |

| Oil & Gas | ✅ | ✅ | ✅ |

| IT Services | ✅ | ✅ | ✅ |

| Banks | ✅ | ✅ | ✅ |

| Insurance | ✅ | ✅ | ❌ |

| Automobile | ✅ | ❌ | ❌ |

| Pharma | ✅ | ✅ | ✅ |

| Construction Materials | ✅ | ✅ | ✅ |

| Passenger Airlines | ✅ | ❌ | ❌ |

| Capital Markets | ❌ | ✅ | ✅ |

| Building Products | ❌ | ✅ | ✅ |

| Machinery | ❌ | ✅ | ✅ |

| Biotechnology | ❌ | ✅ | ❌ |

| Media | ❌ | ✅ | ✅ |

| Entertainment | ❌ | ❌ | ✅ |

| Semiconductor | ❌ | ❌ | ✅ |

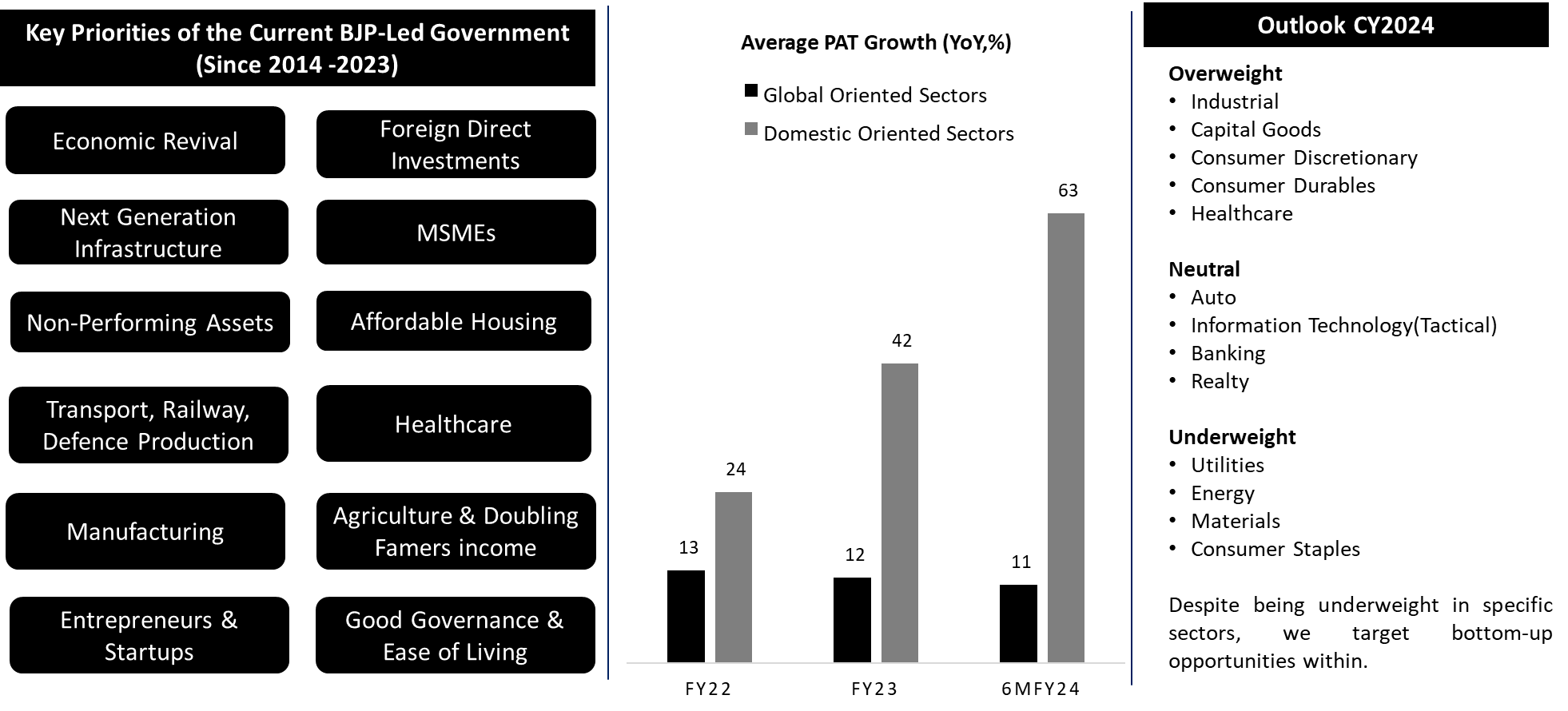

Preferring Domestic Cyclicals

Domestic sectors outpace global counterparts in remarkable growth