Technical Overview – Nifty 50

It is another extremely unexciting market, with little action on either side. The index recovered from the benchmark index’s first 15-minute decline. The index trades above the main DEMA, which may result in a mean reversion down to the 10 and 20 DEMAs. movement was limited to the first hour of the session, with the index consolidating between 23,420 and 23,470 levels for the remainder of the session.

It got some movement in the last minutes of the session, breaking the consolidation and reaching a new all-time high of 23,500. The index remained in extremely tight consolidation over the week. The index has created a Dragonfly Doji candle on the daily timeframe. The index closed above last week’s doji candle high.

On the weekly timeframe, the Momentum Indicator RSI (14) shows a bullish hidden divergence and a double-bottom breakthrough.

Support levels for the following sessions are 23,200 and 22,900, with resistance around 23,600 and 23,750.

Technical Overview – Bank Nifty

The banking index had an extremely uninteresting session. On a daily basis, the index formed a little dragonfly doji candle. On a weekly timeframe, the index has formed a little indecisive candle. It was extremely tough for the index to cross the 50,250 barrier. The index barely managed to close over 50,000.

The index is encountering resistance at a downward sloping trend line on the 75-minute time frame. The index is finding support at the 20-EMA on a 75-minute time period.

The Banking Index is trading in a tight consolidation zone between 49,500 and 50,250. The index must break either side for a one-way momentum either side it breaks.

The support levels for the forthcoming sessions are 49,500 and 48,900, with resistance around 50,250 and 50,500.

Indian markets:

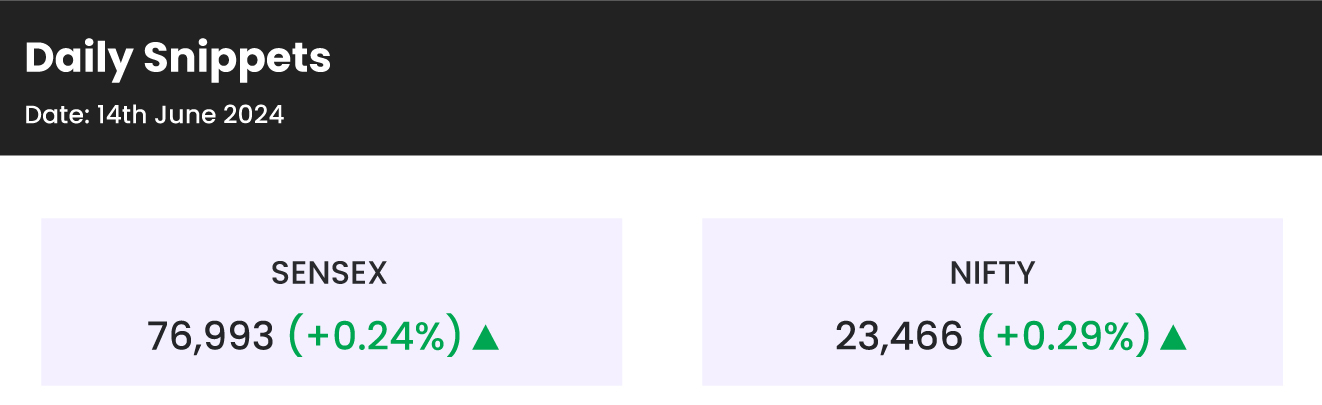

- Domestic benchmark equity indices, Sensex and Nifty 50, ended Friday’s session in the green despite a flat and sluggish start.

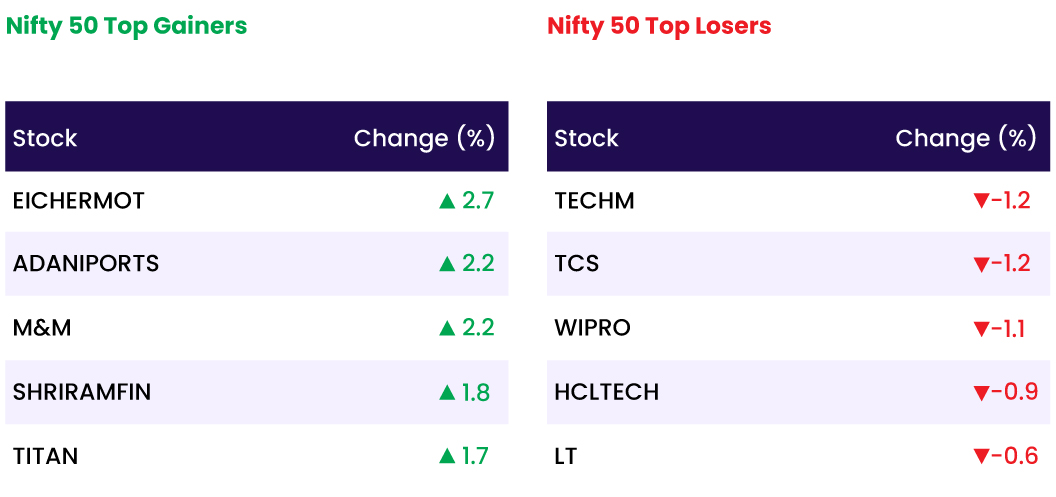

- The major indices were buoyed by the auto and consumer durable sectors, while information technology (IT) firms were the biggest drags due to profit booking.

- On Thursday, IT stocks had risen over 1% amid revived anticipation of a soon-to-be-announced US interest rate cut. In the last 30 minutes of trading, the Nifty 50 touched a record high of 23,481. Among sectors, the Nifty Information Technology index was down nearly 1%, while auto, metal, PSU Bank, and realty sectors saw gains of 0.5-1%.

- The Nifty Midcap and Smallcap indices hit fresh highs during the day, ending with gains of 1% and 0.5%, respectively.

Global Markets:

- Asia-Pacific markets were mixed on Friday after the Bank of Japan (BOJ) kept its benchmark interest rate unchanged but signaled it might reduce its purchases of Japanese government bonds.

- Japan’s Nikkei 225 reversed earlier losses to close 0.24% higher, while the Topix increased by 0.54%.

- South Korea’s Kospi ended 0.13% higher, reaching its highest point in about three months at 2,758.42, but the small-cap Kosdaq fell 1.05%.

- Australia’s S&P/ASX 200 dropped 0.33%. Hong Kong’s Hang Seng index was down 0.48%, while the CSI 300 in mainland China gained 0.44%, rebounding from a near two-month low.

- Overnight in the U.S., the S&P 500 rose, posting a fourth consecutive record close as traders weighed more data indicating that inflation pressures might be easing.

Stocks in Spotlight

- Shares of EIH Associated Hotels, the flagship company of The Oberoi Group, gained approximately 6.5% ahead of the company’s board meeting. The meeting is set to consider and approve the issuance of bonus shares to the company’s equity shareholders.

- Shares of Mahindra & Mahindra rose over 2%, driven by growing optimism and a strong growth outlook for the automotive major. M&M’s market capitalisation briefly surpassed that of Tata Motors, making it India’s second most valuable automobile company as it reached a record high.

- Shares of Adani Ports and Special Economic Zone rose 2% after Kotak Institutional Equities raised its target price on the stock from Rs 1,550 to Rs 1,650 per share. The upgrade reflects the company’s continued outperformance in FYTD24. Despite a weak start to the year for the Indian stock market, Kotak highlighted that Adani Ports has consistently outperformed, with sustainable prospects and potential margin boosts.

News from the IPO world🌐

- Stanley Lifestyles IPO opens on June 21

- Flipkart’s path to profitability will decide IPO timing, says Walmart CFO

- DEE Development IPO Opens June 19

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 1.3 |

| NIFTY MIDSMALL HEALTHCARE | 1.2 |

| NIFTY CONSUMER DURABLES | 1.2 |

| NIFTY REALTY | 0.8 |

| NIFTY METAL | 0.7 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2238 |

| Decline | 1625 |

| Unchanged | 117 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,647 | (0.2) % | 2.5 % |

| 10 Year Gsec India | 7.0 | (0.0) % | (0.3) % |

| WTI Crude (USD/bbl) | 79 | 0.2 % | 11.7 % |

| Gold (INR/10g) | 71,616 | 0.8 % | 4.8 % |

| USD/INR | 83.52 | (0.1) % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer