Government finances are gaining health at a sound pace. Tax collections have been soaring consistently while the trade deficit has been effectively arrested at 20.5% of budget estimates. The GDP expanded by 13.5% in the first quarter of FY23. Though reassuring, the GDP’s absolute numbers are far from the summit we aspire for. While shorter-term debt remains a concern, the external debt situation seems well controlled. Forex reserves are at comfortable levels, but the pace of decline amid a challenging interest rate and currency environment is a definite cause for concern. These ropes need to be tightened a bit.

Broad positivity has been resounding through capital markets as well. After a long nine-month period of disinterest, foreign portfolio investors turned net buyers of Indian equities for the first time in July’22. In August 2022, the investments hit a new high for the first time since December’20. However, the waning robustness of DII participation in the same period spared broader markets of the exuberance that could ensue. Probably a breather for domestic institutions that remained resilient through the FPI slump.

The Indian economy and capital markets are at the thrilling crossroad of bewilderment and excitement. The knapsacks are full, ropes tightened but there is so much to figure before the expedition begins. A long but scenic journey to the summit awaits Indian investors. But today is when everyone rounds up at the base camp.

There is so much that has happened and so much more that we anticipate. All of this, is effectively captured in Fisdom Research’s latest edition of its monthly outlook on the Indian economy and capital markets – CapView. This month, the report is titled – “Base Camp”. You may have already caught onto the reason, but there is so much more. Read on to know more.

Government finances are on track; it arrests fiscal deficit at 20.5 per cent of BE till July 2022

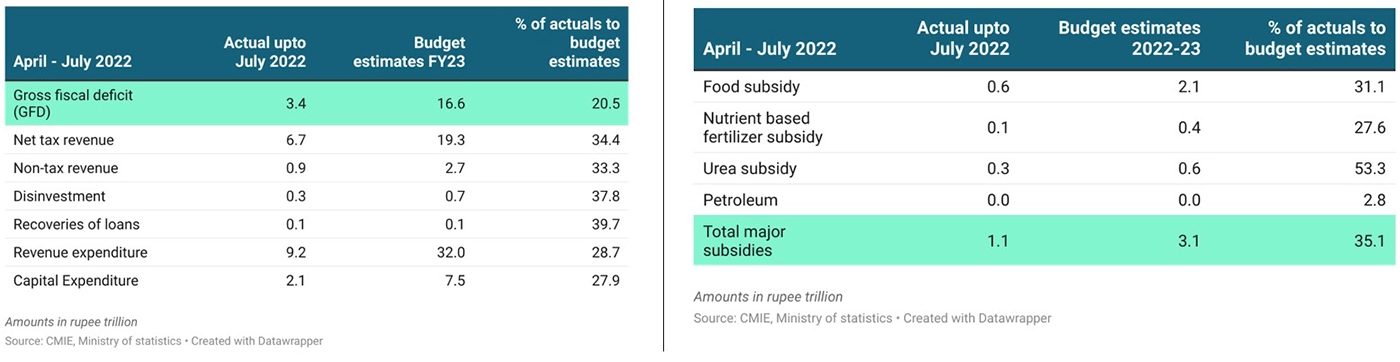

- Central Government arrested its gross fiscal deficit (GFD) at 20.5 per cent of the annual budgeted target during the first four months of 2022-23. At the same time last year, the government had exhausted 21.3 per cent of its annual deficit target. In absolute terms, the deficit from April-July 2022 amounted to Rs.3.4 trillion, higher than the last year’s Rs.3.2 trillion.

- Government expenditure increased by 12.2 per cent year to Rs.11.3 trillion from April-July 2022. Revenue expenditure rose by 4.8 per cent to Rs.9.2 trillion, and capital expenditure rose by 62.5 per cent to Rs.2.1 trillion.

- On the revenue side, net tax collections rose by 25.9 per cent to Rs.6.7 trillion from April-July 2022. Non-tax revenue receipts declined by 36 per cent to Rs.895.8 billion, while non-debt capital receipts, mainly comprised of disinvestment proceeds, increased by 112.9 per cent to Rs.301.2 billion

- The Central Government’s first quarter performance shows that it is well on track to spend the entire budgeted expenditure for 2022-23 without deviating from its fiscal target. Still, We expect its budgetary deficit to rise once the government begins clearing its subsidy dues. The excess net tax revenue of Rs.1.1 trillion will not be able to fully cover the Rs.400 billion shortfalls in non-tax revenue and the additional subsidy liability of Rs.1.25 trillion. The fiscal deficit during 2022-23 will likely amount to Rs.17.4 trillion, nearly Rs.800 billion more than the budget estimate.

GDP grows by 13.5 per cent YoY in Q1FY23; still, a long way to go to recover from the pre-pandemic levels

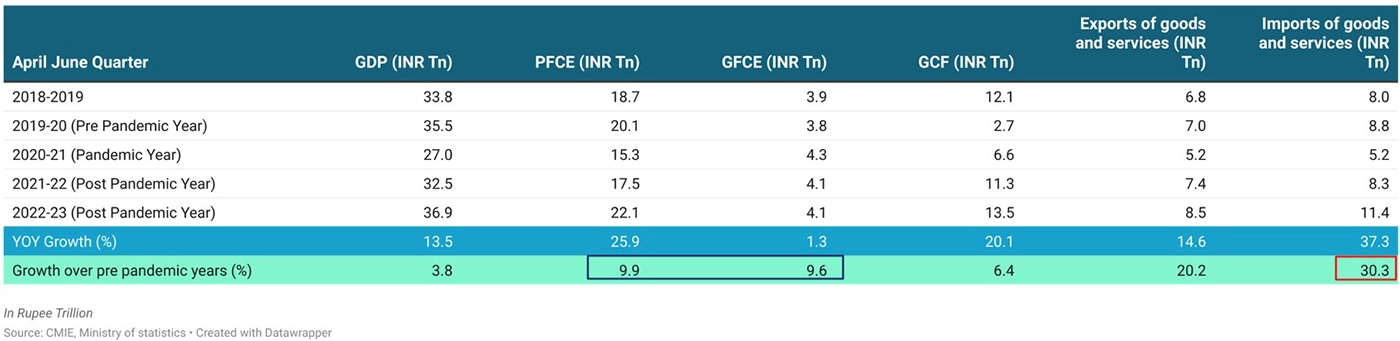

- India’s gross domestic product (GDP) grew by 13.5 per cent in the first quarter of 2022-23 compared to the year-ago level. It is well below the RBI’s estimate of 16.2 per cent. The uptick in YoY growth was mainly because of the low base of FY22 & increase in demand post-pandemic as the economy re-opened.

- Private final consumption expenditure(PFCE), the single most significant component of India’s GDP, grew by 9.9 per cent during the June 2022 quarter. The rise in the consumption to GDP ratio is a big positive as it reflects the revival of the consumption demand. Gross fixed capital formation (GFCF), an indicator of investment demand, increased by 20.2 per cent. The investment to GDP ratio rose to the highest since the pre-pandemic period, all thanks to the heavy capital expenditure done by the government. Imports grew at a faster clip of 30.3 per cent than exports which grew by 20.2 per cent in the June 2022 quarter. Consequently, the trade deficit widened to 8.1 per cent of GDP during April-June 2022 as against a little below three per cent of GDP in the same quarter a year ago.

- Reading the national accounts data for the quarter that ended June 2022, three broad messages seem to emerge:

- Investment growth is improving, and an increase in capacity utilisation data & Capex may add more fuel for investments in the future.

- The export growth may moderate as external demand starts losing momentum in June.

- Consumption is picking up, but the recovery is uneven

- The GDP growth may take a backseat in Q2FY23 as the base effect goes out of the picture. On the MPC front, We can also expect a little less aggressive rate hikes than we have seen in the earlier two meetings, as the growth is far from the RBI’s estimate.

GVA grew by 12.7 per cent YoY due to a favourable base effect

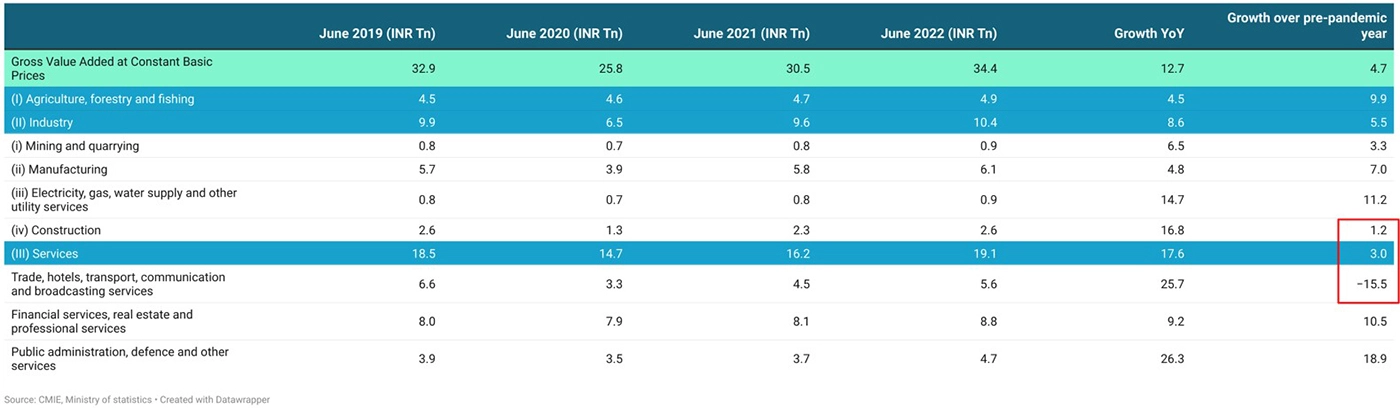

- In absolute terms, India’s gross value added (GVA) grew by 12.7 per cent from April-June 2022 compared to the same period a year ago. It is the steepest growth recorded in the last four quarters, majorly driven by the low base effect. The services sectors led the growth.

- The agricultural sector continued with its good performance, clocking a 4.5 per cent rise in real GVA on top of a 2.2 per cent growth reported in the June 2021 quarter. GVA of the manufacturing sector grew year-on-year by 4.8 per cent and that of mining by 6.5 per cent. Construction and utilities reported a steeper growth in GVA of the order of 16.8 per cent and 14.7 per cent, respectively.

- Value addition by trade, hotels, transport & communication services grew by 25.7 per cent. The growth was because of the favourable base effect. After the pandemic, the sector got a good boost, but the change is still far away from its pre-pandemic numbers. Public administration and defence’s GVA grew by 26.3 per cent, while financial, real estate & professional services reported a 9.2 per cent increase in GVA during the June 2022 quarter.

- Reading the national accounts data for the quarter that ended June 2022, two broad messages seem to emerge:

- Slowdown in services, mainly in trade, hotel & transport, may push RBI to continue with its monetary tightening to control the inflation

- All other segments showed an improvement from their pre-pandemic growth