In the midst of various challenges, including geopolitical tensions such as the Israel-Hamas conflict, investors are eagerly anticipating a breath of fresh air as the official start of the second-quarter earnings reporting season kicks off this week. Market participants are optimistic, hoping that companies will deliver strong results, injecting a optimistic dose of positivity into the capital markets. Here’s a brief summary of previous quarter | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

|

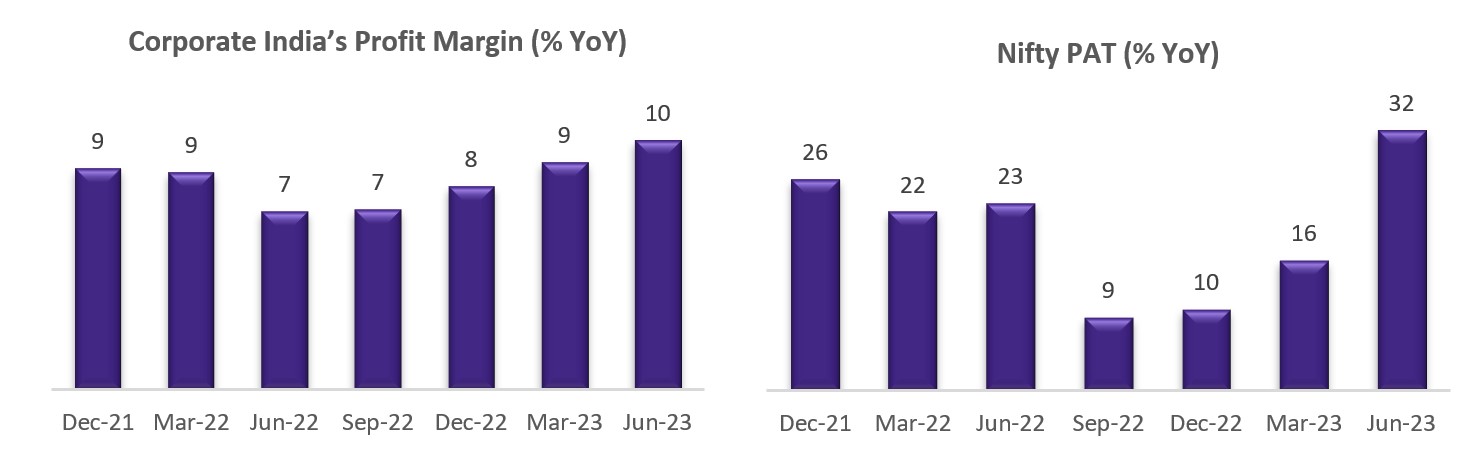

Source: CMIE, Fisdom Research Corporate earnings for the first quarter of FY24 have displayed resilience, painting a favourable picture of India’s economic prospects. The alleviation of input cost pressures underpinned net solid profit performance. Notably, margin expansion was driven by key sectors, including refining, oil exploration, automobiles (four-wheelers), capital goods, and BFSI, while sectors like metals, chemicals, cement, and IT services faced profitability challenges. It’s worth mentioning that Nifty 50 also achieved its highest earnings growth in the past eight quarters, with domestic cyclical sectors like BFSI playing a pivotal role in driving this growth. Lets have a look at earnings expectation for Q2FY24 key sectors which are expected to hit or give a miss this earnings season: | ||||||||||||||||||||||||||

BFSI: Neutral In July-September quarter (Q2), the Indian banking sector is anticipated to demonstrate significant year-on-year (YoY) earnings growth, with private banks expected to achieve higher growth and public sector banks (PSU banks) likely to post a 20% YoY increase. Despite this growth, there might be a slight compression in net interest margin (NIM) due to the upward repricing of deposits and the implementation of the Internal Capital Adequacy Assessment Process (ICAAP). Apart from the financial figures, investors and analysts will closely scrutinize management commentaries on various aspects. Focus areas include unsecured loan growth and margins, trends in deposits and operating expenses (opex), traction in fee income, and the outlook for the treasury. Strong loan growth is anticipated for the quarter, but most banks are expected to experience a NIM compression due to deposit repricing and the Internal Capital Adequacy Assessment Process (ICAAP). | ||||||||||||||||||||||||||

Automobiles: Hit In the quarter ending September 2023, the automobile industry is poised for robust revenue growth and improved margins. This growth is primarily attributed to favorable factors such as strong realization, operational efficiency for select Original Equipment Manufacturers (OEMs), and stable commodity prices. The industry is benefiting from benign commodity costs, which are expected to bolster margins further. Looking ahead, the upcoming festive season stands as a crucial catalyst for the automobile sector. Early signs from regional festive periods have displayed positive momentum, heightening expectations for the major one-month festive period starting from mid-October. OEMs have proactively increased their inventory, anticipating significant growth. The key challenge lies in ensuring strong retail performance during this period, which is essential for preventing an excess inventory backlog post the festive season. | ||||||||||||||||||||||||||

IT Sector: Miss The latest quarterly results from key players in the IT sector, including Tata Consultancy Services Ltd, Infosys Ltd, and HCL Technologies Ltd, suggest a potentially turbulent ride in the second half of the financial year, with limited expectations for FY24. TCS experienced tepid revenue growth, missing market expectations, while Infosys and HCL Technologies’ cuts in revenue growth guidance have disappointed investors. Despite these challenges, there is a glimmer of hope in the form of robust deal wins, particularly highlighted by Infosys Ltd, which secured impressive deals totaling $7.7 billion in the past quarter. This surge in deal wins, coupled with a strong order book, is encouraging for the sector. Despite the persistently challenging macroeconomic environment and obstacles posed by reduced discretionary spending, these substantial deal wins are significant. Although short-term growth prospects might appear subdued for the second half of the year, the current trend of strong deal wins indicates the potential for robust growth expectations in FY25. | ||||||||||||||||||||||||||

Oil & Gas: Hit In the second quarter of the current fiscal year (Q2FY24), earnings for oil marketing companies (OMCs) are anticipated to moderate slightly from the record highs achieved in the previous quarter. This moderation is attributed to the significant impact of higher international crude prices on the marketing segment earnings. Despite this, Q2 results are expected to remain robust, supported by a sharp rise in gross refinery margins (GRMs) and substantial inventory gains. The surge in crude oil prices, soaring as high as 30% over the three-month period from July to September, has been influenced by production cuts announced by major oil-producing nations such as Saudi Arabia and Russia. This reduction in global crude supply has further contributed to the overall positive outlook for OMC earnings in the upcoming quarter. | ||||||||||||||||||||||||||

Outlook: The earnings season is marked by a blend of optimism and caution as the nation navigates through a complex web of challenges and opportunities. However, amid these sector-specific insights, it is crucial to recognize that India’s economic revival is not solely dependent on these individual sectors. A holistic approach, harmonizing government spending, consumer activities, and private investments, is vital. The ongoing momentum propelled by government initiatives must be complemented by sustained consumer confidence and increased private sector participation. Sectors such as Auto, Cement, Capital Goods, FMCG, NBFC, and Healthcare are poised to report robust earnings growth. Their upward trajectory is not just a result of internal efforts but also benefits from a favorable external environment marked by falling raw material prices and improved operating leverage. Contrastingly, certain sectors face a more challenging terrain. Consumer Discretionary, defence, and Largecap IT sectors are expected to see single-digit earnings growth, indicating a need for strategic recalibration. | ||||||||||||||||||||||||||

Markets this week

| ||||||||||||||||||||||||||

Source: BSE and NSE

| ||||||||||||||||||||||||||

|

Weekly Leader Board

Source: BSE | ||||||||||||||||||||||||||

Stocks that made the news this week:

| ||||||||||||||||||||||||||

|

Please visit www.fisdom.com for a standard disclaimer. |