As we celebrate Dussehra, it’s a great time to reflect on the strength and resilience of India’s economy. With robust GDP growth, rising consumption, and strong domestic demand, India is well-positioned for long-term prosperity.

Global investments are pouring in, further strengthening our growth prospects. In this context, we bring you our top stock picks that are aligned with India’s bright future, ready to make the most of this growth trajectory.

Update: Dussehra Picks 2023 (Last Year)

| Company Name | Purchase Price | Target Price | All Time High | Status |

| Maruti Suzuki Ltd. | 10,716 | 12,300 | 13,676 | Target Achieved |

| Balkrishna Industries Ltd. | 2,531 | 2,900 | 3,377 | Target Achieved |

Dussehra Stock Picks 2024

| Company Name | Purchase Price | Target Price | Potential Upside |

| Vedanta Ltd. | 496 | 590 | 19% |

| Polycab India Ltd. | 7,396 | 8,400 | 14% |

1. Vedanta Ltd.: Riding on volume and cost leadership

Vedanta is strategically positioned to capitalize on multiple growth levers. Its aluminum and zinc segments remain the key drivers of future earnings, with significant capacity expansions and cost optimizations. The company’s focus on backward integration—particularly in securing bauxite and coal—sets it up for operational efficiency, while growth in value-added products is expected to enhance profitability.

Moreover, Vedanta’s ongoing efforts in the Oil & Gas and Steel segments, coupled with deleveraging strategies, create a robust outlook for earnings growth in the medium term.

Key Highlights:

Aluminum Segment: Vedanta’s aluminum business is seeing substantial growth, with a focus on expanding capacity and reducing costs. The production target of 3 MTPA by FY26 and cost reduction to USD 1,000 per ton will enhance profitability.

Zinc Division: The Zinc business is poised for volume growth with a strong pipeline of expansion projects. The ramp-up in India and international operations ensures a firm growth trajectory.

Debt Reduction and Cash Flow: Vedanta’s commitment to deleverage USD 3 billion in debt over the next three years, alongside a sustained dividend yield of 5-6%, underlines its strong financial positioning.

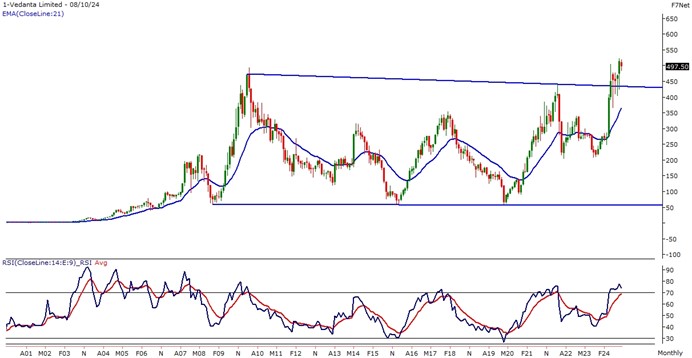

Technical Setup

Breakout and Strengthening Trend: VEDL has recently broken above the 450 level, with a multiyear trendline breakout on the monthly chart, indicating a strengthening trend.

Bullish RSI and Moving Averages Support: The RSI (14) has shifted into a bullish range, crossing above 70, signaling a potential bullish crossover, while moving averages provide strong support for the stock’s upward movement.

Support and Upside Targets: The stock has downside protection in the 430-415 range and has the potential to reach new highs at 550 and 590, offering an optimistic future outlook.

2. Polycab India Ltd.: Powering India’s Infrastructure and Real Estate Boom

Polycab continues to lead the wires and cables industry with its strong market share and expanding footprint. Leveraging robust domestic demand, driven by large-scale infrastructure projects, real estate growth, and digitalization, Polycab is well-positioned for sustained growth across its core and emerging segments.

Polycab’s strategic initiatives, from capacity expansion to global diversification, coupled with strong financials, make it a solid player to capitalize on India’s infrastructure and industrial growth, ensuring sustained profitability and long-term shareholder value.

Key Highlights:

Dominance in Wires & Cables: Polycab holds around 25-26% market share in the organized domestic wires and cables market, benefiting from premium pricing and industry consolidation. With a strong Pan-India distribution network, the company is set to outperform industry growth in the coming years.

Project LEAP Success: Polycab is ahead of its Project LEAP targets, aiming to achieve ₹20,000 crore in revenue by FY26. The company’s focus on product innovation and operational excellence ensures it will continue leading in the cables and wires segment.

International Expansion: With a focus on global markets, Polycab is transitioning its export strategy, particularly in the US, to a distribution-led model. This shift is expected to significantly boost international revenues, contributing to its long-term growth.

Turnaround in FMEG Segment: The FMEG division is seeing a strong demand recovery, particularly in switches and other electrical products, driven by improved product mix and market conditions. Management expects margins in this segment to improve further.

Technical Setup

Breakout and Continuation of Uptrend: The stock recently experienced a breakout from a triangle pattern on the weekly chart, supported by a surge in trading volumes, suggesting an extension of the prior uptrend after a brief consolidation phase.

Bullish RSI and Indicators: The RSI (14) has broken out of its own triangle pattern and is near the 60 level, indicating a bullish crossover. Various indicators and oscillators are reinforcing a “buy-on-dips” opportunity, consistently holding above key polarity levels.

Support and Upside Targets: The stock has a strong support range between 6550 and 6400, offering downside protection. It also presents upside potential with targets in the 8000-8400 range, based on the breakout and anticipated upward continuation.

Disclosure / Disclaimer:

This document is not for public distribution and is meant solely for the personal information of the authorized recipient. No part of the information must be altered, transmitted, copied, distributed, or reproduced in any form to any other person. Persons into whose possession this document may come are required to observe these restrictions. This document is for general information purposes only and does not constitute investment advice or an offer to sell or solicitation of an offer to buy/sell any security and is not intended for distribution in countries where distribution of such material is subject to licensing, registration, or other legal requirements.

The information, opinions, and views contained in this document are as per prevailing conditions and are of the date appearing in this material only and are subject to change. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. Neither Finwizard Technology Private Limited (“Fisdom”), its group companies, its directors, associates, employees, nor any person connected with it accepts any liability or loss arising from the use of this document. The views and opinions expressed herein are based solely on the past performance of the schemes and/or securities and do not necessarily reflect the views of Fisdom. Past performance is no guarantee and does not indicate or guide future performance. The information set out herein may be subject to updating, completion, revision, verification, and amendment, and such information may change materially.

Investing in securities markets involves risks, including the potential loss of principal amount in part or in full. The recommendations are based on the past performance of schemes and/or securities, which is not necessarily indicative of future performance. The recommendations do not guarantee future results, and the value of the invested principal amount and investment returns may fluctuate over time. Therefore, it is essential to review your investment objectives, risk tolerance, and liquidity needs before making any investment decisions. While the information and data contained in this document have been obtained from sources believed to be reliable, Fisdom does not guarantee its accuracy, adequacy, completeness, timeliness, reliability, or availability of any information provided in this document. Fisdom is not responsible for any errors or omissions, regardless of the cause, or for the results obtained from the use of information contained in this document. Fisdom accepts no liability for any losses or damages arising directly or indirectly (including special, incidental, or consequential losses or damages) from the use or reliance placed on any information or data contained in this document, including, without limitation, any lost profits, trading losses, or damages resulting from any errors, omissions, interruptions, deletions, or defects in any manner contained herein.

Readers/Investors should be aware that this document may not be suitable for all types of investors. Investors should independently evaluate any investment or strategy discussed herein. Any decision(s) based on the information contained in this report shall be the sole responsibility of the Reader/Investor.

Fisdom is a SEBI Registered Investment Advisor (RIA) [Registration No: INA200005323] and Research Entity [Registration No: INH000010238]. This document is prepared and distributed in accordance with the SEBI (Investment Advisers) Regulations, 2013, and other relevant regulations. Please read all relevant offer documents, risk disclosure documents, and terms and conditions related to the services provided by Fisdom before making any investment decision. For more details, please visit our official websites at www.fisdom.com and www.Finity.in.