Short-Term Yields Outpace Long-Term

Source: CMIE, Fisdom Research

Context:

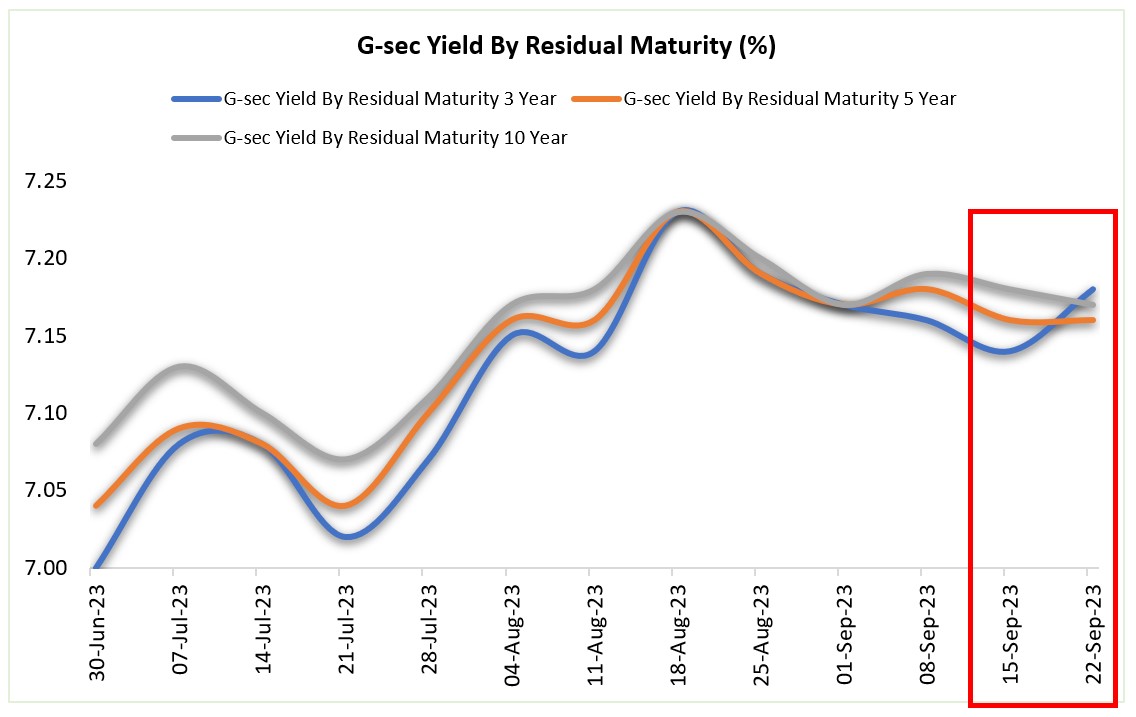

Shorter-term Government of India dated securities (g-secs) responded positively to the rising US yields, while longer-term securities remained relatively stable. Weighted average yields for 1-year and 3-year residual maturity g-secs increased by six and four basis points, reaching 7.14 percent and 7.18 percent. In contrast, 5-year g-secs maintained stability at 7.16 percent, and 10-year g-secs saw a one basis point decline to 7.17 percent.

This marked the first instance in 24 weeks where 3-year g-secs carried higher yields than their 10-year counterparts.

But. Why does yield inversion happen?

Yield inversion occurs when people who invest in bonds believe there will be uncertain times ahead, especially in the near to medium future. So, they decide to put their money into long-term bonds that are considered safer. As a result, they sell off their short and medium-term bonds, causing their prices to drop, and when bond prices drop, the interest rates they pay, known as yields, go up.

On the flip side, more people buying long-term bonds cause their prices to go up, and when bond prices go up, the yields they pay out go down. So, in a yield inversion, short and medium-term bond yields rise while long-term bond yields fall because investors are seeking safety in the long term.

Now that we’ve recognized the possibility of short-term yields increasing because of uncertainty expectations let’s explore those global and domestic uncertainties currently affecting these yields.

- Federal Reserve Meeting and Market Response

On September 21, 10-year US treasury bond yields surged to a 16-year high of 4.49 percent, marking their highest level since November 2007. Simultaneously, two-year bond yields, more sensitive to interest rate changes, reached 5.20 percent—their highest point since July 2006.

The Federal Reserve’s hawkish stance at its recent meeting, with rates maintained at a 22-year high, directly impacts both short-term and long-term yields. This decision sets the tone for the entire yield curve and plays a crucial role in shaping the financial landscape.

The surge in US treasury bond yields, especially in short-term and two-year bonds, directly affects global bond markets, including India. It impacts the relative attractiveness of Indian bonds and, by extension, affects short-term and long-term yields.

- FPI Outflows

Between September 18 and 21, FPIs/FIIs engaged in net selling activities, withdrawing a total of USD 800.2 million. They divested USD 684.6 million in the equity segment from the Indian capital market. They removed USD 142.2 million from the debt market, while the hybrid segment saw a withdrawal of USD 9.3 million. Interestingly, the debt VRR segment experienced a reversal, as FPIs/FIIs became net buyers, injecting USD 35.9 million into the Indian capital market.

Foreign investors’ activities in the Indian market are closely tied to the yield environment. Their exit from equities and reallocation of funds impact short-term and long-term yields and overall market dynamics.

- Escalating Crude Oil Prices

Crude oil prices in India continued their upward trajectory, averaging USD 94.7 per barrel throughout the week—an increase of 1.27 percent from the previous week. On September 19, oil prices even briefly touched USD 95.6 per barrel. This surge was driven by production cuts and export bans imposed by various OPEC+ nations, which exerted upward pressure on oil prices. The extension of these restrictions suggests that crude oil prices are unlikely to witness any significant relief soon.

This expected surge in crude oil prices may not only affect inflation expectations but also have a direct bearing on the government’s borrowing costs. Rising inflation and its potential impact on interest rates are integral aspects of the yield curve, especially in the short term.

- Indian Rupee’s Depreciation and the Resilience of the US Dollar Index

During the past week, the Indian Rupee (INR) witnessed a devaluation of 0.20 per cent against the US Dollar, settling at Rs.83.14 per USD. On an extraordinary note, the INR touched an unprecedented low of Rs.83.26 per USD on September 20. Notably, the unwaveringly hawkish stance adopted by the US Federal Reserve strengthened the US Dollar Index, marking an approximate 0.20 percent increase in the two days following the meeting. The US Dollar Index concluded the week at 105.26 on September 22. Interestingly, despite the US Dollar’s resurgence and the Fed’s cautious tone, the INR displayed remarkable resilience during this brief two-day period.

- Liquidity Deficit

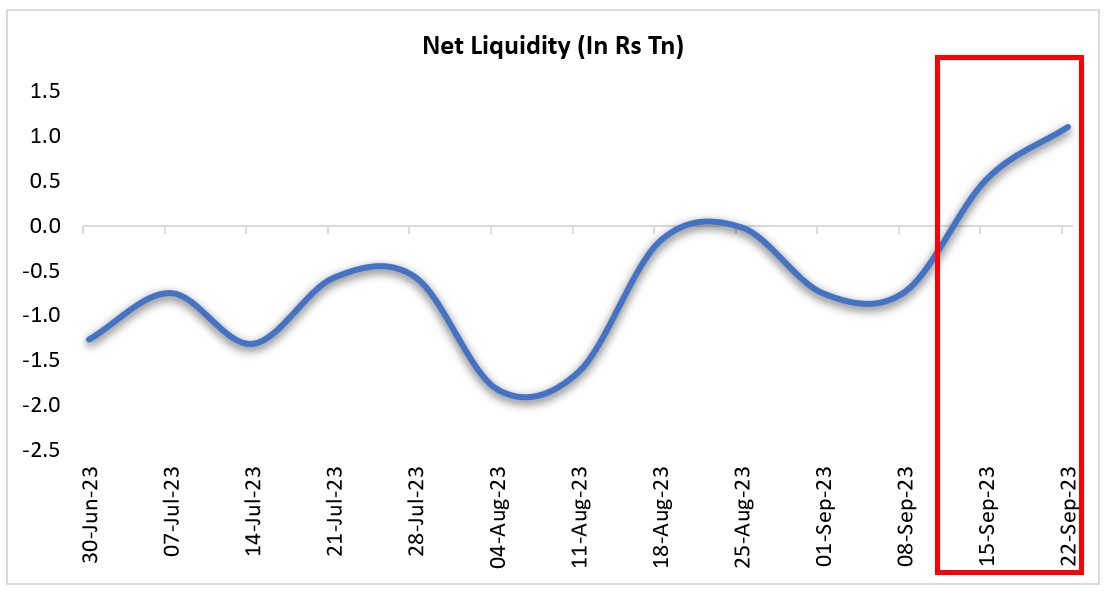

In the past few weeks, the overall liquidity situation has consistently remained in a deficit. This deficit can be attributed to a combination of factors. Firstly, the Reserve Bank of India (RBI) has been conducting variable rate reverse repo auctions, essentially acting to absorb liquidity from the banking system, thus contributing to the liquidity shortage. Additionally, the influx of advance taxes and Goods and Services Tax (GST) flows has further exacerbated the deficit. Lastly, the RBI’s likely involvement in selling dollars to counteract the weakening of the Indian Rupee has also played a role in tightening the liquidity situation. While the current liquidity shortage is a short-term issue, there is an expectation that the situation will improve. This optimism is based on the anticipation of healthy government spending and the redemption of a significant amount of government securities, amounting to several trillion rupees. These factors will help alleviate the current tightness.

Source: CMIE, Fisdom Research. (+) Deficit & (-) Surplus

Impact on Debt Mutual funds

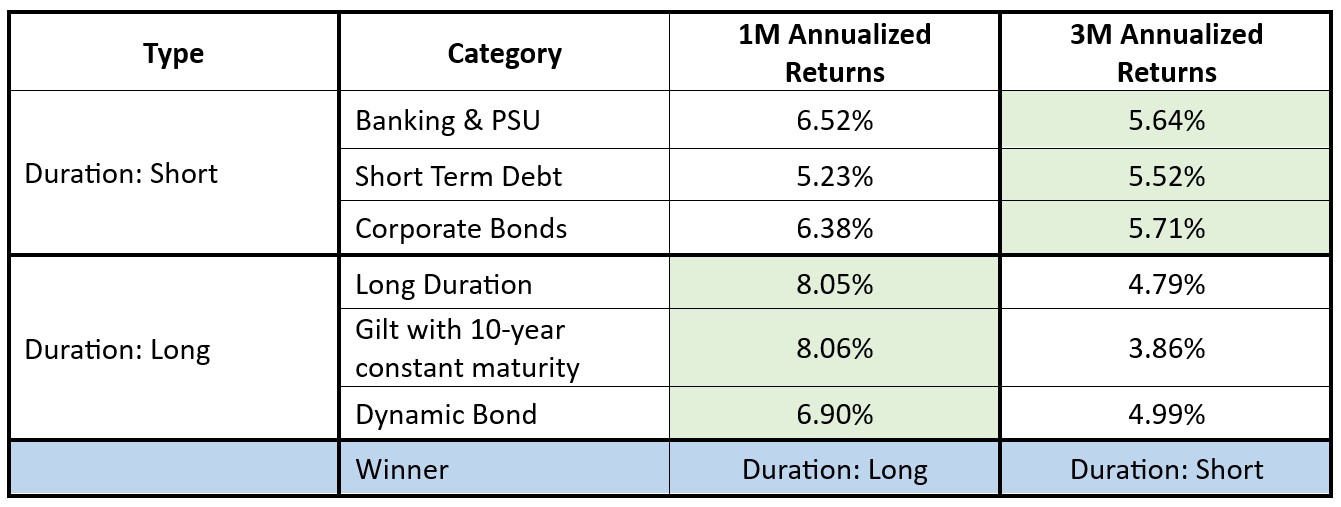

Long-duration categories have outperformed short-term categories due to increased demand for longer-dated securities compared to shorter ones. Now, let’s examine the performance of various categories:

Source: ACE MF, Fisdom Research. Data as of 25th September 2023. Category averages have been considered.

The debt market has experienced intermittent volatility, resulting in a changing landscape of winners over the past few months. If market participants await clear signals and direction, both from domestic and global factors, it is likely that this trend of shifting winners will persist.

Outlook

Given the current macroeconomic conditions and the fragile global environment, it is unlikely that the Reserve Bank of India (RBI) will consider reversing interest rates, at least for the fiscal year 2023-24. The central bank may contemplate such a move in the subsequent fiscal year, depending on the evolving macroeconomic environment.

It’s anticipated that intermittent volatility may persist for some time into the fiscal year 2023-24 (FY24).