Technical Overview – Nifty 50

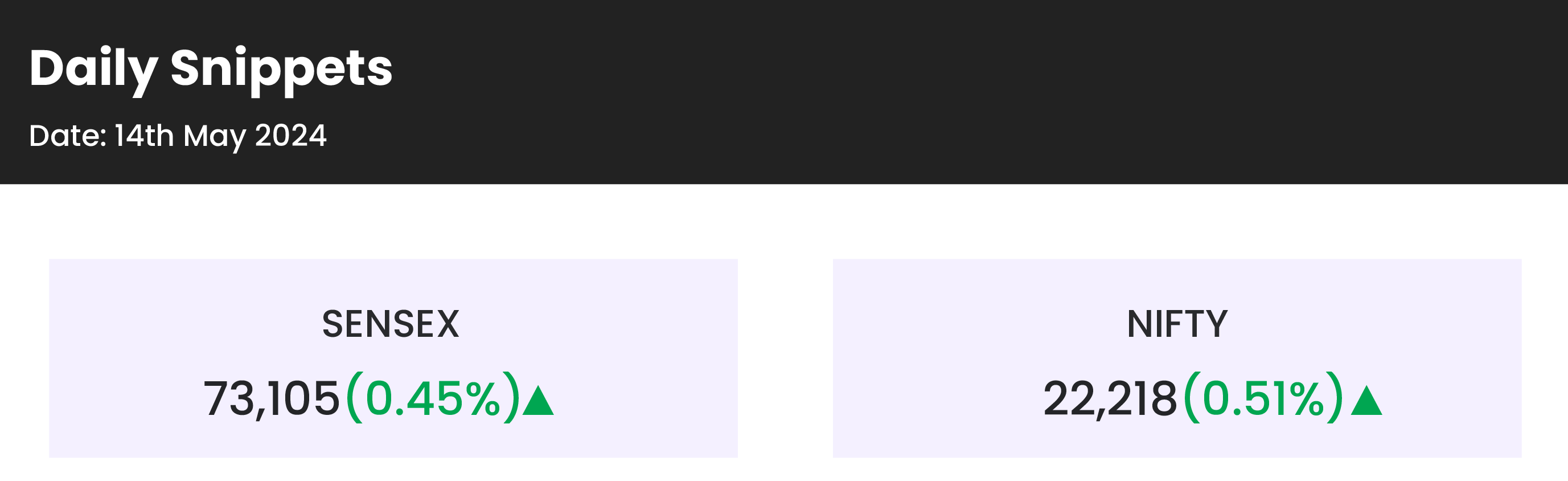

Benchmark index NIFTY closed at 22,218, moved by 114 points/ 0.51%. The benchmark index closed above last session’s high. The index is now trading above 22,200 levels. The move in today’s session was sustained and the index closed to a near high of the session.

Follow-up buying is seen in the benchmark index. Momentum indicator 14-period RSI is reversing from the oversold zone and is now at the 47 level. The index is trading below 20-DEMA. The reversal from the channel lower band can be confirmed once it breaks and closes above 20-DEMA.

India Vix after making a high of 21.875, it cools down and closed at 20.195 down by almost 2%. PCR has risen to 0.93, indicating a heavy position in the put option.

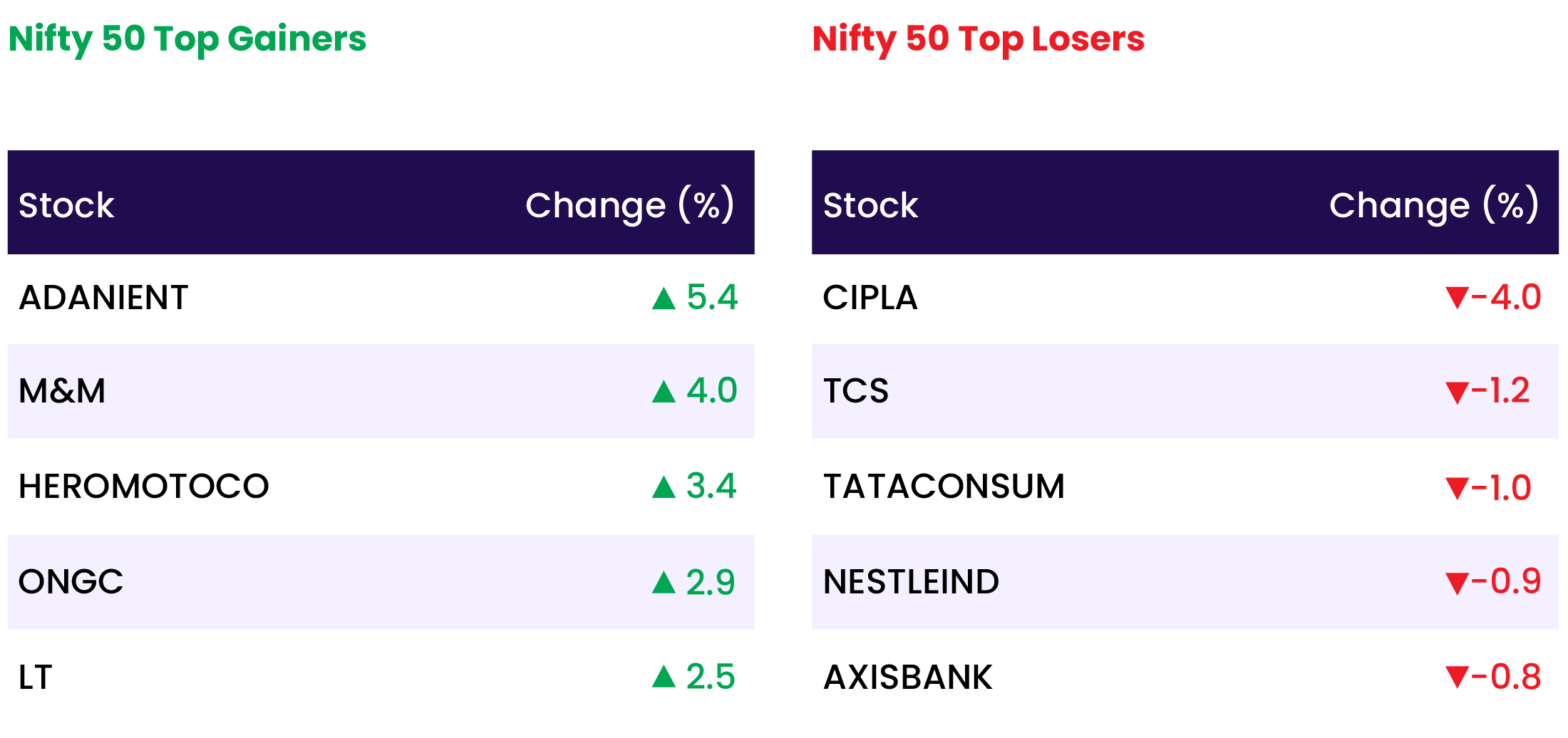

Adani Enterprise, Mahindra & Mahindra, and Hero Moto Corp were top movers of the benchmark index, while Cipla was down by 3%. Nifty Metal and Nifty Pharma were the top mover index and were up by almost 2.8% and 2% respectively. The Nifty Financial Services index remained flat and closed at 21,260. NIFTY MIDCAP 100 index moved by 490 points / 1.00% while NIFTY SMALLCAP 100 index moved by 325 points / 2.00%.

MSCI Global Standard rebalancing on 15th May, the index can witness volatile moves in the last hour of the trading session. The benchmark index has support levels of 22,080 and 21,900 zones. Resistance levels for upcoming sessions are 22,350 and 22,450.

Technical Overview – Bank Nifty

BANK NIFTY index closed at 47,859, moved by 105 points/ 0.22%. The index closed flat while underperforming the benchmark index for the day.

Index managed to sustain and close above 50-DEMA, still trading below 10&20 DEMA. Momentum indicator 14-period RSI is now at 48 not a big change for the day. 14 period ADX is at 16.43, below 20 refers to sideways or non-momentum moves in the index.

IndusInd Bank, PNB, and Federal Bank were the top movers of the day while Axis Bank dipped by almost 1%.

Index resistance levels are 48,200, and 48,600 for upcoming trading sessions. Immediate support levels for the index are 46,950 and 46,550.

Indian markets:

- The Indian stock market indices, namely the Sensex and the Nifty 50, continued their upward trajectory for the third consecutive session on Tuesday, May 14, against a backdrop of mixed global cues.

- Following a nearly 2% decline last week, the market indices rebounded this week, finding some comfort in valuation levels. The medium- to long-term outlook for the Indian stock market remains optimistic, buoyed by the nation’s promising economic growth prospects.

- In sectoral performance, Nifty Metal emerged as the top gainer, climbing by 2.77%, trailed by Nifty auto and oil & gas, each recording a 1.8% increase. Nifty PSU Bank, Consumer durables, and realty sectors each saw gains of 1%. Conversely, Nifty FMCG and Pharma sectors experienced marginal declines of 0.5% each.

- Investor attention is now focused on upcoming US inflation reports, expected to guide market direction. On Tuesday, US producer prices, a pivotal inflation metric, were released, coinciding with remarks from Federal Reserve Chair Jerome Powell. Wednesday’s consumer price index is anticipated to signal a moderation in inflation, though remaining at levels that discourage rate cuts.

Global Markets:

- Asia-Pacific markets experienced a mixed day on Tuesday, reacting to Wall Street’s stumble overnight, notably the Dow Jones Industrial Average snapping its eight-day winning streak. Investor attention in Asia was drawn to India’s inflation figures, which showed a 4.83% year-on-year increase in the consumer price index, released on Monday.

- In Japan, the Nikkei 225 and the broader Topix both saw gains, rising by 0.46% and 0.25% respectively, South Korea’s Kospi edged up by 0.11%, while the smaller-cap Kosdaq surged by 0.9%.

- Australia’s S&P/ASX 200 declined by 0.3%.

- Hong Kong’s Hang Seng index relinquished its gains, trading 0.1% lower, while mainland China’s CSI 300 index fell by 0.21%.

Stocks in Spotlight

- Cochin Shipyard shares surged by 11.7% following the company’s securing of a substantial order from a European client. The order entails the design and construction of a Hybrid Service Operation Vessel (Hybrid SOV), with provisions for two additional vessels. Completion of the project is slated for the conclusion of 2026. Per Cochin Shipyard’s criteria, any order valued between Rs 500 crore and Rs 1,000 crore qualifies as a large order.

- Hindustan Aeronautics shares rose by 4%, hitting a 52-week high, subsequent to a ‘buy’ rating affirmation by global brokerage firm UBS. The firm also raised the target price to Rs 5,200 per share, indicating a 28% potential upside from current levels.

- Bharti Airtel, a prominent player in the telecom sector, reported a 31% decline in consolidated net profit, amounting to Rs 2,072 crore for the quarter ending March 2024, compared to Rs 3,006 crore in the corresponding period last year. The profit fell significantly short of Street estimates, which anticipated figures around Rs 3,274 crore. Despite this, revenue from operations for the January-March 2024 period witnessed a 4% increase, reaching Rs 37,599 crore compared to Rs 36,009 crore in the same period the previous year. Additionally, the Board proposed a final dividend of Rs 8 per fully paid-up share and Rs 2 per partly paid-up equity share for the financial year 2023-24.

News from the IPO world🌐

- Go Digit IPO: Price band for Virat Kohli-backed Rs 2,615 crore IPO announced

- Rulka Electricals IPO to open on May 16

- Indegene makes stellar start, lists at 45% premium on market debut

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY METAL | 2.8 |

| NIFTY AUTO | 1.8 |

| NIFTY OIL & GAS | 1.6 |

| NIFTY PSU BANK | 1.0 |

| NIFTY CONSUMER DURABLES | 0.9 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2689 |

| Decline | 1117 |

| Unchanged | 117 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,432 | (0.2) % | 4.6 % |

| 10 Year Gsec India | 7.1 | (0.1) % | 0.1 % |

| WTI Crude (USD/bbl) | 79 | 1.1 % | 12.4 % |

| Gold (INR/10g) | 71,974 | 0.2 % | 7.3 % |

| USD/INR | 83.55 | 0.0 % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer