On 23rd August 2023, Chandrayaan 3 achieved a historic milestone by softly landing on the moon, marking India as the fourth nation to accomplish this feat. The successful landing paved the way for the deployment of Pragyan, a rover that embarked on data collection missions across the lunar surface. This accomplishment holds not only scientific significance but also promises substantial economic benefits for India. The burgeoning demand for global satellite imaging, positioning, and navigation data has surged, amplifying the impact of this achievement.

The Indian space economy is projected to burgeon to a staggering $13 billion by 2025. The inception of India’s moon exploration journey uncovered crucial evidence of water on the moon, unlocking possibilities for future resource utilization. With a robust foundation of 140 registered space technology startups, India’s stride in space technology with Chandrayaan 3 magnifies the potential for growth not only within the space industry but also in its allied sectors.

Chandrayaan 3’s successful and cost-effective mission aligns seamlessly with India’s ‘Make in India’ initiative. This monumental achievement is poised to foster the growth of domestic companies specializing in satellite systems, generating lucrative investment prospects. As India positions itself as a significant player in the global space exploration arena, the article explores the investment avenues that lie ahead within the Indian space technology sector.

Here’s why the Indian space industry is poised for a long term growth:

|

Increasing global influence:

SapceX – the brain child of one of the richest people in the world Elon Musk is a groundbreaking aerospace company, ipoised to redefine space exploration through its audacious endeavor – the development of the Starship rocket. This colossal project serves a dual purpose, catering to the company’s satellite launch enterprise while also setting its sights on transporting NASA astronauts to the lunar surface, all under the umbrella of a remarkable US$3 billion contract.

The magnitude of SpaceX’s aspirations becomes even clearer considering its substantial investment of approximately US$2 billion into the Starship venture this year alone. Such a commitment underscores the company’s relentless pursuit of innovation, fueled by its visionary founder.

SpaceX’s achievements read like a science fiction novel turned into reality. From pioneering reusable rocket technology to facilitating the International Space Station’s resupply missions, their accomplishments are nothing short of extraordinary. Notably, SpaceX’s speed of progress sets a new benchmark for the aerospace industry, underlining its ability to convert ambitious concepts into tangible, high-impact realities.

Taking a leaf out of Musk’s playbook, India has embarked on its journey with fervor, rapidly ascending the ranks of space exploration in recent years. As the nation expands its horizons and accelerates its efforts, the parallels with SpaceX’s trajectory are undeniable. With a burgeoning economy and a burgeoning space sector, India is unveiling a realm of opportunities that align with its ambitious goals.

|

Rise of Space tech startups:

In the past, the Indian Space Research Organisation (ISRO) remained relatively enigmatic, with its research and development activities often shrouded in secrecy. However, the landscape has undergone a remarkable transformation in recent years, particularly spurred by the emergence of space startups. These new players have redefined the trajectory of space-related commercial activities, setting the stage for a dynamic industry.

Below are some of the key pioneers in the Indian space tech industry.

- The inception of space startups has brought India’s spacetech potential to the forefront. For instance, Pixxel Space, founded by two BITS Pilani students, recognized the need for high-resolution satellite imagery data in their artificial intelligence project.

- This realization marked the birth of Pixxel Space, a startup that offers cutting-edge high-resolution satellite imagery services.

- Another story of innovation lies in Dhruva Space, a venture initiated by Sanjay Nekkanti, who first engaged with satellites as a college student working on the student-made satellite SRMSat. Dhruva Space has now evolved into an end-to-end spacetech service provider, securing funding and orders for satellite deployment.

- There are a cluster of startups, such as Agnikul Cosmos, Skyroot Aerospace, Digantara, and Pixxel, with diverse objectives ranging from high-resolution imaging to space debris management. Investors have flocked to support these ventures, transforming the Indian spacetech ecosystem into a new frontier, poised to attract significant funding and position India as a global commercial space tech hub.

|

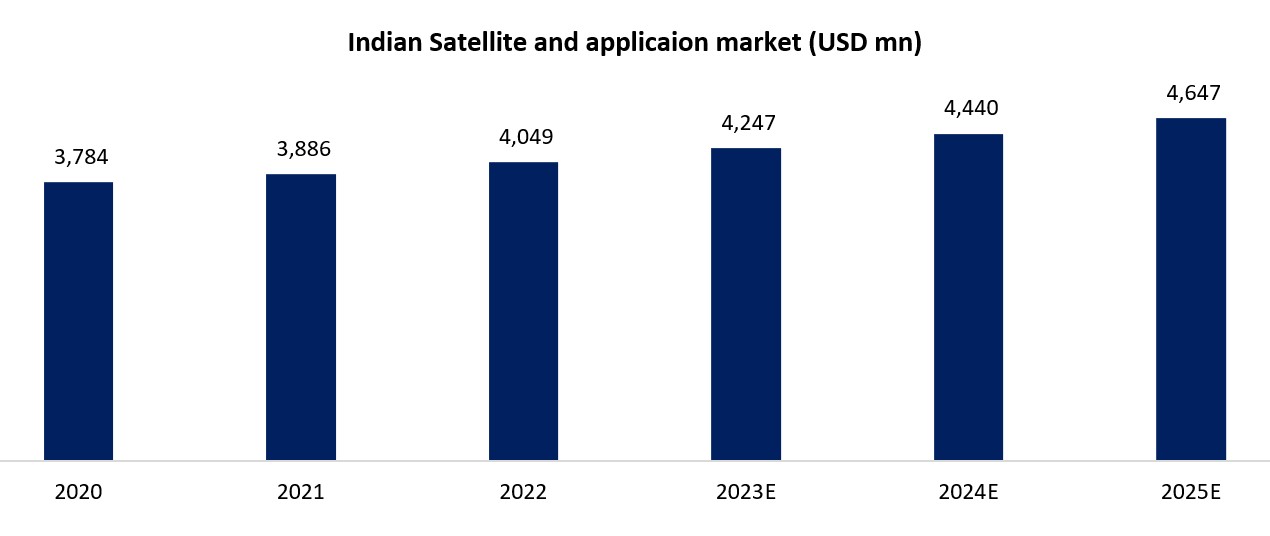

Opportunities in Indian satellite market

In recent times, India has made big changes in its space industry. It allowed private companies to launch things into space and also let foreign investors join in. The goal is to make India five times bigger in the world satellite launch market over the next ten years.

Indian space companies have already done important work in different fields like predicting the weather, studying the earth, managing disasters, and helping farmers. They’ve even helped with things like broadcasting TV shows through satellites.

Satellites can help bridge the gap in technology access in India. They don’t just give internet to cities; they can also help teachers and students in faraway places access learning materials.

Because satellites are widespread, easy to use, and don’t cost too much, they’re a great option for improving education and provide reach to farfetched locations across the country.

Satellites could also bring new health solutions to remote areas. This could create new opportunities in the healthcare sector.

In simple words, India’s satellite industry is becoming bigger and it’s not just about space; it’s about helping with education, healthcare, and much more.

|

|

Source: Allied Market Research, Fisdom Research

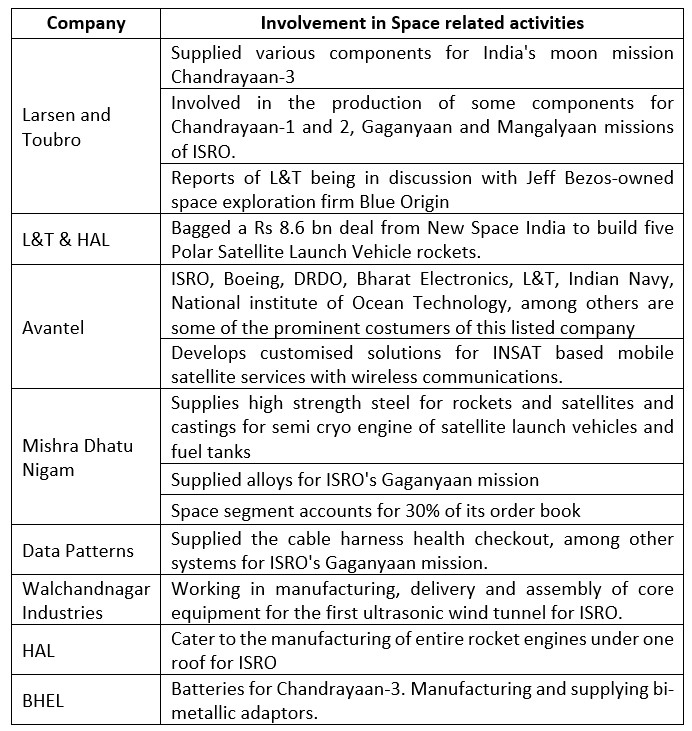

Established players could gain momentum:

The catalyst for the booming spacetech sector was the establishment of the Indian Space Association (ISpA) in 2021. Founding members including prominent names like L&T, Tata Group, MapmyIndia, Walchandnagar Industries, and Bharti Airtel’s OneWeb underlined the industry’s potential.

As startups defy the conventional limitations of space exploration, the Indian spacetech sector emerges as a force to reckon with. Its rapid growth trajectory, coupled with the involvement of established players and a surge in investment, showcases the potential for India to pioneer innovative solutions in the vast expanse of the cosmos.

Below are some of the listed companies that are involved in the space industry:

|

|

Source: Equitymaster, Fisdom Research

To Conclude

In recent times, the Indian space startups scene has seen remarkable growth, with investments growing at an impressive rate of over 94% since 2016, as highlighted by the Indian Space Association (ISpA). This surge marks the post-liberalization era for India’s space industry, offering promising prospects.

However, the journey is not without its challenges, and access to capital emerges as a key hurdle for pure-play spacetech companies. Historically, caution among investors due to limited private engagement and stringent regulations slowed the pace of growth in this sector.

Though the potential for spacetech startups is substantial, the road to maturity in terms of financial stability may take time. As an investor, patience is essential to reap the benefits of this burgeoning field.

The successful Chandrayaan 3 mission has paved the way for the Indian space sector’s triumphs, with ample potential for growth in the future. While resembling the opportunities seen in the defense sector, it’s important to note that this domain is still at a nascent stage. While the prospect is immense, investing in this realm demands patience as startups gather strength.

In essence, the Indian space sector is an unfolding saga of growth, offering investors a chance to be part of a promising journey. While challenges exist, the sector’s potential is undeniable, and those willing to invest wisely and wait stand to be rewarded by the astronomical opportunities that lie ahead.

|

Markets this week | | 21st August 2023 (Open) | 25th August 2023 (Close) | %Change | | Nifty 50 | ₹ 19,321 | ₹ 19,266 | -0.30% | | Sensex | ₹ 64,850 | ₹ 64,887 | 0.10% |

Source: BSE & NSE |

- Indian equity markets initially started positively for the first three sessions.

- Subsequent pressure emerged over the next two sessions due to weak global markets.

- Investors are eagerly awaiting Federal Reserve Chairman Jerome Powell’s speech at Jackson Hole, seeking hints on future interest rate trends.

- Foreign institutional investors (FIIs) continued their selling streak for the fifth consecutive week.

- FIIs sold equities valued at Rs 4,895.29 crore, while domestic institutional investors (DIIs) bought equities worth Rs 8,495.99 crore this week.

- In the ongoing month, FIIs have offloaded equities worth Rs 15,821.13 crore, whereas DIIs purchased equities worth Rs 17,741.85 crore.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | Bajaj Finance | ▲ 5.09% | | Axis Bank | ▲ 4.25 % | | Asian Paints | ▲ 3.03 % | | Bajaj Finserv | ▲ 3.00 % | | Hindalco Industries | ▲ 2.39 % |

| NSE Top Losers | Stock | Change % | | Adani Ports and SEZ | ▼ (3.51) % | | Reliance Ind. | ▼ (3.46) % | | Adani Enterprises | ▼ (3.17) % | | Sun Pharma | ▼ (2.52) % | | Cipla | ▼ (2.18) % |

|

Source: NSE |

Stocks that made the news this week:

👉The removal of Jio Financial Services from the Sensex and other BSE indices has been delayed by three days to September 1 due to the stock consistently triggering the lower circuit on August 24 and 25. Initially scheduled for removal on August 24, the action was first postponed to August 29. However, due to the stock’s consecutive lower circuit hits, the removal has been further pushed to September 1, as announced by the S&P Dow Jones Indices in a statement on August 25.

👉During the week, Paytm’s shares reached a new 52-week high following brokerage Bernstein’s initiation of coverage on One 97 Communications Ltd (Paytm) with an ‘Outperform’ rating. Paytm’s utilization of its strong digital payments platform to gain an advantage in digital lending has been evident, positioning it favorably amidst disruptive trends. Additionally, Antfin’s plan to sell its 3.6% stake in the company on Friday.

👉Nomura has provided an upbeat analysis of Bajaj Finance, attributing its sustained performance to novel products, a balanced loan portfolio, and advanced technology utilization. The brokerage firm initiated coverage on the stock with a ‘buy’ rating and a target price of Rs 8,700. Bajaj Finance’s adept handling of crises, including the recent COVID-19 pandemic, has set it apart from competitors in India. Notably, the company achieved impressive CAGR figures over the years, with assets under management (AUM), profit after tax (PAT), earnings per share (EPS), and book value per share (BVPS) growing at 35 percent, 35 percent, 22 percent, and 20 percent, respectively, from FY03 to FY23. Despite its robust growth, Bajaj Finance maintained strong asset quality, barring the global financial crisis.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|