Hot Stuff this week: Cement stocks hit 52 week high

An array of cement companies, such as UltraTech Cement, Dalmia Bharat Ltd, Birla Corp., and Star Cement Ltd., Ramco Cements Ltd and JK Cement witnessed their stock prices surge to 52-week highs this week. Shree Cement has also been inching closer to its 52-week high. Meanwhile, companies like Ambuja Cements and ACC Ltd, part of the Adani Group, have rallied from their March lows.

Cement sector stocks have begun to glisten with investors’ attention as they anticipate improved earnings growth for the ongoing fiscal year. This improvement in earnings outlook is linked to an enhanced demand environment, translating into an improved volume trajectory.

Below are some key factor contributing to positive outlook on cement sector:

Declining Raw Material and Fuel Costs

In the years FY22 and FY23, the earnings of cement companies were under strain due to the escalated costs of raw materials and fuel. These companies could not transfer this increased cost to consumers due to subdued demand. However, with the moderation of fuel prices, there’s a strong likelihood that future earnings will reflect this positive change once the high-cost inventory has been absorbed.

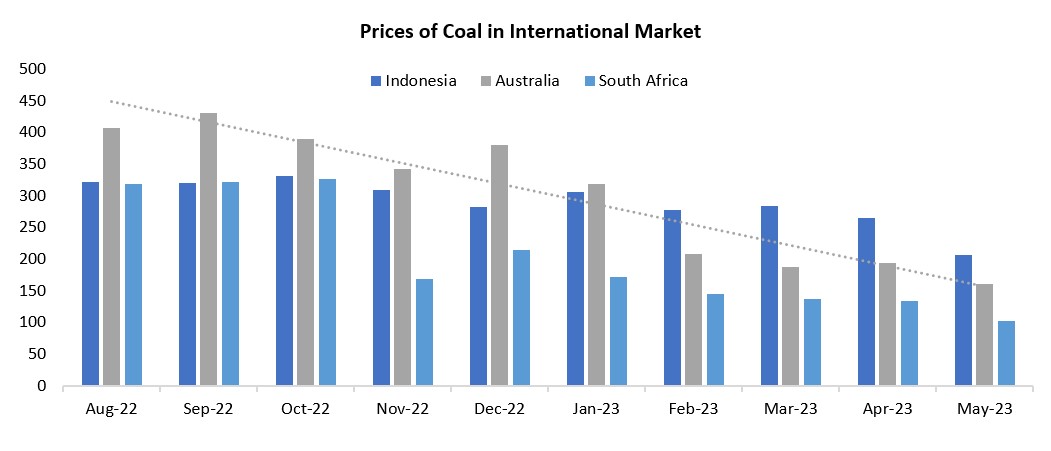

Both imported coal prices and petcoke prices have seen significant corrections in recent months. The former has dropped by 45-60%, while the latter has seen a reduction of 23-35%. With Indian Oil Corporation cutting petcoke prices by 11% in May 2023 over April 2023, domestic prices are also likely to decline, offering additional relief for cement companies. Cement companies stand to gain from improved margins. Another factor that can be in favour of cement companies is that high-cost inventory might get consumed in the coming months which will lead to higher realization reduced costs.

Source: CMIE, Fisdom Research

Thrust on Infra

The demand for cement continues to be robust, with volumes estimated to have grown in low double digits. This surge is powered by the government’s thrust on infrastructure development, an uptick in commercial and industrial activities, a boost from private capex, and improved traction in retail.

With unrelenting demand, cement companies are projected to witness continued volume growth. The demand outlook for FY24 appears robust which is also evident from some high frequency indicators.

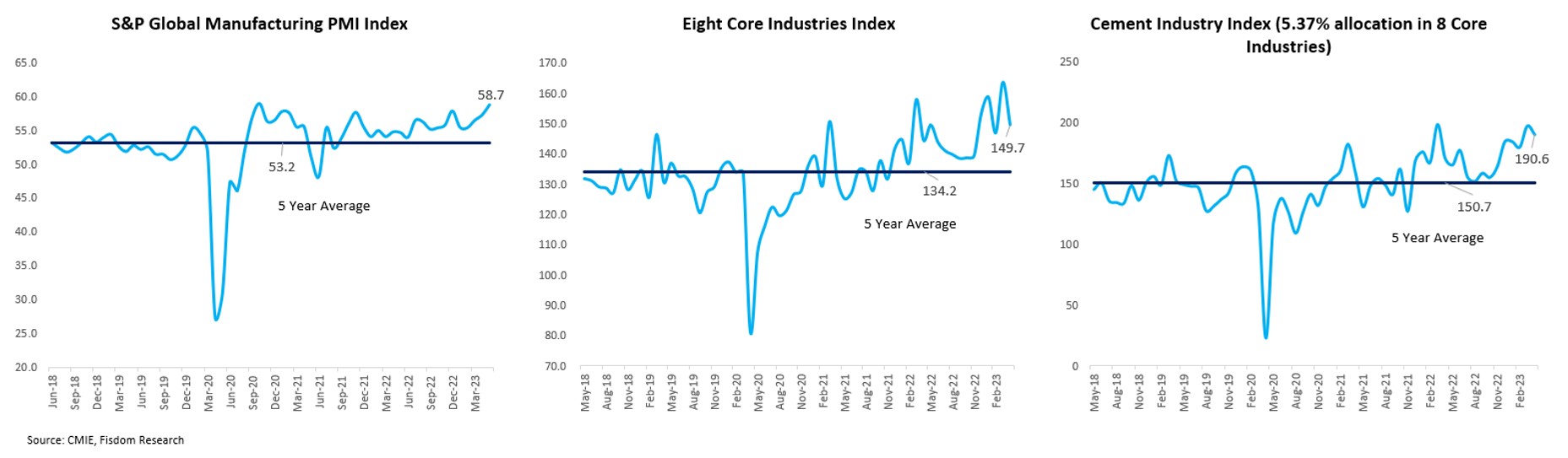

Indicators like the manufacturing PMI, the performance of core 8 industries, and the cement industry’s consistent performance remaining above long-term averages, contribute to a positive outlook for the cement demand.

Housing Industry’s Influence: Approximately 65% of total cement demand is driven by the housing industry. Several components such as improvements in rural incomes, increased availability of rural credit, and heightened allocation for rural, agricultural, and allied sectors stimulate the demand for rural housing, thereby indirectly promoting cement consumption.

Despite concerns about El Nino, a forecast of a normal monsoon in 2023 by the Indian Meteorological Department (IMD), with expected rainfall around 96% of the long period average (LPA), can influence rural income and thereby demand for rural housing, indirectly impacting the cement industry.

As per Magicbricks’ PropIndex report, the resilient and growing demand for housing in India, exhibiting a 14.2% on-year rise during the quarter ending March 2023, along with a 1.9% increase in supply, is a key factor contributing to the rising demand for cement.

Bottomline

The industry outlook is decidedly positive, spurred by an optimistic demand forecast led by the government’s push for infrastructure development and increasing housing demand. Furthermore, potential consolidation in the industry, coupled with cost-efficiency measures such as the installation of green power plants and focus on product premium branding, are set to contribute to this growth.

Additionally, the sector’s key players demonstrate strong financial health, with low debt-to-Ebitda ratios. Companies like UltraTech, Shree Cement, ACC, and JK Cement have reported improved Q4FY23 results, showing robust sequential and YoY revenue expansion and volume growth. These promising results, coupled with sustained capex plans, point to a future of continued growth and stability for the cement sector.

As the industry navigates its way ahead, it would indeed be worthwhile for investors to keep a close watch on the cement sector. However, as always, investors should align their investment decisions with their risk appetite, investment horizon, and financial goals.

Markets this week

| 05th June 2023 (Open) | 09th June 2023 (Close) | %Change | |

| Nifty 50 | ₹ 18,612 | ₹ 18,563 | -0.3% |

| Sensex | ₹ 62,759 | ₹ 62,626 | -0.2% |

Source: BSE and NSE

- Volatility increased due to the weekly expiry of index options during the week. Both benchmark indices closed with minor losses.

- The Nifty 50 index dipped below the 18,600 mark during the week.

- The RBI’s Monetary Policy Committee (MPC) unanimously voted to maintain the repo rate at 6.5%.

- Other rates, including the standing deposit facility (SDF) at 6.25%, and the marginal standing facility (MSF) and the Bank Rate at 6.75%, were also held steady. The MPC is committed to a measured retraction of fiscal accommodations, aiming to gradually align inflation with targets, while supporting economic growth.

- Investors booked profit due to the expected outcome of RBIs monetary policy.

- Attention is now focused on the upcoming US FOMC meeting.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| JSW Steel | ▲ +5.93% | Tech Mahindra | ▼ -5.35% |

| L&T | ▲ +5.75% | Kotak Mahindra Bank | ▼ -3.44% |

| Axis Bank | ▲ +5.25% | Eicher Motors | ▼ -3.19% |

| TATA Motors Ltd | ▲ +4.93% | HUL | ▼ -2.96% |

| Britannia Inds. | ▲ +4.83% | TCS | ▼ -2.91% |

Source: BSE

Stocks that made the news this week:

👉Fintech firms One97 Communications, Paytm’s operator, and PB Fintech were in the spotlight on June 8, as Bank of America Securities revised their ratings. One97 was upgraded to ‘buy’ with a 10% price target increase to Rs 855, propelled by anticipated strong revenue momentum. The brokerage noted Paytm’s promising potential for positive operational leverage, enhanced by limited competition. The growth of digital payments, driven by expanding digitalization, and Paytm’s substantial cash balance were other positive aspects highlighted by the firm.

In another news, One97 Communications experienced a gain of over 3 percent, following the RBI’s approval of the First Loss Default Guarantee (FLDG) programme. FLDG is a widely adopted product utilized by fintech companies in India to establish partnerships with banks and non-banking financial companies (NBFCs). This innovative programme serves multiple purposes, enabling banks and NBFCs to safeguard against potential losses while instilling confidence in fintechs’ understanding of credit risk.

👉Zomato touched one-year high during the week. This surge in stock price can be attributed to several positive factors surrounding the company. Firstly, Zomato has witnessed an improvement in its earnings, indicating a promising financial performance. Additionally, the recent inclusion of Zomato’s stock by Chris Woods of Jefferies in his long portfolio has further bolstered investor confidence. Woods allocated a weight of 4 percent to Zomato in both of his long-only portfolios, signifying his optimism towards the company’s future prospects.

👉Tata Consumer Products‘ shares saw an increase of over 2.5% on June 7, following the Tata Group chairman N Chandrasekaran’s announcement at the annual general meeting regarding the group’s openness to acquisitions and expansion into new categories. The management remains optimistic about the Indian market, forecasting that its business growth will surpass international markets.

👉Hindustan Aeronautics Ltd shares surged during the week, fueled by reports of an impending agreement with General Electric (GE) for co-production of jet engines in India. The U.S. Biden administration’s approval of this cooperation comes prior to Prime Minister Modi’s scheduled visit to the U.S. later in the month. The two firms had initially entered into a deal in 2012, but it faltered due to the Indian government’s demand for a higher level of technology transfer. Now, an agreement on enhanced technology transfer has reportedly been reached, positioning India as a unique partner to the U.S. in this respect.