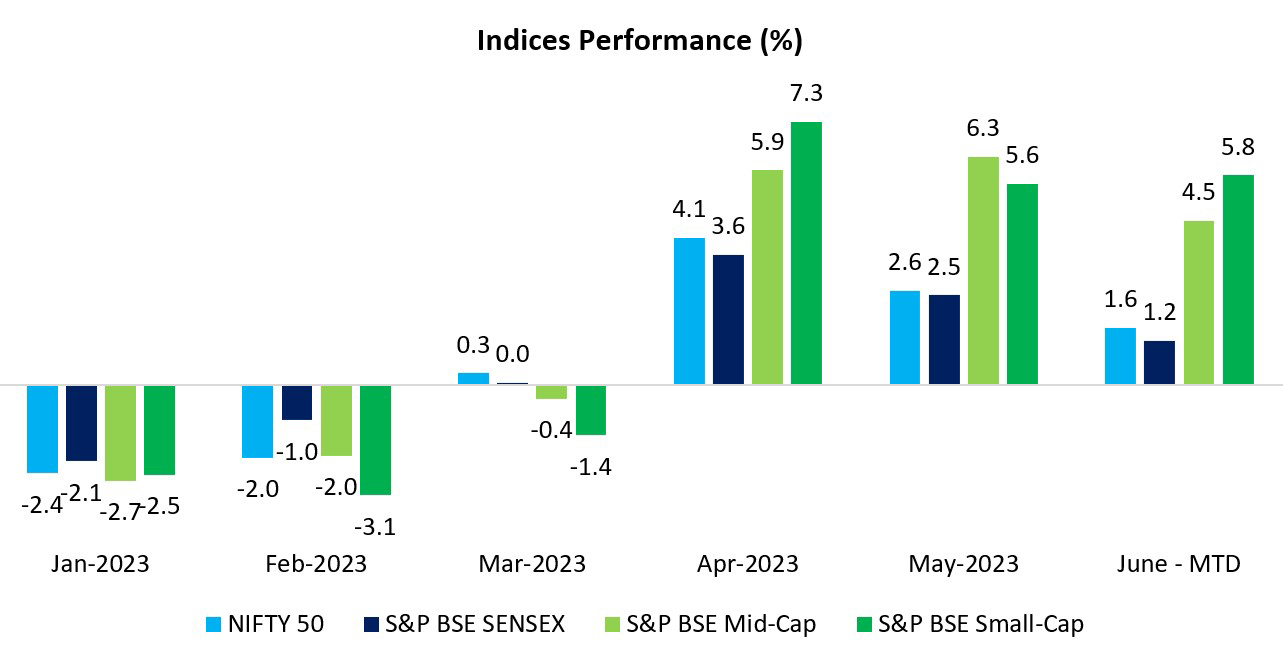

Over the past few months, there has been a discernible rally in the mid- and small-cap stocks, outshining the performance of large-cap stocks, with their respective sectoral indices achieving new records.

The S&P BSE Smallcap and S&P BSE Midcap index delivered 5.6% and 6.3% returns respectively in the May 2023, a clear outperformance compared to Sensex, a large-cap index, which provided nearly 2.5% returns. This trend extends to the broader market indices as well, which have consistently outperformed the benchmark index in recent months.

Source: BSE India, NSE India, Fisdom Research. June MTD data as on 16th June 2023

What were the factors that have led to this rally?

- The year 2022 saw a correction in small-cap stocks, perceived as a golden opportunity for investors to build a robust small-cap portfolio. Moreover, the slowing down of earnings downgrades within small and mid-cap (SMIDs) since Q2FY23 has been another factor fueling the rally. With this trend expected to continue over the next year, it signifies a transition phase in the market, paving the way for a period of earnings upgrades.

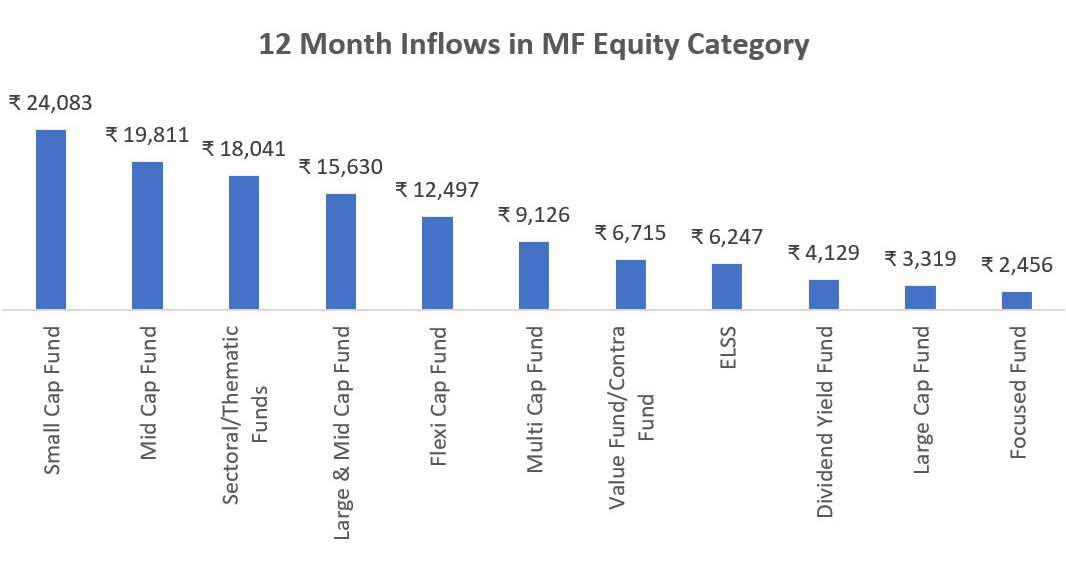

- An additional factor bolstering this rally has been the inflow into equity mutual funds, led predominantly by consistent flows into small and mid-cap funds. This has been underpinned by the expectation of improved earnings in small-cap stocks and mid-caps’ potential to outperform both large and small-cap companies. The shift from underperformance in 2022 to an advantageous position has been accredited to the valuation discount that had set in over recent years.

Source: ACEMF, Fisdom Research

- Further supporting this performance, the decline in raw material prices and operational costs has enhanced earnings in Q4 and boosted forward earnings outlook for these companies. This, coupled with a stronger than expected domestic demand, has led to an improved outlook for margins.

- From a macroeconomic perspective, the pause in the rate hike cycle, improved fundamentals, and continued inflows from foreign investors have been critical drivers of the rally. The expected pause by the RBI and declining commodity costs have brought about stable interest costs, which particularly benefits mid- and small-cap companies as they typically find it more challenging to access capital compared to larger companies.

However, caution is warranted despite these promising indicators. While the overall outlook for mid and small-caps is encouraging, it is crucial to perform stock-specific analysis due to the prevailing broad valuations.

The recent rally in mid- and small-cap stocks is expected to persist and gain further momentum over the next two years. Investors have long 5 year or more time horizon can strategically increase their exposure in this area over the next few months. High-growth niche businesses in the mid- and small-cap spaces, especially in emerging trends like renewables, electric vehicles, transportation, EMS, and defence are looking attractive from a long term perspective.

In conclusion, the recent rally in mid- and small-cap stocks reflects the robust growth prospects of these companies, fueled by several factors ranging from better corporate performance, attractive valuations, and positive macroeconomic factors.

Markets this week

| 12th June 2023 (Open) | 16th June 2023 (Close) | %Change | |

| Nifty 50 | ₹ 18,595 | ₹ 18,826 | 1.2% |

| Sensex | ₹ 62,660 | ₹ 63,385 | 1.2% |

Source: BSE and NSE

- The market broke its consolidation phase in the last week, gaining over 1% and marking the fourth week of consecutive gains ending on June 16.

- This rally was fuelled by a series of supportive domestic and global data points.

- The week witnessed a data surge in both domestic and global markets.

- Sustained flow of better-than-expected macroeconomic data helped maintain positive sentiments across domestic equities.

- Key data points such as CPI, WPI, and IIP played a significant role in investor optimism.

- Domestic CPI data moderated, inching closer to the RBI’s target, primarily due to softened food inflation and a favourable base.

- The moderation in CPI data increases the likelihood of a rate cut before the end of the year.

- Foreign institutional investors (FIIs) bought equities worth Rs 6,645.99 crore over the week.

- Domestic institutional investors (DIIs) purchased equities worth Rs 1,319.21 crore in the same period.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| TATA Consumer | ▲ +7.71% | Wipro | ▼ -4.03% |

| Apollo Hospitals | ▲ +5.55% | Hero Motocorp | ▼ -2.32% |

| Dr Reddy’s | ▲ +5.32% | Bajaj Auto | ▼ -2.14% |

| TATA Steel | ▲ +4.91% | SBI | ▼ -1.29% |

| BPCL | ▲ +4.83% | IndusInd Bank | ▼ -1.28% |

Source: BSE

Stocks that made the news this week:

👉Tata Consumer Products Ltd (TCPL) surged touching a 52-week high in the week gone by. Analysts are optimistic that the worst has passed for TCPL’s Indian tea business, forecasting an upward trajectory for the stock in the current financial year. The previously impacted Indian tea business and international margins, due to inflationary pressures and softened volumes, are showing signs of recovery. Nuvama Institutional Equities not only maintains a “buy” rating for the Tata group stock, but also raises the target price.

👉HDFC Life’s shares soared 4% in the week, following positive statements from the company’s top executives. The CEO mentioned that the company’s growth has generally outpaced the private sector, and is expected to continue its upward trajectory, with June forecasted to outperform May. The firm’s retail AP business has grown its market share from 16.5% to 16.7%, maintaining its leading position in the private sector group business.

👉Boosted by reports of a potential Rs 14,000-crore capital infusion plan, shares of Vodafone Idea Ltd exhibited an impressive uptick. As part of a robust business revival strategy, the telecom giant’s stock soared by 5% in early trade, eventually closing 2.6% higher than the previous day. The anticipated capital is said to be jointly contributed by the Aditya Birla Group and the UK’s Vodafone Group, reinforcing the promising prospects of the company’s strategic overhaul.