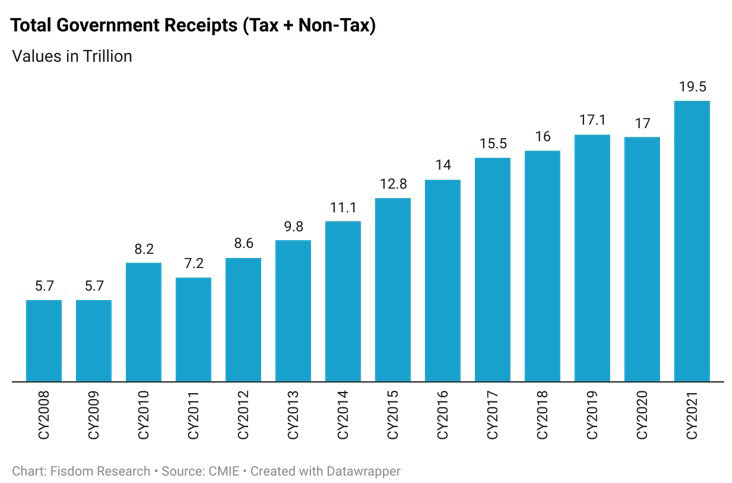

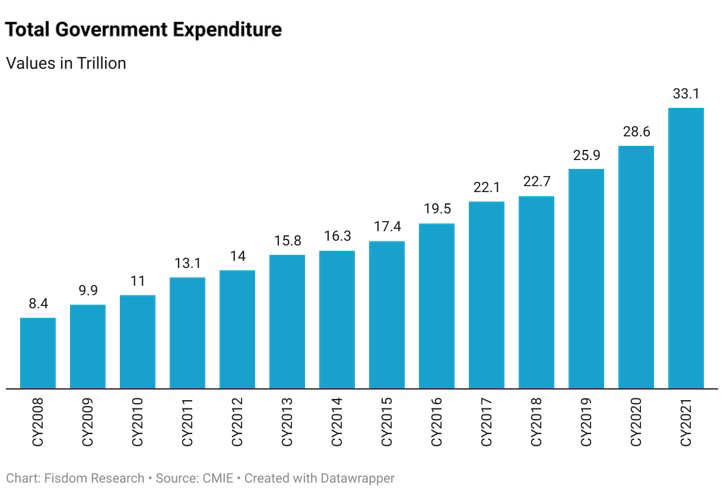

Healthy Accounts Recorded In CY21; Tax Collection At All Time High

- The government’s total receipts for CY21 stands at ~INR.19.5 tn, almost 1.1x compared to last year’s levels. Expenditures for the same period also increased by ~1.1x only to INR 33.1 tn as the government meets ~45% of budgeted target.

- The government witnessed robust tax collections, the highest ever in three fiscal years. Income tax collections, Corporate tax collections & consistent GST collections contributed more to the overall tax revenue collections. Lower-than-targeted disinvestment reflects in poor capital receipts.

- Notable growth has been observed in capital expenditure towards road transport & highways, railways, transfers to states, and housing & urban affairs compared to FY20.

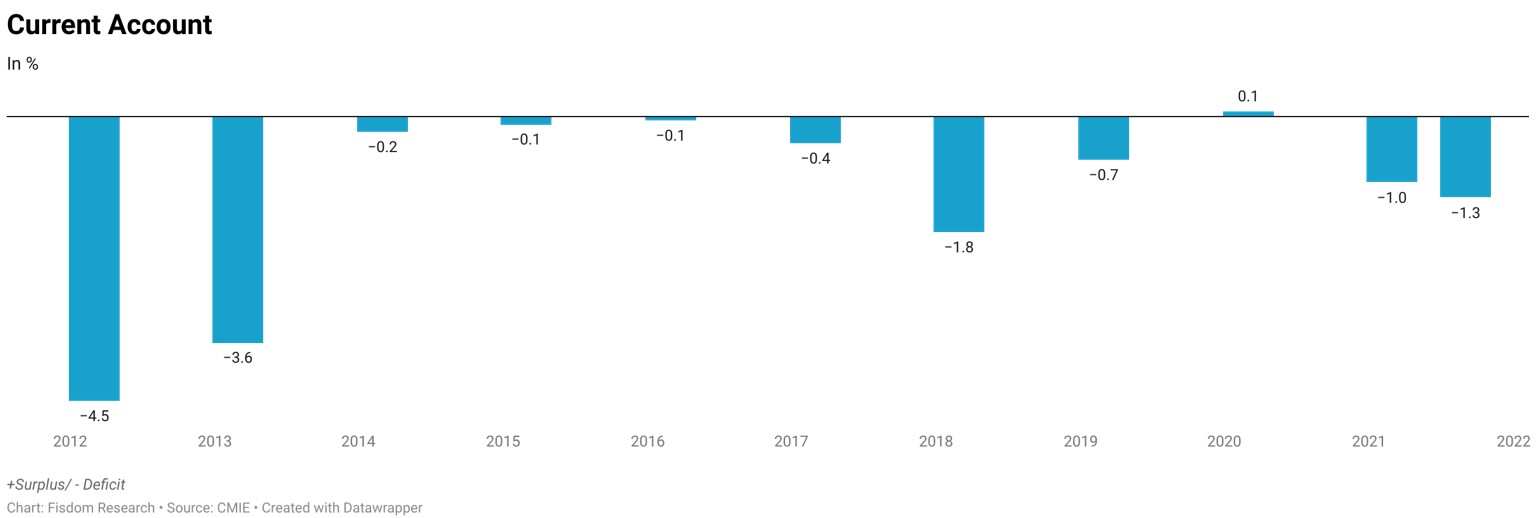

India’s Current Account Situation is Strengthening; Not Out Of The Woods Yet

Values as on March End Every Year. Latest value is as on Sept’21

- The current account retrogressed to a deficit of 1.3% of GDP in Q2FY22 as against a surplus of 0.9% of GDP in Q1FY22, dilating trade deficit and a higher drag from net investment income.

- The services surplus remained steady. Despite a more comprehensive CAD, the BoP surplus remained robust at USD31.2bn, partly due to a one-time SDR allocation (USD17.9bn) by IMF, which, if excluded, would lower the rest to USD13.3bn. The primary balance (CAD+FDI), which reflects stable current account funding, turned mildly negative amid low FDI.

- New global/domestic headwinds amid Omicron and persistent supply constraints are the key factors to watch out for.

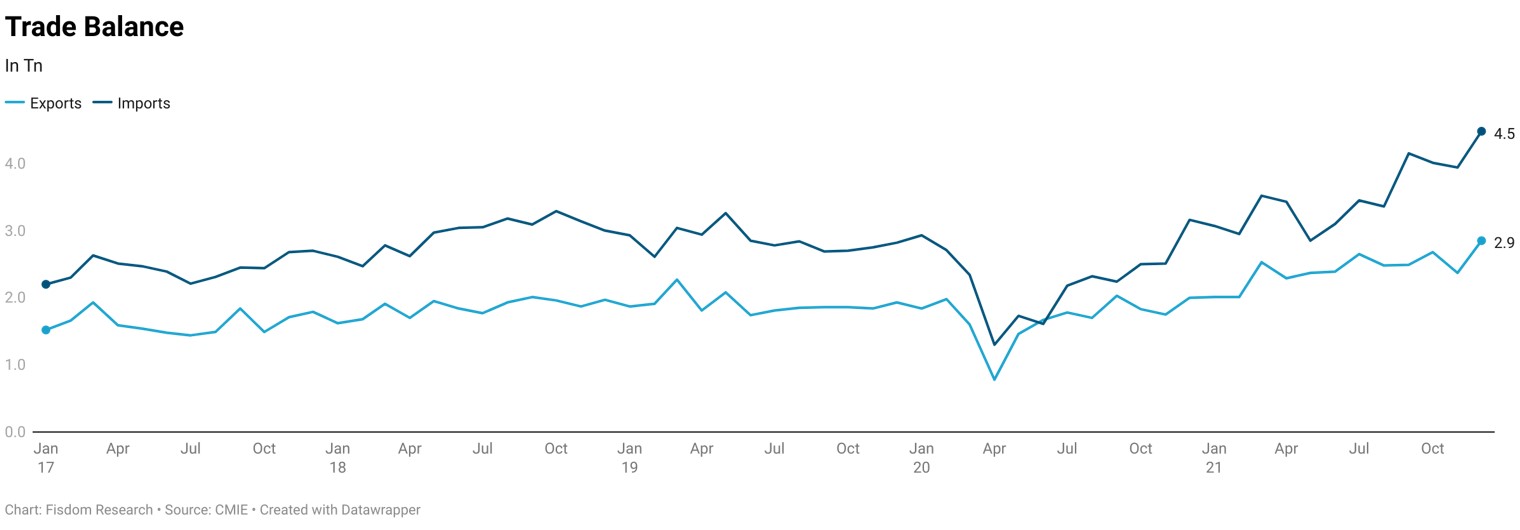

India’s Trade Deficit At Record High As Exports Weakens; Currency Depreciation Could Extend Support

- December was the fourth straight month of elevated trade deficit (1.63 trillion), close to the earlier high of 1.67 trillion recorded in September’21. Imports of crude oil petroleum products, non crude oil & petroleum products & even gold silver imports went up by 11%, 15% & 12% respectively.

- We think higher commodity prices and a relatively more robust exchange rate could play into the widening deficit more than the demand. Falling domestic currency could extend support to the weakening exports. However, implications of the Omicron variant of coronavirus on global trade flows and slowing demand from significant export partners pose downside risks to Indian exports.