Technical Overview – Nifty 50

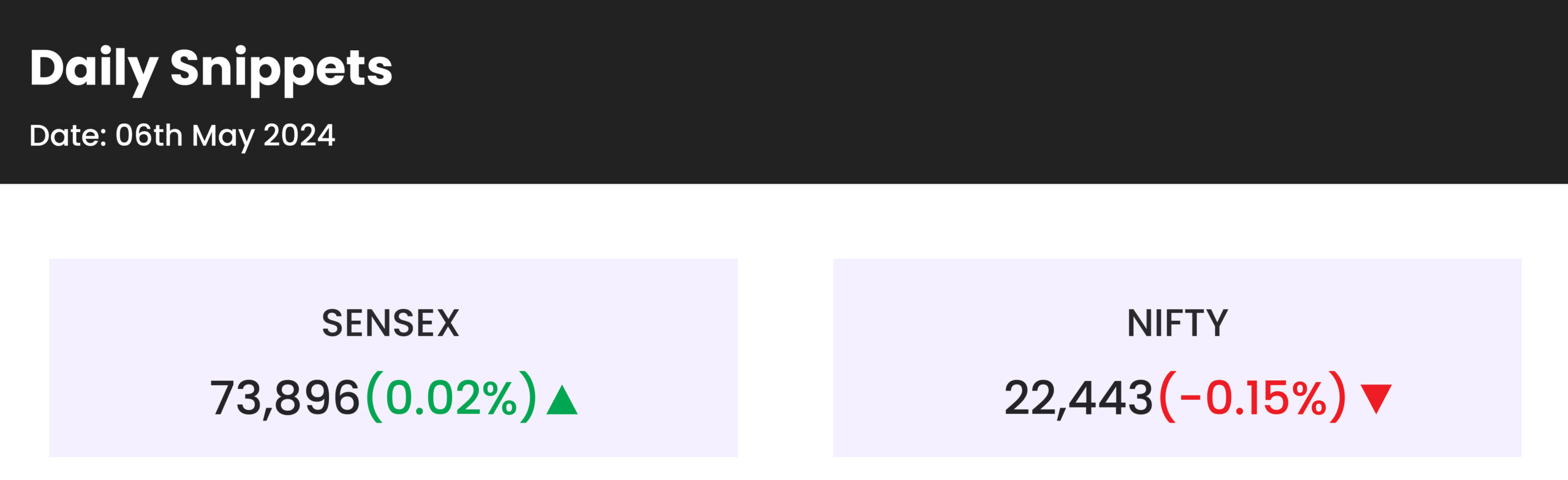

Benchmark index NIFTY closed at 22,442.70, down by 33.15 points/-0.15%. The index opened 108 points above and made a high of 22588.80 initial 15 minutes of the trading session. This high didn’t even sustain for first half and closed near to day low of 22,409. Index consolidated for rest hours of the session between 22,400 – 22490 levels.

With ongoing elections and nearing to results India VIX, known as the fear indicator, is near 16.5 levels. What will happen if VIX goes up? The higher the VIX, the greater the level of fear and uncertainty in the market. The markets come under pressure due to increased fear in the markets. VIX has risen nearly 60% in the last 8 trading sessions. Put-Call Ratio has moved below 0.50 and is currently at 0.48, indicating no bearish moves as of today.

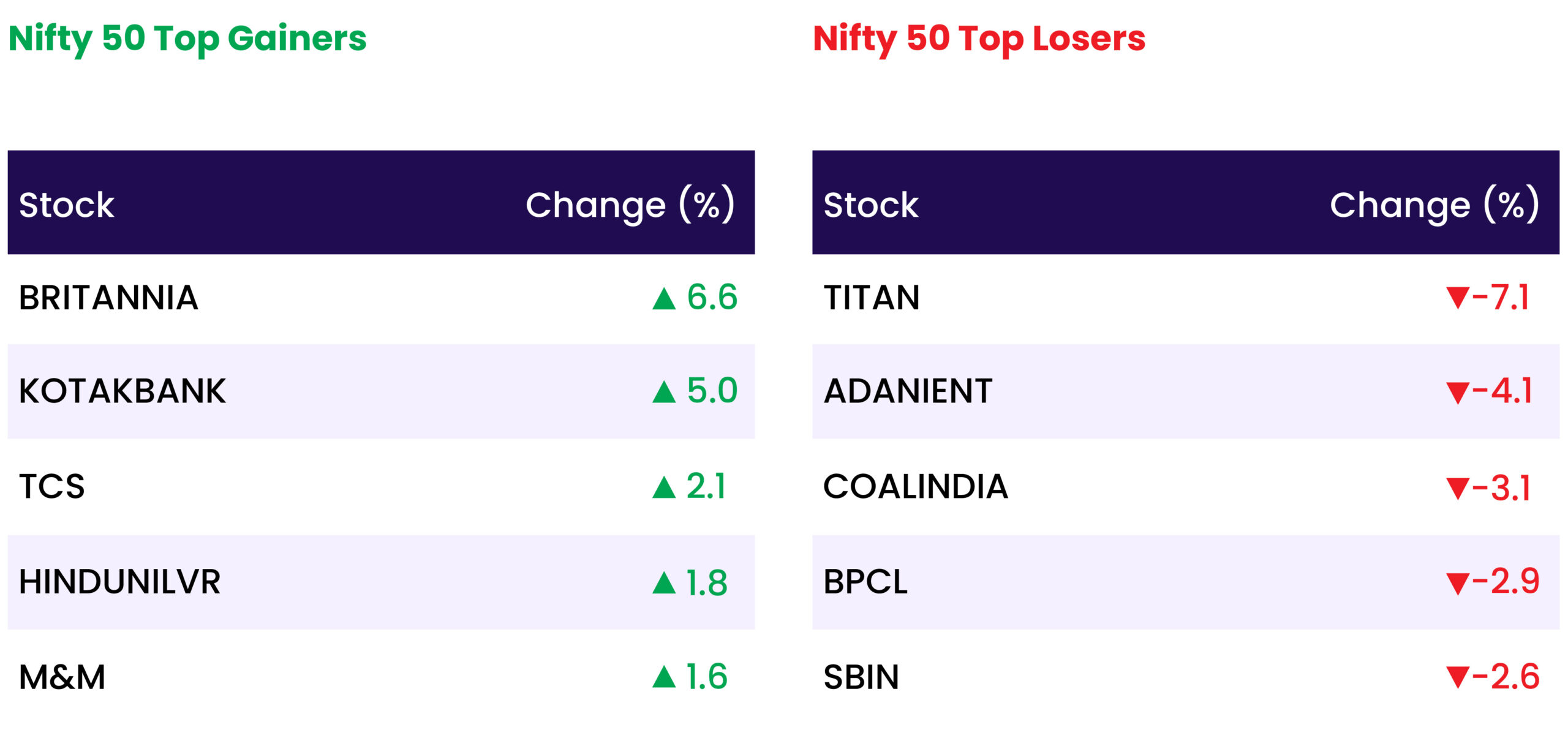

Titan, Adani Enterprise, BPCL, and Coal India were among the biggest losers of the day.

Index managed to sustain above 20-DEMA. Index is facing resistance at 22,780 level and need to sustain above the same for further move. Immediate next support levels are 22,300, 22,180. CNX PSU BANK, and CNX ENERGY are major indices that dragged most today.

Technical Overview – Bank Nifty

BANK NIFTY index closed at 48,895.30, down by 28.25 points/-0.06%. After opening higher and moving towards 49,250, index didn’t sustain and cracked down till 48,780 levels. Index traded and hovered around the 49,000 level. No big bullish move is expected till 50,000 levels are crossed. A major drag down was seen in Federal Bank, PNB, and Kotak bank.

Shooting Star candle formed on 30th April at an all-time high level, follow-up selling is seen in the index. Momentum oscillator 14-period RSI has a negative divergence. The index still sustained above 10-DEMA. PNB, Bank of Baroda, and SBIN were the biggest losers of the index today while Kotak Mahindra Bank sustained was up by almost 5%.

Index resistance levels are 49,130, 49,600, and 49,950 for upcoming trading sessions. Immediate support levels for the index are 48,500 and 48,000.

Indian markets:

- On Monday, May 6, the Indian stock market benchmarks, Sensex and Nifty 50, closed with a mixed performance. Shares of heavyweight companies like Titan, SBI, and Reliance Industries acted as major drags on these indices.

- The Indian stock market experienced significant volatility, with the India VIX index surging nearly 14% to around 17 on Monday.

- Among the sectoral indices, the Nifty Realty index saw a notable increase of 2.76%. However, the Nifty PSU Bank index witnessed a decline of 3.66%, while consumer durables and oil & gas sectors dropped by 2.55% and 1.75% respectively.

Global Markets:

- Asia-Pacific markets mirrored the gains seen on Wall Street on Monday, buoyed by a softer-than-expected U.S. jobs report which raised hopes of potential rate cuts by the Federal Reserve.

- Australia’s S&P/ASX 200 climbed by 0.7% to reach 7,682.4, extending its winning streak for the third consecutive day.

- Additionally, on Monday, S&P Global released composite purchasing managers’ index readings for Hong Kong, while service PMI readings were also unveiled for mainland China and India.

- Hong Kong’s Hang Seng index edged up by 0.47%, while mainland China’s CSI 300 surged by 1.48% to close at 3,657.88, as traders returned from the Labor Day holiday.

Stocks in Spotlight

- Despite Britannia Industries’ net profit falling more than anticipated, its stock surged by 6%. The company’s strategic pricing actions to maintain competitiveness and increased investments in brands, along with expanded distribution, contributed to a revival in market share.

- Tata Technologies witnessed a 3% decline in its shares following disappointing Q4 results. The company’s net profit for the March quarter dropped approximately 8% sequentially to Rs 157 crore, compared to Rs 170 crore in the previous quarter. This decline in profitability was primarily attributed to subdued revenue growth and reduced other income due to a one-time deferred tax asset write-back.

- Blue Dart shares soared by 5% after the company delivered results in line with expectations for the quarter ending March 2024, impressing analysts who maintained a ‘buy’ rating on the stock. As the leading player in India’s air express market with over 54% market share, analysts believe Blue Dart’s structural turnaround narrative remains intact, with temporary issues expected to dissipate soon.

News from the IPO world🌐

- Swiggy secures shareholder nod for a potential $1.2 billion IPO

- Indegene IPO fully subscribed on Day 1

- FirstCry’s parent firm Brainbees Solutions re-files IPO papers

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 2.8 |

| NIFTY IT | 0.9 |

| NIFTY MIDSMALL HEALTHCARE | 0.8 |

| NIFTY FMCG | 0.7 |

| NIFTY HEALTHCARE INDEX | 0.6 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1207 |

| Decline | 2726 |

| Unchanged | 161 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,676 | 1.2 % | 2.5 % |

| 10 Year Gsec India | 7.1 | (0.6) % | (0.2) % |

| WTI Crude (USD/bbl) | 79 | (4.5) % | 12.2 % |

| Gold (INR/10g) | 71,191 | 0.7 % | 6.6 % |

| USD/INR | 83.43 | (0.0) % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer