Technical Overview – Nifty 50

It was carnage selling in the Indian bourses for this week and the volatility was the only factor where traders were on the firing line for the entire week. The Benchmark index on the weekly chart has formed a bearish engulfing pattern and the index has witnessed a correction of more than 2 percent for the week.

The momentum oscillator RSI (14) has whipsawed its range breakout and drifted within the pattern with a bearish crossover on the cards. The Nifty50 on the daily chart is trading in a rising wedge pattern and prices have formed a bearish candle near the upper band of the pattern.

The Index on the daily chart is trading between 21 & 50 EMA and the breakout on either side initiates a trigger on either side. Technically speaking, from inter monthly perspective, all bullish eyes are still on the Nifty at the 21,800 mark. For the week, Nifty’s hurdles are at the 22,300 mark on a closing basis. That said, the downside risk, or rather the major support still seen at the Nifty 21,800 mark

Technical Overview – Bank Nifty

It was carnage selling in the Banking Index for this week and the volatility was the only factor where traders were on the firing line for the entire week. The Bank Nifty on the weekly chart has formed a tall bearish candle and the index has witnessed a correction of more than 2.50 percent for the week.

The Index has drifted below its 9 and 21 EMA and it is hovering near its 50 EMA on the daily time frame. The momentum oscillator RSI (14) has formed a rounding top near 65 levels and drifted lower near 50 levels with a bearish crossover on the cards.

The Banking Index on the daily chart has formed a long-legged Doji candle stick pattern which indicates volatility on both ends. The market context has changed for now as sellers use every smaller rally as a selling opportunity. The immediate support for the Bank Nifty is placed at 46,000 levels and 47,500 will act as an immediate resistance for the Banking index.

Indian markets:

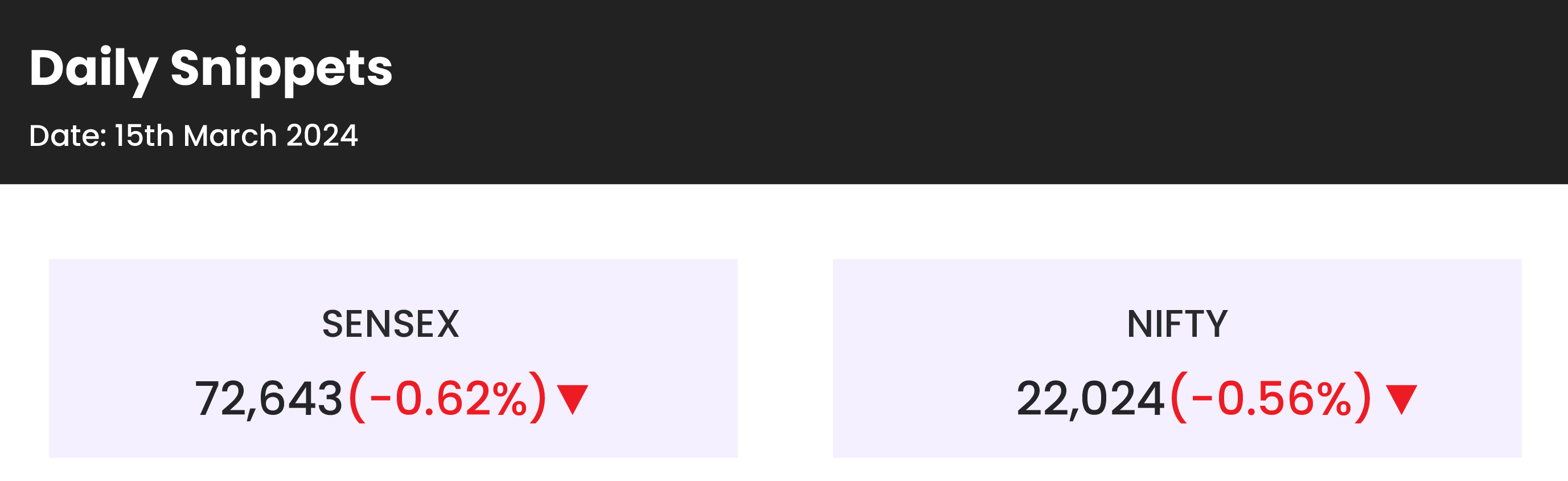

- The Indian stock market experienced broad-based buying on Thursday, March 14, facilitating commendable gains for the equity benchmarks – the Sensex and the Nifty 50.

- Despite mixed global signals, the Indian stock market continued its upward trajectory. Analysts suggest that institutional investors strategically amassed high-quality stocks post a recent correction, indicating their confidence in the resilience of the domestic market.

- The anticipation of robust economic expansion further enhances the attractiveness of the Indian stock market as an investment destination.

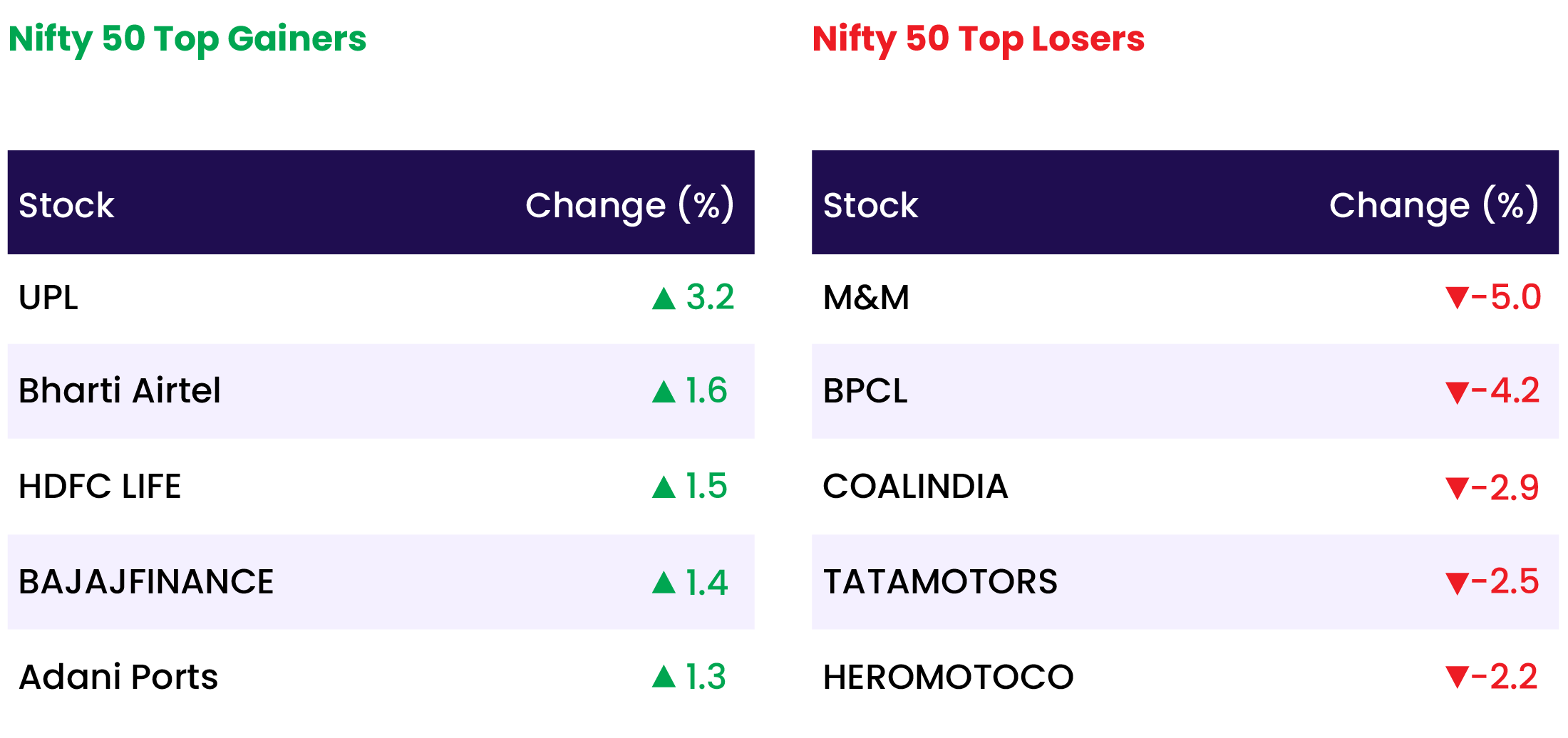

- Except for bank, all other sectoral indices ended in the green with telecom, power, oil & gas added 3 percent each, while auto, capital goods, FMCG, Information Technology, healthcare and metal rose 1-2 percent.

Global Markets:

- Japan’s largest companies reached an agreement with labor unions to implement the highest wage increase in 33 years on Friday.

- This development strengthens the belief that Japan’s central bank is on the brink of a significant departure from negative interest rates.

- Investors are closely monitoring decisions of other central banks, particularly regarding the pace of interest rate cuts, following efforts to mitigate rampant inflation.

- The upcoming meetings of the Bank of England and Swiss National Bank are under scrutiny in this context.

- While the Federal Reserve is not anticipated to adjust interest rates, unexpected increases in U.S. producer and consumer price data this week have prompted traders to moderate their expectations for future rate cuts.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Biocon witnessed a decline of over 4 percent following the acquisition of its subsidiary, Biocon Biologics’ India-branded formulation business, by Eris Lifesciences, a firm specializing in chronic therapy-focused drugs. The transaction, valued at Rs 1,242 crore, represents a favorable multiple of 3.4 times revenue and 18 times EBITDA. As part of the agreement, more than 430 employees linked with the business are set to transition to Eris.

- Larsen and Toubro Technology Services saw a rise of over 2 percent, reaching Rs 5,385, following the announcement of securing an Rs 800-crore order. The order entails the provision of advanced cyber security solutions for Maharashtra, aimed at bolstering public safety against cyber threats. In collaboration with KPMG Assurance and Consulting Services LLP as the forensics partner, the company is set to deliver these solutions as per an exchange filing statement.

- The US Food and Drug Administration (FDA) identified procedural and cleanliness concerns at Aurobindo Pharma subsidiary Eugia Pharma SEZ unit in Telangana. Following an inspection from February 19 to 29, the facility received seven observations in its Form 483, citing lapses in contamination prevention procedures and lack of maintenance of written records, resulting in unexplained discrepancies.

News from the IPO world🌐

- Shares worth $21 billion to enter market in 4 months as IPO lock-in period expires for 66 companies

- Vishal Mega Mart planning $1 billion IPO

- Transrail Lighting files IPO papers with Sebi; eyes Rs 450-cr via fresh issue

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY METAL | 0.03 |

| NIFTY FMCG | 0.02 |

| NIFTY MEDIA | -0.04 |

| NIFTY PRIVATE BANK | -0.04 |

| NIFTY REALTY | -0.17 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1811 |

| Decline | 2010 |

| Unchanged | 115 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,905 | (0.4) % | 3.1 % |

| 10 Year Gsec India | 7.0 | 0.0 % | (1.6) % |

| WTI Crude (USD/bbl) | 81 | 2.0 % | 15.3 % |

| Gold (INR/10g) | 65,420 | (0.4) % | 1.3 % |

| USD/INR | 82.91 | 0.1 % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer