Technical Overview – Nifty 50

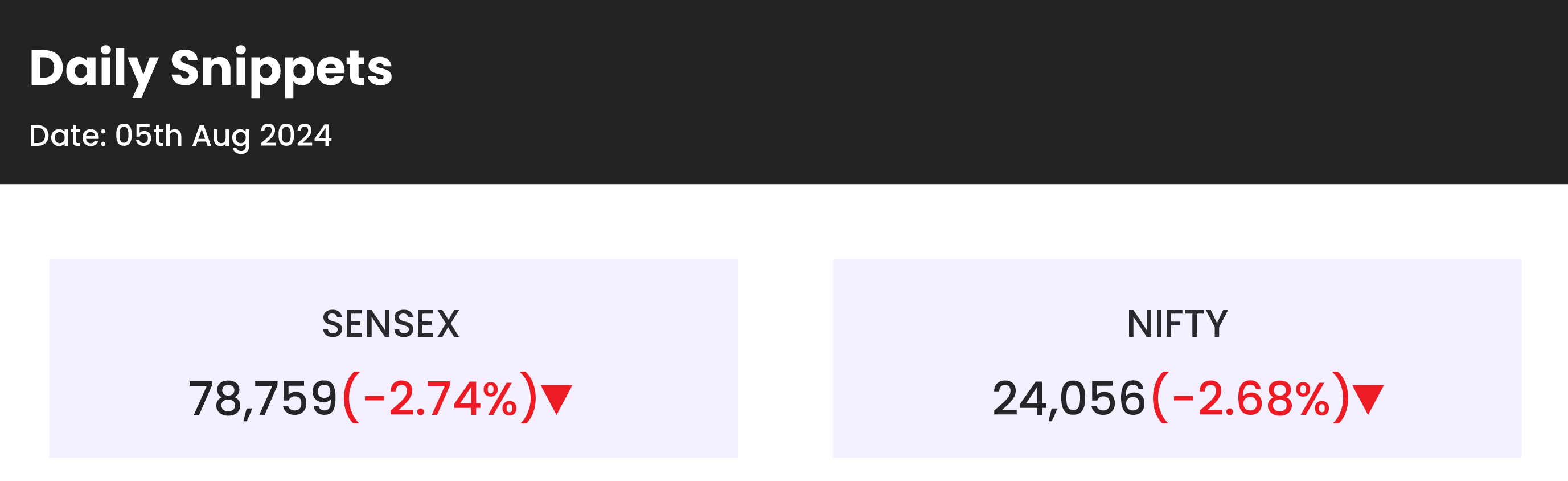

Due to the global discomfort, the Indian Bourses witnessed a massive gap down opening of more than 300 points which Is more than 1% and prices continued to trade lower throughout the day with strong negative bias. Towards the end, the Benchmark index closes more than 2.50% on the daily chart.

The Index on the daily has whipsawed its bullish breakout and prices entered within the rectangle pattern and drifted below 9 & 21 EMA. The momentum oscillator RSI (14) formed a negative divergence on 1st August and after that prices started to deteriorate the bullish momentum and formed a consecutive bearish candle.

On the weekly the index is still moving higher above the important moving average (EMA), suggesting that the upward momentum is still in place.

The view remains Bearish to sideways for the shorter term. The support levels for the upcoming sessions are at 23,800 and 23,700 and resistance at 24,400 and 24,500, respectively.

Technical Overview – Bank Nifty

The Banking index starts its week with a massive sell-off and prices have formed a tall bearish candle on the daily time frame. The gap remained unfilled for the day and will act as an immediate resistance for the Banking index. Towards the end, the Banking index closes more than 2.50% on the daily chart.

The Banking Index closed near its make-or-break levels where prices can either reverse or give a bearish breakdown on the daily chart. On the weekly time frame, the prices form a rounding top-like formation which indicates distribution formation for the short term.

Based on benchmark index OI data, a base formation may take place at the 51,500 level. The resistance and support levels for the upcoming sessions are 49,700, and 49,000 for resistance, and 51,000, and 51,500 for support.

Indian markets:

- On August 5, benchmark indices faced a tough day, declining nearly three percent each as weak global cues stoked recession fears among investors, leading to a broad-based selloff.

- India’s VIX surged over 42% to approximately 20.37, marking a 52% increase, the highest since August 2015 and a nine-year peak.

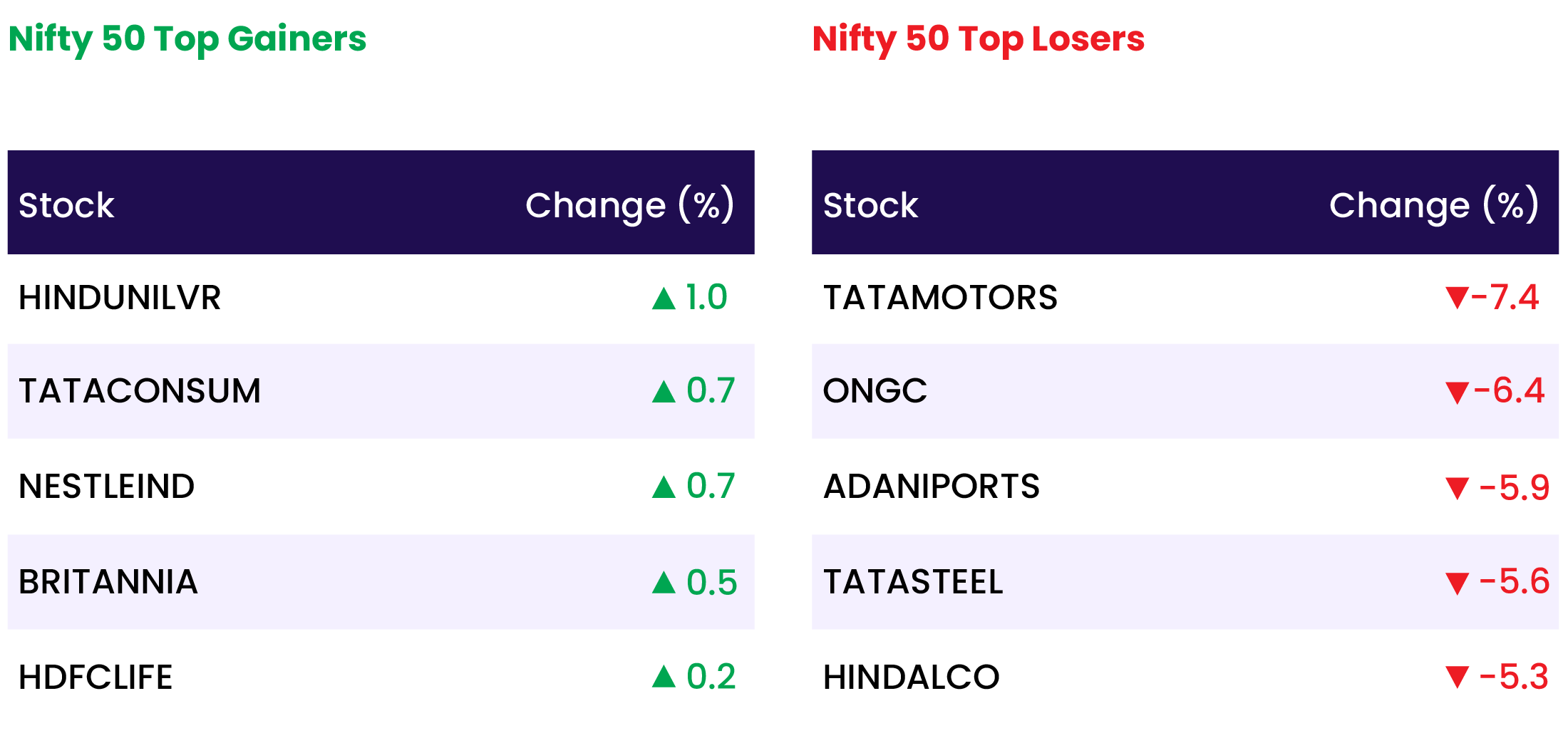

- In today’s session, all 13 sector indices plunged, with Nifty Metal and Realty facing the steepest declines, dropping 5% and 4.5%, respectively. Metal stocks like Tata Steel, Hindalco, and JSW Steel were the major laggards.

- The Nifty Auto and Energy indices also fell significantly, losing nearly 4%. Tata Motors emerged as the top loser on the Nifty, plummeting almost 8%.

Global Markets:

- On Monday, Japan’s stock markets confirmed a bear market as the sell-off across Asia-Pacific continued from last week, with the Nikkei 225 and Topix both plunging over 12%.

- South Korea’s Kospi dropped 8.77%, while the small-cap Kodaq experienced a 11.3% decline. This decline followed Friday’s sharp losses, where Japan’s Nikkei 225 and Topix fell more than 5% and 6%, respectively. The Topix recorded its worst day in eight years, and the Nikkei had its worst day since March 2020.

- In Monday’s trading, the yen strengthened to its highest level against the dollar since January, trading at 142.09. Taiwan’s benchmark index, the Taiwan Weighted Index, dropped over 8%, hit hard by declines in tech and real estate stocks. Australia’s S&P/ASX 200 fell 3.7%.

- The Hong Kong Hang Seng index decreased by 1.62% in its final hour of trading, while mainland China’s CSI 300 fell 1.21%, showing the smallest loss in Asia.

- In the U.S. on Friday, stocks fell sharply following a much weaker-than-expected jobs report for July, raising concerns about a potential recession.

Stocks in Spotlight

- Bharat Forge Shares declined over 6 percent following a drop in Class-8 truck orders in North America, reaching a 15-month low in July.

- Marico Shares increased by 1.5 percent after the company reported a year-on-year rise in revenue, net profit, EBITDA, and margin for the June quarter.

- On August 5, Bharti Airtel reported a significant increase in its Q1 FY25 net profit, rising to Rs 4,160 crore from Rs 1,612 crore in the same quarter the previous year, surpassing Street expectations. The telecom giant’s revenue for the April-June quarter grew to Rs 38,506 crore, up from Rs 37,440 crore a year earlier.

News from the IPO world🌐

- Ola Electric IPO subscribed 64% in 2 days.

- FirstCry set to open 6th Aug 2024.

- Unicommerce eSolutions set to open 6th Aug 2024.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY FMCG | -0.3 |

| NIFTY PHARMA | -1.5 |

| NIFTY HEALTHCARE INDEX | -1.7 |

| NIFTY MIDSMALL HEALTHCARE | -2.0 |

| NIFTY PRIVATE BANK | -2.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 664 |

| Decline | 3414 |

| Unchanged | 111 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,737 | (1.5) % | 5.4 % |

| 10 Year Gsec India | 7.0 | 1.0 % | 12.3 % |

| WTI Crude (USD/bbl) | 74 | (3.7) % | 4.5 % |

| Gold (INR/10g) | 68,799 | (0.8) % | 3.1 % |

| USD/INR | 83.73 | 0.0 % | 0.8 % |

Please visit www.fisdom.com for a standard disclaimer