Technical Overview – Nifty 50

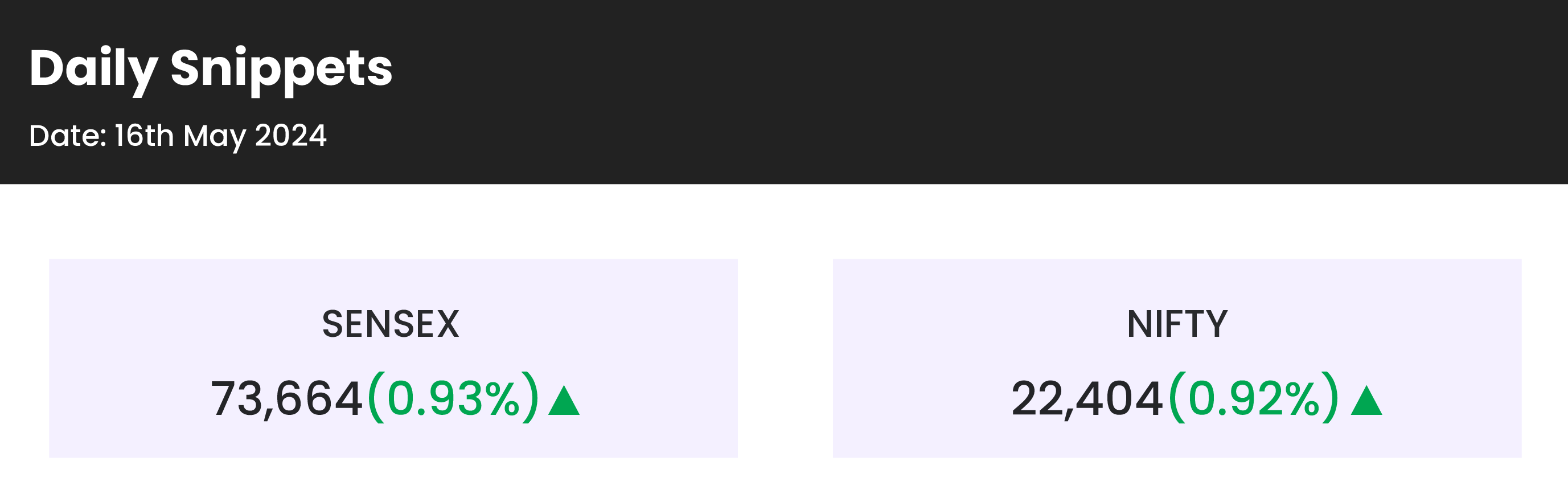

The benchmark NIFTY index moved by 203 points / 0.92%, to settle at 22,404. The index had a wild ride; it gapped up 100 points at first but couldn’t hold on. The index saw significant volatility today, but it was still able to close at the day’s high, about 300 points above the day’s low.

Momentum indicator 14 period RSI has now moved above 50 indicating a bullish momentum to continue. Index is currently above the 10, 20, and 50 DEMAs. The ADX now at 18; ADX below 20 is considered non-momentum. Channel lower band is intact, and reversal indicators appear to be active and noticeable.

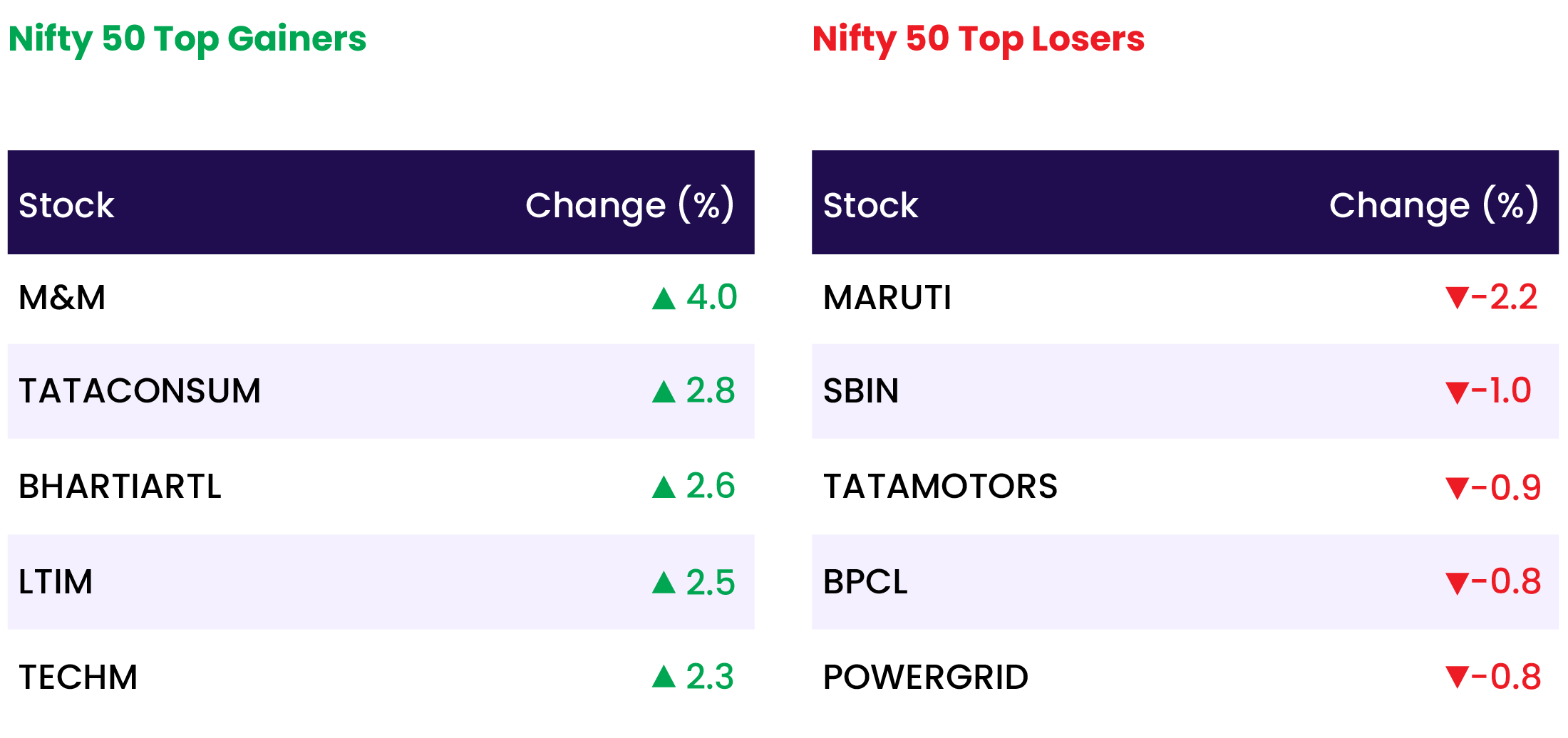

India VIX falls by almost 1.40% after benchmark index rises close to 1% in last leg of the session, now below 20, closed at 19.99. Tata Consumer, Mahindra & Mahindra, Tech Mahindra were top movers for the day.

Support levels for the benchmark index are 22,050 and 21,900 zones. Upcoming sessions will use resistance levels of 22,500 and 22,600.

Technical Overview – Bank Nifty

The BANK NIFTY index moved by 290 points / 0.61%, to settle at 47,977. Pin Bar/ Hammer candle has formed neat to channel lower band. Index is still trading below the 10 and 20 DEMA, but it was able to hold and close above the 50-DEMA.

The 14-period RSI momentum indicator is currently at 48, not much of a change for the day. When the 14-period ADX is below 20, it indicates sideways or non-momentum changes in the index.

The top performers of the day are HDFC Bank and Kotak Mahindra Bank, while Bandhan Bank fell by about 5% and SBIN fell close to 1%.

The resistance levels for the index in the upcoming trading sessions are 48,200 and 48,600. The index’s immediate support levels are 47,300 and 46,950.

Indian markets:

- Indian stock market indices, including the Sensex and the Nifty 50, closed nearly one percent higher on Thursday, May 16, buoyed by late-session buying across various sectors amidst mixed global signals.

- Following the lead of major Asian markets, Indian stocks rose, driven by optimism that the Federal Reserve might initiate a cycle of rate cuts, fueled by softer April inflation figures in the US.

- Although banking and IT sectors saw notable gains, power stocks underperformed. Yet, concerns lingered over foreign institutional investor (FII) selling and uncertainties surrounding election outcomes.

- Despite fluctuations, the broader market sustained its upward trajectory, with both the BSE Midcap and BSE Smallcap indices surging by over one percent each.

Global Markets:

- Asia-Pacific markets rallied on Thursday following record highs on Wall Street, buoyed by softer inflation data and scrutiny of Japan’s GDP figures.

- In the U.S., the April Consumer Price Index (CPI) edged up by 0.3%, falling short of Dow Jones’ forecast of a 0.4% increase. However, the year-over-year CPI rose by 3.4%, aligning with market expectations.

- Japan’s first-quarter GDP contracted at an annualized rate of 2%, surpassing the Reuters poll prediction of 1.5%. This unexpected downturn could potentially impact the Bank of Japan’s intentions to raise interest rates.

- In market specifics, Japan’s Nikkei 225 surged by 1.39%, while the broader Topix index also ended higher by 0.24%.

- Hong Kong’s Hang Seng index reopened after a holiday with a notable 1.43% gain, while Mainland China’s CSI 300 index climbed by 0.39%.

- The Taiwan Weighted Index reached a new record closing high, up by 0.74%.

- South Korea’s markets resumed trading after a holiday break, witnessing the Kospi rising by 0.75% and the smaller-cap Kosdaq adding 0.8%.

- Meanwhile, Australia’s S&P/ASX 200 index surged by 1.65%

Stocks in Spotlight

- Bharti Airtel emerged as the leading Nifty gainer on May 16, surging by up to 3 percent. Market optimism was fueled by expectations of forthcoming tariff increases, enhanced average revenue per user (ARPU), and the expansion of its 5G network. Despite the telecom major witnessing a 31.1 percent decline in consolidated net profit for the March quarter of the financial year 2023-24, brokerages maintained their bullish outlook on Bharti Airtel.

- Canara Bank’s shares dropped by approximately 6 percent as investors hurried to lock in profits following recent significant advances. The stock garnered attention in recent days following its inclusion in the MSCI Global Standard index.

- Titagarh Rail Systems saw its shares surge by over 9 percent as the company reported strong earnings for the March quarter of FY24. The rail wagon manufacturer witnessed a notable increase in net profit, up by 64 percent year-on-year to Rs 79 crore in Q4 FY24, compared to Rs 48.2 crore in the same quarter of the previous fiscal year. Additionally, revenue climbed by 8 percent year-on-year to Rs 1,052.4 crore in the corresponding quarter.

News from the IPO world🌐

- Go Digit retail portion subscribed 1.4 times

- Awfis Space Solutions Limited IPO to open on May 22

- Aadhar Housing Finance makes a flat debut

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY CONSUMER DURABLES | 1.7 |

| NIFTY IT | 1.7 |

| NIFTY REALTY | 1.6 |

| NIFTY MEDIA | 1.2 |

| NIFTY FINANCIAL SERVICES | 1.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2125 |

| Decline | 1706 |

| Unchanged | 121 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,908 | 0.9 % | 5.8 % |

| 10 Year Gsec India | 7.1 | (0.1) % | (0.4) % |

| WTI Crude (USD/bbl) | 78 | (1.4) % | 10.9 % |

| Gold (INR/10g) | 72,920 | (0.1) % | 7.6 % |

| USD/INR | 83.51 | (0.0) % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer