Technical Overview – Nifty 50

Benchmark index NIFTY closed flat at 22,302.50. Flat closing for the benchmark index. The Benchmark index rose 180 points in the first half of the session but didn’t sustain and fell again near 22,300 levels. The index is not sustaining the rise and every rise is possibly a sell. There is a heavy Open-Interest at 22,400 and 22,500 level for the upcoming expiry (9th May). So, we can see a major resistance between 22,400 and 22,500 levels.

After making a new All Time High Benchmark Index has almost corrected 500 points down 2% in just 4 sessions. Thursday’s session still saw some rise sustaining above 50-DEMA. The index is now near to upward trend line as seen in the above chart. Momentum indicator 14 period RSI remained at 47 levels, still below 50. India’s VIX was again up by almost half a percent nearing 17.10 levels.

NSE Midcap 100 Index and NSE Small Cap 100 Index both sustained above yesterday’s close and both indices were almost up by 0.73% and 0.57% respectively.

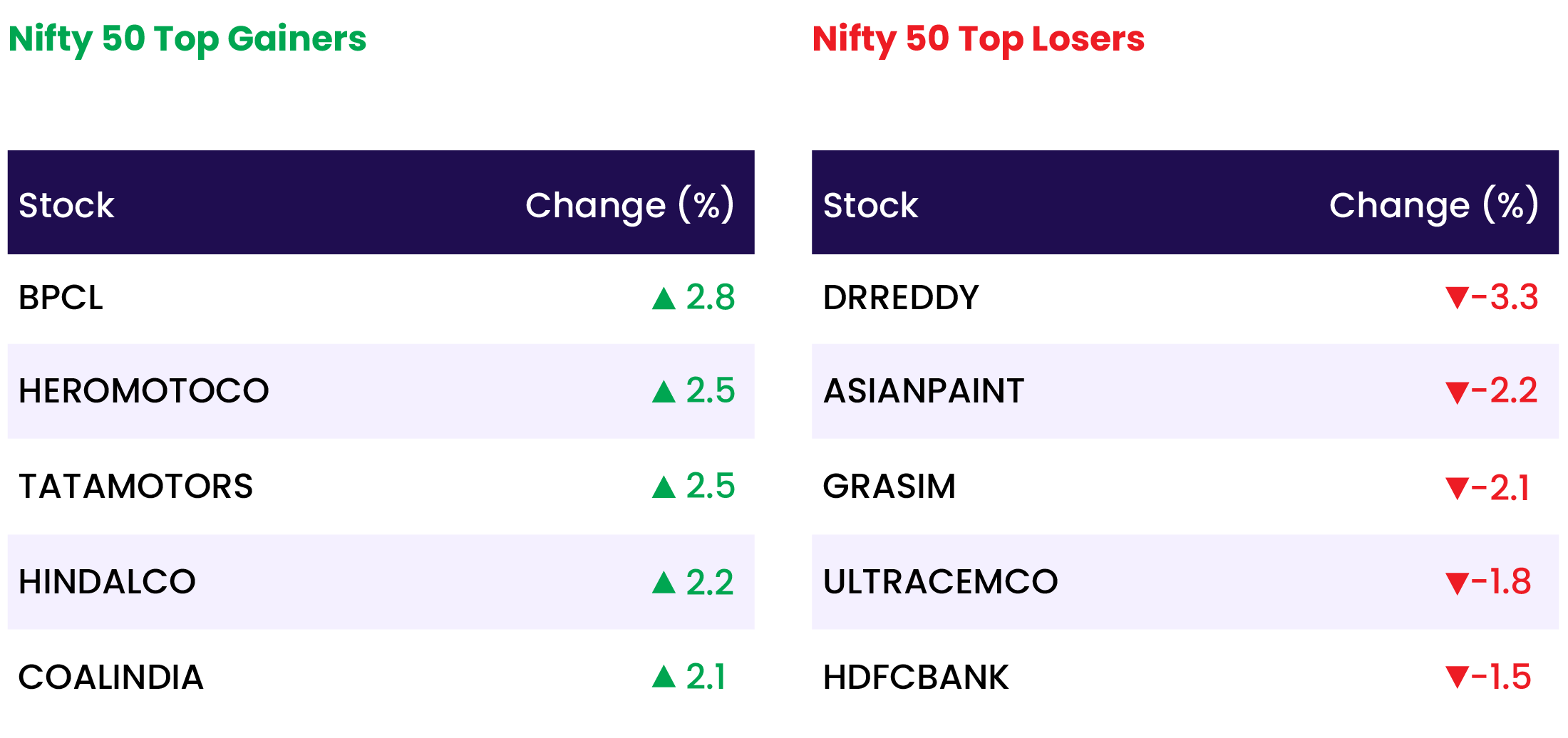

The index is facing resistance at 22,400, and 22,5000 levels and needs to sustain above the same for further moves. Immediate next support levels are 22,180, 22,100. Oil & Gas and Auto stocks showed momentum, Hero Moto Corp, Tata Motors, BPCL, and Coal India were the biggest gainers of the day while HDFC Bank and HUL were among the top draggers of the day.

Technical Overview – Bank Nifty

BANK NIFTY index closed at 48,021, down by 264 points/-0.55%. Index cracked for 6th consecutive session. With election results coming up market is witnessing quite high volatility. Index consolidated over the whole session and hovered around 48,200 – 47,850 levels. The index is now down 2000 points / 4% from The Time High of 49,970 level.

Shooting Star candle formed on 30th April at an all-time high level, follow-up selling is seen in the index. RSI is now near to 48. An index is now below 10 & 20 DEMA. PNB and Bank of Baroda are the highest gainers of today while HDFC Bank was down by 1.60%.

Index resistance levels are 48,250, and 48,450 for upcoming trading sessions. Immediate support levels for the index are 47,750 and 47,400.

Indian markets:

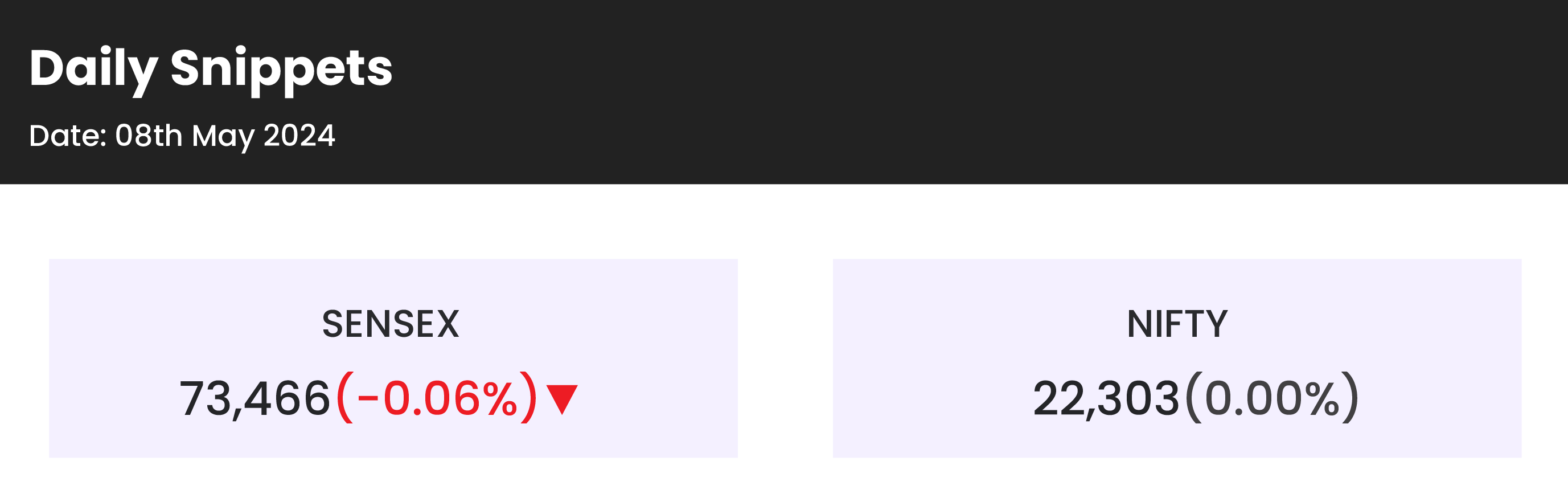

- On Wednesday, May 8th, the Indian stock market benchmarks, the Sensex and the Nifty 50, ended the day without significant change. While certain heavyweights like Reliance Industries, Larsen & Toubro, and Tata Motors saw gains, these were balanced by losses in HDFC Bank, ICICI Bank, and Infosys shares.

- Throughout the session, the major equity indices experienced volatility, reflecting cautious investor sentiment preceding the Lok Sabha election outcome on June 4th.

- Analysts observed a pattern of foreign portfolio investors (FPIs) selling Indian equities ahead of the election, a trend seen in previous instances.

- Nevertheless, the broader markets demonstrated resilience, with the BSE Smallcap rising by 0.5 percent and the BSE Midcap edging up by 0.8 percent, recovering from losses of nearly 2 percent each recorded the day before.

Global Markets:

- Asia-Pacific markets witnessed declines on Wednesday, with Japan stocks leading the downturn as investors analyzed earnings reports from the region’s major companies, including Toyota Motor and Mitsubishi.

- Japan’s Nikkei 225 dropped by 1.63%, while the broader Topix index ended 1.45% lower. Both indexes reached their lowest levels in nearly two weeks.

- The Straits Times Index fell by 1.29%, Hong Kong’s Hang Seng index dropped by 0.77%, and mainland China’s CSI 300 index lost about 0.8%.

- On a positive note, South Korea’s Kospi index climbed 0.39% to reach its highest level in over a month, while the small-cap Kosdaq reversed losses, rising 0.13% and also reaching a month-high.

- Meanwhile, Australia’s S&P/ASX 200 edged up by 0.14%, marking a five-day winning streak.

Stocks in Spotlight

- Bharat Forge shares surged by almost 16 percent following the company’s impressive Q4 earnings report and optimistic outlook for FY25. The company’s net profits increased by 59.3 percent year-on-year to Rs 389.6 crore. Baba Kalyani, Chairman and MD of Bharat Forge, expressed confidence in the company’s growth prospects for FY25, citing anticipated expansion in the defence and industrial casting sectors, as well as improved capacity utilization in overseas operations. Kalyani expects a turnaround in overseas business along with margin enhancements in other verticals to drive robust profitability growth in FY25.

- Paytm’s stock fell by 5 percent, triggering a lower circuit, following reports that Aditya Birla Finance, a key lending partner, invoked loan guarantees due to repayment defaults by customers. Additionally, other lenders like Piramal Finance and Clix Capital terminated their partnerships with Paytm after the RBI prohibited Paytm Payments Bank from conducting operations. During the session, the stock also reached its all-time low level.

- Voltas shares declined by 4 percent following a 19 percent decrease in its net profit for the March quarter to Rs 116 crore. The EBITDA margin stood at 4.5 percent, down by 280 basis points compared to the previous year. Morgan Stanley remarked that the AC segment’s margins were disappointing, attributing it to ongoing losses in the project business. Despite this, the brokerage maintained its equal-weight call, setting a price target of Rs 1,160 per share.

News from the IPO world🌐

- Swiggy secures shareholder nod for a potential $1.2 billion IPO

- Aadhar Housing Finance IPO booked 19% so far on the first day.

- FirstCry’s parent firm Brainbees Solutions re-files IPO papers

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY OIL & GAS | 1.7 |

| NIFTY AUTO | 1.6 |

| NIFTY METAL | 1.5 |

| NIFTY MEDIA | 0.9 |

| NIFTY PSU BANK | 0.9 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2128 |

| Decline | 1667 |

| Unchanged | 131 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,884 | 0.1 % | 3.1 % |

| 10 Year Gsec India | 7.2 | 0.1 % | 0.6 % |

| WTI Crude (USD/bbl) | 78 | 0.0 % | 11.4 % |

| Gold (INR/10g) | 71,123 | (0.0) % | 6.4 % |

| USD/INR | 83.47 | 0.1 % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer