Hot stuff this week: ONDC Vs Zomato-Swiggy

The Open Network for Digital Commerce (ONDC), supported by the government, has captured the attention of social media users in the past week. The platform has garnered widespread acclaim from users who have lauded for its ability to offer superior pricing for products when compared to industry giants like Zomato and Swiggy, which dominate the food delivery sector.

What is ONDC?

ONDC is just a network that anyone can ride on to enhance their business. ONDC is actually a private company that has been backed by various institutional investors like State Bank of India, Kotak Mahindra Bank, HDFC Bank, NSDL and BSE Investments. However, it is registered as a non-profit organisation.

Consider the analogy of UPI (Unified Payments Interface) for a moment. When a company intends to incorporate UPI payments into its application, it doesn’t have to engage with each bank across the nation individually. Instead, it can seamlessly integrate with the existing UPI network. This interconnectedness enables the banks and payment applications within the network to effortlessly communicate and collaborate.

Likewise, the functioning of ONDC follows a similar principle. It involves the presence of a third-party application, acting as a mediator connecting restaurants, other businesses, and consumers like us. This intermediary platform facilitates smooth and efficient interactions, allowing businesses and buyers to engage seamlessly with each other.

How does ONDC work in the food delivery segment?

Seller App: The process begins with the presence of a seller app, such as Magicpin or eSamudaay. These apps take on the responsibility of onboarding and aggregating all the restaurants in a particular area. They act as the intermediary between the restaurants and the ONDC network.

Joining the ONDC Network: Once the restaurants are onboarded by the seller apps, they become part of the ONDC network. This network facilitates seamless connections between various buyer apps and the restaurants.

Buyer App: Buyer apps, such as Paytm, come into the picture. These apps have already established themselves as consumer-facing platforms with a large user base. When they join the ONDC network, they can interact with the seller apps, such as Magicpin or eSamudaay.

Adding ‘Food’ Tab: As part of integrating with the ONDC network, buyer apps like Paytm can create a new section within their app called ‘Food’. This tab enables users to access a wide range of restaurants that were aggregated by seller apps like Magicpin or eSamudaay.

The key advantage of this system is that restaurants become visible across all buyer apps without the need for individual tie-ups. This streamlined approach enhances convenience for customers and provides broader exposure for restaurants, benefiting both parties involved in the food-ordering process.

Why is ONDC considered as a threat to Zomato and Swiggy?

Restaurants pay a commission for utilizing the services of the food-ordering platform. However, the commission charged is significantly lower compared to what Zomato and Swiggy typically charge. Reports suggest that the commission can range from 4% to 10% of the order value. This commission is likely to be divided among the seller app (e.g., Magicpin), the buyer app (e.g., Paytm), and ONDC.

The commission earned from restaurants is shared among the different entities involved in the food-ordering process. The seller app, buyer app, and ONDC each receive a portion of the commission as compensation for their respective roles in facilitating the transactions.

In addition to the restaurant commission, the customer pays a delivery charge. This charge is paid to a delivery service provider like Dunzo or a similar entity responsible for the actual delivery of the food to the customer’s location.

Through this process, each entity involved in the food-ordering ecosystem has the opportunity to earn revenue. The seller app, buyer app, ONDC, and the delivery service provider receive their share of earnings, allowing all participants to generate earnings from their involvement in the food delivery process.

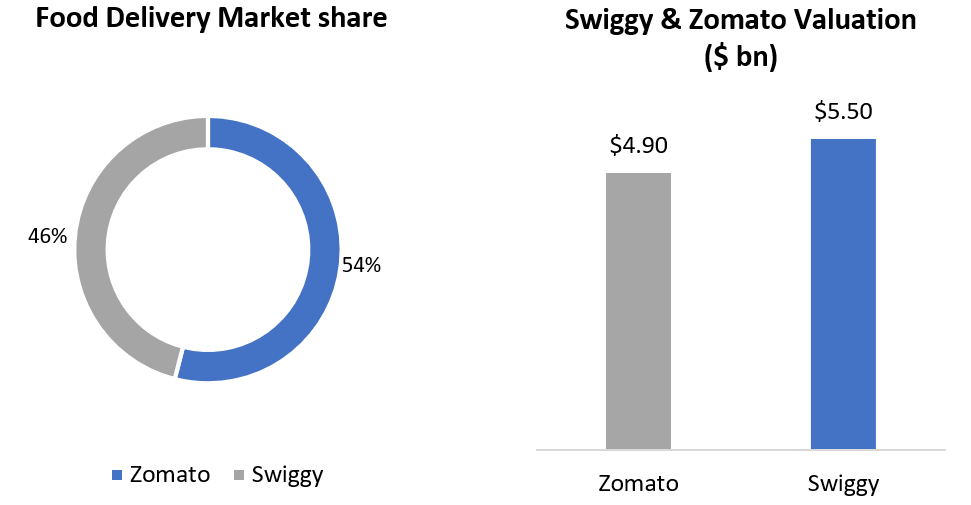

Meanwhile below is market share of these companies and breakup of their valuation:

Source: ET, Fisdom Research, Valuation as on 31st Jan 2023

Is ONDC really a threat?

Everything is cheaper on the ONDC network. And the reason is discounts. The ONDC platform is poised to revolutionize the food delivery landscape by empowering restaurants to directly sell their offerings to consumers through buyer apps. One of its significant advantages is the substantially reduced commission rates it imposes, which are less than half of what industry giants like Swiggy and Zomato typically charge, ranging between 18% and 25%. This lower fee structure enables restaurants and food chains to price their products more competitively, benefiting both businesses and customers alike.

Similar to how Zomato and Swiggy used venture capital funds to entice users with discounts, ONDC is also burning cash of its investors. There’s no denying that this endeavor comes at a cost. As part of their strategy, ONDC is offering a ₹50 incentive to buyer apps such as Paytm, which is directly passed on to customers as a flat discount when they place their orders. Additionally, companies like Shadowfax, responsible for the last-mile delivery of food from restaurants to customers’ doorsteps, receive an incentive of ₹75.

ONDC might soon find itself at a crucial juncture where it can no longer sustain burning through its cash reserves. While it operates as a not-for-profit entity, it is important to acknowledge the significant investments made by its backers, who have injected substantial amounts of capital into the platform. With an astonishing surge in daily transactions, soaring from 1,000 to over 20,000 within a matter of weeks, ONDC has recognized the need to reassess its discounting strategy and introduce certain terms and conditions. According to reports from media sources, the buyer app has initiated measures to limit the discount to a specific number of users.

Consequently, the era of mega discounts appears to be diminishing, signaling a potential price parity with other food delivery aggregators. Undoubtedly, the primary allure of ONDC lies in its ability to provide more affordable prices. However, it was expected that these discounts would eventually be curtailed. In fact, this adjustment has transpired relatively quickly. It is important to bear in mind that ONDC remains a private enterprise that necessitates financial resources to cover its operational expenses at the very least.

While the operational part of ONDC is considered as a revolutionary move there have been concerns around the user experience in terms of receiving wrong orders and delayed deliveries. There is lack of customer support and interaction where Swiggy and Zomato still dominate the space.

Niche players like Zomato and Swiggy eventually might not run out of business as they control the entire user experience.

Is Magicpin the new disruptor?

Magicpin plays a pivotal role in facilitating the majority of retail orders on ONDC through its multi-faceted involvement. In fact, it actively participates in approximately 90 percent of transactions, demonstrating its significance within the ecosystem.

First and foremost, Magicpin stands as the largest seller-side app on ONDC, boasting an impressive roster of 40,000 sellers. As a crucial intermediary within the interoperable e-commerce network, seller-side apps serve as the connecting link between sellers and the ONDC platform. They play a vital role in digitizing sellers’ catalogs, enabling seamless payments, and providing essential training to ensure optimal e-commerce practices and quality fulfillment.

Moreover, Magicpin assumes the role of a logistics aggregator for merchants. When an order is placed, Magicpin’s robust backend logistics platform efficiently dispatches order details to multiple last-mile delivery companies, just like taxi aggregators like Uber and Ola allocate rides to drivers. Leveraging an algorithm and considering the availability of delivery partners, a suitable rider from one of these last-mile delivery companies is assigned to fulfill the order promptly.

Furthermore, Magicpin serves as a technology service provider for buyer-side apps, the interface through which consumers access and engage with products on the ONDC platform. For instance, when a user clicks on ONDC within the Paytm app, they are seamlessly redirected to an interface bearing the label “Powered by Magicpin.” While seller-side apps primarily serve the business-to-business (B2B) function within the network, buyer-side apps cater to the business-to-consumer (B2C) segment.

This integrated interface provided by Magicpin serves as a gateway, comparable to renowned payment gateways like Razorpay or Juspay, allowing any platform aspiring to join the ONDC network as a buyer-side app to effortlessly plug in and participate in the ecosystem. This ready-to-use interface significantly simplifies the onboarding process for new platforms, fostering seamless integration and engagement within the ONDC network.

With its notable first-mover advantage in the thriving ONDC ecosystem, which is widely regarded as the e-commerce counterpart to the unified payments interface (UPI), Magicpin finds itself in a promising position.

In its recent Series D funding round, Magicpin successfully secured a substantial investment of $61 million which is equal to approximately Rs. 446 crores with Zomato taking the lead as the prominent investor. So technically Zomato has 16% stake in Magicpin!

Markets this week

| 08th May 2023 (Open) | 13th May 2023 (Close) | %Change | |

| Nifty 50 | 18,121 | 18,315 | +1.1% |

| Sensex | 61,166 | 62,028 | +1.4% |

Source: BSE and NSE

- Markets witnessed ended on a positive note.

- Indian equity markets witnessed significant gains, closing over 1 percent higher amidst a volatile week.

- Positive global market trends, including favorable US inflation numbers and jobs data, influenced the domestic market.

- US inflation moderating below 5 percent brought relief to investors, suggesting effective management of inflation levels by the Federal Reserve.

- However, concerns arose due to weak macroeconomic data, including elevated jobless claims and a modest rise in producer prices, impacting market sentiment towards the latter half of the week.

- Foreign institutional investors (FIIs) made substantial equity purchases of Rs 7,750.35 crore, whereas domestic institutional investors (DIIs) offloaded equities worth Rs 1,261.98 crore.

- In the current month, FIIs have accumulated equities worth Rs 13,278.11 crore, contrasting with DIIs who have sold equities worth Rs 3,997.23 crore.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| IndusInd Bank | ▲ +12.61% | Dr Reddy’s Lab | ▼ -9.64% |

| TATA Motors | ▲ +8.14% | Hindalco Industries | ▼ -6.79% |

| Eicher Motors | ▲ +8.08% | L&T | ▼ -6.58% |

| M&M | ▲ +5.35% | UPL | ▼ -5.13% |

| Axis Bank | ▲ +5.24% | JSW Steel | ▼ -4.19% |

Source: BSE

Stocks that made the news this week:

👉Following the release of its Q4 results, Dr. Reddy’s witnessed a notable decline percent in its stock price, reflecting market apprehension. While the drugmaker reported an impressive tenfold increase in net profit for the quarter, rising from Rs 87.5 crore to Rs 959.2 crore compared to the same period last year, it fell short of the estimated figure of Rs 1,093.6 crore as projected by analysts. This discrepancy between actual performance and market expectations, coupled with concerns raised by brokerages regarding the company’s growth path, has cast a shadow of caution over Dr. Reddy’s.

👉Hindalco Industries, witnessed a significant drop in its share price, following disappointing Q4 numbers reported by its wholly owned subsidiary, Novelis. With Novelis accounting for over 60 percent of Hindalco’s overall revenue, the company’s lackluster performance had a notable impact. Novelis reported a 27 percent year-on-year decline in net income, amounting to $156 million, while net sales dipped by 9 percent to $4.4 billion for the fourth quarter.

👉IndusInd Bank witnessed a notable surge in its share price. This surge was triggered by UBS’s decision to upgrade the private sector lender’s rating from ‘neutral’ to ‘buy’. UBS emphasized the positive outlook for the bank, citing the favorable corporate credit cycle and the peaking of interest rates. Additionally, they noted that the bank’s operating metrics would be supported by the stability observed in corporate, commercial vehicle (CV), and microfinance institution (MFI) cycles.