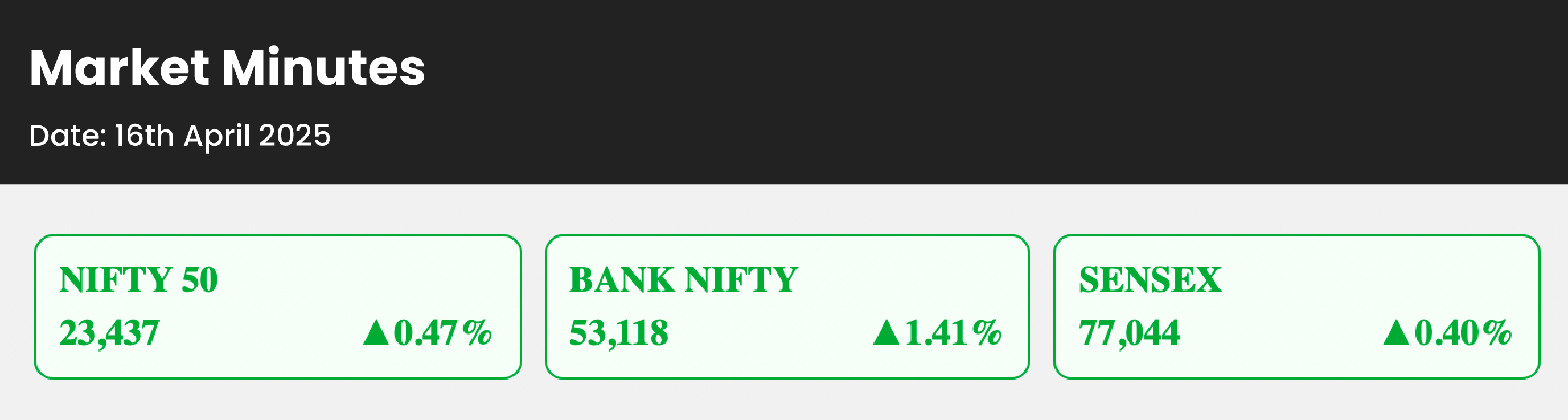

Market Snapshot

- Benchmark indices ended higher on Wednesday, with the Sensex up over 300 points and Nifty closing above 23,400, driven by late-session buying in financial and heavyweight stocks.

- Banking stocks surged for the third consecutive session, supported by softer inflation data and rising expectations of an RBI rate cut.

- Foreign investors net bought ₹6,065 crore on Tuesday—their highest single-day inflow since March 27—boosting market sentiment.

- IMD’s above-average monsoon forecast uplifted sentiment in FMCG, rural consumption, and agri-related sectors.

- The rupee appreciated 26 paise to 85.54 against the USD, supported by strong FII inflows, weak dollar, and a decline in crude oil prices, amid retail inflation falling to a nearly six-year low at 3.34%.

Sectoral Trends

|

Sector Name |

% Change |

Sector Name |

% Change |

|

NIFTY PSU BANK |

2.4 |

NIFTY FMCG |

0.8 |

|

NIFTY MEDIA |

1.9 |

NIFTY REALTY |

0.7 |

|

NIFTY PRIVATE BANK |

1.7 |

NIFTY CONSUMER DURABLES |

0.6 |

|

NIFTY OIL & GAS |

1.3 |

NIFTY METAL |

0.3 |

Top News

- Metal stocks declined on April 16 as the Nifty Metal index fell nearly 1%, dragged by heavyweights like Hindalco and JSW Steel, amid rising US-China trade tensions following the US probe into new tariffs on critical mineral imports.

- IREDA surged 7% after posting a strong Q4FY25 performance with a 49% YoY rise in net profit to ₹501.55 crore, driven by robust growth in its core lending operations.

- Banking stocks continued their rally, lifting the Nifty Bank index by over 380 points, supported by easing inflation at a 67-month low and gains in stocks like Bank of Baroda, Federal Bank, and Canara Bank.

Top Gainers and Losers

|

Top Gainers |

% Change |

Top Losers |

% Change |

|

INDUSINDBK |

6.7 |

MARUTI |

-1.6 |

|

AXISBANK |

4.3 |

HINDALCO |

-1.3 |

|

ONGC |

3.5 |

TATAMOTORS |

-1.0 |

Trade Ideas Update

- Our trade ideas success rate has 73% over the past month, even with increased volatility in the benchmark index. Follow Trade Ideas for timely stock insights.