In India, the stage is set for an exceptionally vibrant festive season, with various high-frequency indicators signalling robust growth in consumer expenditure. September saw record-breaking car sales, driven by festive-season bookings and new car launches.

The Goods and Services Tax (GST) collection remained strong, surpassing Rs 1.62 lakh crore, with states like Maharashtra, Karnataka, Tamil Nadu, and Andhra Pradesh reporting remarkable 17-21% year-on-year growth in GST revenues.

Additionally, the performance of eight core infrastructure industries surged by 12.1% YoY in August, reaching a 14-month high, with key sectors like coal, natural gas, steel, cement, and electricity showing double-digit growth. Although Manufacturing PMI moderated slightly, business optimism remains high, and Services PMI recorded its strongest growth in 13 years in September, with a reading of 61.

Amid concerns about muted consumption demand in the current fiscal, these positive indicators underscore the anticipation of a buoyant festive period in India, spanning from Ganesh Chaturthi to Diwali and then further extended towards New Year.

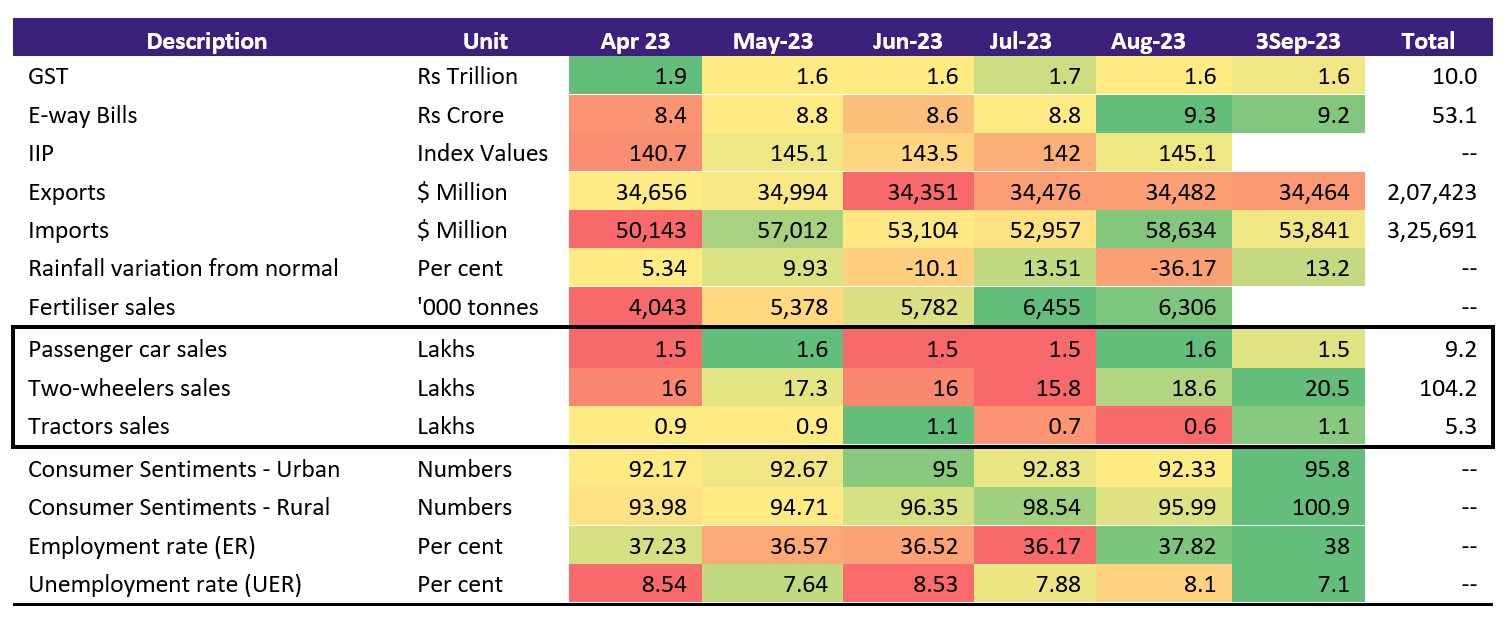

Below is a summary of some high frequency indicators

|

|

Source: CMIE, Fisdom Research

Amid all the high frequency indicators auto industry is expected to witness robust sales as the festive season began in the month of September 2023.

Car inventory levels are at all-time high. But the auto industry is betting on bumper festive sales while doling out huge discounts to ease their inventories. After nearly a 20 percent jump in retail sales last month, auto dealer’s body FADA expects a robust festive season for car makers on phasing out of monsoon worries. Stocks of automobile companies have run up in anticipation of strong festive sales amid easing commodity costs.

In September 2023, the Indian passenger vehicle industry achieved an unprecedented milestone, with wholesale figures reaching an impressive 363,733 units. This significant surge highlights the industry’s proactive response to meet the strong demand witnessed during the ongoing festive season. Notably, this record-breaking achievement surpassed the previous best recorded in August 2023, which stood at 360,700 units.

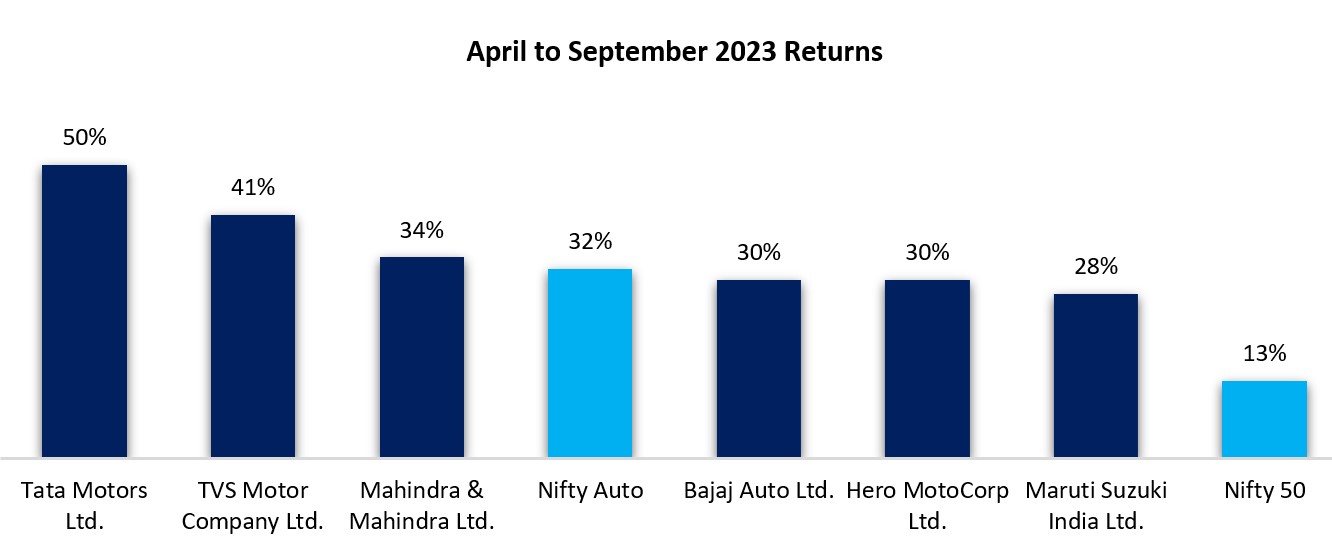

The Nifty Auto index is up by 32% in the first two quarters of FY24 as against a 13 percent rise in Nifty 50 indices. Among stocks TATA Motors is up 50 percent, TVS Motors and Maruti Suzuki are up by more than 25 percent for the same period.

|

|

Source: NSE India, Fisdom Research

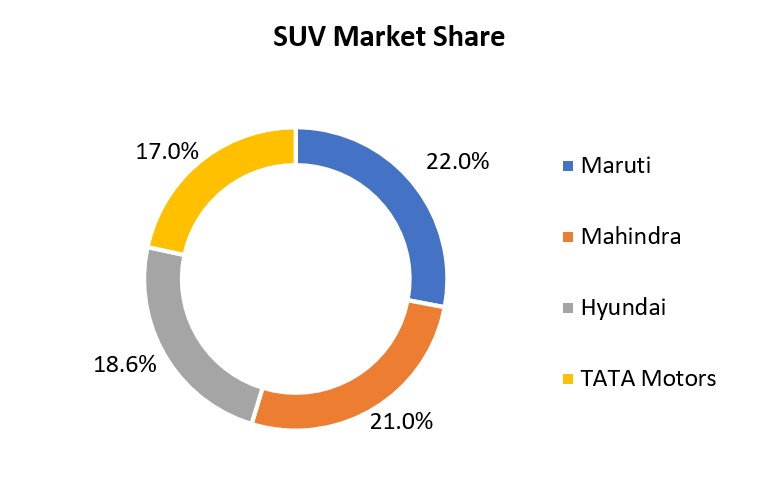

Notably Maruti Suzuki has overtaken the SUV Segment in September quarter with around 22 percent market share:

|

|

Source: Business Standard. Fisdom Research

In September, SUVs made up a remarkable 52% of the total 363,733 passenger vehicles sold, marking a record high for a single month. This surge boosted their market share, which was around 43.6% in the same period last year (September 2022).

The notable increase in vehicle dispatches throughout September can be attributed to several factors. To begin with, dealerships have been actively preparing for the festive season, which traditionally commences with grand celebrations on October 14. Additionally, there was a substantial surge in demand in the western and southern states, driven by various festivals, leading to a significant boost in car sales.

Moreover, the situation improved as car manufacturers started receiving more stable supplies of essential chips. This development played a crucial role, enabling leading automakers such as Maruti Suzuki, Hyundai, Toyota, and Mahindra & Mahindra to achieve their highest-ever monthly wholesale figures. These automakers adeptly responded to the enthusiastic demand generated by the festive season.

And one of the primary reasons why automobile stocks have been rising, especially leading up to the Diwali and festive season is because margins of these auto companies are expected to increase, by how much the raw material prices, whether it is aluminium steel etc have fallen, and some key commodities have corrected by 40-50%.

As the festival season unfolds, the Indian automotive sector anticipates even more robust growth. However, the industry is mindful of potential challenges post-festive season, especially concerning inventory management. While the passenger vehicle segment appears poised for double-digit growth, the two-wheeler sector might experience slower, single-digit growth.

Rural areas are expected to witness faster growth compared to urban centers, driven by heightened festival enthusiasm in smaller towns and an increased preference for entry-level cars during the festive period. The industry maintains a cautious optimism regarding challenges posed by unpredictable monsoons, including their potential impact on food inflation and rural sentiment.

As the festival season unfolds and automobile manufacturers adapt to changing consumer trends, the Indian auto industry remains a dynamic and adaptable force, ready to embrace the opportunities and obstacles that come its way.

|

Markets this week | | 16th Oct 2023 (Open) | 20th Oct 2023 (Close) | %Change | | Nifty 50 | ₹ 19,737 | ₹ 19,543 | -1.00% | | Sensex | ₹ 66,246 | ₹ 65,398 | -1.30% |

|

Source: BSE and NSE

- In the week ending October 20, the Indian equity market faced significant pressure due to escalating conflict between Israel and Hamas, leading to a surge in crude oil prices.

- Additionally, rising bond yields following US Federal Reserve Chair Jerome Powell’s statement on prolonged higher interest rates and weak global markets further impacted market sentiment.

- Foreign institutional investors (FIIs) continued to be net sellers, offloading equities worth Rs 2,799.08 crore, while domestic institutional investors (DIIs) bought equities amounting to Rs 3,510.97 crore during this period.

- In the month of October, FIIs sold equities totaling Rs 13,411.72 crore, while DIIs purchased equities worth Rs 11,883.80 crore.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | Bajaj Auto | ▲ 8.65% | | LTIMindtree |

▲ 6.30% | | Hero MotoCorp |

▲ 3.64% | | SBI Life Insurance |

▲ 3.51% | | Nestle India |

▲ 3.08% |

| NSE Top Losers | Stock | Change % | | Divids Lab |

▼ 4.85% | | Wipro |

▼ 4.67% | | Bajaj Finance |

▼ 3.51% | | UPL |

▼ 3.15% | | HUL |

▼ 2.89% |

|

Source: BSE |

Stocks that made the news this week:

- YES Bank reported a notable 47.4 percent increase in its net profit, reaching Rs 225.21 crore in the second quarter of the current financial year compared to Rs 152.82 crore in the same period last year. However, the bank’s sequential net profit saw a decline of over 34 percent. During this reporting quarter, YES Bank showed improvement in its asset quality, with a gross non-performing asset (NPA) ratio at 2 percent and Net NPA ratio at 0.9 percent. In terms of numbers, gross NPA stood at Rs 4319.03 crore, while net NPA stood at Rs 27419.11 crore as of September 30. Provisions and contingencies for the quarter decreased by 14.1 percent year-on-year, amounting to Rs 500.38 crore, down from Rs 582.81 crore in the same period last year.

- Bajaj Finance reported a significant increase in net profit, rising by 27.8 percent to ₹3,550 crore from ₹2,781 crore in the same period last year. Analysts’ expectations of stable asset quality and robust loan growth were met. The company also saw a substantial growth in net interest income (NII), surging by 26.4 percent to ₹8,841 crore, compared to ₹6,997 crore in the corresponding year-ago period.

- Jio Financial Services (JFSL) declined 4.6% during the week. However, the company’s financial performance in Q2 FY24 showcased significant growth, reporting a 101.31% increase in consolidated net profit, reaching Rs 668 crore compared to Rs 332 crore in Q1 FY24. Additionally, the total revenue from operations surged by 46.82% to Rs 608 crore from Rs 414 crore, indicating a strong quarter for the company.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|