Technical Overview – Nifty 50

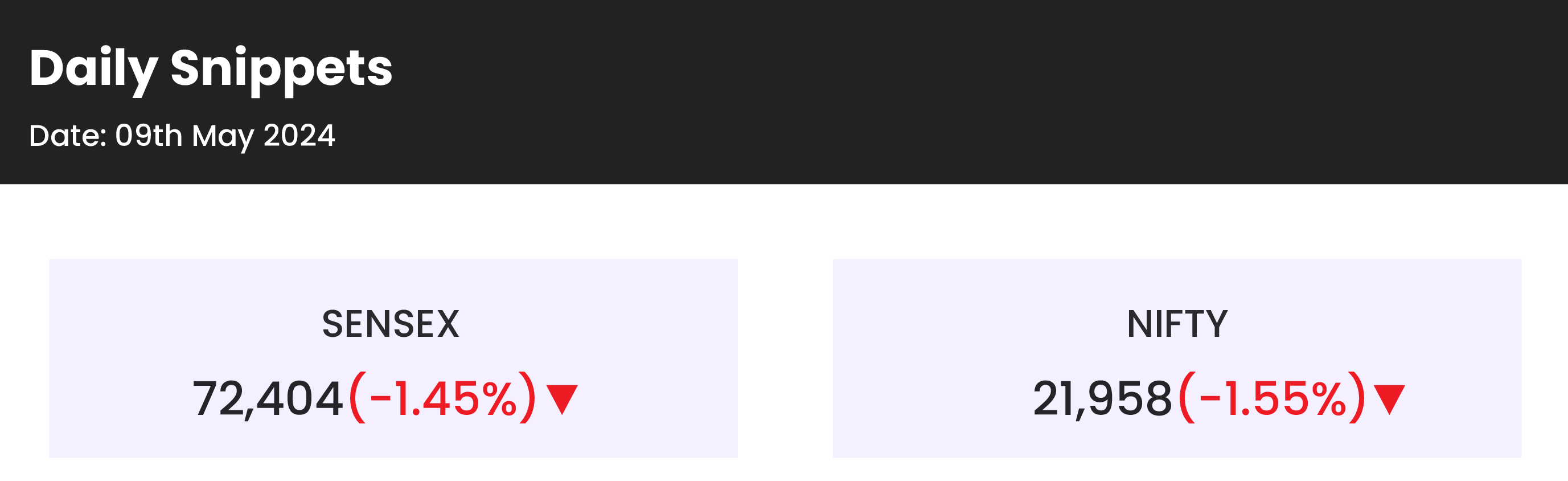

Benchmark index NIFTY closed at 21957.50, down by 345 points/-1.55%. Index downstream continues and closed near to day low on Thursday session. The losing streak for the benchmark index continues after a halt on fall in the last session. The benchmark index is down a little more than 3.5% in just 5 sessions. With election results coming near the index is a sell on the rise.

Benchmark index now below 22,000 level. Momentum indicator 14-period RSI went below 40 levels on a daily time frame. The index is now at an upward trend line as seen in the above-given chart. The index is now trading below 10, 20 & 50 DEMA. With ongoing elections and nearing to results India VIX, known as the fear indicator, went up to 19 levels and closed at 18.20 level. What will happen if VIX goes up? The higher the VIX, the greater the level of fear and uncertainty in the market. The markets come under pressure due to increased fear in the markets. VIX has risen nearly 90% in the last 10 trading sessions.

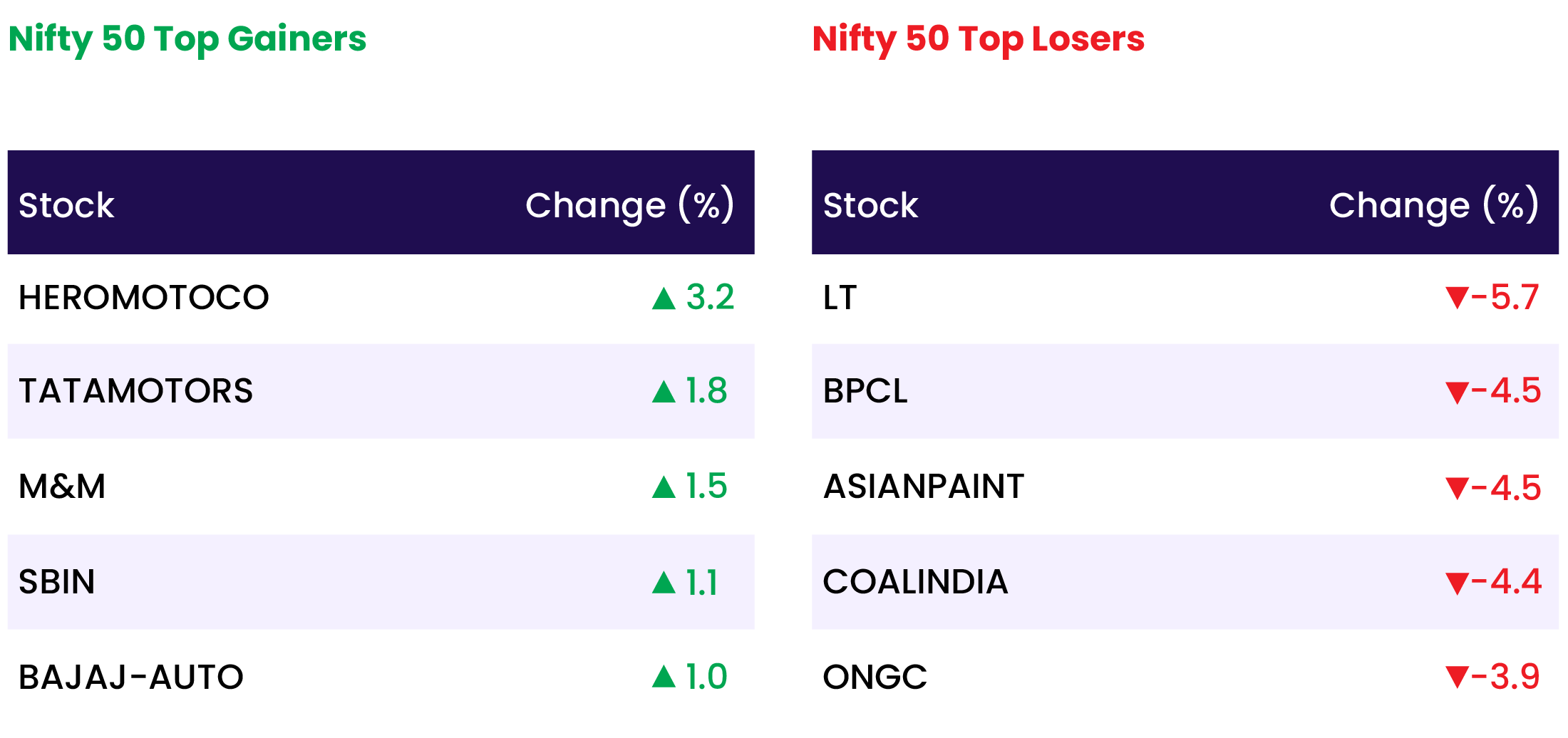

More than 20 constituents of the benchmark index were down by more than 2% wherein LT, Asian Paint, Coal India, BPCL, and ONGC were the biggest draggers for the session.

With every sell on the rise next immediate resistance levels are 22,200, 22,300. The index has broken some important support levels, support levels for upcoming sessions are 21,800, 21,700.

Technical Overview – Bank Nifty

BANK NIFTY index closed at 47,488.30, down by 53.20 points/-1.11%. 6th losing streak in index. The index fell more than 1% in Thursday’s session. Index has cracked down 5% from All all-time high levels, down more than 2500 points.

Index took resistance at 20-DEMA and fell more than 700 points from the day high on Thursday’s session. The index is now trading below 10, 20 & 50 DEMA. The index is now near to lower band of the upward channel as seen in the above chart. Momentum indicator 14-period RSI is not at 43 level on daily time-frame.

Out of 12 constituents of the Bank Nifty Index 8 stocks fell, IndusInd Bank, and HDFC Bank were the biggest dragger of the session down more than 2%.

Index resistance levels are 47,900, and 48,200 for upcoming trading sessions. Immediate support levels for the index are 47,200 and 46,700.

Indian markets:

- The domestic equity benchmark indices, namely the Sensex and the Nifty 50, continued their morning decline, slipping over 1 percent during Thursday’s session amidst ongoing worries about the general elections.

- Additionally, the weekly Nifty options expiry, slated for today, contributed to increased volatility in the headline indices.

- Except Nifty Auto, all sectors declined. Nifty Oil & Gas was the top loser, falling by 3.2 percent.

- Nifty Metal and FMCG indices dropped 2.9 percent and 2.5 percent, respectively. Nifty Pharma and Realty indices fell 2 percent each. Among gainers, Nifty Auto rose by 0.8 percent.

Global Markets:

- On Thursday, Chinese stocks climbed as imports exceeded expectations and exports met anticipated levels, contrasting with a mixed performance across the broader Asia-Pacific region.

- Following the release of data, Mainland China’s CSI 300 index surged by 0.95%, building on an initial 0.2% uptick. Concurrently, Hong Kong’s Hang Seng index also rose, recording a 1.16% increase.

- In Europe, markets displayed a mixed sentiment on Thursday, with positive momentum faltering amidst a flurry of earnings reports.

- Japan’s Nikkei 225 experienced a 0.34% decline, marking a second consecutive day of losses, while the Topix index edged up by 0.26%.

- South Korea’s Kospi index retreated from a one-month peak, falling by 1.2%, while the Kosdaq, representing small-cap stocks, dipped by 0.26%.

- Meanwhile, Australia’s S&P/ASX 200 retreated by 1.06%.

Stocks in Spotlight

- Larsen and Toubro’s shares Falls by 5 percent following the company’s issuance of a bleak outlook. R Shankar Raman, L&T’s Chief Financial Officer, indicated that order inflows in the first and second quarters of FY25 would be subdued due to the ongoing Lok Sabha elections and the subsequent delay by the new government in awarding projects.

- Asian Paints saw a 4 percent decline in its stock value after its Q4 earnings failed to meet expectations. Despite a marginal 1.3 percent year-on-year increase in net profit to Rs 1,275.3 crore, the company experienced a 0.64 percent drop in revenue, amounting to Rs 8,730.76 crore.

- Bajaj Consumer’s stock fell by 7 percent subsequent to the company’s announcement of a 12 percent decrease in consolidated net profit for the quarter ending in March. The small-cap FMCG firm reported a net profit of Rs 35.58 crore, down from Rs 40.46 crore in the corresponding quarter of the previous year. Total revenue for the quarter dipped by 3.8 percent year-on-year to Rs 239.96 crore, compared to Rs 249.42 crore in the March quarter of FY23.

News from the IPO world🌐

- Swiggy secures shareholder nod for a potential $1.2 billion IPO

- Aadhar Housing Finance IPO fully booked on Day 2

- FirstCry’s parent firm Brainbees Solutions re-files IPO papers

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 0.8 |

| NIFTY IT | -0.4 |

| NIFTY PSU BANK | -0.7 |

| NIFTY BANK | -1.1 |

| NIFTY CONSUMER DURABLES | -1.2 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 843 |

| Decline | 2998 |

| Unchanged | 102 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,056 | 0.4 % | 3.6 % |

| 10 Year Gsec India | 7.2 | (0.1) % | 0.5 % |

| WTI Crude (USD/bbl) | 78 | 0.0 % | 11.4 % |

| Gold (INR/10g) | 71,167 | 0.1 % | 6.5 % |

| USD/INR | 83.48 | 0.0 % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer