Key Highlights:

- The Nifty’s rollover is at 81.91% versus 76.05% a month before & against a 3-month average of 79%.

- The Bank Nifty’s rollover is at 88.19% versus 76.73% a month before & against a 3-month average of 82%.

- Nifty Futures began the December series with an open interest of 1.12 crore shares versus 1.17 crore shares in open interest.

- The December series started with Rs.189,528 crore versus Rs. 185,670 crore in stock futures, Rs. 22,711 crore versus Rs 20,965 crore in Nifty futures and Rs.490,724 crore versus Rs. 399,962 crore in index options and Rs. 66,454 crores versus Rs. 62,348 crores in stock options.

- Roll levels (spreads) improved significantly in the range of 68 to 70 bps (for 5-week expiry), compared to 42 to 44 bps (for 4-week expiry) during the last series.

- Hence, we expect arbitrage funds to deliver 7-8% annualized returns in the next two to three months.

Update: Arbitrage

Widening of spreads

Arbitrage spreads have been widening constantly. The key reasons behind widening spreads are as follows.

Source: ACE MF.

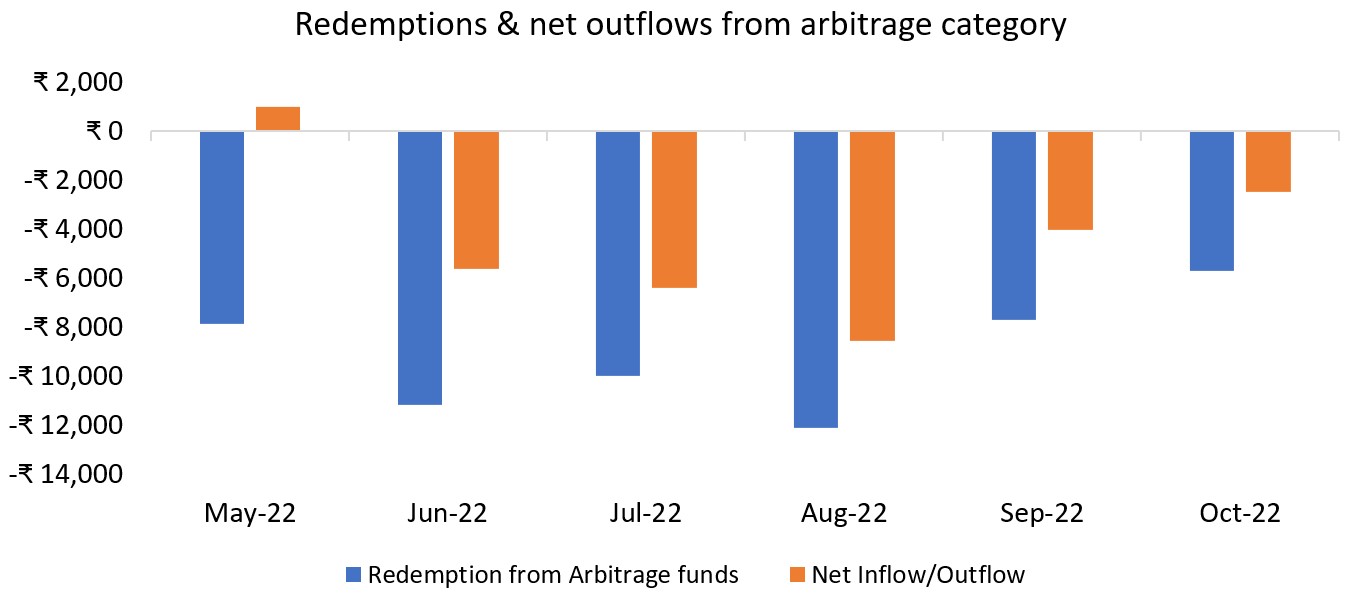

As can be observed in the graph, arbitrage funds have seen consistent redemption in the last five months. The total AUM of arbitrage funds has decreased to ~89,000 Crores (reduced by ~24,000 Crores/20% from the top).

Due to lower pressure on the short side position from arbitrage funds (because of redemption), roll spreads kept on moving higher.

Below mentioned roll-over data also backed the argument of lower pressure on the short side:

It indicates that some of the Nifty’s & Nifty bank’s longs have been carried forward. This may lead to the continuation of a bullish trend and hence a wider spread.

Higher interest rates

Source: CMIE

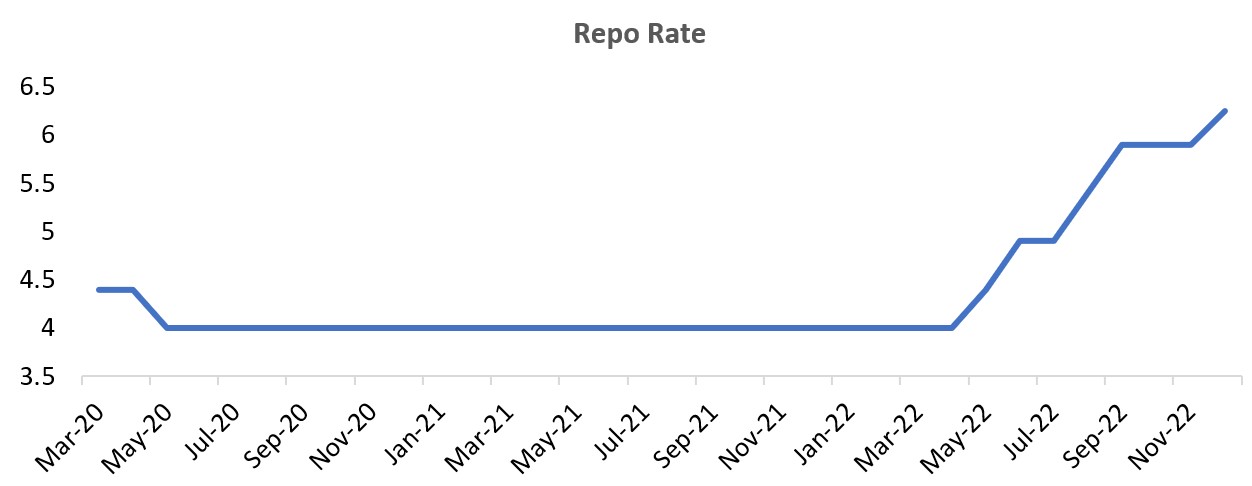

With the policy rates being raised rapidly and money market rates rising in accordance, the implied carry/interest cost embedded into future prices has also increased significantly. This has widened the spread in spot and futures markets significantly.

Cash-future component

All the arbitrage mutual fund schemes have increased the cash-future exposure. It implies the opportunity everyone is trying to achieve in the arbitrage market.

|

Scheme Name |

November 2022 |

October 2022 |

Sept 2022 |

|

% Exposure excluding debt |

|||

| Edelweiss Arbitrage Fund (Recommended) | 80.8 | 75.4 | 73.9 |

| Kotak Equity Arbitrage Fund (Recommended) | 99.9 | 96.9 | 99.8 |

| ICICI Prudential Equity-Arbitrage Fund (Recommended) | 79.5 | 78.3 | 76.6 |

| UTI Arbitrage Fund (Recommended) | 78.2 | 72.9 | 72.8 |

| Axis Arbitrage Fund (Recommended) | 91.8 | 90.1 | 89.6 |

| Aditya Birla SL Arbitrage Fund | 100.0 | 100.0 | 100.0 |

| Bank of India Arbitrage Fund | 84.0 | 84.2 | 84.7 |

| Baroda BNP Paribas Arbitrage Fund | 77.7 | 74.9 | 70.0 |

| DSP Arbitrage Fund | 83.0 | 73.2 | 74.0 |

| HDFC Arbitrage-WP | 93.1 | 92.3 | 91.8 |

| HSBC Arbitrage Fund | 74.4 | 72.5 | 70.0 |

| IDFC Arbitrage Fund | 79.2 | 75.3 | 79.4 |

| Indiabulls Arbitrage Fund | 84.9 | 85.0 | 85.1 |

| Invesco India Arbitrage Fund | 96.6 | 92.9 | 91.4 |

| ITI Arbitrage Fund | 100.0 | 100.0 | 100.0 |

| JM Arbitrage Fund | 77.3 | 78.3 | 78.8 |

| LIC MF Arbitrage Fund | 100.0 | 100.0 | 100.0 |

| Mahindra Manulife Arbitrage Yojana | 100.0 | 100.0 | 100.0 |

| Mirae Asset Arbitrage Fund | 84.0 | 80.3 | 82.8 |

| Nippon India Arbitrage Fund | 93.6 | 90.2 | 91.0 |

| NJ Arbitrage Fund | 80.9 | 80.0 | 80.2 |

| PGIM India Arbitrage Fund | 93.9 | 95.7 | 95.9 |

| SBI Arbitrage Opportunities Fund | 88.1 | 85.7 | 85.1 |

| Sundaram Arbitrage Fund | 0.0 | 82.4 | 83.2 |

| Tata Arbitrage Fund | 94.3 | 88.3 | 89.7 |

| Union Arbitrage Fund | 90.0 | 87.4 | 87.9 |

Source: ACE MF.

Outlook

The arbitrage fund category highly correlates with market sentiment, liquidity and economic parameters, including interest rates. The category can be expected to perform better as the economy and markets become healthier. The outlook for the category aligns with the view on Indian equities. Understanding the risks associated with the category and investing per risk profile and time horizon is essential.

Investors looking to deploy fresh money into arbitrage funds should look at the below-mentioned points:

Past performance is not an indicator of future performance. An excellent indicator to benchmark arbitrage fund performance can be a liquid or overnight fund over 3-6 months on a post-tax basis.

Why Arbitrage funds over liquid & overnight funds?

| Particulars | Arbitrage Funds | Liquid & Overnight Funds |

| Investment Amount | Rs.10,00,000 | Rs.10,00,000 |

| Assumed Returns Pre-Tax | 4.0% | 4.0% |

| Period | Six months | Six months |

| Current Value | Rs.10,20,000 | Rs.10,20,000 |

| Tax Rates Applicable | STCG:15% | STCG:30% ^ |

| Tax Amount | Rs.3,000 | Rs.6,000 |

| Current Value Post tax | Rs.10,17,000 | Rs.10,14,000 |

| Returns Post-Tax | 3.4% | 2.8% |

^Assuming investor belongs to the highest tax bracket

Annexure: About Arbitrage

Per SEBI mandate, arbitrage funds are required to park a minimum of 65% in equity and/or equity-oriented securities. Now, this equity position is utilised by executing a completely hedged position by utilising stocks and stock futures.

To develop an arbitrage profit, the fund must buy stock in the cash market and sell the same in the futures market. Typically, futures are priced at a premium to spot stock prices because of the carry/interest cost. This differential takes cues from prevailing interest rates in money markets. Typically, this spread is the arbitrage gain booked at the time of execution, thus insulating it significantly against intermittent volatility in the stock in any of the markets.

The important point is that mutual funds can not engage in reverse arbitrage – sell spot and buy futures.

Illustration 1.1:

Fund Deployment

- Arbitrage Mutual Fund (AMF) receives INR 1,000.

- It buys a stock for INR 650 (remember, min. 65% to be invested in equities per SEBI).

- It sells the same stock on futures for INR 660.

- INR 10 is booked as an arbitrage gain.

- The remaining INR 35 is invested in fixed-income securities.

Month End (Prices converge)

Situation A: Stock appreciates to INR 700 (from INR 650) – book an INR 50 Profit on the stock and lose INR 40 in the future (INR 660 – INR 700); net profit comes to INR 10.

Situation B: Stock depreciates to INR 100 (from INR 650) – book a loss of INR 150 and earns INR 160 (INR 660 – INR 500); net profit of INR 10.

Profit booking in an arbitrage can happen by executing one of the two methods:

- Profit can be realised by unwinding the trade. The stock in the cash market is sold, and the position in the futures market is reversed simultaneously.

- Holding in cash can be as is, and position in futures is rolled over to the next contract basis spread.

In option 1, the position can be unwound even before expiry if the spread has reduced significantly. While this may allow super-active fund managers to capture upside during extremely volatile times, it needs to be used with heightened discretion since transaction costs may snowball into a burden on the already slim margin/spread.

In option 2, the transaction cost incidence is low. In less volatile market situations, institutions typically prefer to roll over positions.